- Canada

- /

- Metals and Mining

- /

- TSXV:TRAN

We Think Rogue Resources Inc.'s (CVE:RRS) CEO Compensation Package Needs To Be Put Under A Microscope

Key Insights

- Rogue Resources to hold its Annual General Meeting on 21 December 2022

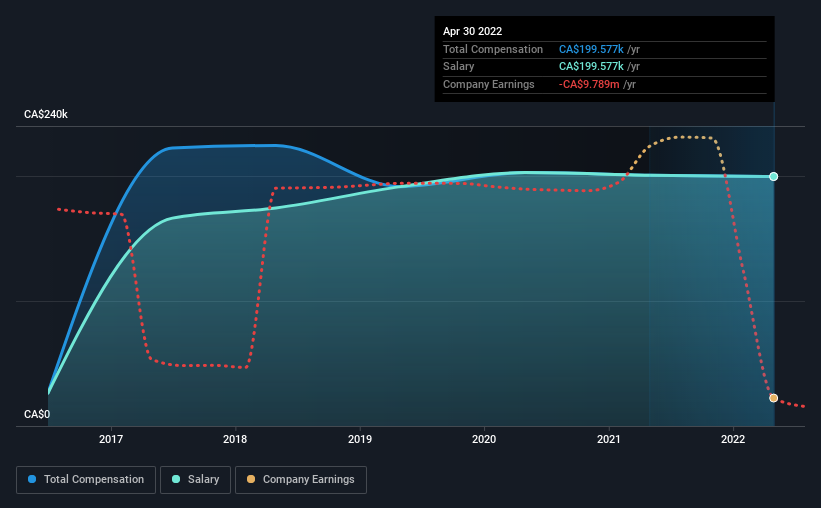

- CEO Sean Joseph Samson's total compensation includes salary of CA$199.6k

- Total compensation is similar to the industry average

- Rogue Resources' EPS grew by -75% over the past three years while total shareholder return over the past three years was -53%

The results at Rogue Resources Inc. (CVE:RRS) have been quite disappointing recently and CEO Sean Joseph Samson bears some responsibility for this. At the upcoming AGM on 21 December 2022, shareholders can hear from the board including their plans for turning around performance. They will also get a chance to influence managerial decision-making through voting on resolutions such as executive remuneration, which may impact firm value in the future. The data we present below explains why we think CEO compensation is not consistent with recent performance.

Check out our latest analysis for Rogue Resources

Comparing Rogue Resources Inc.'s CEO Compensation With The Industry

According to our data, Rogue Resources Inc. has a market capitalization of CA$1.2m, and paid its CEO total annual compensation worth CA$200k over the year to April 2022. That is, the compensation was roughly the same as last year. It is worth noting that the CEO compensation consists entirely of the salary, worth CA$200k.

In comparison with other companies in the Canadian Metals and Mining industry with market capitalizations under CA$271m, the reported median total CEO compensation was CA$182k. So it looks like Rogue Resources compensates Sean Joseph Samson in line with the median for the industry.

| Component | 2022 | 2021 | Proportion (2022) |

| Salary | CA$200k | CA$201k | 100% |

| Other | - | - | - |

| Total Compensation | CA$200k | CA$201k | 100% |

On an industry level, around 89% of total compensation represents salary and 11% is other remuneration. Speaking on a company level, Rogue Resources prefers to tread along a traditional path, disbursing all compensation through a salary. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

Rogue Resources Inc.'s Growth

Over the last three years, Rogue Resources Inc. has shrunk its earnings per share by 75% per year. It saw its revenue drop 17% over the last year.

Few shareholders would be pleased to read that EPS have declined. And the impression is worse when you consider revenue is down year-on-year. So given this relatively weak performance, shareholders would probably not want to see high compensation for the CEO. While we don't have analyst forecasts for the company, shareholders might want to examine this detailed historical graph of earnings, revenue and cash flow.

Has Rogue Resources Inc. Been A Good Investment?

The return of -53% over three years would not have pleased Rogue Resources Inc. shareholders. Therefore, it might be upsetting for shareholders if the CEO were paid generously.

To Conclude...

Rogue Resources rewards its CEO solely through a salary, ignoring non-salary benefits completely. Along with the business performing poorly, shareholders have suffered with poor share price returns on their investments, suggesting that there's little to no chance of them being in favor of a CEO pay raise. At the upcoming AGM, the board will get the chance to explain the steps it plans to take to improve business performance.

CEO compensation is an important area to keep your eyes on, but we've also need to pay attention to other attributes of the company. We did our research and identified 4 warning signs (and 3 which are a bit unpleasant) in Rogue Resources we think you should know about.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSXV:TRAN

Clean Energy Transition

A mining company, focuses on selling dimensional limestone for landscape applications in Canada.

Adequate balance sheet with slight risk.

Market Insights

Community Narratives