- Canada

- /

- Entertainment

- /

- TSX:BAMI

Blue Ant Media (TSX:BAMI) Q4 Net Income Driven by CA$24.8 Million One-Off Gain, Clouding Narrative

Reviewed by Simply Wall St

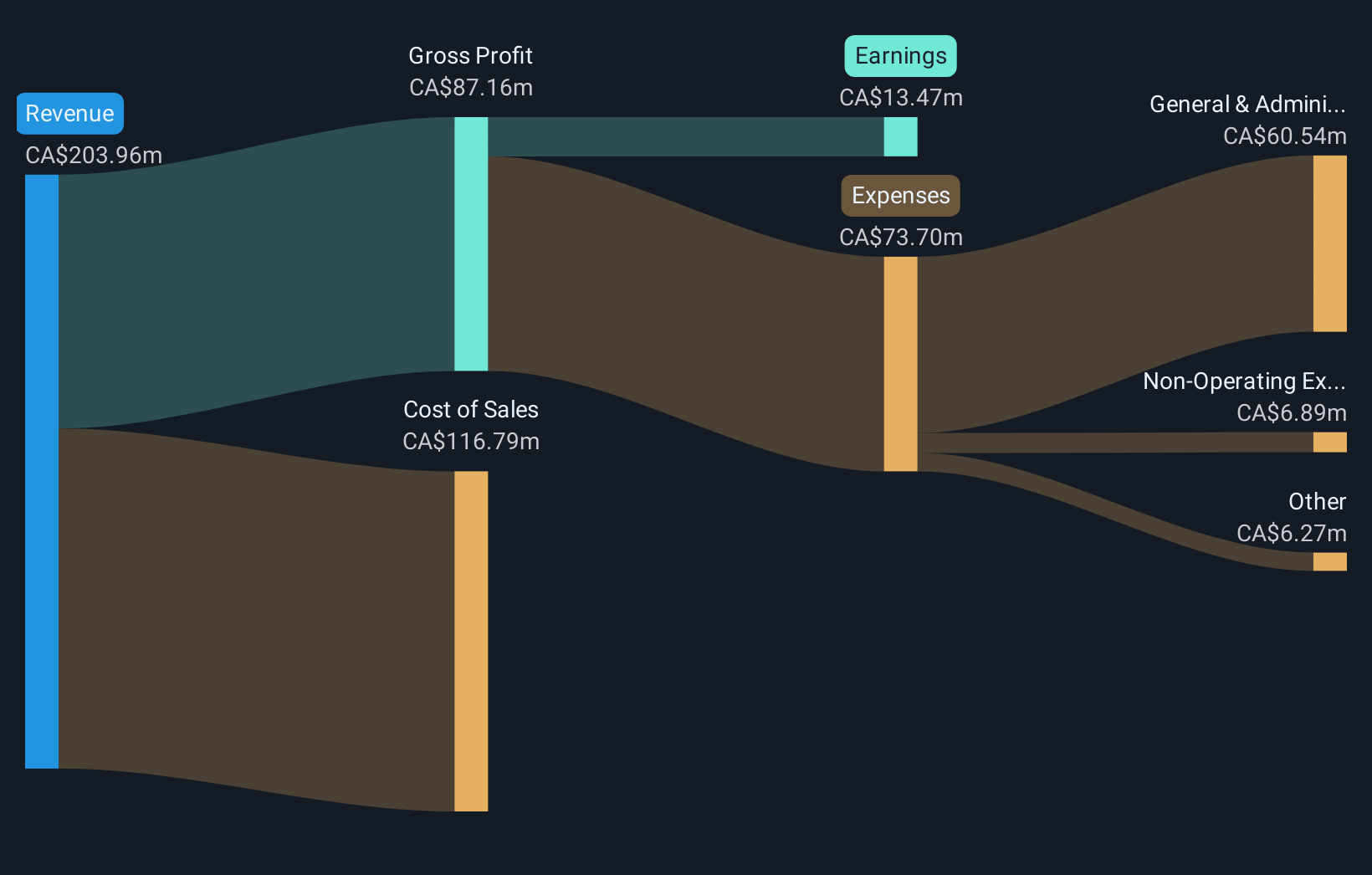

Blue Ant Media (TSX:BAMI) just released its FY 2025 results, reporting Q4 revenue of CA$63.7 million and net income (excluding extraordinary items) of CA$29.1 million. Looking back, the company’s trailing twelve month revenue came in at CA$204.0 million, and net income (excluding extraordinary items) reached CA$13.5 million for the period. With net profit margins showing a modest uptick and growth forecasts outpacing broader market trends, the numbers frame an interesting margin story for investors this quarter.

See our full analysis for Blue Ant Media.Now, let’s see how these latest results stack up against the most widely held market narratives. Some expectations will match up, while others may get a reality check.

Curious how numbers become stories that shape markets? Explore Community Narratives

Premium Valuation Gap Widens

- Blue Ant Media shares now trade at CA$8.23, well above both their DCF fair value of CA$5.49 and the North American entertainment sector average price-to-earnings multiple (21x compared to the industry average of 20.8x and peers at 13.8x).

- For those following the prevailing market view, this pricing premium challenges the case for further upside.

- The current valuation rests on revenue forecasts of 20.5% annual growth, outpacing the wider Canadian market’s 4.6% rate.

- However, earnings are only expected to climb 4.5% annually, trailing the market's 11.7% pace.

One-Off Gains Cloud Trend

- The recent CA$24.8 million one-off gain played a large role in lifting reported net income to CA$29.1 million in Q4 FY 2025.

- This skews the net profit margin, which climbed to 6.6% from 6.1% year-over-year.

- The underlying earnings power is less clear without these extraordinary items.

- Investors may need to discount the headline jump when assessing sustainable profitability.

Public Track Record Remains Short

- Blue Ant Media has less than three years of public trading history, making longer-term trend analysis more challenging.

- Despite this, the business demonstrated an 11.7% year-over-year increase in earnings per share to CA$0.81.

- Solid EPS growth adds a point for fundamentals, but limited data means investors focus more on each quarter’s swings.

- Results get more scrutiny, especially in a high growth sector crowded with emerging competitors.

Consensus expectations are shifting. See how the main narrative stacks up against the latest numbers in our detailed market storyline. 📊 Read the full Blue Ant Media Consensus Narrative.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Blue Ant Media's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Blue Ant Media’s premium valuation, reliance on one-off gains, and earnings growth trailing expectations raise questions about sustainable upside and long-term value.

If you want companies with stronger fundamentals at more attractive prices, use our these 926 undervalued stocks based on cash flows to target opportunities that offer better value and less headline risk.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Blue Ant Media might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:BAMI

Blue Ant Media

Engages in streamer, production studio, and rights business.

Excellent balance sheet with moderate growth potential.

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success