- Canada

- /

- Metals and Mining

- /

- TSXV:SME

TSX Opportunities: NeoTerrex Minerals Among 3 Promising Penny Stocks

Reviewed by Simply Wall St

Despite the ongoing federal government disruptions in Washington, D.C., Canadian markets have largely kept their focus on other drivers, such as the potential for lower interest rates and significant investments in AI technology. In this context, penny stocks—often associated with smaller or newer companies—continue to offer intriguing growth opportunities for investors willing to explore beyond traditional large-cap equities. While the term "penny stocks" might seem outdated, these investments can still provide a mix of affordability and potential upside when backed by strong financial health and solid fundamentals.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$2.64 | CA$66.74M | ✅ 3 ⚠️ 4 View Analysis > |

| Canso Select Opportunities (TSXV:CSOC.A) | CA$4.50 | CA$22.73M | ✅ 2 ⚠️ 2 View Analysis > |

| Montero Mining and Exploration (TSXV:MON) | CA$0.39 | CA$3.26M | ✅ 2 ⚠️ 4 View Analysis > |

| CEMATRIX (TSX:CEMX) | CA$0.35 | CA$52.57M | ✅ 2 ⚠️ 1 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$1.32 | CA$878.19M | ✅ 3 ⚠️ 2 View Analysis > |

| Automotive Finco (TSXV:AFCC.H) | CA$1.00 | CA$19.82M | ✅ 2 ⚠️ 3 View Analysis > |

| Amerigo Resources (TSX:ARG) | CA$2.80 | CA$452.18M | ✅ 3 ⚠️ 2 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$3.37 | CA$171.04M | ✅ 2 ⚠️ 1 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$2.17 | CA$206M | ✅ 3 ⚠️ 1 View Analysis > |

| Matachewan Consolidated Mines (TSXV:MCM.A) | CA$0.71 | CA$8.84M | ✅ 2 ⚠️ 4 View Analysis > |

Click here to see the full list of 409 stocks from our TSX Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

NeoTerrex Minerals (TSXV:NTX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: NeoTerrex Minerals Inc. is involved in the evaluation, acquisition, and exploration of mineral properties in Canada, with a market cap of CA$24.66 million.

Operations: NeoTerrex Minerals Inc. has not reported any revenue segments.

Market Cap: CA$24.66M

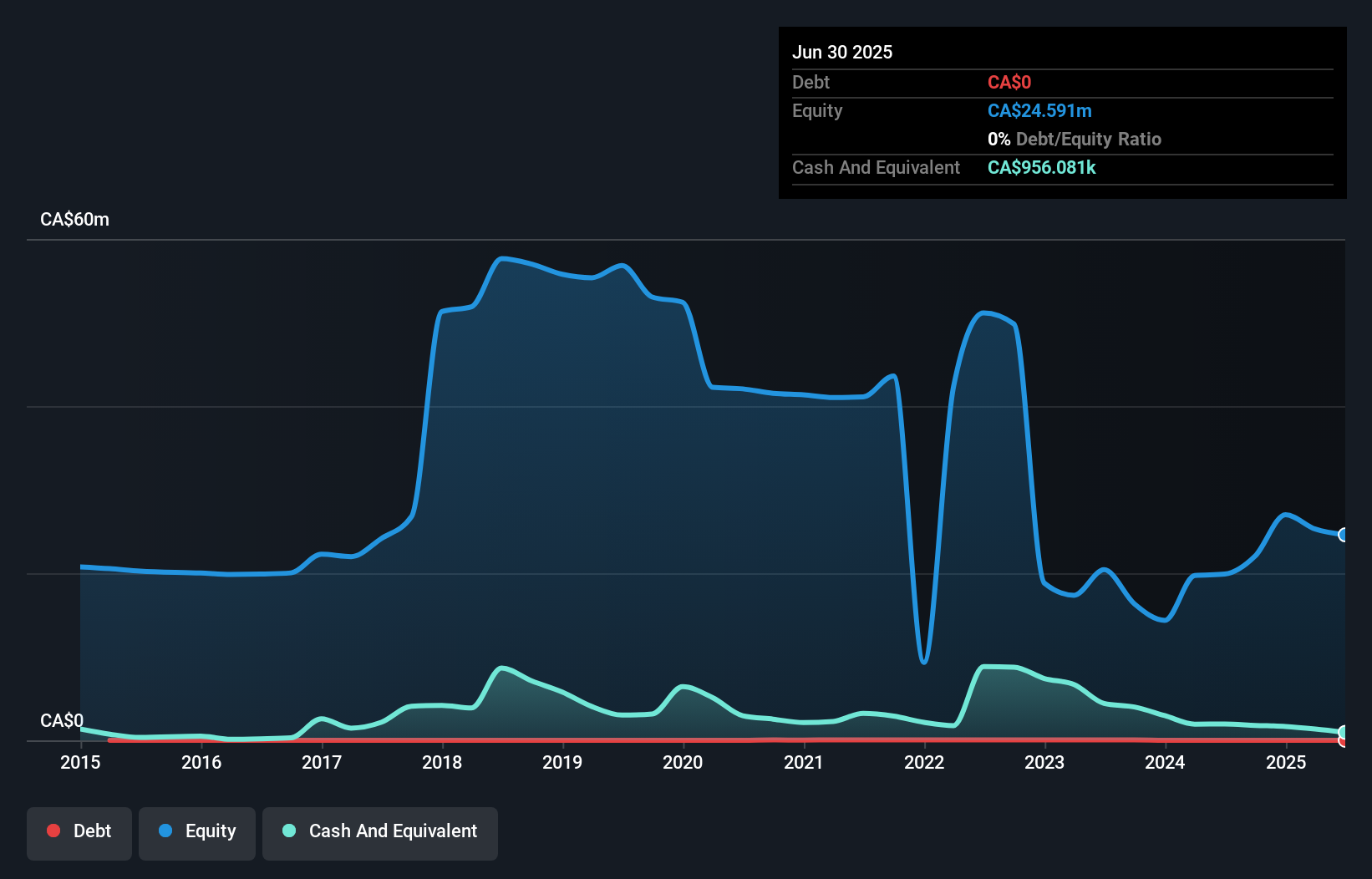

NeoTerrex Minerals Inc., with a market cap of CA$24.66 million, is pre-revenue and focused on exploring rare earth elements in Quebec. Recent developments include completing Phase I exploration at the Monument and Revolver projects, revealing promising REE occurrences and planning further drilling. Despite its unprofitability, NeoTerrex benefits from being debt-free with sufficient cash to advance its projects. The company’s strategic location near established infrastructure supports its exploration efforts. While the volatility of its share price remains high compared to Canadian stocks, NeoTerrex's financial stability may provide resilience as it seeks to capitalize on North America's critical minerals demand.

- Dive into the specifics of NeoTerrex Minerals here with our thorough balance sheet health report.

- Learn about NeoTerrex Minerals' historical performance here.

Sama Resources (TSXV:SME)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Sama Resources Inc. is engaged in the exploration and development of mineral properties in West Africa and Canada, with a market cap of CA$16.51 million.

Operations: Sama Resources Inc. does not report distinct revenue segments.

Market Cap: CA$16.51M

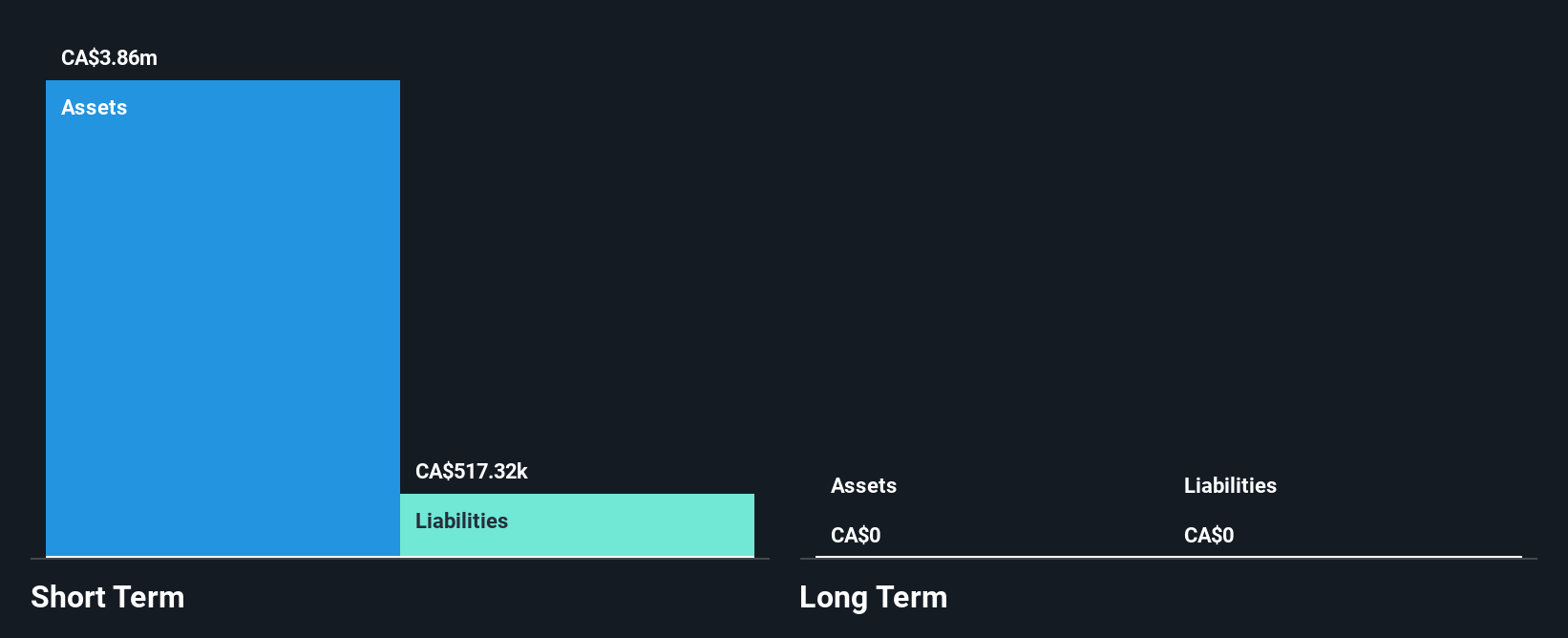

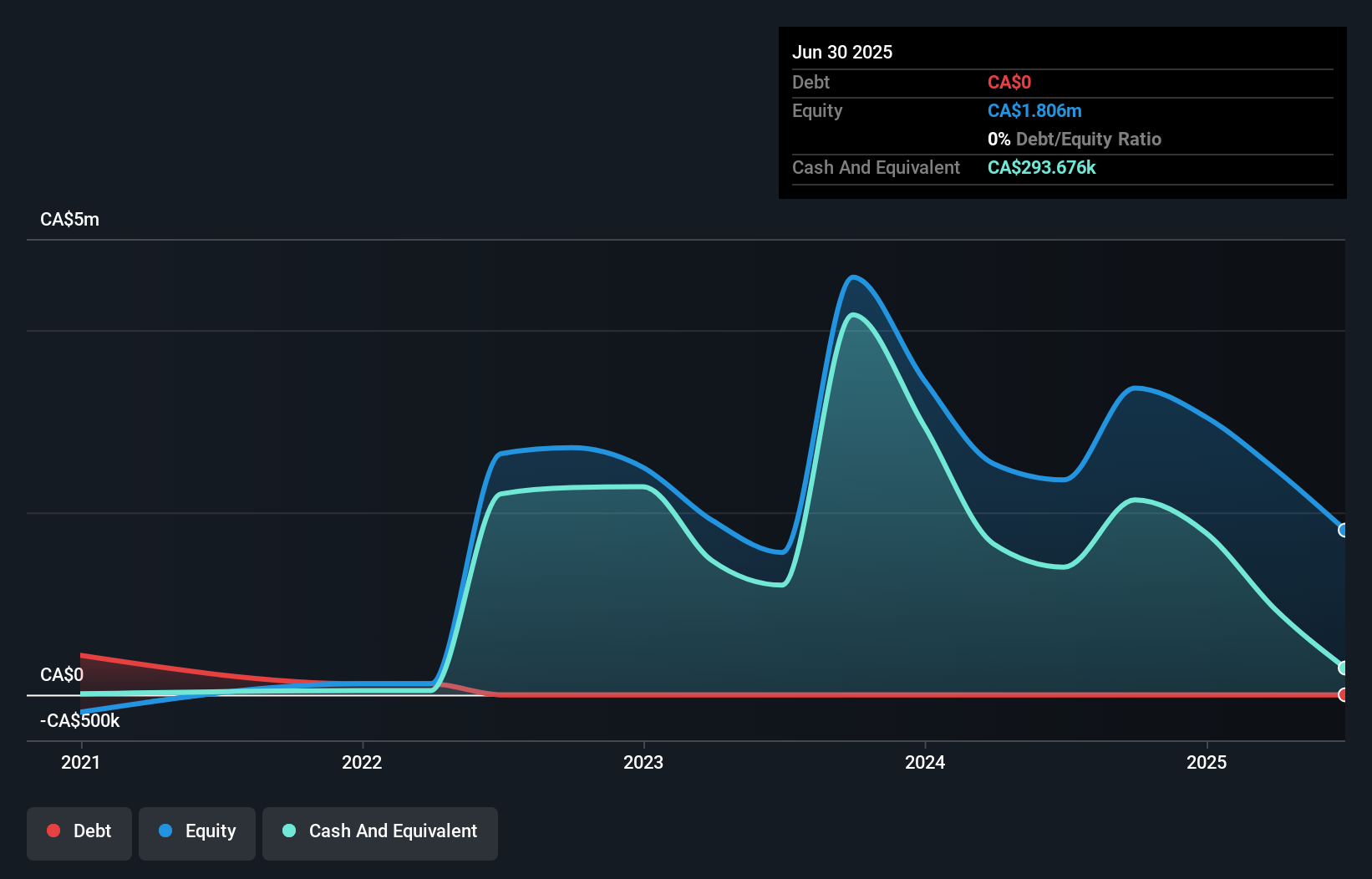

Sama Resources Inc., with a market cap of CA$16.51 million, is pre-revenue and engaged in mineral exploration in West Africa and Canada. The company has no debt or long-term liabilities, offering a solid financial foundation despite being unprofitable. Recent developments include progress at the Samapleu-Grata Nickel-Copper Project in Cote d'Ivoire, where new polymetallic mineralization was discovered, validating its regional exploration model. Although Sama's share price is highly volatile compared to Canadian stocks, it maintains sufficient cash runway for over a year and benefits from an experienced management team averaging 11 years of tenure.

- Click to explore a detailed breakdown of our findings in Sama Resources' financial health report.

- Examine Sama Resources' past performance report to understand how it has performed in prior years.

Tribeca Resources (TSXV:TRBC)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Tribeca Resources Corporation is a junior resource company focused on acquiring and exploring unproven mineral interests in Chile, with a market cap of CA$19.63 million.

Operations: Currently, there are no reported revenue segments for this junior resource company focused on mineral exploration in Chile.

Market Cap: CA$19.63M

Tribeca Resources Corporation, with a market cap of CA$19.63 million, is a pre-revenue junior resource company exploring mineral interests in Chile. The company remains debt-free and has recently announced a private placement to raise up to CA$5 million, enhancing its financial flexibility. Despite being unprofitable and having experienced increased losses over the past five years, Tribeca's short-term assets exceed its liabilities. The board of directors is considered experienced with an average tenure of 4.5 years. However, the company's cash runway was limited to two months as of June 2025 but may improve following the recent capital raise announcement.

- Navigate through the intricacies of Tribeca Resources with our comprehensive balance sheet health report here.

- Gain insights into Tribeca Resources' past trends and performance with our report on the company's historical track record.

Summing It All Up

- Unlock more gems! Our TSX Penny Stocks screener has unearthed 406 more companies for you to explore.Click here to unveil our expertly curated list of 409 TSX Penny Stocks.

- Searching for a Fresh Perspective? Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:SME

Sama Resources

Explores and develops mineral properties in West Africa and Canada.

Flawless balance sheet with low risk.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion