- Canada

- /

- Metals and Mining

- /

- TSXV:THX

Thor Explorations Ltd. (CVE:THX) Stock Catapults 28% Though Its Price And Business Still Lag The Market

Despite an already strong run, Thor Explorations Ltd. (CVE:THX) shares have been powering on, with a gain of 28% in the last thirty days. The last month tops off a massive increase of 185% in the last year.

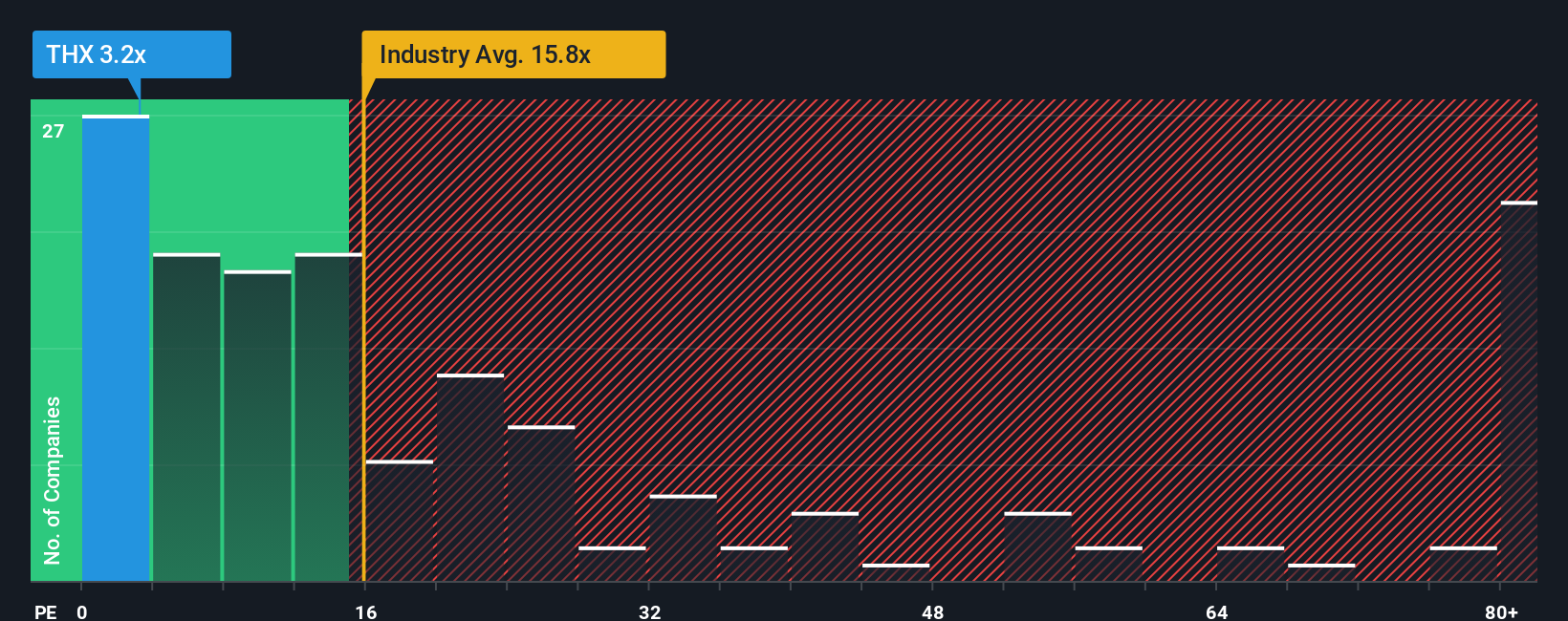

In spite of the firm bounce in price, given about half the companies in Canada have price-to-earnings ratios (or "P/E's") above 16x, you may still consider Thor Explorations as a highly attractive investment with its 3.2x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/E.

Thor Explorations certainly has been doing a good job lately as it's been growing earnings more than most other companies. One possibility is that the P/E is low because investors think this strong earnings performance might be less impressive moving forward. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

View our latest analysis for Thor Explorations

How Is Thor Explorations' Growth Trending?

There's an inherent assumption that a company should far underperform the market for P/E ratios like Thor Explorations' to be considered reasonable.

If we review the last year of earnings growth, the company posted a terrific increase of 454%. The strong recent performance means it was also able to grow EPS by 9,587% in total over the last three years. So we can start by confirming that the company has done a great job of growing earnings over that time.

Turning to the outlook, the next three years should bring diminished returns, with earnings decreasing 14% per annum as estimated by the two analysts watching the company. That's not great when the rest of the market is expected to grow by 11% each year.

With this information, we are not surprised that Thor Explorations is trading at a P/E lower than the market. Nonetheless, there's no guarantee the P/E has reached a floor yet with earnings going in reverse. There's potential for the P/E to fall to even lower levels if the company doesn't improve its profitability.

The Bottom Line On Thor Explorations' P/E

Thor Explorations' recent share price jump still sees its P/E sitting firmly flat on the ground. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of Thor Explorations' analyst forecasts revealed that its outlook for shrinking earnings is contributing to its low P/E. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

You always need to take note of risks, for example - Thor Explorations has 2 warning signs we think you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Thor Explorations might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSXV:THX

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success