- Canada

- /

- Metals and Mining

- /

- TSXV:THX

Top 3 TSX Penny Stocks To Consider In July 2025

Reviewed by Simply Wall St

The Canadian market has been enjoying a steady climb, with the TSX reaching new highs amid trade optimism and solid corporate earnings, though upcoming events like big-tech earnings and central bank meetings could introduce some volatility. In this context of elevated valuations and cautious optimism, investors are advised to focus on quality and diversification. While the term "penny stocks" might seem outdated, these smaller or newer companies can still offer significant opportunities for growth when they are backed by strong financials.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$0.66 | CA$66.76M | ✅ 3 ⚠️ 3 View Analysis > |

| Fintech Select (TSXV:FTEC) | CA$0.03 | CA$2.4M | ✅ 2 ⚠️ 3 View Analysis > |

| Foraco International (TSX:FAR) | CA$1.75 | CA$172.6M | ✅ 4 ⚠️ 1 View Analysis > |

| Findev (TSXV:FDI) | CA$0.42 | CA$12.03M | ✅ 2 ⚠️ 4 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$0.78 | CA$518.93M | ✅ 3 ⚠️ 2 View Analysis > |

| Automotive Finco (TSXV:AFCC.H) | CA$0.92 | CA$18.23M | ✅ 2 ⚠️ 4 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$3.61 | CA$183.23M | ✅ 2 ⚠️ 1 View Analysis > |

| Avino Silver & Gold Mines (TSX:ASM) | CA$4.88 | CA$708.6M | ✅ 3 ⚠️ 1 View Analysis > |

| ACT Energy Technologies (TSX:ACX) | CA$4.84 | CA$164.2M | ✅ 4 ⚠️ 2 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$1.93 | CA$184.26M | ✅ 3 ⚠️ 1 View Analysis > |

Click here to see the full list of 456 stocks from our TSX Penny Stocks screener.

We'll examine a selection from our screener results.

Mayfair Gold (TSXV:MFG)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Mayfair Gold Corp. is engaged in the acquisition, exploration, evaluation, and development of mineral properties with a market cap of CA$183.60 million.

Operations: Currently, there are no reported revenue segments for Mayfair Gold Corp.

Market Cap: CA$183.6M

Mayfair Gold Corp., with a market cap of CA$183.60 million, is pre-revenue and currently unprofitable, facing increased losses over the past five years. The company has no debt but less than a year of cash runway based on its current free cash flow. Despite these challenges, Mayfair's Fenn-Gib Gold Project in Ontario shows promise with an indicated mineral resource estimate containing 4.3 million ounces of gold. Recent updates focus on advancing a Pre-Feasibility Study targeting high-grade mineralization to maximize short-term value, alongside plans for extensive reverse circulation drilling to improve geological confidence and future operations planning.

- Get an in-depth perspective on Mayfair Gold's performance by reading our balance sheet health report here.

- Gain insights into Mayfair Gold's historical outcomes by reviewing our past performance report.

Thor Explorations (TSXV:THX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Thor Explorations Ltd., along with its subsidiaries, operates as a gold producer and explorer with a market cap of CA$518.93 million.

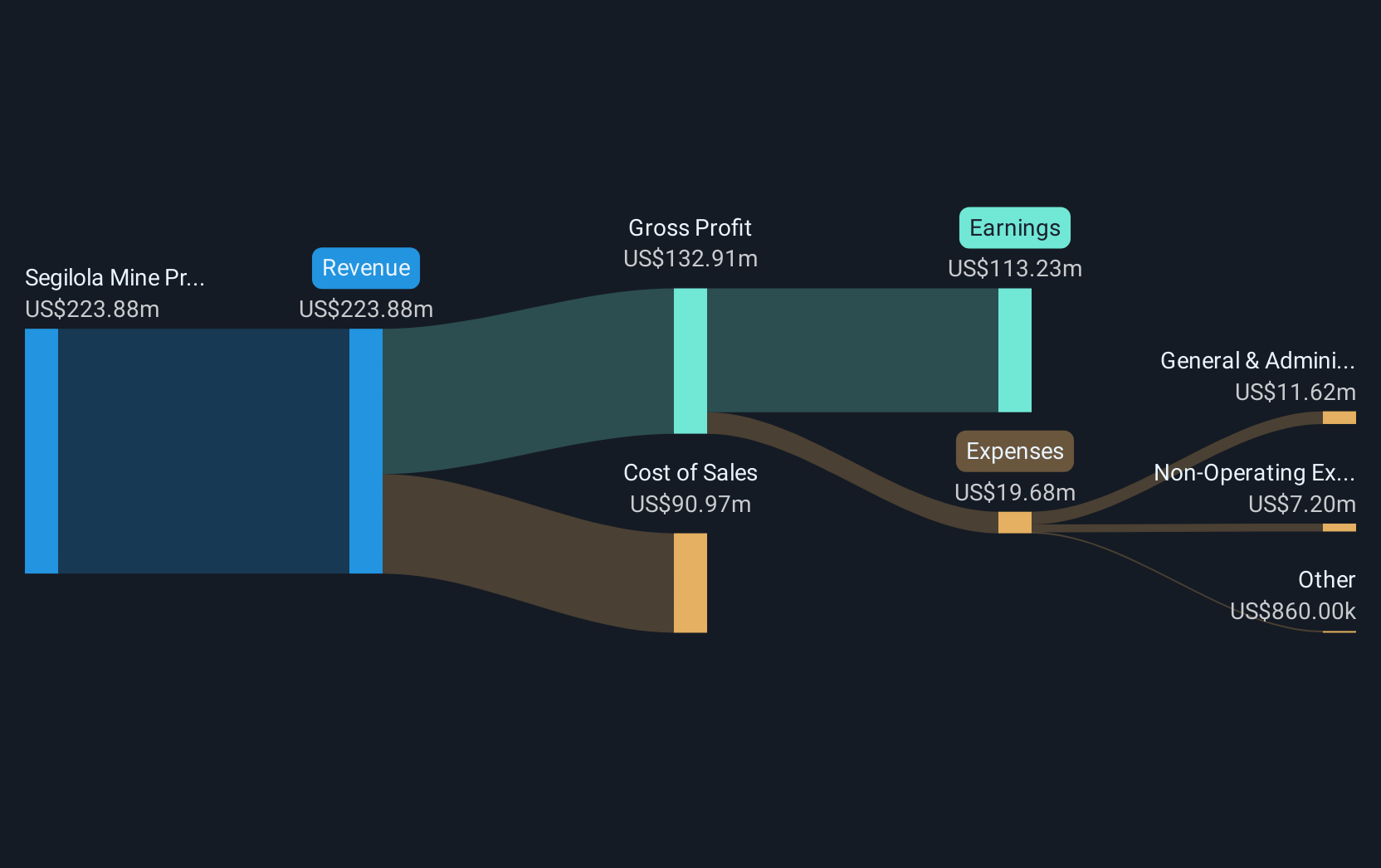

Operations: The company generates revenue from its Segilola Mine Project, amounting to $223.88 million.

Market Cap: CA$518.93M

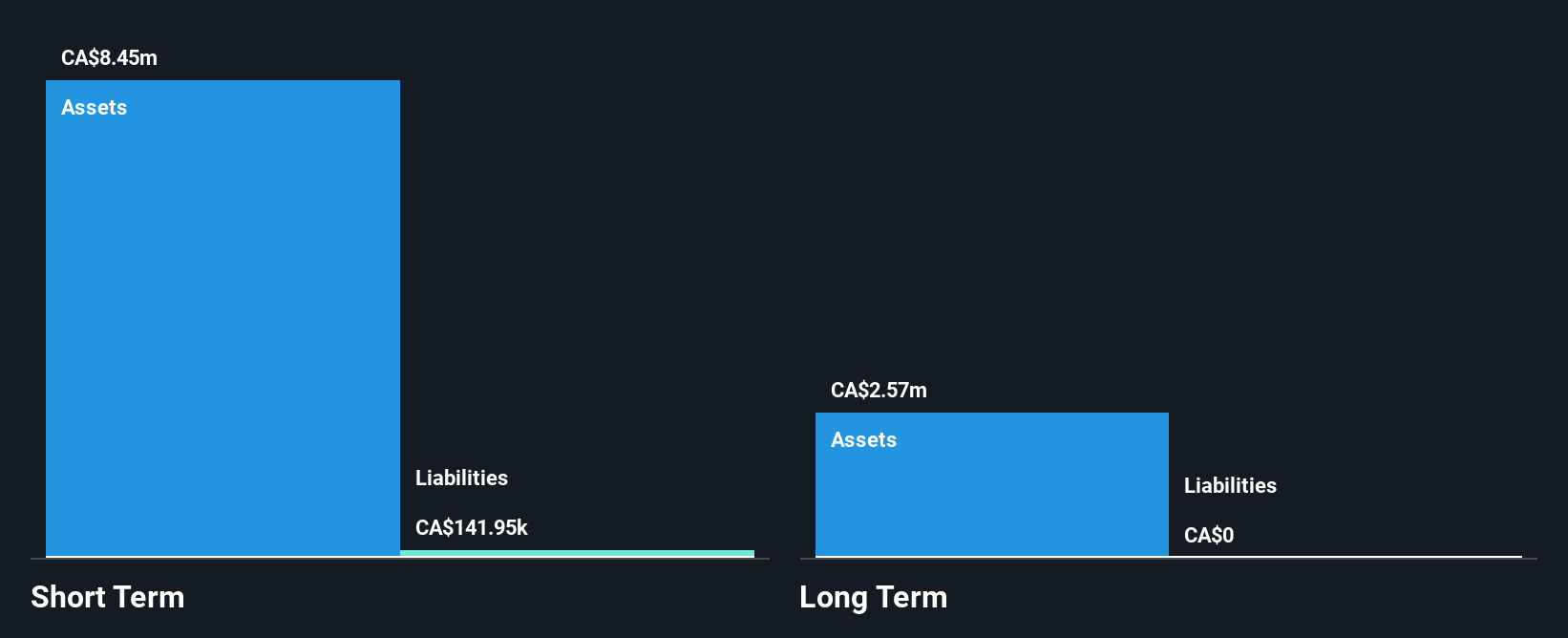

Thor Explorations Ltd. has shown robust financial performance, with a market cap of CA$518.93 million and significant revenue generation from its Segilola Mine Project, totaling US$223.88 million. The company maintains strong profitability, evidenced by a substantial net profit margin of 50.6% and impressive earnings growth of 457.6% over the past year, far outpacing industry averages. Thor's financial health is solid with no debt and short-term assets exceeding liabilities significantly. Recent drilling results at the Guitry Gold Project in Cote d'Ivoire indicate promising gold mineralization potential, supporting future exploration activities and potential growth opportunities for investors.

- Click to explore a detailed breakdown of our findings in Thor Explorations' financial health report.

- Gain insights into Thor Explorations' outlook and expected performance with our report on the company's earnings estimates.

Teuton Resources (TSXV:TUO)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Teuton Resources Corp. is an exploration stage company focused on acquiring, exploring, and dealing mineral properties in Canada, with a market cap of CA$52.55 million.

Operations: Teuton Resources Corp. has not reported any revenue segments, as it is currently in the exploration stage of its operations focused on mineral properties in Canada.

Market Cap: CA$52.55M

Teuton Resources Corp., a pre-revenue exploration stage company, maintains a market cap of CA$52.55 million and is debt-free with sufficient cash runway exceeding three years. Despite stable weekly volatility, the company remains unprofitable with increasing losses over the past five years. Recent developments include a private placement raising CA$1.6 million and ongoing exploration at the Treaty Creek Project, where Teuton holds a 20% interest and 0.98% net smelter royalty in the Goldstorm Deposit. The current drilling program aims to expand high-grade gold discoveries, potentially enhancing future prospects despite recent insider selling concerns.

- Click here and access our complete financial health analysis report to understand the dynamics of Teuton Resources.

- Review our historical performance report to gain insights into Teuton Resources' track record.

Summing It All Up

- Unlock more gems! Our TSX Penny Stocks screener has unearthed 453 more companies for you to explore.Click here to unveil our expertly curated list of 456 TSX Penny Stocks.

- Contemplating Other Strategies? The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 19 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Thor Explorations might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:THX

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives