David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. Importantly, Corus Entertainment Inc. (TSE:CJR.B) does carry debt. But is this debt a concern to shareholders?

Why Does Debt Bring Risk?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. The first step when considering a company's debt levels is to consider its cash and debt together.

See our latest analysis for Corus Entertainment

What Is Corus Entertainment's Net Debt?

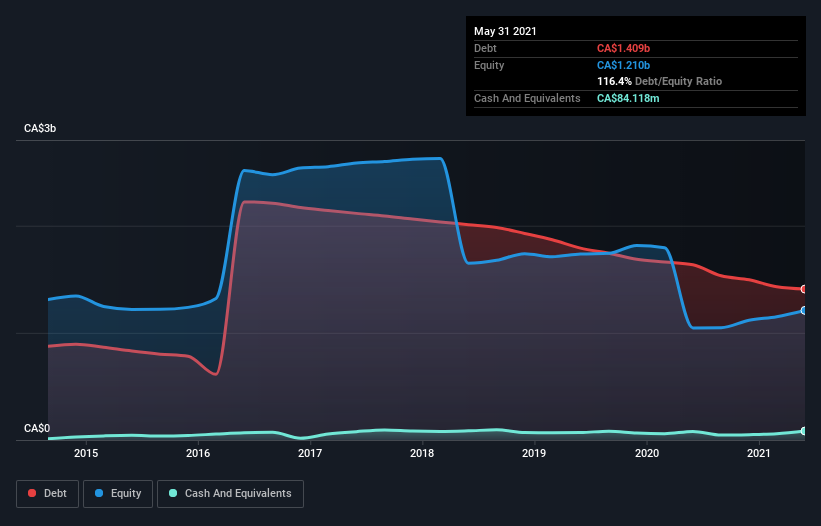

The image below, which you can click on for greater detail, shows that Corus Entertainment had debt of CA$1.39b at the end of May 2021, a reduction from CA$1.64b over a year. However, because it has a cash reserve of CA$84.1m, its net debt is less, at about CA$1.31b.

How Healthy Is Corus Entertainment's Balance Sheet?

The latest balance sheet data shows that Corus Entertainment had liabilities of CA$600.7m due within a year, and liabilities of CA$2.17b falling due after that. Offsetting these obligations, it had cash of CA$84.1m as well as receivables valued at CA$373.2m due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by CA$2.32b.

This deficit casts a shadow over the CA$1.25b company, like a colossus towering over mere mortals. So we'd watch its balance sheet closely, without a doubt. After all, Corus Entertainment would likely require a major re-capitalisation if it had to pay its creditors today.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

Corus Entertainment has a debt to EBITDA ratio of 2.6 and its EBIT covered its interest expense 3.7 times. Taken together this implies that, while we wouldn't want to see debt levels rise, we think it can handle its current leverage. Even more troubling is the fact that Corus Entertainment actually let its EBIT decrease by 4.6% over the last year. If it keeps going like that paying off its debt will be like running on a treadmill -- a lot of effort for not much advancement. There's no doubt that we learn most about debt from the balance sheet. But it is future earnings, more than anything, that will determine Corus Entertainment's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So we always check how much of that EBIT is translated into free cash flow. Over the most recent three years, Corus Entertainment recorded free cash flow worth 73% of its EBIT, which is around normal, given free cash flow excludes interest and tax. This cold hard cash means it can reduce its debt when it wants to.

Our View

Mulling over Corus Entertainment's attempt at staying on top of its total liabilities, we're certainly not enthusiastic. But on the bright side, its conversion of EBIT to free cash flow is a good sign, and makes us more optimistic. Looking at the bigger picture, it seems clear to us that Corus Entertainment's use of debt is creating risks for the company. If all goes well, that should boost returns, but on the flip side, the risk of permanent capital loss is elevated by the debt. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. Be aware that Corus Entertainment is showing 3 warning signs in our investment analysis , and 1 of those doesn't sit too well with us...

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

If you're looking for stocks to buy, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSX:CJR.B

Corus Entertainment

A media and content company, operates specialty and conventional television networks, and radio stations in Canada and internationally.

Undervalued with slight risk.

Similar Companies

Market Insights

Community Narratives