Don't Race Out To Buy Corus Entertainment Inc. (TSE:CJR.B) Just Because It's Going Ex-Dividend

Regular readers will know that we love our dividends at Simply Wall St, which is why it's exciting to see Corus Entertainment Inc. (TSE:CJR.B) is about to trade ex-dividend in the next four days. This means that investors who purchase shares on or after the 14th of December will not receive the dividend, which will be paid on the 30th of December.

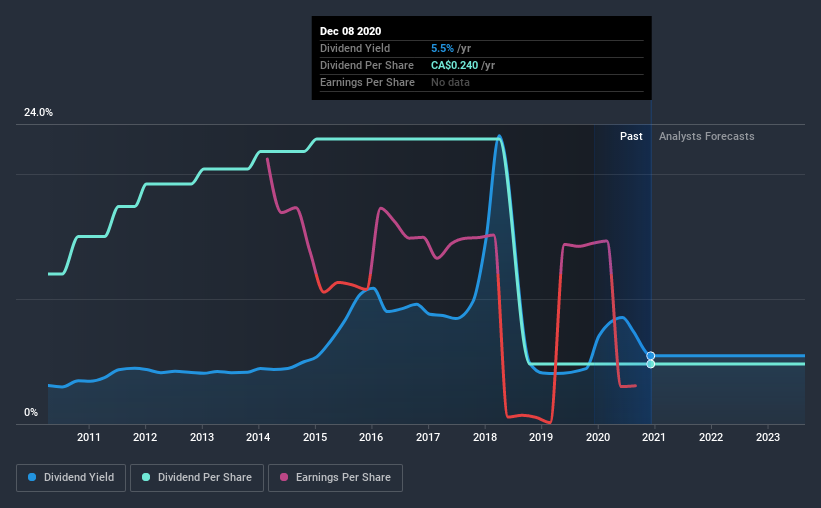

Corus Entertainment's next dividend payment will be CA$0.06 per share, on the back of last year when the company paid a total of CA$0.24 to shareholders. Calculating the last year's worth of payments shows that Corus Entertainment has a trailing yield of 5.5% on the current share price of CA$4.4. Dividends are a major contributor to investment returns for long term holders, but only if the dividend continues to be paid. So we need to check whether the dividend payments are covered, and if earnings are growing.

See our latest analysis for Corus Entertainment

If a company pays out more in dividends than it earned, then the dividend might become unsustainable - hardly an ideal situation. Corus Entertainment's dividend is not well covered by earnings, as the company lost money last year. This is not a sustainable state of affairs, so it would be worth investigating if earnings are expected to recover. Considering the lack of profitability, we also need to check if the company generated enough cash flow to cover the dividend payment. If cash earnings don't cover the dividend, the company would have to pay dividends out of cash in the bank, or by borrowing money, neither of which is long-term sustainable. It paid out 17% of its free cash flow as dividends last year, which is conservatively low.

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

When earnings decline, dividend companies become much harder to analyse and own safely. If earnings fall far enough, the company could be forced to cut its dividend. Corus Entertainment was unprofitable last year and, unfortunately, the general trend suggests its earnings have been in decline over the last five years, making us wonder if the dividend is sustainable at all.

Another key way to measure a company's dividend prospects is by measuring its historical rate of dividend growth. Corus Entertainment has seen its dividend decline 8.8% per annum on average over the past 10 years, which is not great to see. While it's not great that earnings and dividends per share have fallen in recent years, we're encouraged by the fact that management has trimmed the dividend rather than risk over-committing the company in a risky attempt to maintain yields to shareholders.

Remember, you can always get a snapshot of Corus Entertainment's financial health, by checking our visualisation of its financial health, here.

To Sum It Up

Has Corus Entertainment got what it takes to maintain its dividend payments? First, it's not great to see the company paying a dividend despite being loss-making over the last year. On the plus side, the dividend was covered by free cash flow." It's not an attractive combination from a dividend perspective, and we're inclined to pass on this one for the time being.

With that being said, if you're still considering Corus Entertainment as an investment, you'll find it beneficial to know what risks this stock is facing. For example, we've found 3 warning signs for Corus Entertainment (1 doesn't sit too well with us!) that deserve your attention before investing in the shares.

We wouldn't recommend just buying the first dividend stock you see, though. Here's a list of interesting dividend stocks with a greater than 2% yield and an upcoming dividend.

If you’re looking to trade Corus Entertainment, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About TSX:CJR.B

Corus Entertainment

A media and content company, operates specialty and conventional television networks, and radio stations in Canada and internationally.

Undervalued with slight risk.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026