- Canada

- /

- Entertainment

- /

- TSX:EAGR

Some East Side Games Group Inc. (TSE:EAGR) Shareholders Look For Exit As Shares Take 26% Pounding

To the annoyance of some shareholders, East Side Games Group Inc. (TSE:EAGR) shares are down a considerable 26% in the last month, which continues a horrid run for the company. For any long-term shareholders, the last month ends a year to forget by locking in a 58% share price decline.

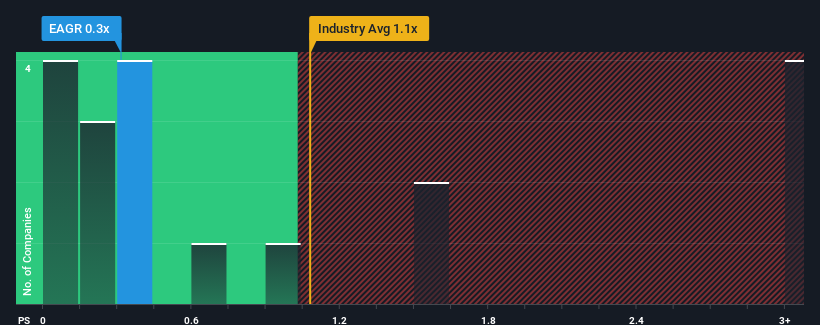

In spite of the heavy fall in price, there still wouldn't be many who think East Side Games Group's price-to-sales (or "P/S") ratio of 0.3x is worth a mention when the median P/S in Canada's Entertainment industry is similar at about 0.4x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Our free stock report includes 1 warning sign investors should be aware of before investing in East Side Games Group. Read for free now.Check out our latest analysis for East Side Games Group

What Does East Side Games Group's P/S Mean For Shareholders?

East Side Games Group has been struggling lately as its revenue has declined faster than most other companies. Perhaps the market is expecting future revenue performance to begin matching the rest of the industry, which has kept the P/S from declining. If you still like the company, you'd want its revenue trajectory to turn around before making any decisions. Or at the very least, you'd be hoping it doesn't keep underperforming if your plan is to pick up some stock while it's not in favour.

Keen to find out how analysts think East Side Games Group's future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The P/S?

The only time you'd be comfortable seeing a P/S like East Side Games Group's is when the company's growth is tracking the industry closely.

Retrospectively, the last year delivered a frustrating 4.4% decrease to the company's top line. As a result, revenue from three years ago have also fallen 11% overall. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Shifting to the future, estimates from the lone analyst covering the company suggest revenue should grow by 12% over the next year. Meanwhile, the rest of the industry is forecast to expand by 16%, which is noticeably more attractive.

With this in mind, we find it intriguing that East Side Games Group's P/S is closely matching its industry peers. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. These shareholders may be setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

What Does East Side Games Group's P/S Mean For Investors?

With its share price dropping off a cliff, the P/S for East Side Games Group looks to be in line with the rest of the Entertainment industry. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Given that East Side Games Group's revenue growth projections are relatively subdued in comparison to the wider industry, it comes as a surprise to see it trading at its current P/S ratio. When we see companies with a relatively weaker revenue outlook compared to the industry, we suspect the share price is at risk of declining, sending the moderate P/S lower. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

It is also worth noting that we have found 1 warning sign for East Side Games Group that you need to take into consideration.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if East Side Games Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:EAGR

East Side Games Group

Through its subsidiaries, develops, operates, and publishes free-to-play casual mobile games in Canada, the United States, and Europe.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026