- Canada

- /

- Metals and Mining

- /

- TSX:STGO

TSX Penny Stocks To Watch In November 2025

Reviewed by Simply Wall St

As November unfolds, the Canadian market reflects a complex interplay of AI enthusiasm and valuation adjustments, with corporate earnings remaining robust despite recent equity market pullbacks. In such a landscape, investors often look towards smaller or newer companies for opportunities that larger firms may not offer. While "penny stocks" might sound like a concept from trading days gone by, they continue to highlight potential in less-established companies; those built on strong financials can provide significant returns.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$2.13 | CA$54.35M | ✅ 3 ⚠️ 4 View Analysis > |

| Canso Select Opportunities (TSXV:CSOC.A) | CA$4.50 | CA$21.61M | ✅ 2 ⚠️ 2 View Analysis > |

| Zoomd Technologies (TSXV:ZOMD) | CA$2.06 | CA$204.52M | ✅ 4 ⚠️ 1 View Analysis > |

| Montero Mining and Exploration (TSXV:MON) | CA$0.48 | CA$3.76M | ✅ 2 ⚠️ 4 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$1.20 | CA$778.4M | ✅ 3 ⚠️ 2 View Analysis > |

| Automotive Finco (TSXV:AFCC.H) | CA$1.15 | CA$21.6M | ✅ 2 ⚠️ 3 View Analysis > |

| Madoro Metals (TSXV:MDM) | CA$0.03 | CA$2.73M | ✅ 2 ⚠️ 4 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$2.87 | CA$148.71M | ✅ 2 ⚠️ 1 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$2.15 | CA$202.66M | ✅ 3 ⚠️ 2 View Analysis > |

| Matachewan Consolidated Mines (TSXV:MCM.A) | CA$0.75 | CA$9.58M | ✅ 2 ⚠️ 4 View Analysis > |

Click here to see the full list of 411 stocks from our TSX Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Steppe Gold (TSX:STGO)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Steppe Gold Ltd. is involved in operating, developing, exploring, and acquiring precious metal projects in Mongolia and Peru, with a market cap of CA$576.45 million.

Operations: The company's revenue is primarily generated from its Metals & Mining segment, specifically focusing on Gold & Other Precious Metals, amounting to $148.25 million.

Market Cap: CA$576.45M

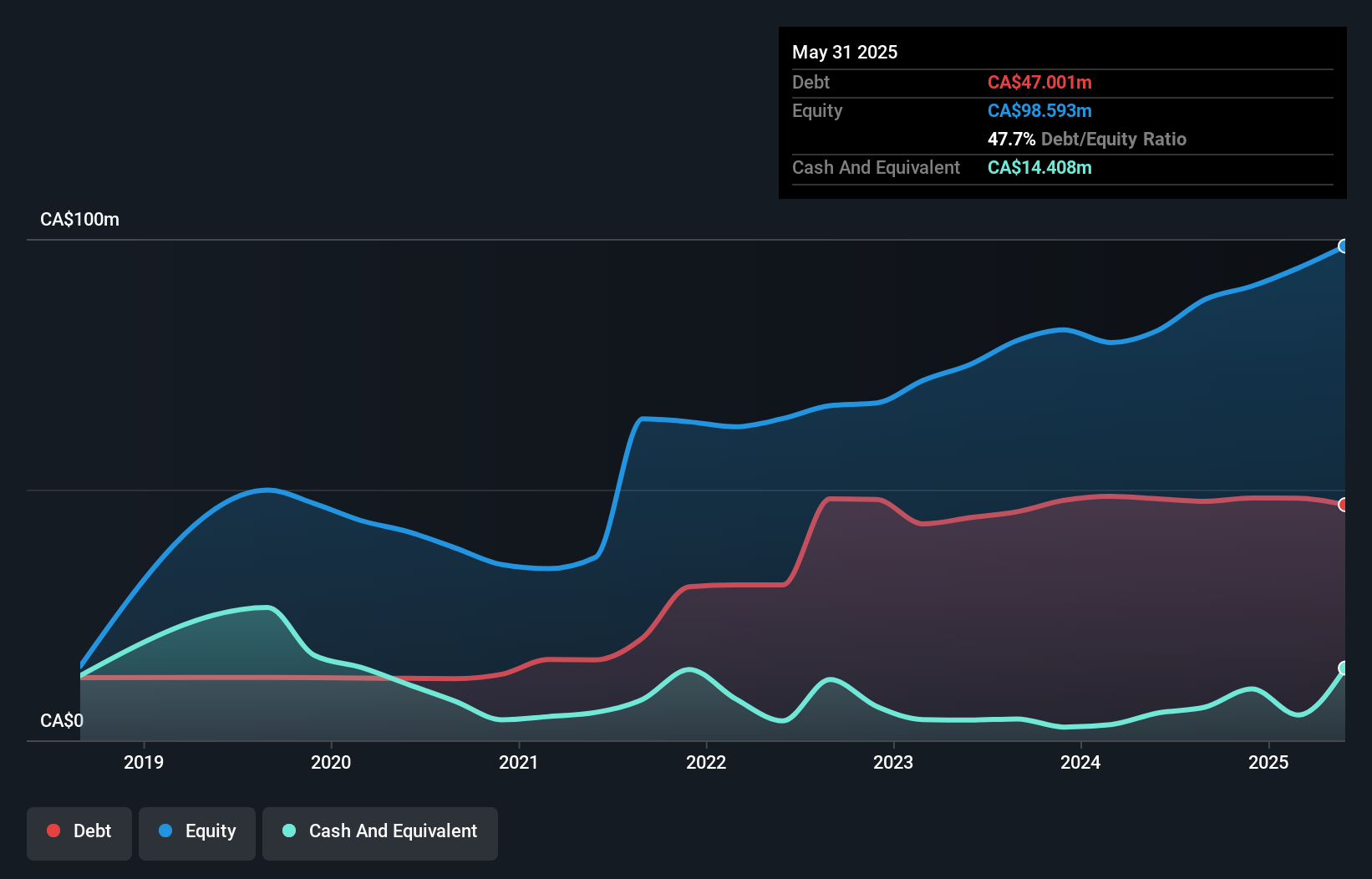

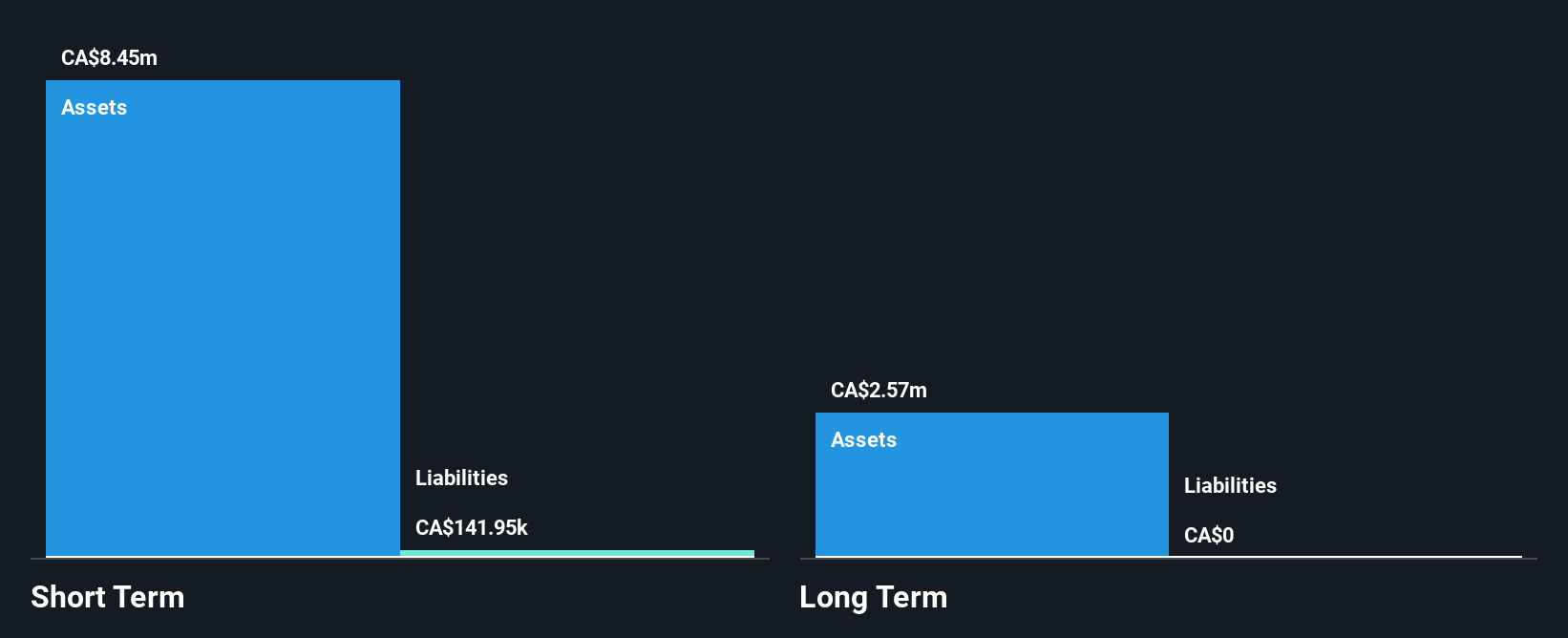

Steppe Gold Ltd. has shown mixed performance as a penny stock, with its net profit margins declining from 31.1% to 27.3% over the past year, and negative earnings growth of -16.2%. Despite this, the company maintains high-quality earnings and a satisfactory net debt to equity ratio of 37.4%, with short-term assets covering both short- and long-term liabilities comfortably. The management team is experienced, although recent executive changes have introduced new leadership dynamics in Mongolia operations. Revenue forecasts suggest significant growth potential at 52.25% annually, though recent sales figures have declined compared to last year’s performance.

- Click to explore a detailed breakdown of our findings in Steppe Gold's financial health report.

- Gain insights into Steppe Gold's future direction by reviewing our growth report.

Cannara Biotech (TSXV:LOVE)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Cannara Biotech Inc., along with its subsidiaries, focuses on the indoor cultivation, processing, and sale of cannabis and cannabis-derived products in Canada, with a market cap of CA$150.86 million.

Operations: The company generates revenue primarily through its Cannabis Operations, which account for CA$97.95 million, and also earns from Real Estate Operations totaling CA$3.82 million.

Market Cap: CA$150.86M

Cannara Biotech Inc. has demonstrated strong financial health, with a market cap of CA$150.86 million and robust revenue from its cannabis operations at CA$97.95 million. The company benefits from a seasoned management team and high-quality earnings, supported by a satisfactory net debt to equity ratio of 33.1%. Recent strategic moves include an amendment to its credit facility with Bank of Montreal, adding a CA$10 million capital expenditures facility aimed at enhancing production capabilities at the Valleyfield facility. Cannara's inclusion in the S&P/TSX Venture Composite Index highlights its growing presence in the market.

- Take a closer look at Cannara Biotech's potential here in our financial health report.

- Examine Cannara Biotech's earnings growth report to understand how analysts expect it to perform.

Teuton Resources (TSXV:TUO)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Teuton Resources Corp. is an exploration stage company focused on acquiring, exploring, and dealing with mineral properties in Canada, with a market cap of CA$75.88 million.

Operations: Teuton Resources Corp. has not reported any revenue segments.

Market Cap: CA$75.88M

Teuton Resources Corp., with a market cap of CA$75.88 million, remains pre-revenue as it focuses on exploration activities in Canada's Golden Triangle. Despite being unprofitable, the company is debt-free and has a robust cash runway exceeding three years. Recent developments include strategic spinouts of mineral properties and NSR interests to streamline operations and potentially unlock shareholder value. The completion of drilling at the Ram property highlights promising porphyry copper-gold and VMS mineralization zones, which could benefit from regional exploration momentum. Teuton's stable share structure without significant dilution further supports its position in speculative investments.

- Navigate through the intricacies of Teuton Resources with our comprehensive balance sheet health report here.

- Examine Teuton Resources' past performance report to understand how it has performed in prior years.

Summing It All Up

- Embark on your investment journey to our 411 TSX Penny Stocks selection here.

- Interested In Other Possibilities? The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:STGO

Steppe Gold

Engages in operating, developing, exploring, and acquiring precious metal projects in Mongolia and Peru.

Excellent balance sheet and slightly overvalued.

Market Insights

Community Narratives