- Canada

- /

- Metals and Mining

- /

- TSXV:VLC

TSX Penny Stocks To Consider In June 2025

Reviewed by Simply Wall St

As the Canadian market navigates through trade developments and central bank meetings, investors are keeping a close eye on potential volatility and opportunities that may arise. Penny stocks, though often considered a relic of past market eras, continue to capture interest due to their affordability and growth potential, especially when backed by strong financials. In this context, we will explore three penny stocks that stand out for their financial strength and potential in the current economic landscape.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| PetroTal (TSX:TAL) | CA$0.66 | CA$612.95M | ✅ 3 ⚠️ 3 View Analysis > |

| Orezone Gold (TSX:ORE) | CA$1.31 | CA$701.13M | ✅ 4 ⚠️ 2 View Analysis > |

| Dynacor Group (TSX:DNG) | CA$4.51 | CA$193.51M | ✅ 4 ⚠️ 2 View Analysis > |

| Findev (TSXV:FDI) | CA$0.45 | CA$12.46M | ✅ 2 ⚠️ 4 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$0.73 | CA$492.32M | ✅ 3 ⚠️ 2 View Analysis > |

| Automotive Finco (TSXV:AFCC.H) | CA$0.87 | CA$17.24M | ✅ 2 ⚠️ 4 View Analysis > |

| NTG Clarity Networks (TSXV:NCI) | CA$2.30 | CA$96.86M | ✅ 4 ⚠️ 2 View Analysis > |

| Intermap Technologies (TSX:IMP) | CA$2.32 | CA$140.1M | ✅ 3 ⚠️ 1 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$1.85 | CA$178.86M | ✅ 3 ⚠️ 1 View Analysis > |

| McChip Resources (TSXV:MCS) | CA$0.95 | CA$5.42M | ✅ 2 ⚠️ 4 View Analysis > |

Click here to see the full list of 877 stocks from our TSX Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Velocity Minerals (TSXV:VLC)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Velocity Minerals Ltd. focuses on acquiring, exploring, and evaluating mineral resource properties in Bulgaria and Greece, with a market cap of CA$36.49 million.

Operations: No revenue segments are reported for the company.

Market Cap: CA$36.49M

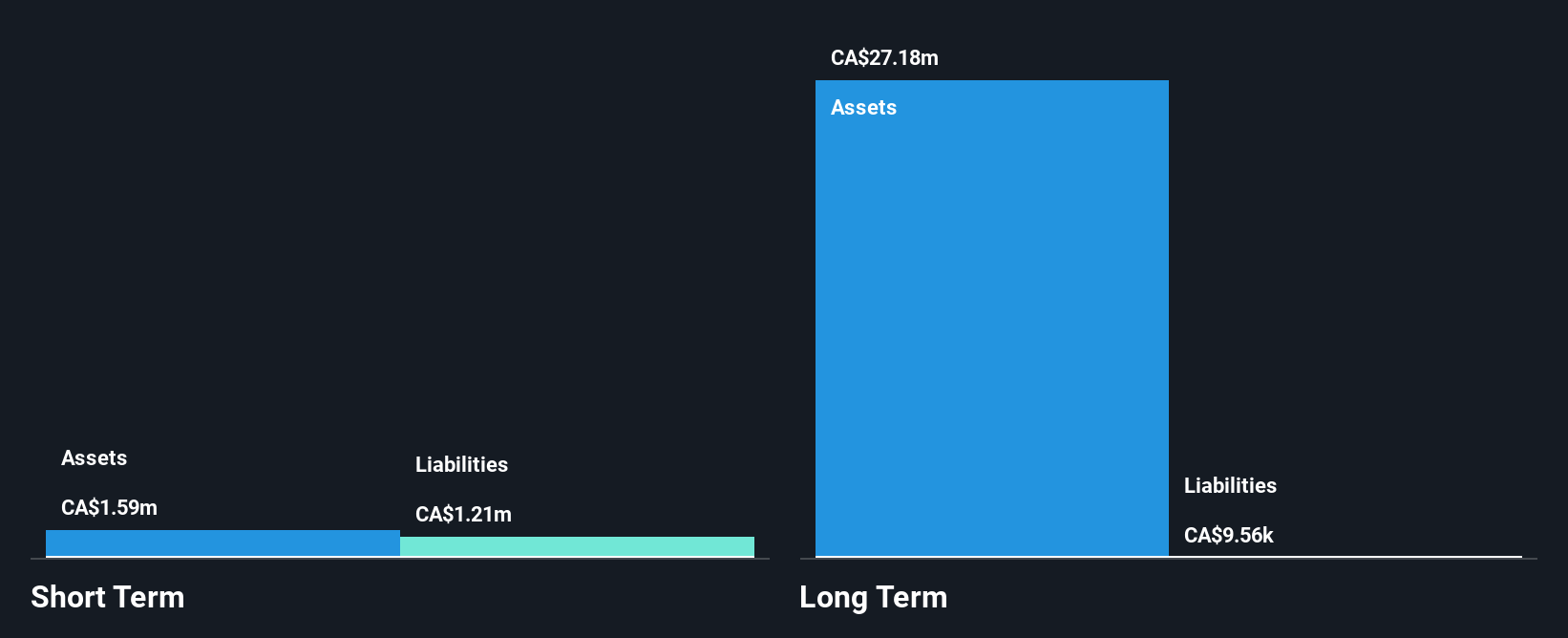

Velocity Minerals Ltd., with a market cap of CA$36.49 million, is a pre-revenue company focusing on mineral exploration in Bulgaria and Greece. Despite having no significant revenue streams, the company's short-term assets exceed both its short-term and long-term liabilities, indicating sound liquidity. The management team and board are experienced, with average tenures of 3.6 and 7.9 years respectively. Velocity has no debt but faces going concern doubts from auditors due to limited cash runway under one year. Recent exploration efforts in Greece show promising mineralization results, potentially enhancing future prospects despite current unprofitability challenges.

- Get an in-depth perspective on Velocity Minerals' performance by reading our balance sheet health report here.

- Explore historical data to track Velocity Minerals' performance over time in our past results report.

Vulcan Minerals (TSXV:VUL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Vulcan Minerals Inc. focuses on the acquisition, evaluation, and exploration of mineral properties in Newfoundland and Labrador, with a market cap of CA$14.87 million.

Operations: No revenue segments have been reported.

Market Cap: CA$14.87M

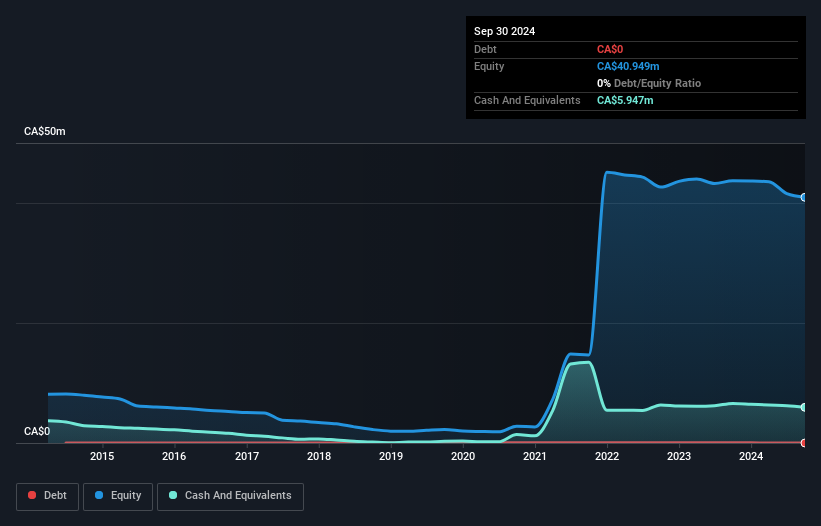

Vulcan Minerals Inc., with a market cap of CA$14.87 million, is a pre-revenue entity focused on mineral exploration in Newfoundland and Labrador. Despite its unprofitability, the company maintains sound liquidity as its short-term assets of CA$5.5 million surpass both short and long-term liabilities. The board's average tenure of 6.7 years reflects experienced governance, while the absence of debt eliminates interest coverage concerns. However, Vulcan has faced increasing losses over five years at an annual rate of 19%. Recent earnings reports highlight continued net losses, underscoring ongoing financial challenges amidst high share price volatility.

- Click here to discover the nuances of Vulcan Minerals with our detailed analytical financial health report.

- Assess Vulcan Minerals' previous results with our detailed historical performance reports.

Yangarra Resources (TSX:YGR)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Yangarra Resources Ltd. is a junior oil and gas company focused on the exploration, development, and production of natural gas and conventional oil in Western Canada, with a market cap of CA$96.16 million.

Operations: The company's revenue is primarily derived from its operations in the production, exploration, and development of resource properties, totaling CA$118.93 million.

Market Cap: CA$96.16M

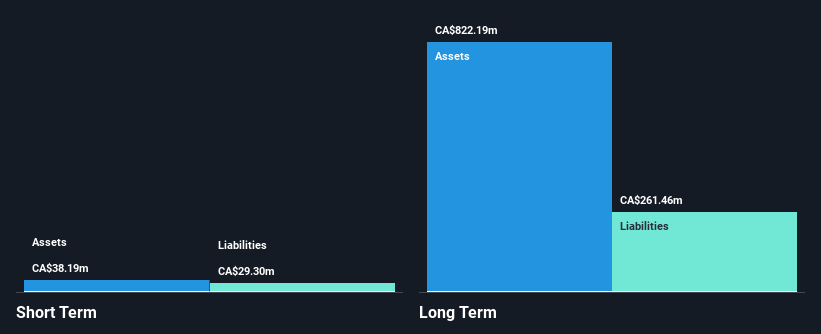

Yangarra Resources Ltd., with a market cap of CA$96.16 million, demonstrates certain strengths and challenges typical of penny stocks. The company has maintained high-quality earnings and stable weekly volatility over the past year, supported by a seasoned management team averaging nine years in tenure. While its price-to-earnings ratio is favorable compared to the broader Canadian market, recent performance shows declining production and revenue figures, alongside reduced net profit margins from 27.9% to 19%. Despite these setbacks, Yangarra's debt management remains robust with satisfactory coverage by operating cash flow and interest payments well-covered by EBIT.

- Jump into the full analysis health report here for a deeper understanding of Yangarra Resources.

- Assess Yangarra Resources' future earnings estimates with our detailed growth reports.

Make It Happen

- Jump into our full catalog of 877 TSX Penny Stocks here.

- Searching for a Fresh Perspective? AI is about to change healthcare. These 22 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:VLC

Velocity Minerals

Engages in the acquiring, exploring, and evaluating mineral resource properties in Bulgaria and Greece.

Good value with adequate balance sheet.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion