- Canada

- /

- Metals and Mining

- /

- TSXV:SLI

August 2025 TSX Penny Stocks To Watch

Reviewed by Simply Wall St

The Canadian market has shown resilience with improved labour productivity and positive real wage gains, supporting consumer spending and the broader economy. Despite the term "penny stock" sounding like a relic from past trading days, these stocks continue to offer opportunities for growth, especially when they are backed by strong financials. In this article, we explore several penny stocks that stand out for their financial strength and potential to deliver impressive returns in today's economic landscape.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$0.62 | CA$62.71M | ✅ 3 ⚠️ 3 View Analysis > |

| Tornado Infrastructure Equipment (TSXV:TGH) | CA$1.80 | CA$248.52M | ✅ 4 ⚠️ 1 View Analysis > |

| CEMATRIX (TSX:CEMX) | CA$0.32 | CA$48.06M | ✅ 2 ⚠️ 1 View Analysis > |

| Fintech Select (TSXV:FTEC) | CA$0.03 | CA$2.4M | ✅ 2 ⚠️ 3 View Analysis > |

| Findev (TSXV:FDI) | CA$0.45 | CA$12.89M | ✅ 2 ⚠️ 4 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$0.79 | CA$525.59M | ✅ 3 ⚠️ 2 View Analysis > |

| Automotive Finco (TSXV:AFCC.H) | CA$0.90 | CA$17.84M | ✅ 2 ⚠️ 4 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$4.13 | CA$209.62M | ✅ 2 ⚠️ 1 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$1.93 | CA$184.26M | ✅ 3 ⚠️ 1 View Analysis > |

| McChip Resources (TSXV:MCS) | CA$1.69 | CA$9.65M | ✅ 2 ⚠️ 4 View Analysis > |

Click here to see the full list of 432 stocks from our TSX Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Chesapeake Gold (TSXV:CKG)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Chesapeake Gold Corp. is a mineral exploration and evaluation company that focuses on the acquisition, evaluation, and development of precious metal deposits in North and Central America, with a market cap of CA$133.37 million.

Operations: Chesapeake Gold Corp. does not report any revenue segments as it is primarily engaged in the exploration and evaluation of precious metal deposits.

Market Cap: CA$133.37M

Chesapeake Gold Corp., a pre-revenue company with a market cap of CA$133.37 million, recently strengthened its board by adding experienced mining professionals, which could enhance strategic direction. The company remains debt-free and has raised additional capital through a private placement led by Eric Sprott, increasing his stake to 17.9% on a non-diluted basis. Despite unprofitability and insufficient long-term liability coverage, Chesapeake's short-term assets exceed liabilities, providing some financial stability. With sufficient cash runway for 11 months post-capital raise and stable weekly volatility, investors may find potential in its strategic developments amidst inherent risks typical of penny stocks.

- Click here and access our complete financial health analysis report to understand the dynamics of Chesapeake Gold.

- Understand Chesapeake Gold's track record by examining our performance history report.

Hannan Metals (TSXV:HAN)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Hannan Metals Ltd. is a junior mineral exploration company focused on acquiring and exploring mineral properties in Ireland and Peru, with a market cap of CA$122.49 million.

Operations: Hannan Metals Ltd. does not report any specific revenue segments.

Market Cap: CA$122.49M

Hannan Metals Ltd., a pre-revenue company with a market cap of CA$122.49 million, is actively exploring its alkaline epithermal gold target at the Previsto project in Peru. Recent high-grade assay results have expanded the project's mineralized footprint, highlighting both low to moderate-grade zones and smaller high-grade pockets. The company's exploration efforts reveal similarities to significant global alkaline gold systems, suggesting potential for systematic exploration across a large area. Hannan's financials show short-term assets exceeding liabilities and no debt, but less than one year of cash runway raises concerns about funding future operations amidst volatile share prices.

- Click here to discover the nuances of Hannan Metals with our detailed analytical financial health report.

- Explore historical data to track Hannan Metals' performance over time in our past results report.

Standard Lithium (TSXV:SLI)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Standard Lithium Ltd. explores, develops, and processes lithium brine properties in the United States with a market cap of CA$778.52 million.

Operations: Standard Lithium Ltd. has not reported any revenue segments.

Market Cap: CA$778.52M

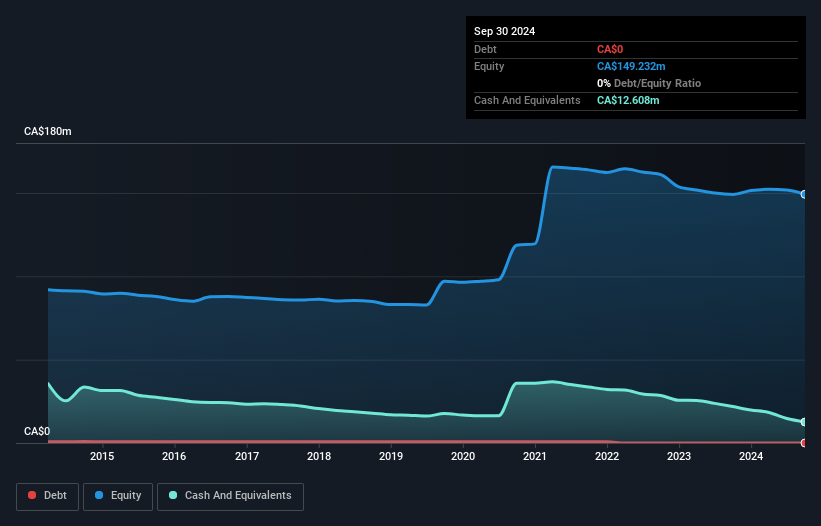

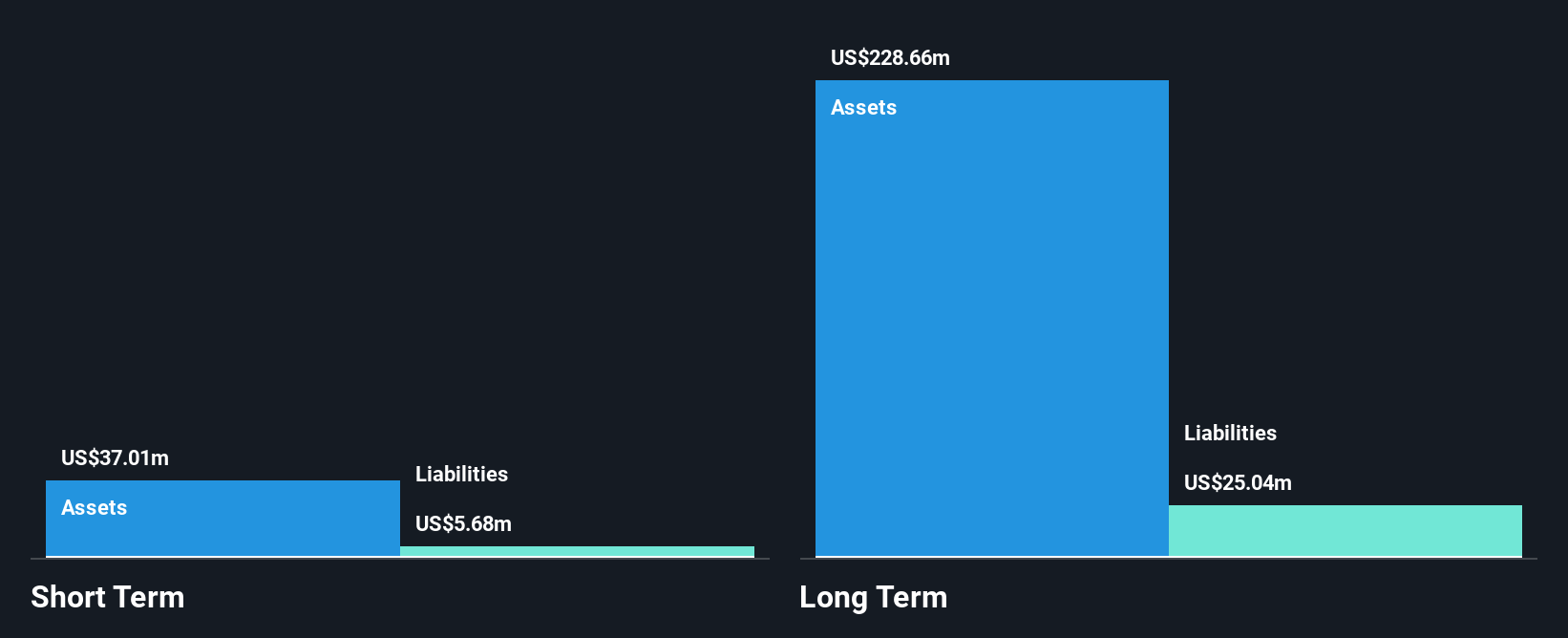

Standard Lithium Ltd., with a market cap of CA$778.52 million, remains pre-revenue while advancing its lithium brine projects in the U.S. The company recently completed a $50 million equity offering to bolster its financial position, despite reporting a net loss of US$4.98 million for Q2 2025. Its joint venture in Arkansas has yielded promising lithium concentrations, marking progress towards feasibility studies and potential project financing by year-end 2025. Although unprofitable with increasing losses over five years, Standard Lithium is debt-free and maintains short-term assets exceeding liabilities, supporting ongoing development efforts amidst volatile market conditions.

- Take a closer look at Standard Lithium's potential here in our financial health report.

- Review our growth performance report to gain insights into Standard Lithium's future.

Make It Happen

- Click here to access our complete index of 432 TSX Penny Stocks.

- Ready To Venture Into Other Investment Styles? This technology could replace computers: discover the 26 stocks are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:SLI

Standard Lithium

Explores for, develops, and processes lithium brine properties in the United States.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives