- Canada

- /

- Entertainment

- /

- TSX:CGX

Top 3 High Growth Tech Stocks in Canada to Watch

Reviewed by Simply Wall St

As the Canadian market navigates through a period of anticipation following the U.S. Federal Reserve's symposium in Jackson Hole, investors are closely watching economic indicators and market sentiment that could impact small-cap companies. In this environment, identifying high-growth tech stocks becomes crucial for those looking to capitalize on potential opportunities; strong fundamentals and innovative business models are key factors to consider.

Top 10 High Growth Tech Companies In Canada

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Docebo | 14.74% | 34.09% | ★★★★★☆ |

| Constellation Software | 16.17% | 23.55% | ★★★★★☆ |

| HIVE Digital Technologies | 54.20% | 100.27% | ★★★★★☆ |

| GameSquare Holdings | 38.08% | 86.64% | ★★★★★☆ |

| Medicenna Therapeutics | 62.37% | 57.20% | ★★★★★☆ |

| Stingray Group | 4.94% | 69.22% | ★★★★☆☆ |

| Sabio Holdings | 12.97% | 122.50% | ★★★★☆☆ |

| BlackBerry | 20.61% | 76.74% | ★★★★★☆ |

| Cineplex | 8.05% | 179.27% | ★★★★☆☆ |

| Alpha Cognition | 62.98% | 69.54% | ★★★★★☆ |

Click here to see the full list of 22 stocks from our TSX High Growth Tech and AI Stocks screener.

Let's review some notable picks from our screened stocks.

Cineplex (TSX:CGX)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Cineplex Inc., along with its subsidiaries, operates as an entertainment and media company in Canada and internationally, with a market cap of CA$682.06 million.

Operations: The company generates revenue primarily from three segments: Film Entertainment and Content (CA$1.05 billion), Location-Based Entertainment (CA$132.08 million), and Media (CA$120.16 million). The largest revenue stream is Film Entertainment and Content, significantly contributing to the overall income.

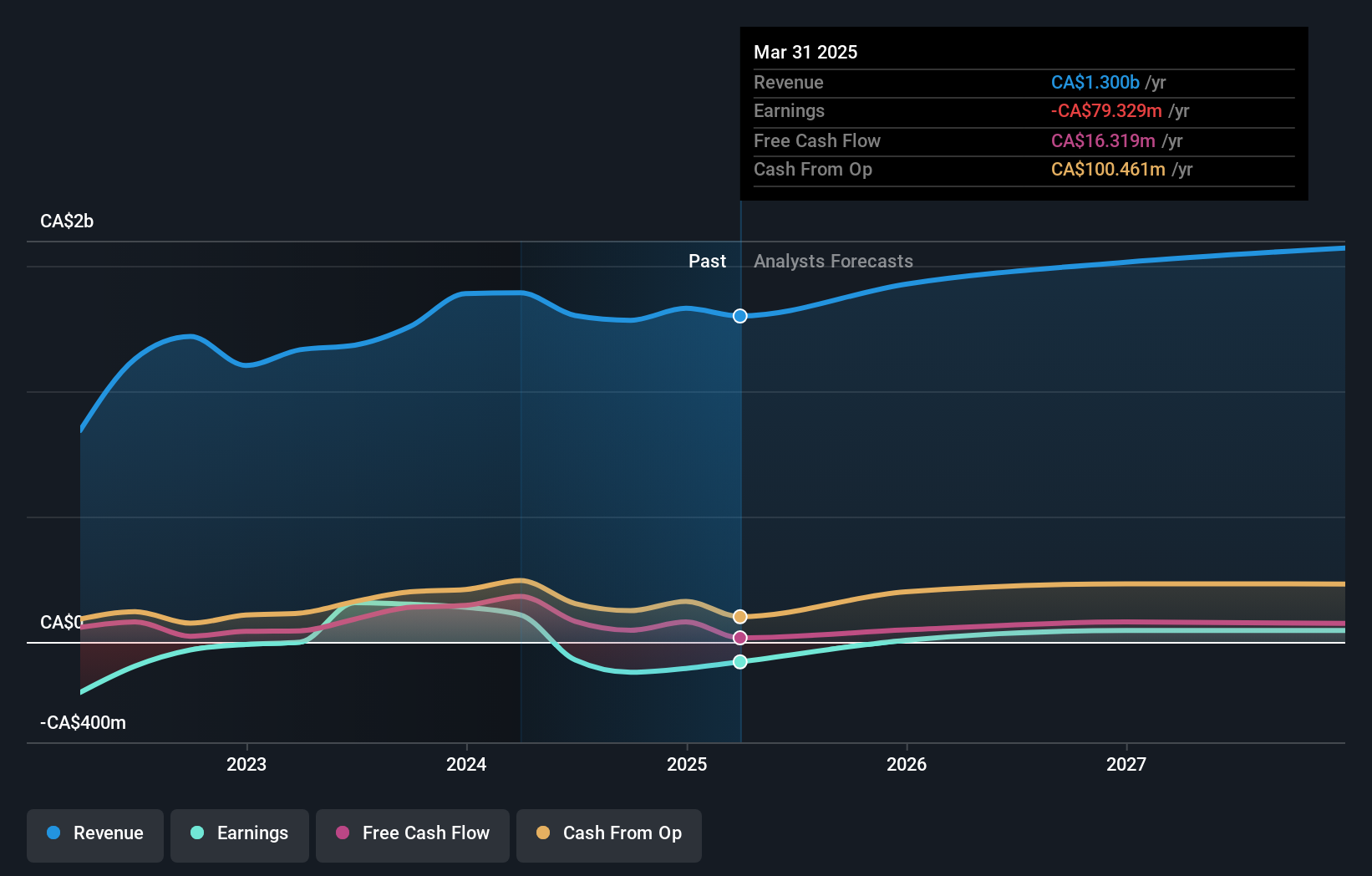

Cineplex's recent earnings report revealed a net loss of CAD 21.44 million for Q2 2024, contrasting sharply with a net income of CAD 176.55 million the previous year. Despite this, the company forecasts an impressive annual profit growth rate of 179.27%, indicating potential recovery and profitability within three years. Revenue is expected to grow at an annual rate of 8.1%, outpacing the Canadian market average of 7%. Additionally, Cineplex has initiated a share repurchase program to buy back up to 6,318,346 shares by August 2025, potentially enhancing shareholder value in the long term.

- Take a closer look at Cineplex's potential here in our health report.

Review our historical performance report to gain insights into Cineplex's's past performance.

Computer Modelling Group (TSX:CMG)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Computer Modelling Group Ltd. is a software and consulting technology company specializing in the development and licensing of reservoir simulation and seismic interpretation software and services, with a market cap of CA$1.03 billion.

Operations: Computer Modelling Group Ltd. generates revenue primarily through the development and licensing of reservoir simulation and seismic interpretation software, amounting to CA$90.29 million. The company also incurs segment adjustments totaling CA$28.16 million.

Computer Modelling Group (CMG) has demonstrated robust growth, with earnings expected to increase by 24.6% annually, outpacing the Canadian market's forecast of 15.5%. The company's revenue is projected to grow at 11.5% per year. Despite a net profit margin decrease from 29.2% to 19.7%, CMG's innovative carbon capture and storage solutions, such as the CO2LINK initiative with Kongsberg Digital, highlight its commitment to leading-edge technology in environmental sustainability—a critical sector for future growth and industry impact.

Constellation Software (TSX:CSU)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Constellation Software Inc., along with its subsidiaries, acquires, builds, and manages vertical market software businesses in Canada, the United States, Europe, and internationally with a market cap of CA$90.38 billion.

Operations: Constellation Software Inc. generates revenue primarily from its Software & Programming segment, amounting to CA$9.27 billion. The company focuses on acquiring, building, and managing vertical market software businesses across various regions including Canada, the United States, and Europe.

Constellation Software's revenue for Q2 2024 reached $2.47 billion, up from $2.04 billion a year ago, while net income rose to $177 million from $103 million. The company's R&D expenses have been pivotal, with a focused investment of approximately 16% of its revenue in innovation and development efforts. Omegro's launch consolidates over 30 business units and serves more than 15,000 customers globally, enhancing Constellation's reach in diverse software applications like ERP & CRM and logistics management. With earnings projected to grow at an impressive rate of 23.6% annually over the next three years, Constellation Software demonstrates strong potential in the tech sector despite its higher debt levels.

- Get an in-depth perspective on Constellation Software's performance by reading our health report here.

Gain insights into Constellation Software's past trends and performance with our Past report.

Key Takeaways

- Explore the 22 names from our TSX High Growth Tech and AI Stocks screener here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CGX

Cineplex

Operates as an entertainment and media company in Canada and internationally.

Good value with reasonable growth potential.