- Canada

- /

- Oil and Gas

- /

- TSX:PXT

Top TSX Dividend Stocks To Watch In August 2025

Reviewed by Simply Wall St

As the Canadian stock market continues to reach new heights, buoyed by trade optimism and strong corporate earnings, investors are keeping a close eye on dividend stocks for their potential to offer stable returns amid the ongoing economic developments. In this environment of steady gains and low volatility, selecting quality dividend stocks can provide a reliable income stream while navigating the evolving landscape shaped by trade negotiations and policy decisions.

Top 10 Dividend Stocks In Canada

| Name | Dividend Yield | Dividend Rating |

| Sun Life Financial (TSX:SLF) | 4.17% | ★★★★★☆ |

| Russel Metals (TSX:RUS) | 3.88% | ★★★★★☆ |

| Royal Bank of Canada (TSX:RY) | 3.46% | ★★★★★☆ |

| Quebecor (TSX:QBR.A) | 3.53% | ★★★★★☆ |

| Power Corporation of Canada (TSX:POW) | 4.39% | ★★★★★☆ |

| National Bank of Canada (TSX:NA) | 3.27% | ★★★★★☆ |

| IGM Financial (TSX:IGM) | 4.90% | ★★★★★☆ |

| Canadian Imperial Bank of Commerce (TSX:CM) | 3.92% | ★★★★★☆ |

| Atrium Mortgage Investment (TSX:AI) | 9.51% | ★★★★★☆ |

| Acadian Timber (TSX:ADN) | 6.46% | ★★★★★☆ |

Click here to see the full list of 24 stocks from our Top TSX Dividend Stocks screener.

We'll examine a selection from our screener results.

Parex Resources (TSX:PXT)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Parex Resources Inc. is involved in the exploration, development, production, and marketing of oil and natural gas in Colombia with a market cap of CA$1.57 billion.

Operations: Parex Resources Inc. generates revenue primarily through its activities in the oil and natural gas sectors within Colombia.

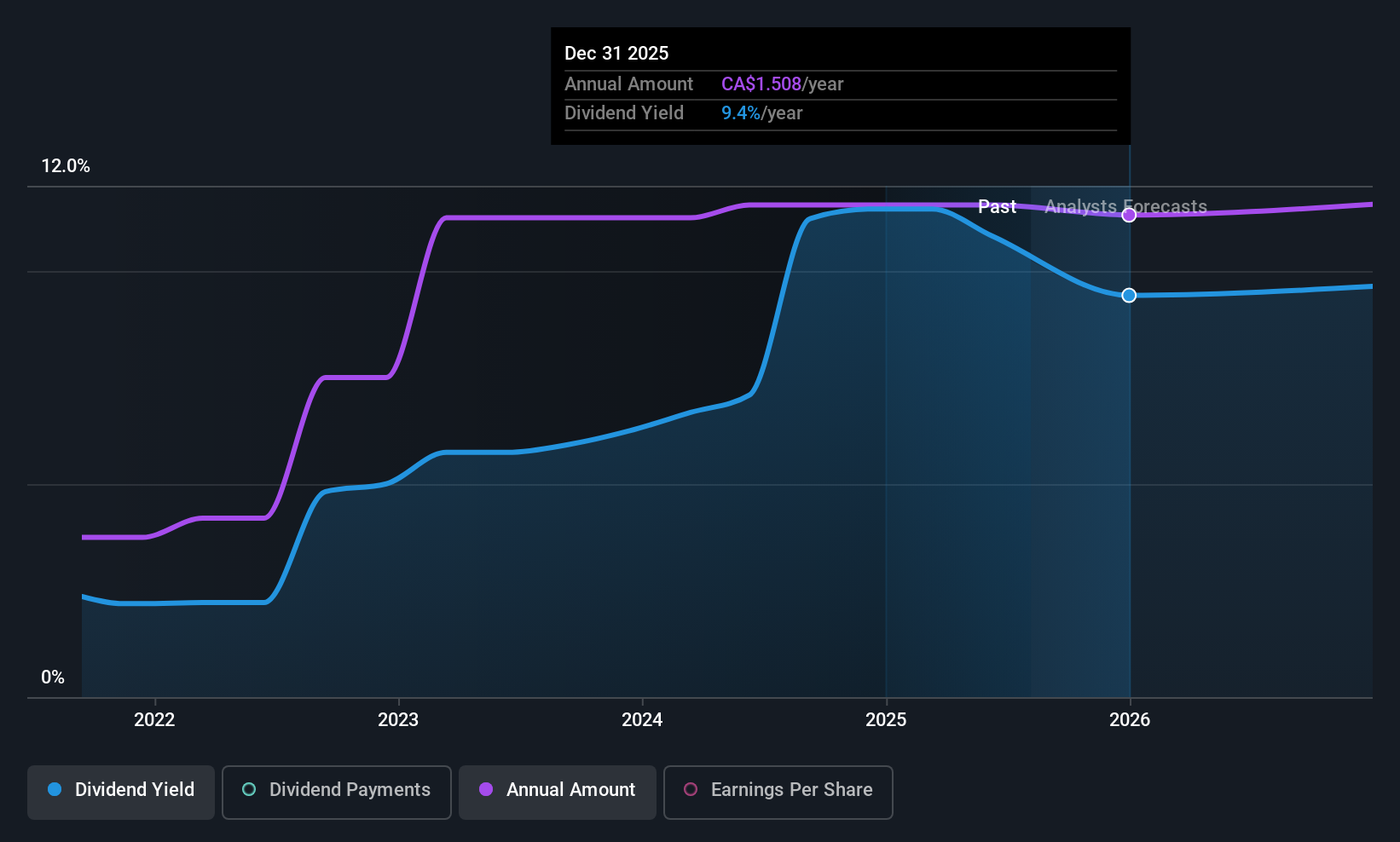

Dividend Yield: 9.3%

Parex Resources offers a compelling dividend profile, with its dividend yield in the top 25% of Canadian payers. Despite having paid dividends for only four years, payments have been stable and covered by earnings (payout ratio: 82.9%) and cash flows (cash payout ratio: 63.1%). Recent earnings showed strong net income growth despite lower revenue, indicating financial resilience. However, profit margins have decreased from last year, which may affect future payouts if not addressed.

- Click here and access our complete dividend analysis report to understand the dynamics of Parex Resources.

- The analysis detailed in our Parex Resources valuation report hints at an deflated share price compared to its estimated value.

Russel Metals (TSX:RUS)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Russel Metals Inc. operates in the distribution of steel and other metal products across Canada and the United States, with a market cap of CA$2.49 billion.

Operations: Russel Metals Inc. generates revenue primarily from its Metals Service Centers at CA$2.98 billion, followed by Energy Field Stores at CA$981 million and Steel Distributors at CA$388.20 million.

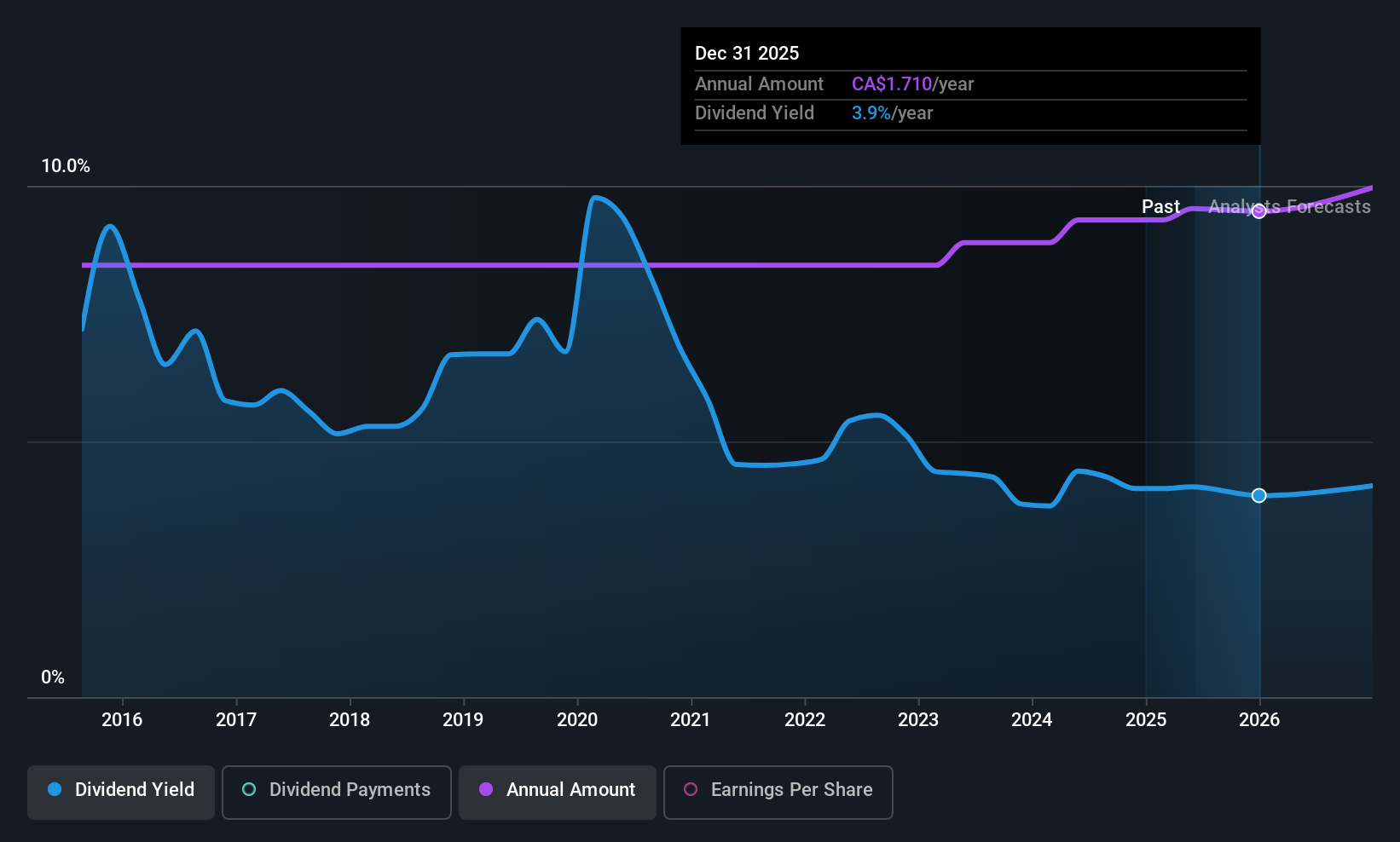

Dividend Yield: 3.9%

Russel Metals' dividend yield of 3.88% is lower than the top Canadian payers but remains reliable, with consistent increases over the past decade. The payout is well-covered by earnings (63.2%) and cash flows (41.9%). Despite a recent dip in profit margins from 5.5% to 3.5%, Russel Metals increased its quarterly dividend by 2.4% to CAD 0.43 per share, marking a cumulative rise of 13.2% since May 2023, showcasing ongoing commitment to shareholder returns amidst stable financial management strategies including share buybacks.

- Dive into the specifics of Russel Metals here with our thorough dividend report.

- Our comprehensive valuation report raises the possibility that Russel Metals is priced lower than what may be justified by its financials.

Thor Explorations (TSXV:THX)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Thor Explorations Ltd., along with its subsidiaries, operates as a gold producer and explorer, with a market cap of CA$492.32 million.

Operations: Thor Explorations Ltd.'s revenue primarily comes from its Segilola Mine Project, which generated $223.88 million.

Dividend Yield: 6.8%

Thor Explorations has recently initiated dividend payments, offering a yield of 6.78%, placing it among the top Canadian payers. The payout ratio is low at 5.1%, indicating strong earnings coverage, while cash flows also support sustainability with a cash payout ratio of 37.5%. Despite robust past earnings growth and favorable valuation compared to peers, future earnings are expected to decline by an average of 16.5% annually over the next three years.

- Navigate through the intricacies of Thor Explorations with our comprehensive dividend report here.

- Upon reviewing our latest valuation report, Thor Explorations' share price might be too pessimistic.

Key Takeaways

- Navigate through the entire inventory of 24 Top TSX Dividend Stocks here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:PXT

Parex Resources

Engages in the exploration, development, production, and marketing of oil and natural gas in Colombia.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives