- Canada

- /

- Metals and Mining

- /

- TSXV:SGC

TSX Penny Stocks To Watch In February 2025

Reviewed by Simply Wall St

As we move into February 2025, the Canadian market is navigating a complex landscape of persistent inflation and solid corporate earnings, with European equity markets quietly outperforming amid global uncertainties. Amid these crosscurrents, investors are seeking opportunities in various sectors, including the often-overlooked realm of penny stocks. Although considered a niche investment area today, penny stocks can still offer compelling growth opportunities when backed by strong financials and clear growth potential.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Alvopetro Energy (TSXV:ALV) | CA$5.00 | CA$182.79M | ★★★★★★ |

| Findev (TSXV:FDI) | CA$0.52 | CA$14.9M | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$4.67 | CA$438.56M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.24 | CA$220.49M | ★★★★★☆ |

| PetroTal (TSX:TAL) | CA$0.71 | CA$647.19M | ★★★★★★ |

| NamSys (TSXV:CTZ) | CA$1.16 | CA$31.16M | ★★★★★★ |

| East West Petroleum (TSXV:EW) | CA$0.04 | CA$3.62M | ★★★★★★ |

| Orezone Gold (TSX:ORE) | CA$0.86 | CA$397.63M | ★★★★★☆ |

| Hemisphere Energy (TSXV:HME) | CA$1.86 | CA$180.58M | ★★★★★☆ |

| DIRTT Environmental Solutions (TSX:DRT) | CA$1.19 | CA$230.15M | ★★★★☆☆ |

Click here to see the full list of 938 stocks from our TSX Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Progressive Planet Solutions (TSXV:PLAN)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Progressive Planet Solutions Inc., along with its subsidiaries, focuses on acquiring and exploring mineral properties in Canada and the United States, with a market cap of CA$17.67 million.

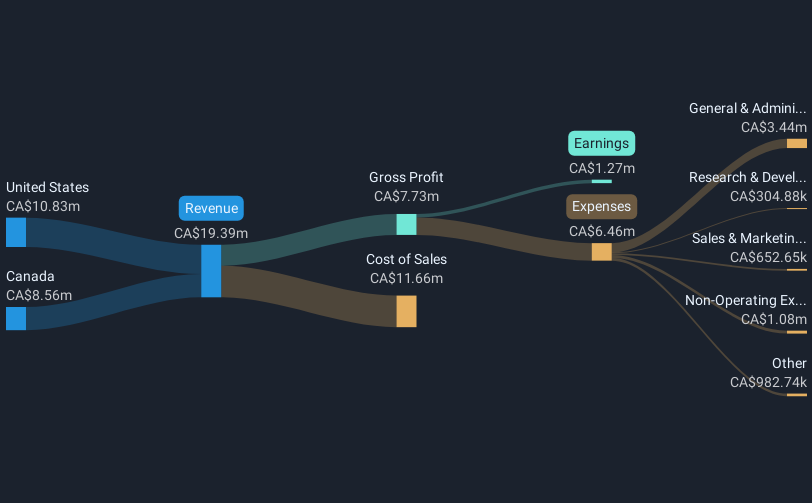

Operations: The company's revenue segment is derived from the acquisition and exploration of exploration and evaluation assets, totaling CA$19.39 million.

Market Cap: CA$17.67M

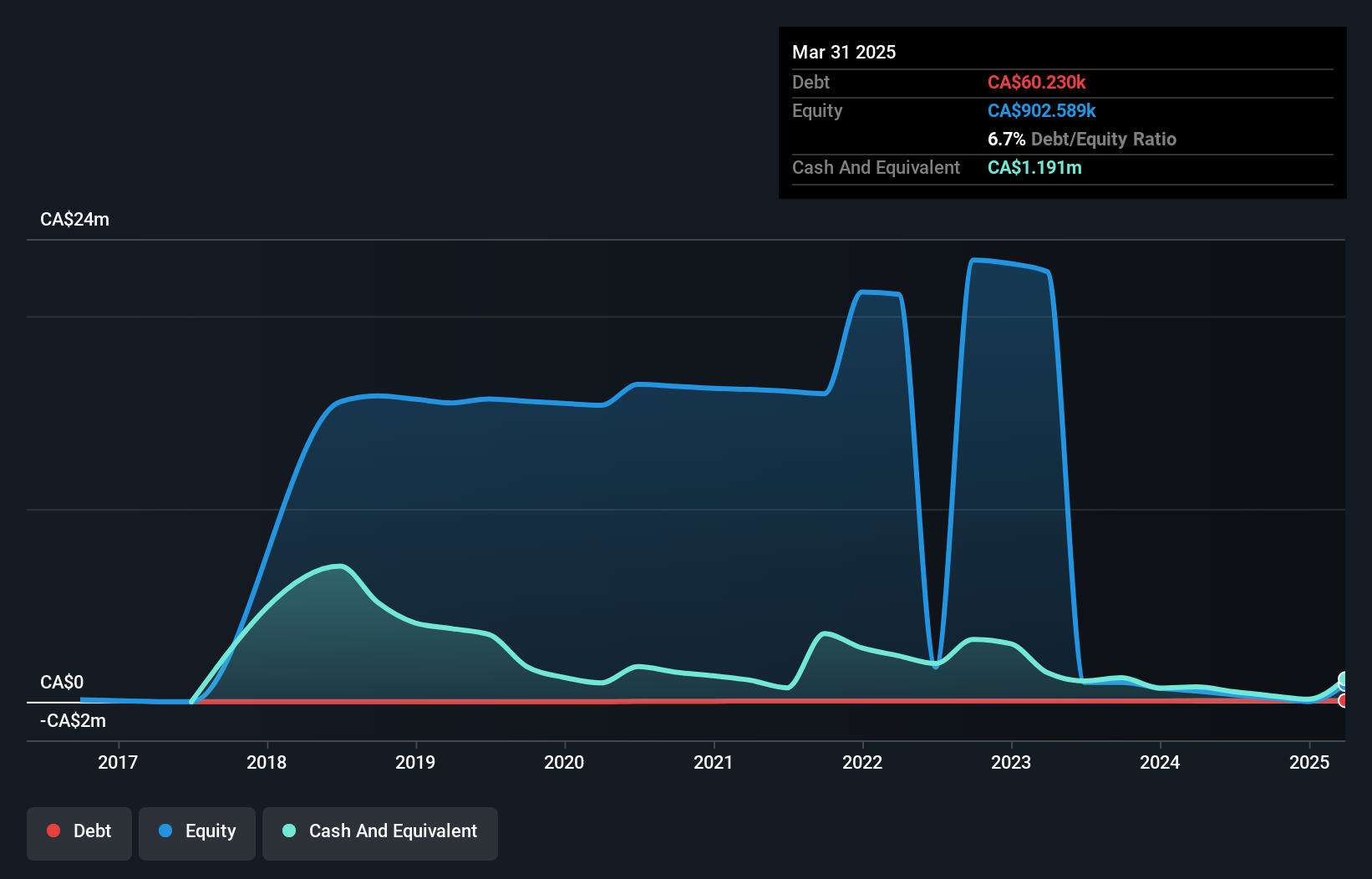

Progressive Planet Solutions Inc., with a market cap of CA$17.67 million, recently reported earnings improvements, achieving profitability with a net income of CA$0.62 million for the second quarter ending October 31, 2024. The company has experienced management and board teams and maintains satisfactory debt levels with interest payments well covered by EBIT (3.9x). Despite its low Return on Equity (9.3%), short-term assets exceed liabilities, though long-term liabilities remain uncovered by current assets. The stock trades at a significant discount to estimated fair value but faces challenges from large one-off financial impacts and increased debt over five years.

- Dive into the specifics of Progressive Planet Solutions here with our thorough balance sheet health report.

- Review our historical performance report to gain insights into Progressive Planet Solutions' track record.

Solstice Gold (TSXV:SGC)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Solstice Gold Corp. is a company focused on the exploration and development of mineral resource properties in Canada, with a market cap of CA$8.30 million.

Operations: Solstice Gold Corp. does not report any revenue segments.

Market Cap: CA$8.3M

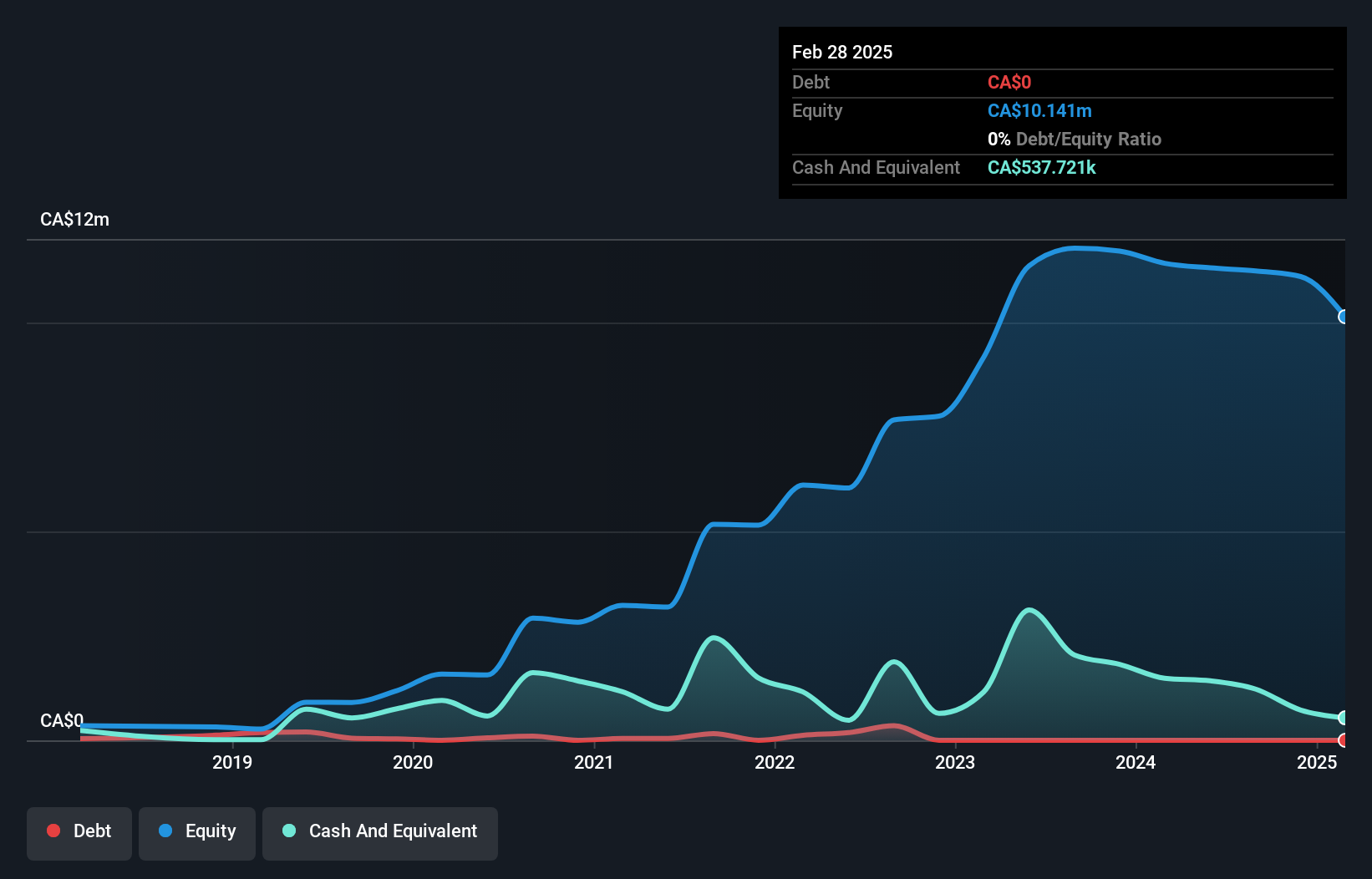

Solstice Gold Corp., with a market cap of CA$8.30 million, is pre-revenue and currently unprofitable, experiencing increased losses over the past five years. The management team is relatively new with an average tenure of 1.8 years, while the board has more experience at 4.7 years on average. Although the company has sufficient short-term assets to cover its liabilities and more cash than debt, its cash runway was limited to five months as of September 2024 before additional capital was raised through private placements in November 2024. Recent exploration results at their Strathy Gold Project identified multiple high-priority drill-ready targets, offering potential growth opportunities despite current financial challenges and high share price volatility.

- Click here and access our complete financial health analysis report to understand the dynamics of Solstice Gold.

- Assess Solstice Gold's previous results with our detailed historical performance reports.

Stuhini Exploration (TSXV:STU)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Stuhini Exploration Ltd. is a mineral exploration company focused on acquiring, exploring, and developing mineral properties in Canada and the United States, with a market cap of CA$6.97 million.

Operations: Stuhini Exploration Ltd. currently does not report any revenue segments.

Market Cap: CA$6.97M

Stuhini Exploration Ltd., with a market cap of CA$6.97 million, is pre-revenue and currently unprofitable, experiencing increased losses over the past five years. The company maintains a debt-free status and has sufficient short-term assets to cover its liabilities. However, it faces financial constraints with less than a year of cash runway at current burn rates. Recent developments include an option agreement for the Jersey Valley Property in Nevada, offering potential exploration upside in a historically mineral-rich area. Despite high share price volatility, these strategic expansions could position Stuhini for future growth opportunities within the mining sector.

- Unlock comprehensive insights into our analysis of Stuhini Exploration stock in this financial health report.

- Gain insights into Stuhini Exploration's past trends and performance with our report on the company's historical track record.

Make It Happen

- Unlock more gems! Our TSX Penny Stocks screener has unearthed 935 more companies for you to explore.Click here to unveil our expertly curated list of 938 TSX Penny Stocks.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:SGC

Solstice Gold

An exploration company, engages in the exploration for and development of mineral resource properties in Canada.

Excellent balance sheet with moderate risk.

Market Insights

Community Narratives