- Canada

- /

- Paper and Forestry Products

- /

- TSXV:WBE

How Should Investors Feel About WestBond Enterprises' (CVE:WBE) CEO Remuneration?

Gennaro Magistrale is the CEO of WestBond Enterprises Corporation (CVE:WBE), and in this article, we analyze the executive's compensation package with respect to the overall performance of the company. This analysis will also evaluate the appropriateness of CEO compensation when taking into account the earnings and shareholder returns of the company.

See our latest analysis for WestBond Enterprises

How Does Total Compensation For Gennaro Magistrale Compare With Other Companies In The Industry?

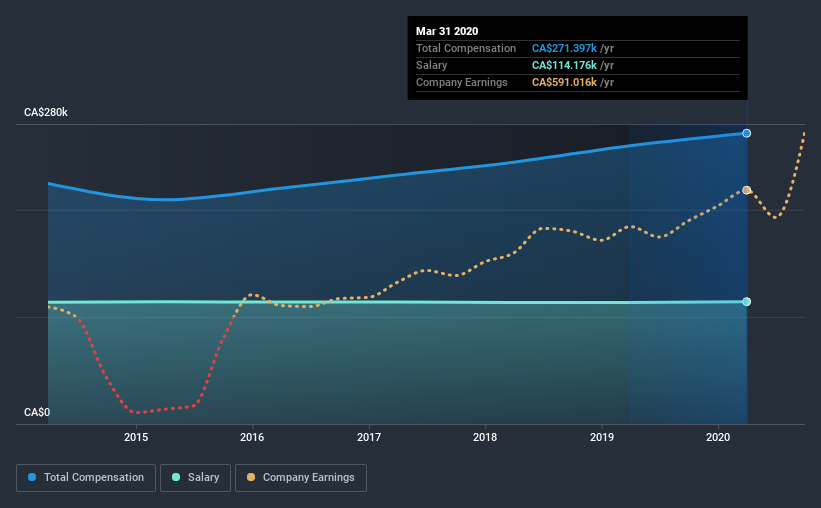

Our data indicates that WestBond Enterprises Corporation has a market capitalization of CA$29m, and total annual CEO compensation was reported as CA$271k for the year to March 2020. That's a modest increase of 4.5% on the prior year. We think total compensation is more important but our data shows that the CEO salary is lower, at CA$114k.

On comparing similar-sized companies in the industry with market capitalizations below CA$256m, we found that the median total CEO compensation was CA$209k. From this we gather that Gennaro Magistrale is paid around the median for CEOs in the industry. What's more, Gennaro Magistrale holds CA$6.7m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | CA$114k | CA$113k | 42% |

| Other | CA$157k | CA$146k | 58% |

| Total Compensation | CA$271k | CA$260k | 100% |

On an industry level, around 45% of total compensation represents salary and 55% is other remuneration. There isn't a significant difference between WestBond Enterprises and the broader market, in terms of salary allocation in the overall compensation package. If total compensation is slanted towards non-salary benefits, it indicates that CEO pay is linked to company performance.

WestBond Enterprises Corporation's Growth

WestBond Enterprises Corporation has seen its earnings per share (EPS) increase by 62% a year over the past three years. In the last year, its revenue is down 3.4%.

Overall this is a positive result for shareholders, showing that the company has improved in recent years. While it would be good to see revenue growth, profits matter more in the end. We don't have analyst forecasts, but you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Has WestBond Enterprises Corporation Been A Good Investment?

Boasting a total shareholder return of 807% over three years, WestBond Enterprises Corporation has done well by shareholders. As a result, some may believe the CEO should be paid more than is normal for companies of similar size.

To Conclude...

As previously discussed, Gennaro is compensated close to the median for companies of its size, and which belong to the same industry. Investors would surely be happy to see that returns have been great, and that EPS is up. Although the pay is close to the industry median, overall performance is excellent, so we don't think the CEO is paid too generously. Stockholders might even be okay with a bump in pay, seeing as how investor returns have been so strong.

While it is important to pay attention to CEO remuneration, investors should also consider other elements of the business. That's why we did some digging and identified 3 warning signs for WestBond Enterprises that investors should think about before committing capital to this stock.

Switching gears from WestBond Enterprises, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

When trading WestBond Enterprises or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if WestBond Enterprises might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSXV:WBE

WestBond Enterprises

Together with its subsidiary WestBond Industries Inc., engages in the manufacture and sale of disposable paper products for medical, hygienic, and industrial uses in Canada and the United States.

Flawless balance sheet and slightly overvalued.

Market Insights

Community Narratives

Recently Updated Narratives

No miracle in sight

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success