- Canada

- /

- Metals and Mining

- /

- TSXV:SLVR

3 Penny Stocks On TSX With Market Caps Up To CA$400M

Reviewed by Simply Wall St

The Canadian market is currently navigating potential changes in U.S. tax policies, which could impact dividends received from American companies, while also witnessing a rise in bond yields that reflects broader global trends. In this context, penny stocks—often smaller or newer companies—remain an intriguing investment area for those looking to uncover hidden value. Despite being considered somewhat outdated as a term, penny stocks can offer significant growth potential when supported by strong financials and sound business strategies.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$0.74 | CA$75.86M | ✅ 3 ⚠️ 3 View Analysis > |

| NTG Clarity Networks (TSXV:NCI) | CA$2.95 | CA$114.25M | ✅ 4 ⚠️ 2 View Analysis > |

| Intermap Technologies (TSX:IMP) | CA$2.33 | CA$134.95M | ✅ 3 ⚠️ 2 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$0.73 | CA$445.75M | ✅ 3 ⚠️ 2 View Analysis > |

| Orezone Gold (TSX:ORE) | CA$1.20 | CA$636.86M | ✅ 4 ⚠️ 2 View Analysis > |

| McChip Resources (TSXV:MCS) | CA$0.80 | CA$4.4M | ✅ 2 ⚠️ 5 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$1.74 | CA$168.16M | ✅ 3 ⚠️ 1 View Analysis > |

| PetroTal (TSX:TAL) | CA$0.61 | CA$548.99M | ✅ 3 ⚠️ 3 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$2.60 | CA$132.47M | ✅ 1 ⚠️ 2 View Analysis > |

| Findev (TSXV:FDI) | CA$0.44 | CA$12.6M | ✅ 2 ⚠️ 3 View Analysis > |

Click here to see the full list of 905 stocks from our TSX Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Chesapeake Gold (TSXV:CKG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Chesapeake Gold Corp. is a mineral exploration and evaluation company that focuses on acquiring, evaluating, and developing precious metal deposits in North and Central America, with a market cap of CA$68.39 million.

Operations: Chesapeake Gold Corp. has not reported any revenue segments, as it is focused on the exploration and evaluation of precious metal deposits in North and Central America.

Market Cap: CA$68.39M

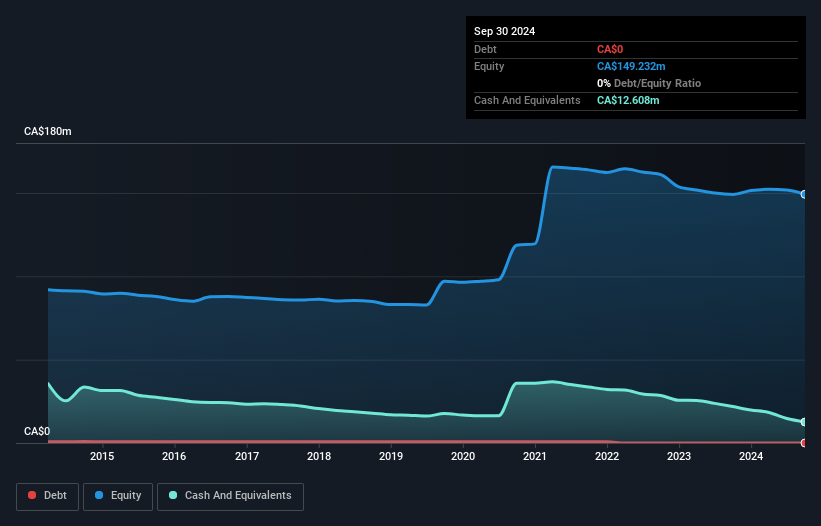

Chesapeake Gold Corp., with a market cap of CA$68.39 million, is pre-revenue and focused on exploration activities in North and Central America. The company has no debt, providing financial flexibility, and its short-term assets exceed both short- and long-term liabilities, indicating solid liquidity. Despite being unprofitable with increasing losses over five years, the recent reduction in annual net loss from CA$5.67 million to CA$2.54 million signals potential improvement in financial management. Stable weekly volatility at 11% suggests consistent trading patterns for investors considering this penny stock's speculative nature within the mining sector.

- Get an in-depth perspective on Chesapeake Gold's performance by reading our balance sheet health report here.

- Review our historical performance report to gain insights into Chesapeake Gold's track record.

Orogen Royalties (TSXV:OGN)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Orogen Royalties Inc. is a mineral exploration company active in Canada, the United States, Mexico, Argentina, Kenya, and Colombia with a market cap of CA$369.27 million.

Operations: The company generates CA$7.93 million from its mineral exploration activities.

Market Cap: CA$369.27M

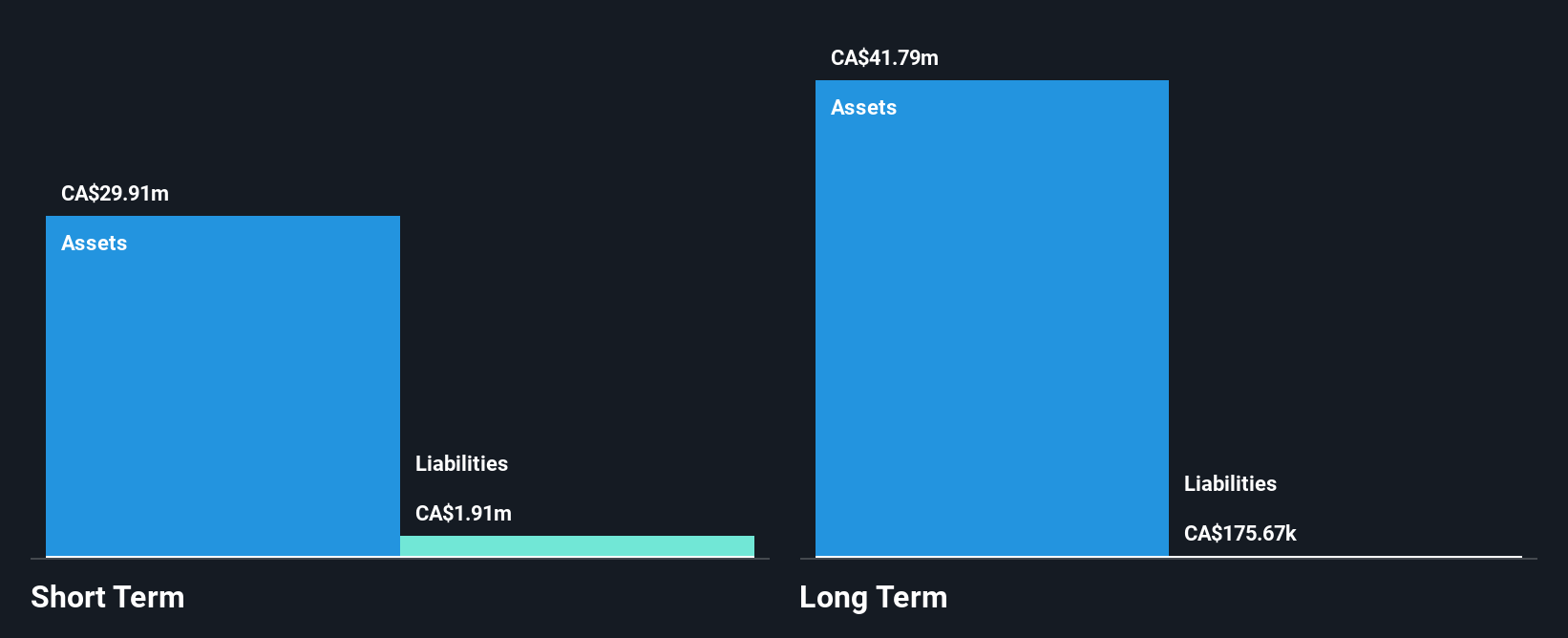

Orogen Royalties Inc., with a market cap of CA$369.27 million, has shown profitability over the past five years, though recent negative earnings growth poses challenges. The company remains debt-free, enhancing financial stability, and its short-term assets significantly exceed liabilities. Recent developments include a definitive agreement for acquisition by Triple Flag Precious Metals Corp., offering Orogen shareholders cash or shares plus an interest in Orogen Spinco. Despite lower net profit margins this year compared to last, the company's high-quality earnings and experienced management team provide some assurance amidst fluctuating performance indicators in the mining sector.

- Click here and access our complete financial health analysis report to understand the dynamics of Orogen Royalties.

- Gain insights into Orogen Royalties' future direction by reviewing our growth report.

Silver Tiger Metals (TSXV:SLVR)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Silver Tiger Metals Inc. focuses on the exploration and evaluation of mineral properties in Mexico, with a market cap of CA$116.82 million.

Operations: Silver Tiger Metals Inc. has not reported any revenue segments.

Market Cap: CA$116.82M

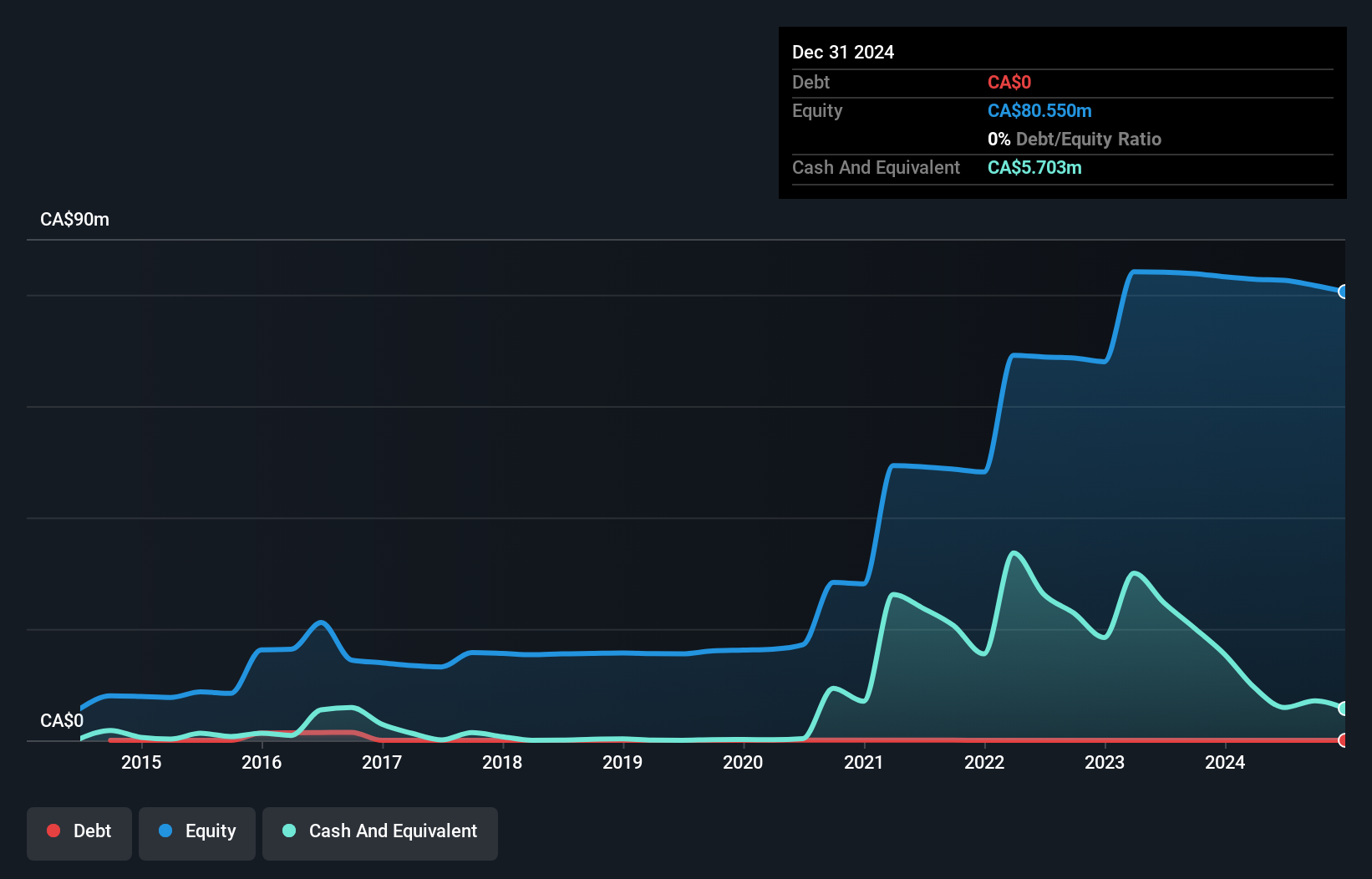

Silver Tiger Metals Inc., with a market cap of CA$116.82 million, is pre-revenue and currently unprofitable, with increasing losses over the past five years. Despite this, the company remains debt-free and its short-term assets of CA$6.4 million exceed liabilities significantly. The management and board are experienced, averaging tenures of 3.3 and 3.7 years respectively. Recent capital raises through follow-on equity offerings have bolstered its cash position by CA$15 million, potentially extending its cash runway beyond previous estimates of two months if growth continues at historical rates. Earnings are forecast to grow substantially in the future despite current challenges.

- Unlock comprehensive insights into our analysis of Silver Tiger Metals stock in this financial health report.

- Explore Silver Tiger Metals' analyst forecasts in our growth report.

Turning Ideas Into Actions

- Embark on your investment journey to our 905 TSX Penny Stocks selection here.

- Looking For Alternative Opportunities? The end of cancer? These 23 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:SLVR

Silver Tiger Metals

Engages in the exploration and evaluation of mineral properties in Mexico.

Flawless balance sheet and good value.

Market Insights

Community Narratives