- Canada

- /

- Metals and Mining

- /

- TSXV:NOB

TSX Penny Stocks To Watch In June 2025

Reviewed by Simply Wall St

As the Canadian market navigates a complex landscape of trade developments, central bank meetings, and fiscal debates, investors are keeping a close eye on potential volatility and opportunities. Amidst these broader economic conditions, penny stocks remain an intriguing area for exploration. Though often seen as relics of past trading days, these smaller or newer companies can still offer significant growth potential when backed by strong financial health and fundamentals.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| PetroTal (TSX:TAL) | CA$0.66 | CA$612.95M | ✅ 3 ⚠️ 3 View Analysis > |

| Orezone Gold (TSX:ORE) | CA$1.31 | CA$701.13M | ✅ 4 ⚠️ 2 View Analysis > |

| Dynacor Group (TSX:DNG) | CA$4.51 | CA$193.51M | ✅ 4 ⚠️ 2 View Analysis > |

| Findev (TSXV:FDI) | CA$0.45 | CA$12.46M | ✅ 2 ⚠️ 4 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$0.73 | CA$492.32M | ✅ 3 ⚠️ 2 View Analysis > |

| Automotive Finco (TSXV:AFCC.H) | CA$0.87 | CA$17.24M | ✅ 2 ⚠️ 4 View Analysis > |

| NTG Clarity Networks (TSXV:NCI) | CA$2.30 | CA$96.86M | ✅ 4 ⚠️ 2 View Analysis > |

| Intermap Technologies (TSX:IMP) | CA$2.32 | CA$140.1M | ✅ 3 ⚠️ 1 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$1.85 | CA$178.86M | ✅ 3 ⚠️ 1 View Analysis > |

| McChip Resources (TSXV:MCS) | CA$0.95 | CA$5.42M | ✅ 2 ⚠️ 4 View Analysis > |

Click here to see the full list of 877 stocks from our TSX Penny Stocks screener.

Let's review some notable picks from our screened stocks.

NervGen Pharma (TSXV:NGEN)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: NervGen Pharma Corp. is a biotechnology company focused on discovering, developing, and commercializing pharmaceutical treatments for nervous system repair in neurotrauma and neurologic diseases, with a market cap of CA$252.11 million.

Operations: NervGen Pharma Corp. has not reported any revenue segments.

Market Cap: CA$252.11M

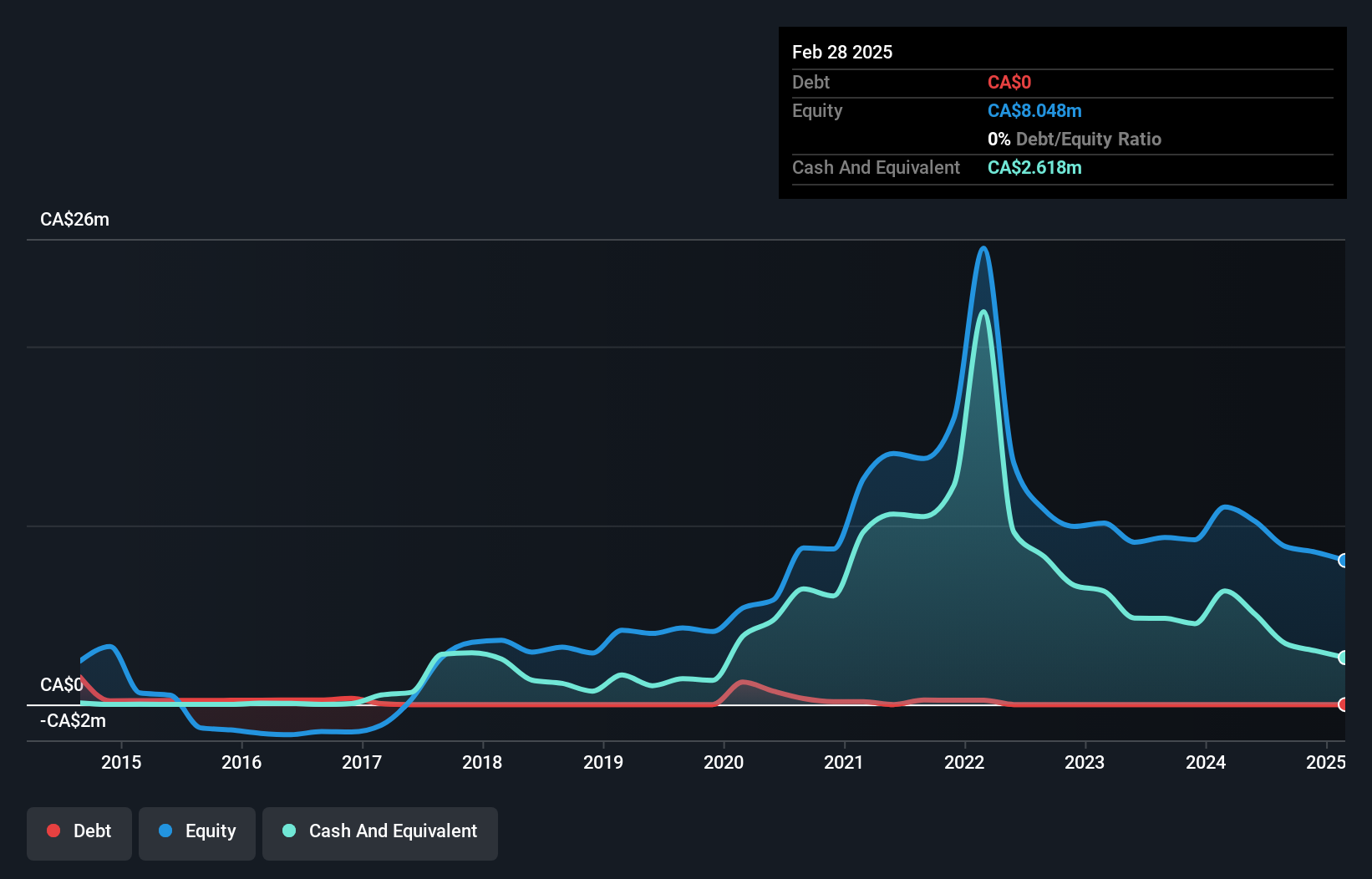

NervGen Pharma Corp., with a market cap of CA$252.11 million, is a pre-revenue biotechnology company focused on nervous system repair. Recent positive topline results from its Phase 1b/2a trial for NVG-291 highlight potential treatment advances for spinal cord injury, though the company remains unprofitable with increasing losses and less than one year of cash runway. Despite no debt and experienced board members, NervGen's management team is relatively new, contributing to its high share price volatility. Shareholders have not faced significant dilution recently, but the path to profitability remains uncertain in the near term.

- Jump into the full analysis health report here for a deeper understanding of NervGen Pharma.

- Gain insights into NervGen Pharma's future direction by reviewing our growth report.

Noble Mineral Exploration (TSXV:NOB)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Noble Mineral Exploration Inc. is a junior exploration company focused on the exploration and evaluation of mineral properties in Canada, with a market cap of CA$13.05 million.

Operations: Noble Mineral Exploration Inc. does not have any reported revenue segments.

Market Cap: CA$13.05M

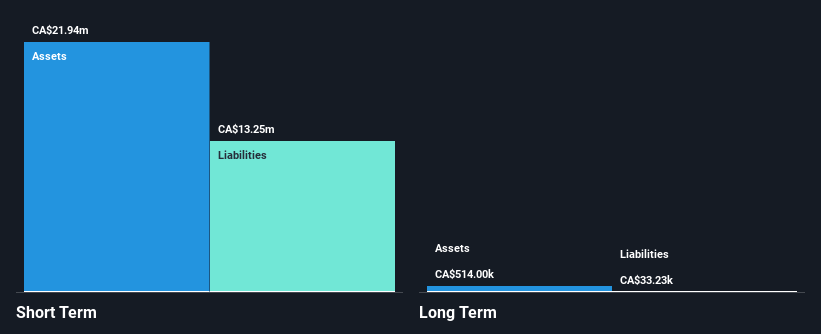

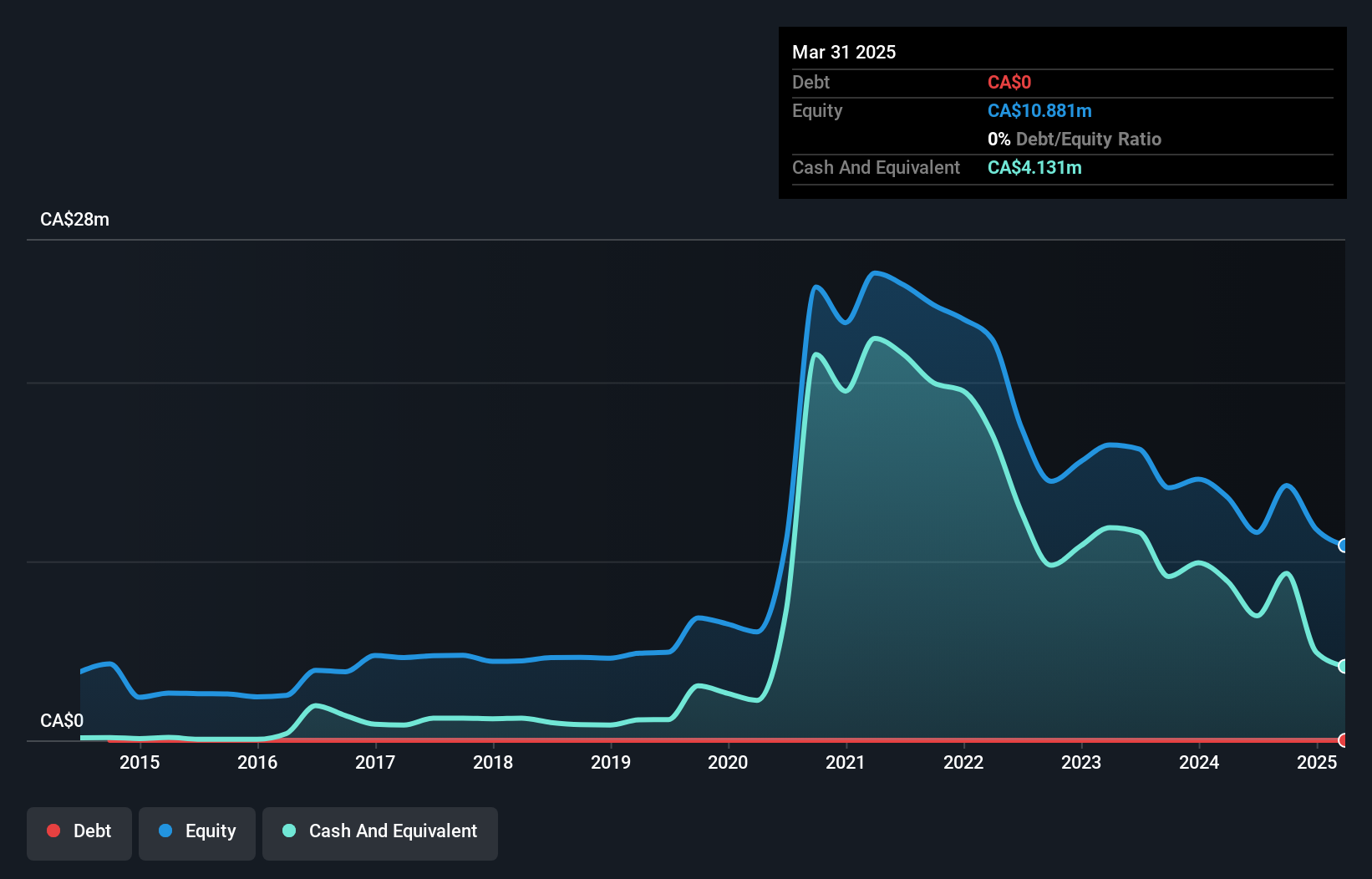

Noble Mineral Exploration Inc., with a market cap of CA$13.05 million, is a pre-revenue junior exploration company. Recent successful drilling results from its joint venture with Canada Nickel Company in the East Timmins Nickel Project highlight potential resource development, with an initial resource estimate expected soon. Despite being debt-free and having seasoned management and board members, Noble's financials reflect ongoing challenges, including recent net losses and high share price volatility over the past three months. The company maintains sufficient cash runway for 1.6 years under current conditions but remains in an exploratory phase without significant revenue streams.

- Click to explore a detailed breakdown of our findings in Noble Mineral Exploration's financial health report.

- Examine Noble Mineral Exploration's past performance report to understand how it has performed in prior years.

Teuton Resources (TSXV:TUO)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Teuton Resources Corp. is an exploration stage company focused on acquiring, exploring, and managing mineral properties in Canada, with a market cap of CA$51.97 million.

Operations: Teuton Resources Corp. does not have any reported revenue segments as it is in the exploration stage of its operations.

Market Cap: CA$51.97M

Teuton Resources, with a market cap of CA$51.97 million, is a pre-revenue exploration company in Canada, currently unprofitable with net losses of CA$0.91 million in Q1 2025. Despite its financial challenges, the company benefits from being debt-free and having an experienced board with an average tenure of 4.9 years. With short-term assets (CA$8.5M) comfortably exceeding liabilities (CA$141.9K), Teuton maintains a stable cash runway for over three years under current conditions and has not significantly diluted shareholders recently, though earnings have declined by 28.9% annually over the past five years.

- Get an in-depth perspective on Teuton Resources' performance by reading our balance sheet health report here.

- Understand Teuton Resources' track record by examining our performance history report.

Turning Ideas Into Actions

- Reveal the 877 hidden gems among our TSX Penny Stocks screener with a single click here.

- Ready For A Different Approach? Explore 22 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Noble Mineral Exploration might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:NOB

Noble Mineral Exploration

A junior exploration company, engages in the exploration and evaluation of mineral properties in Canada.

Flawless balance sheet with slight risk.

Market Insights

Community Narratives