- Canada

- /

- Paper and Forestry Products

- /

- TSXV:WBE

We Think Some Shareholders May Hesitate To Increase WestBond Enterprises Corporation's (CVE:WBE) CEO Compensation

Performance at WestBond Enterprises Corporation (CVE:WBE) has been reasonably good and CEO Gennaro Magistrale has done a decent job of steering the company in the right direction. In light of this performance, CEO compensation will probably not be the main focus for shareholders as they go into the AGM on 11 August 2021. However, some shareholders will still be cautious of paying the CEO excessively.

View our latest analysis for WestBond Enterprises

How Does Total Compensation For Gennaro Magistrale Compare With Other Companies In The Industry?

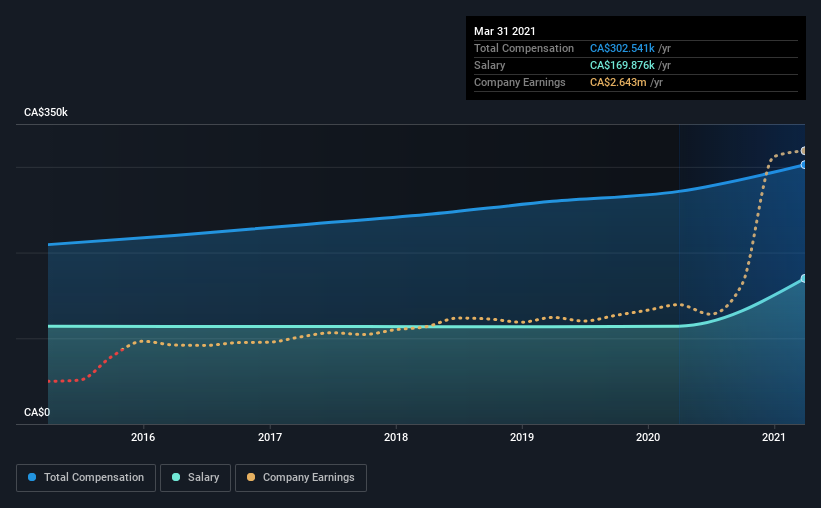

According to our data, WestBond Enterprises Corporation has a market capitalization of CA$26m, and paid its CEO total annual compensation worth CA$303k over the year to March 2021. We note that's an increase of 11% above last year. We note that the salary of CA$169.9k makes up a sizeable portion of the total compensation received by the CEO.

In comparison with other companies in the industry with market capitalizations under CA$251m, the reported median total CEO compensation was CA$221k. Accordingly, our analysis reveals that WestBond Enterprises Corporation pays Gennaro Magistrale north of the industry median. What's more, Gennaro Magistrale holds CA$6.0m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2021 | 2020 | Proportion (2021) |

| Salary | CA$170k | CA$114k | 56% |

| Other | CA$133k | CA$157k | 44% |

| Total Compensation | CA$303k | CA$271k | 100% |

On an industry level, around 33% of total compensation represents salary and 67% is other remuneration. According to our research, WestBond Enterprises has allocated a higher percentage of pay to salary in comparison to the wider industry. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

A Look at WestBond Enterprises Corporation's Growth Numbers

WestBond Enterprises Corporation has seen its earnings per share (EPS) increase by 103% a year over the past three years. It achieved revenue growth of 20% over the last year.

Shareholders would be glad to know that the company has improved itself over the last few years. It's a real positive to see this sort of revenue growth in a single year. That suggests a healthy and growing business. We don't have analyst forecasts, but you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Has WestBond Enterprises Corporation Been A Good Investment?

Boasting a total shareholder return of 756% over three years, WestBond Enterprises Corporation has done well by shareholders. As a result, some may believe the CEO should be paid more than is normal for companies of similar size.

To Conclude...

Given that the company's overall performance has been reasonable, the CEO remuneration policy might not be shareholders' central point of focus in the upcoming AGM. However, if the board proposes to increase the compensation, some shareholders might have questions given that the CEO is already being paid higher than the industry.

CEO compensation can have a massive impact on performance, but it's just one element. We've identified 2 warning signs for WestBond Enterprises that investors should be aware of in a dynamic business environment.

Switching gears from WestBond Enterprises, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

When trading stocks or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if WestBond Enterprises might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSXV:WBE

WestBond Enterprises

Together with its subsidiary WestBond Industries Inc., engages in the manufacture and sale of disposable paper products for medical, hygienic, and industrial uses in Canada and the United States.

Flawless balance sheet and slightly overvalued.

Market Insights

Community Narratives

Recently Updated Narratives

No miracle in sight

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success