- Canada

- /

- Metals and Mining

- /

- TSXV:WGO

3 Promising TSX Penny Stocks With Market Caps Over CA$1M

Reviewed by Simply Wall St

The Canadian market has been navigating a complex landscape of economic trends and investor sentiment, as experts like Angelo Kourkafas analyze these conditions to guide long-term financial strategies. In the context of this evolving market, penny stocks—often smaller or newer companies—remain relevant for their potential to offer growth opportunities at lower price points. While the term may seem outdated, these stocks can still provide value when backed by robust financials and sound fundamentals, making them intriguing options for investors seeking hidden gems in the market.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Pulse Seismic (TSX:PSD) | CA$2.28 | CA$116.01M | ★★★★★★ |

| Silvercorp Metals (TSX:SVM) | CA$4.31 | CA$907.23M | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$4.02 | CA$391.6M | ★★★★★★ |

| Findev (TSXV:FDI) | CA$0.54 | CA$15.47M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.55 | CA$483.37M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.25 | CA$224.43M | ★★★★★☆ |

| Vox Royalty (TSX:VOXR) | CA$3.27 | CA$168.47M | ★★★★★★ |

| NamSys (TSXV:CTZ) | CA$1.25 | CA$33.58M | ★★★★★★ |

| East West Petroleum (TSXV:EW) | CA$0.04 | CA$3.62M | ★★★★★★ |

| Hemisphere Energy (TSXV:HME) | CA$1.83 | CA$179.46M | ★★★★★☆ |

Click here to see the full list of 952 stocks from our TSX Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Kincora Copper (TSXV:KCC)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Kincora Copper Limited is involved in the acquisition, exploration, and evaluation of mineral properties in Mongolia and Australia, with a market cap of CA$7.79 million.

Operations: Kincora Copper Limited does not have reported revenue segments.

Market Cap: CA$7.79M

Kincora Copper Limited, with a market cap of CA$7.79 million, is pre-revenue and focuses on exploration in Mongolia and Australia. Recent strategic partnerships, including with Fleet Space Technologies, aim to leverage advanced geophysical surveys for identifying promising drill targets at projects like Nyngan and Wongarbon. Despite being unprofitable, Kincora has reduced its losses over the past five years by 32.7% annually and remains debt-free with no long-term liabilities. The company recently raised additional capital to extend its cash runway beyond seven months as it continues exploring high-priority targets in collaboration with AngloGold Ashanti.

- Get an in-depth perspective on Kincora Copper's performance by reading our balance sheet health report here.

- Learn about Kincora Copper's historical performance here.

Sendero Resources (TSXV:SEND)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Sendero Resources Corp., through its subsidiary, operates as an exploration company in Argentina with a market cap of CA$1.47 million.

Operations: Sendero Resources currently does not report any revenue segments.

Market Cap: CA$1.47M

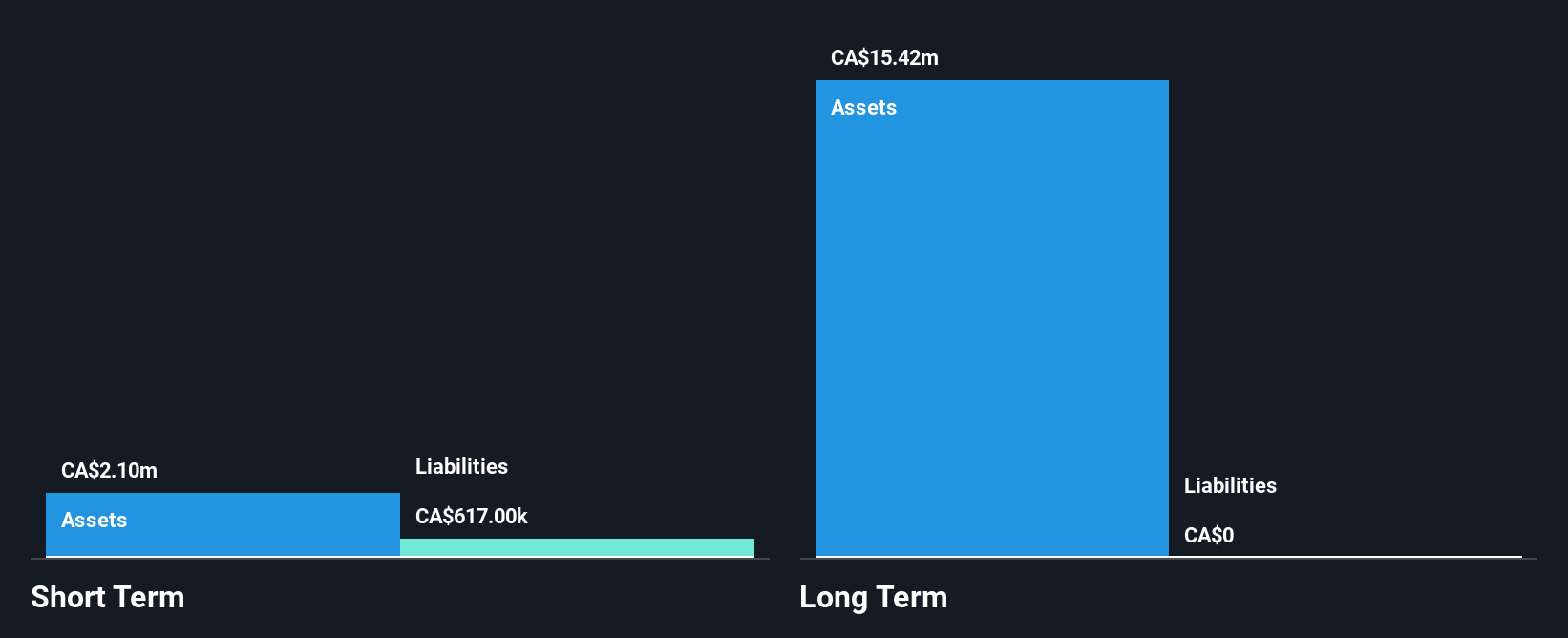

Sendero Resources, with a market cap of CA$1.47 million, is a pre-revenue exploration company operating in Argentina. The company has no debt or long-term liabilities but faces challenges with short-term liabilities exceeding its assets. Recent board changes include the resignation of its founder as Chairman and CFO, replaced by David Cross to revamp operations. A recent private placement aims to raise CA$1.68 million for further exploration activities at its Peñas Negras Project, despite previous drilling yielding limited results. However, auditors have expressed concerns about Sendero's ability to continue as a going concern due to significant annual losses and cash flow issues.

- Navigate through the intricacies of Sendero Resources with our comprehensive balance sheet health report here.

- Explore historical data to track Sendero Resources' performance over time in our past results report.

White Gold (TSXV:WGO)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: White Gold Corp. is involved in the acquisition, exploration, and development of mineral properties in Canada with a market cap of CA$37.03 million.

Operations: Currently, there are no reported revenue segments for this company.

Market Cap: CA$37.03M

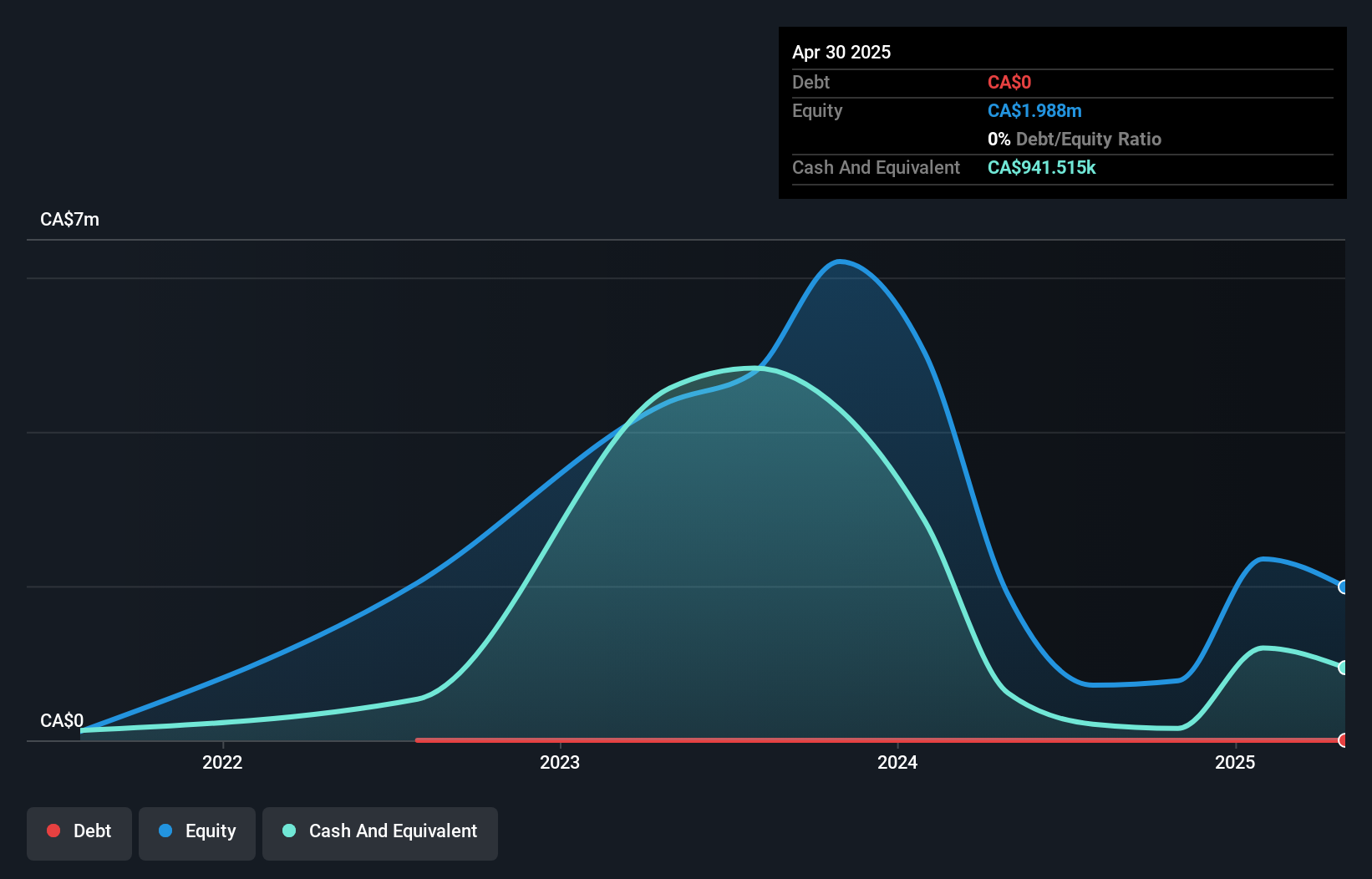

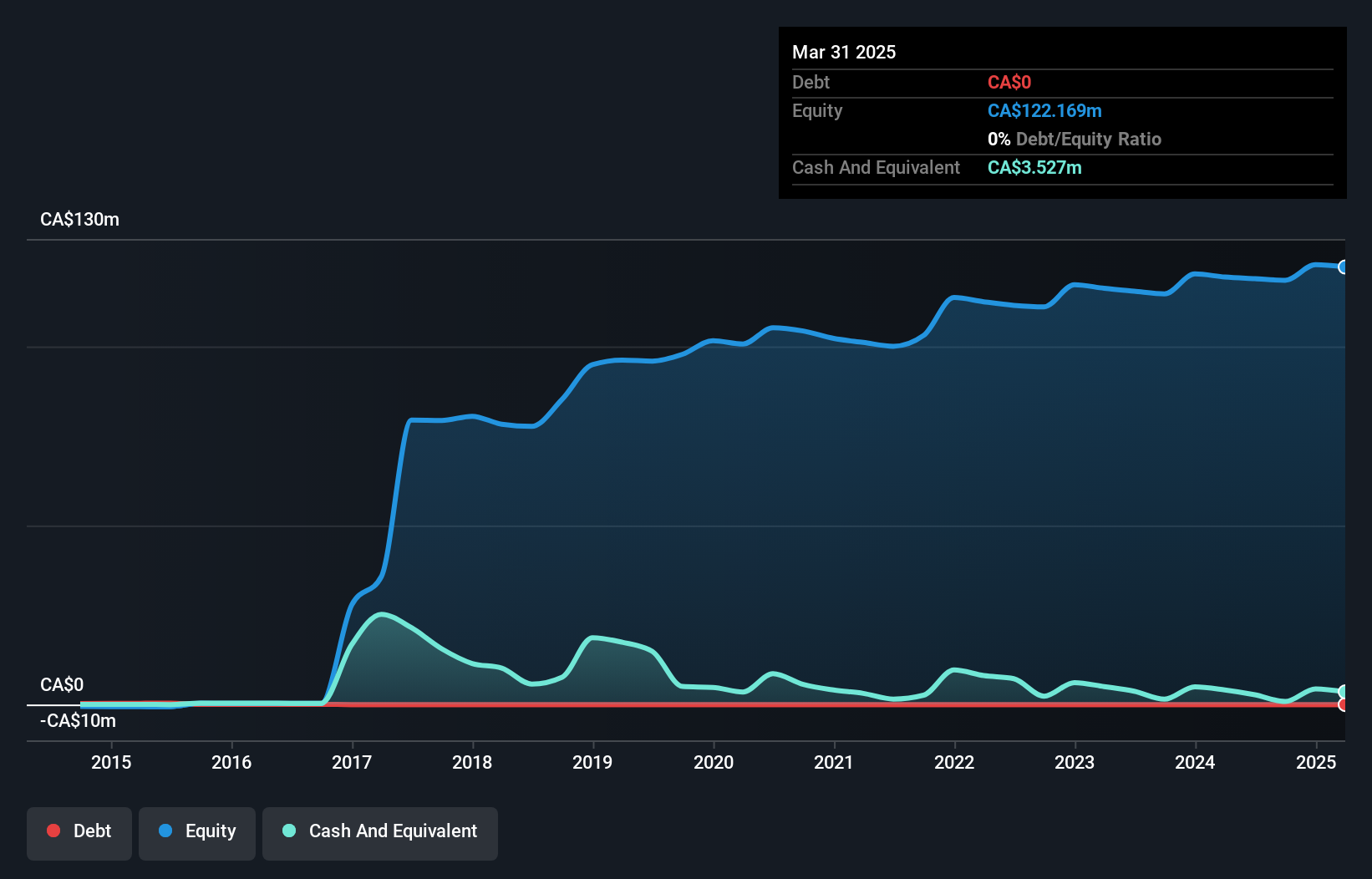

White Gold Corp., with a market cap of CA$37.03 million, is a pre-revenue company focused on mineral exploration in Canada. It recently announced a private placement to raise up to CA$4.5 million, supporting its exploration activities. The updated Mineral Resource Estimate for the White Gold project shows significant increases in both indicated and inferred gold resources, suggesting potential for future growth. Despite having no debt, White Gold faces challenges with short-term liabilities exceeding assets and limited cash runway without additional capital infusion. The seasoned management team continues to advance strategic partnerships and exploration efforts in the Yukon region.

- Click here and access our complete financial health analysis report to understand the dynamics of White Gold.

- Assess White Gold's previous results with our detailed historical performance reports.

Where To Now?

- Click through to start exploring the rest of the 949 TSX Penny Stocks now.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if White Gold might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:WGO

White Gold

Engages in the acquisition, exploration, and development of mineral properties in Canada.

Mediocre balance sheet low.

Market Insights

Community Narratives