- Canada

- /

- Metals and Mining

- /

- TSX:SAM

TSX Penny Stocks To Watch In November 2025

Reviewed by Simply Wall St

The Canadian market has shown resilience, with a surprising uptick in employment figures for October, even as global equity markets experience volatility due to AI valuation concerns. Amid this backdrop, investors are reminded of the importance of maintaining a balanced portfolio across various sectors and market caps. While penny stocks may seem like an outdated term, they still represent opportunities within smaller or newer companies that boast strong financial health and potential for growth.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$2.13 | CA$54.35M | ✅ 3 ⚠️ 4 View Analysis > |

| Canso Select Opportunities (TSXV:CSOC.A) | CA$4.50 | CA$21.61M | ✅ 2 ⚠️ 2 View Analysis > |

| Zoomd Technologies (TSXV:ZOMD) | CA$2.06 | CA$204.52M | ✅ 4 ⚠️ 1 View Analysis > |

| Montero Mining and Exploration (TSXV:MON) | CA$0.48 | CA$3.76M | ✅ 2 ⚠️ 4 View Analysis > |

| Monument Mining (TSXV:MMY) | CA$1.10 | CA$351.67M | ✅ 2 ⚠️ 1 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$1.20 | CA$778.4M | ✅ 3 ⚠️ 2 View Analysis > |

| Automotive Finco (TSXV:AFCC.H) | CA$1.15 | CA$21.6M | ✅ 2 ⚠️ 3 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$2.87 | CA$148.71M | ✅ 2 ⚠️ 1 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$2.15 | CA$202.66M | ✅ 3 ⚠️ 2 View Analysis > |

| Matachewan Consolidated Mines (TSXV:MCM.A) | CA$0.75 | CA$9.58M | ✅ 2 ⚠️ 4 View Analysis > |

Click here to see the full list of 411 stocks from our TSX Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Starcore International Mines (TSX:SAM)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Starcore International Mines Ltd., with a market cap of CA$41.06 million, operates primarily through its subsidiary, Compañia Minera Peña de Bernal, focusing on mining activities.

Operations: The company generates CA$31.92 million in revenue from its gold and silver mining operations.

Market Cap: CA$41.06M

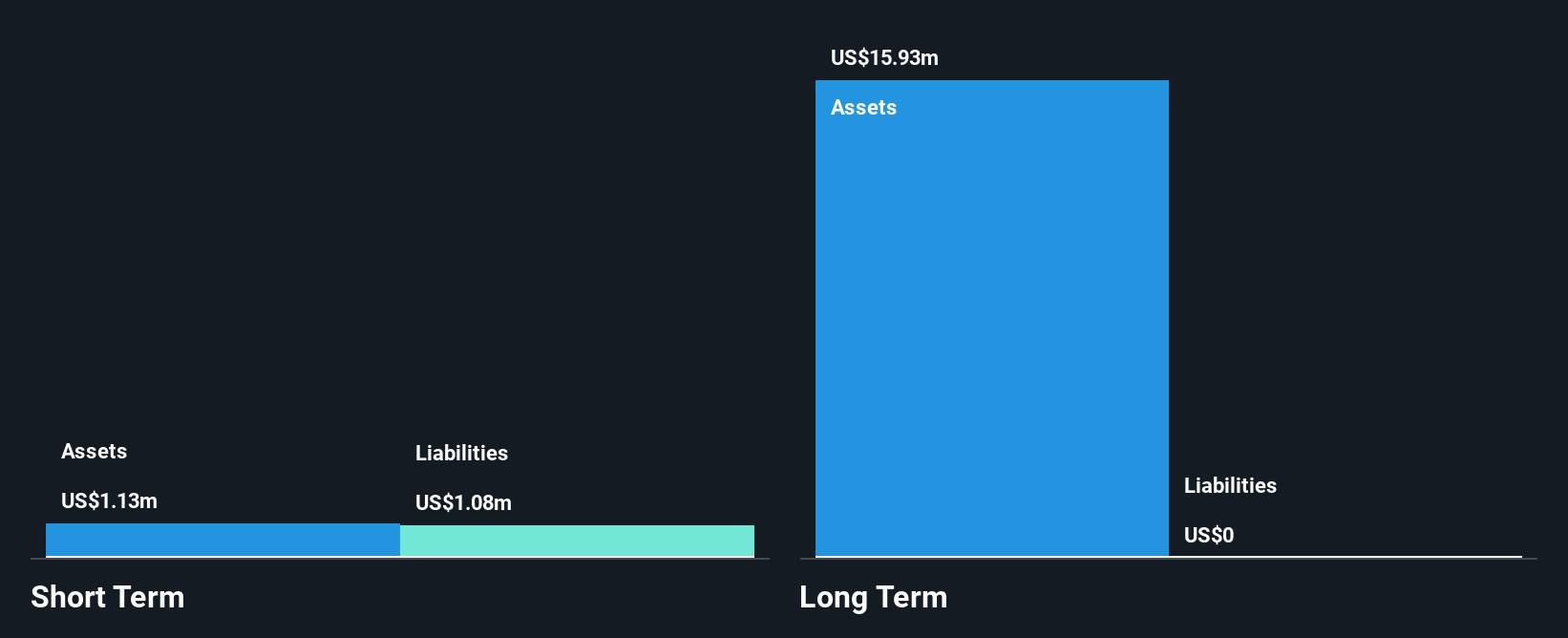

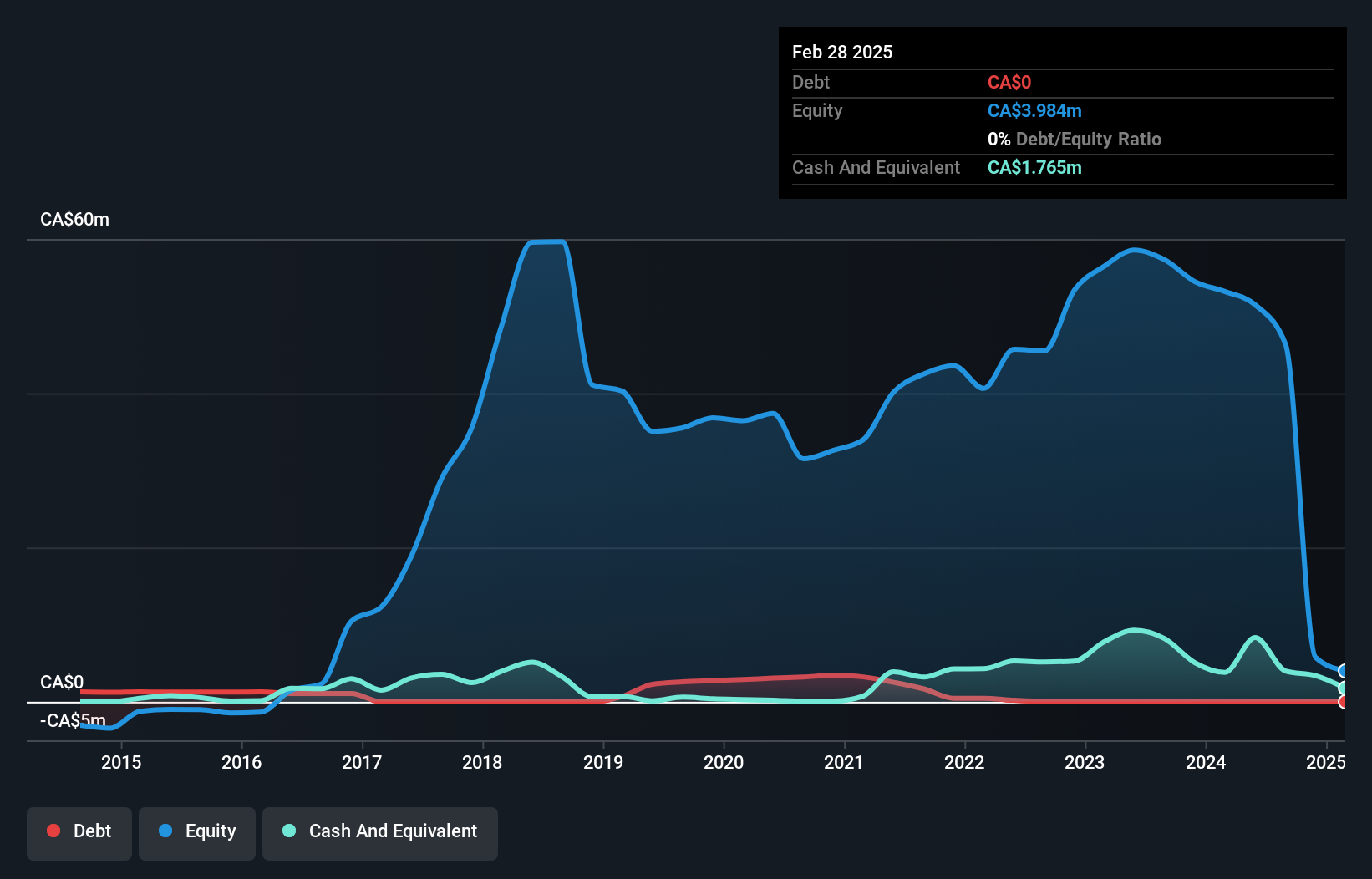

Starcore International Mines Ltd., with a market cap of CA$41.06 million, has shown mixed performance as a penny stock. The company reported net income of CA$0.927 million for Q1 2025, up from the previous year, yet its profit margins have declined to 2.3% from 12.1%. Despite being debt-free and having seasoned management and board members, Starcore's earnings growth has been negative over the past year and its share price highly volatile in recent months. Recent private placements raised CA$2.34 million, indicating efforts to bolster financial resources amid these challenges.

- Navigate through the intricacies of Starcore International Mines with our comprehensive balance sheet health report here.

- Explore historical data to track Starcore International Mines' performance over time in our past results report.

Alpha Exploration (TSXV:ALEX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Alpha Exploration Ltd., through its subsidiary, focuses on acquiring, exploring, and developing mineral resource properties in Eritrea with a market cap of CA$47.61 million.

Operations: Currently, there are no reported revenue segments for Alpha Exploration Ltd.

Market Cap: CA$47.61M

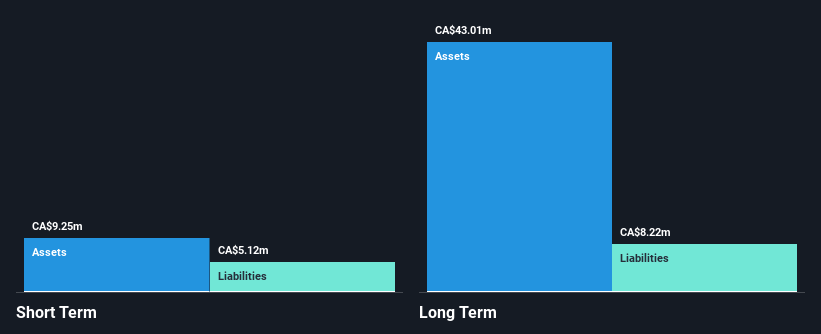

Alpha Exploration Ltd., with a market cap of CA$47.61 million, is pre-revenue and focuses on mineral exploration in Eritrea. The company recently reported promising drilling results from its Aburna Gold Project, revealing significant gold mineralization over shallow depths, which could indicate potential for further discoveries. Despite no reported revenue segments, Alpha has achieved profitability this year and maintains a debt-free balance sheet with short-term assets exceeding liabilities. The management team is experienced with recent leadership changes aimed at strengthening strategic direction. These factors position Alpha as an intriguing prospect within the speculative landscape of penny stocks.

- Click here and access our complete financial health analysis report to understand the dynamics of Alpha Exploration.

- Review our historical performance report to gain insights into Alpha Exploration's track record.

Wealth Minerals (TSXV:WML)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Wealth Minerals Ltd. focuses on the acquisition, exploration, and development of mineral properties in Canada, Chile, Peru, and Mexico with a market cap of CA$30.80 million.

Operations: There are no reported revenue segments for the company.

Market Cap: CA$30.8M

Wealth Minerals Ltd., with a market cap of CA$30.80 million, is currently pre-revenue and focuses on mineral exploration across several countries. The company has faced challenges, such as withdrawing from the Andacollo Oro Gold Project in Chile due to regulatory and compliance issues, leading to the return of raised funds. Recent financial results show reduced net losses compared to the previous year, indicating some operational improvements. Wealth Minerals has engaged in multiple private placements to raise capital, reflecting its ongoing efforts to secure funding for future projects amidst high share price volatility and a limited cash runway.

- Click to explore a detailed breakdown of our findings in Wealth Minerals' financial health report.

- Gain insights into Wealth Minerals' past trends and performance with our report on the company's historical track record.

Turning Ideas Into Actions

- Unlock our comprehensive list of 411 TSX Penny Stocks by clicking here.

- Ready For A Different Approach? We've found 14 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:SAM

Starcore International Mines

Through its subsidiary, Compañia Minera Peña de Bernal, S.A.

Flawless balance sheet with slight risk.

Market Insights

Community Narratives