- Canada

- /

- Metals and Mining

- /

- TSXV:SCZ

Santacruz Silver Mining Ltd. (CVE:SCZ) Held Back By Insufficient Growth Even After Shares Climb 35%

Santacruz Silver Mining Ltd. (CVE:SCZ) shares have continued their recent momentum with a 35% gain in the last month alone. This latest share price bounce rounds out a remarkable 449% gain over the last twelve months.

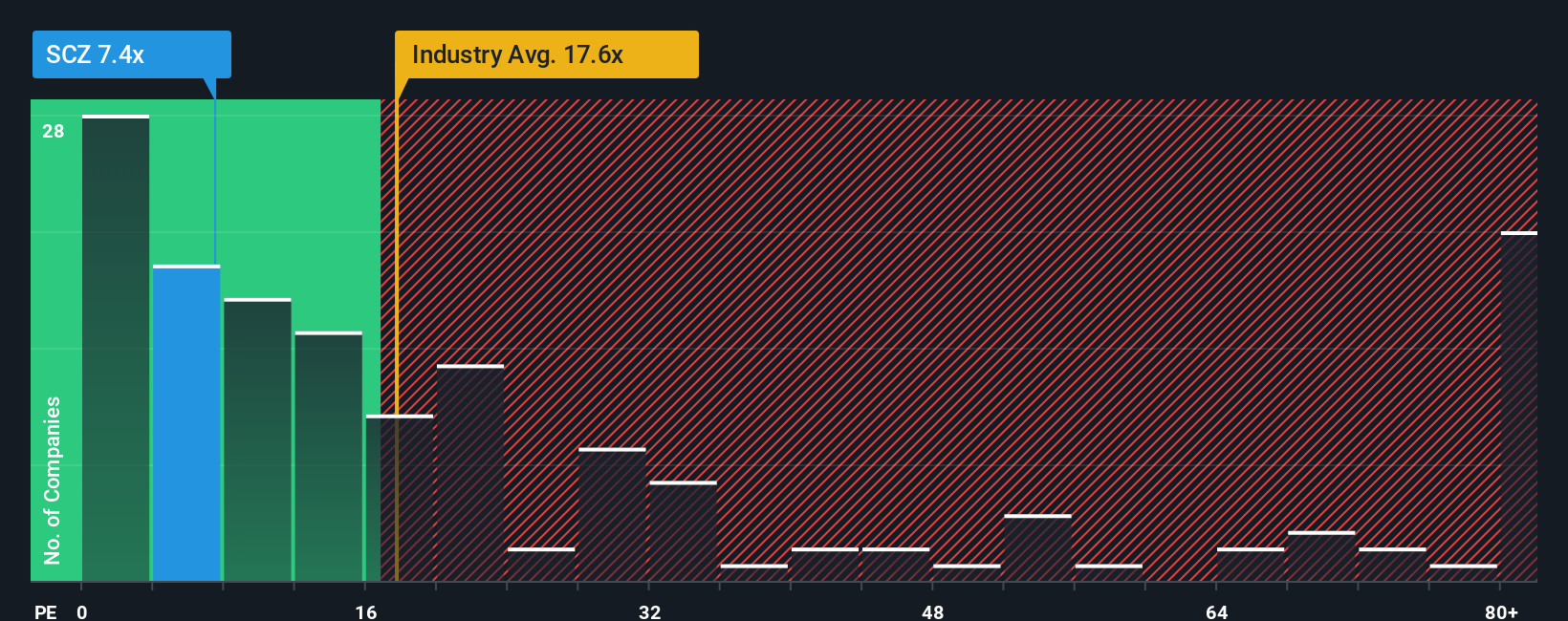

In spite of the firm bounce in price, Santacruz Silver Mining may still be sending very bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 7.4x, since almost half of all companies in Canada have P/E ratios greater than 17x and even P/E's higher than 32x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so limited.

Santacruz Silver Mining hasn't been tracking well recently as its declining earnings compare poorly to other companies, which have seen some growth on average. It seems that many are expecting the dour earnings performance to persist, which has repressed the P/E. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

See our latest analysis for Santacruz Silver Mining

Does Growth Match The Low P/E?

There's an inherent assumption that a company should far underperform the market for P/E ratios like Santacruz Silver Mining's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 50% decrease to the company's bottom line. At least EPS has managed not to go completely backwards from three years ago in aggregate, thanks to the earlier period of growth. So it appears to us that the company has had a mixed result in terms of growing earnings over that time.

Turning to the outlook, the next year should generate growth of 2.3% as estimated by the lone analyst watching the company. Meanwhile, the rest of the market is forecast to expand by 17%, which is noticeably more attractive.

In light of this, it's understandable that Santacruz Silver Mining's P/E sits below the majority of other companies. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Bottom Line On Santacruz Silver Mining's P/E

Shares in Santacruz Silver Mining are going to need a lot more upward momentum to get the company's P/E out of its slump. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Santacruz Silver Mining maintains its low P/E on the weakness of its forecast growth being lower than the wider market, as expected. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

There are also other vital risk factors to consider before investing and we've discovered 3 warning signs for Santacruz Silver Mining that you should be aware of.

If these risks are making you reconsider your opinion on Santacruz Silver Mining, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSXV:SCZ

Santacruz Silver Mining

Engages in the acquisition, exploration, development, production, and operation of mineral properties in Latin America.

Flawless balance sheet and good value.

Market Insights

Community Narratives