- Canada

- /

- Energy Services

- /

- TSX:MCB

TSX Gems: McCoy Global And 2 Other Promising Penny Stocks

Reviewed by Simply Wall St

With recent fluctuations in bond yields and potential changes to U.S.-Canada tax treaties, Canadian investors are navigating a complex landscape. Amid these broader market dynamics, penny stocks remain an intriguing area for those interested in smaller or newer companies. Although the term "penny stocks" might seem outdated, it still represents opportunities for growth by focusing on firms with solid financial foundations and potential for long-term success.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$0.76 | CA$73.84M | ✅ 3 ⚠️ 3 View Analysis > |

| NTG Clarity Networks (TSXV:NCI) | CA$2.67 | CA$107.9M | ✅ 4 ⚠️ 2 View Analysis > |

| Intermap Technologies (TSX:IMP) | CA$2.26 | CA$132.09M | ✅ 3 ⚠️ 2 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$0.70 | CA$465.71M | ✅ 3 ⚠️ 2 View Analysis > |

| Orezone Gold (TSX:ORE) | CA$1.23 | CA$669.5M | ✅ 4 ⚠️ 2 View Analysis > |

| McChip Resources (TSXV:MCS) | CA$0.84 | CA$4.57M | ✅ 2 ⚠️ 5 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$1.80 | CA$173.01M | ✅ 3 ⚠️ 2 View Analysis > |

| PetroTal (TSX:TAL) | CA$0.60 | CA$539.84M | ✅ 3 ⚠️ 3 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$2.63 | CA$131.96M | ✅ 1 ⚠️ 2 View Analysis > |

| Findev (TSXV:FDI) | CA$0.45 | CA$12.75M | ✅ 2 ⚠️ 3 View Analysis > |

Click here to see the full list of 900 stocks from our TSX Penny Stocks screener.

Let's review some notable picks from our screened stocks.

McCoy Global (TSX:MCB)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: McCoy Global Inc. offers equipment and technologies for tubular running operations to improve wellbore integrity and data collection in the energy industry across various global regions, with a market cap of CA$97.66 million.

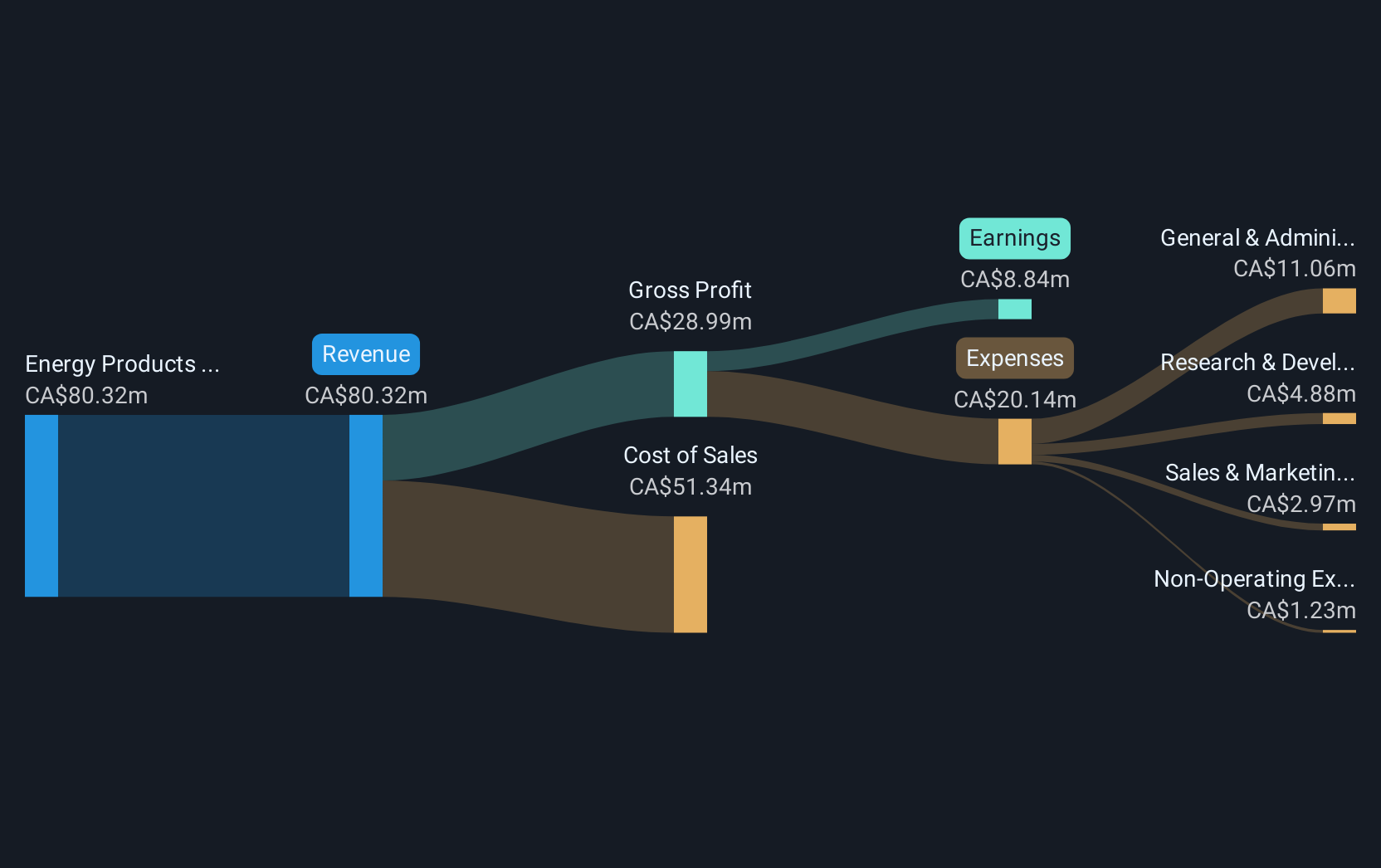

Operations: The company generates revenue from its Energy Products & Services (EP&S) segment, which amounted to CA$80.32 million.

Market Cap: CA$97.66M

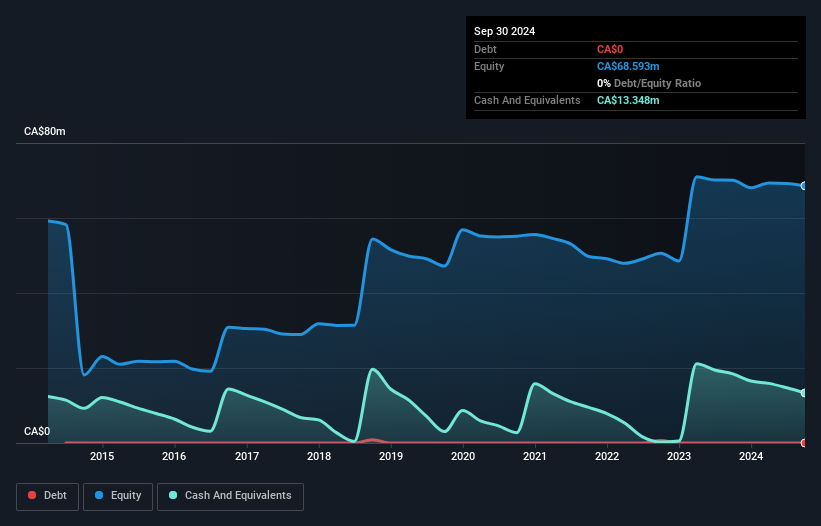

McCoy Global Inc. has demonstrated solid financial performance, with a recent earnings growth of 26.7%, surpassing the broader Energy Services industry. The company remains debt-free and has maintained stable weekly volatility at 13%. Recent announcements highlight successful commercialization of its smarTR™ technology, securing $11 million in contracts, which could enhance future revenue streams. Despite trading significantly below its estimated fair value, McCoy's return on equity is relatively low at 13.4%. The board and management teams are experienced, contributing to the company's strategic direction and operational stability amidst an unstable dividend track record.

- Take a closer look at McCoy Global's potential here in our financial health report.

- Explore McCoy Global's analyst forecasts in our growth report.

Regulus Resources (TSXV:REG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Regulus Resources Inc. is a mineral exploration company active in Canada and Peru, with a market cap of CA$261.78 million.

Operations: Regulus Resources Inc. has not reported any revenue segments.

Market Cap: CA$261.78M

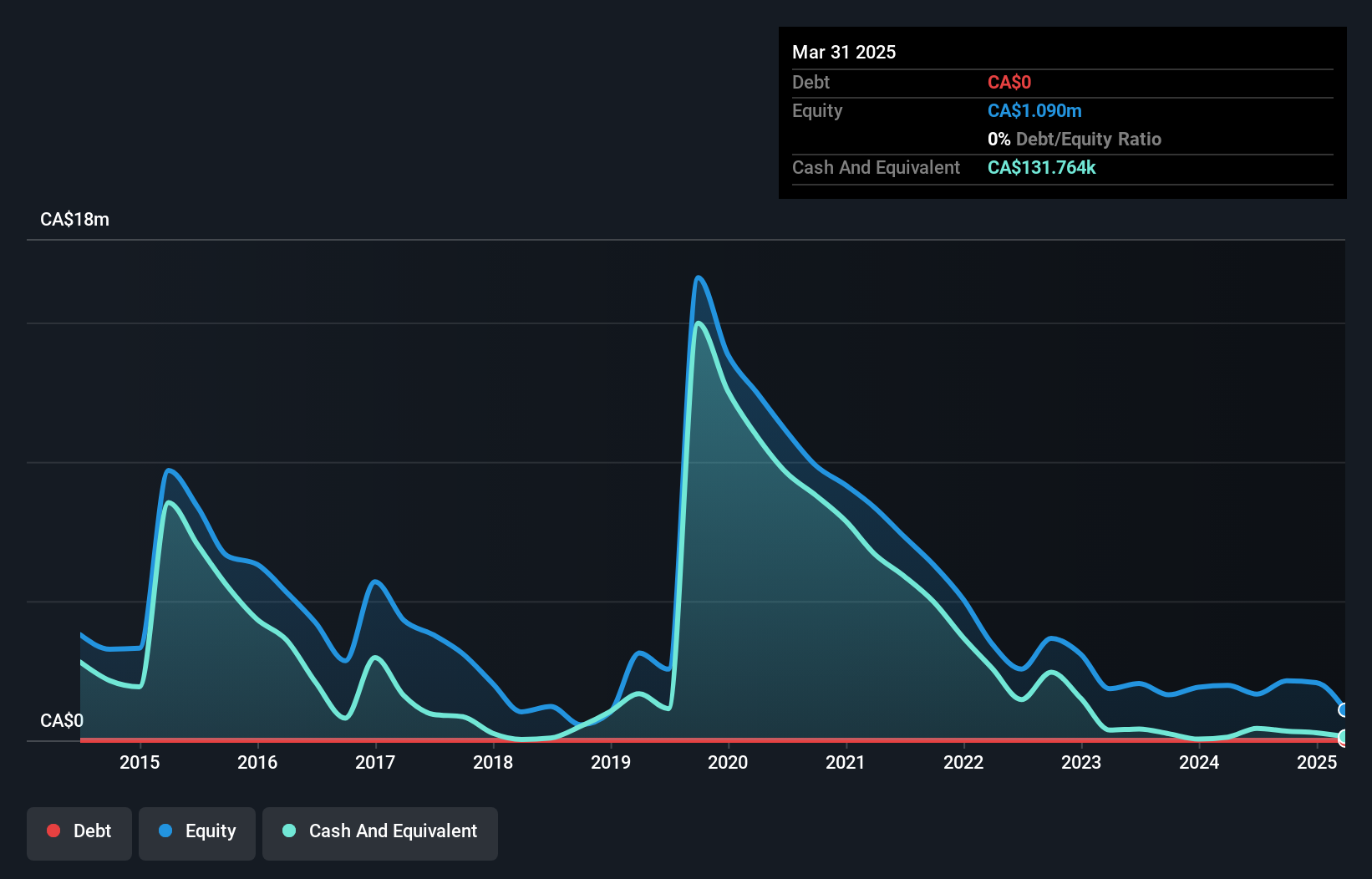

Regulus Resources Inc., with a market cap of CA$261.78 million, is currently pre-revenue, focusing on mineral exploration in Canada and Peru. The company has a cash runway of over two years if free cash flow continues to grow as historically observed. Recent updates highlight progress in the Nuton Phase Two metallurgical test program at the AntaKori project, achieving promising copper extraction rates using bio-leaching technology. Additionally, Regulus is advancing an integrated resource estimate for the Integrated Sulphide Project with Coimolache S.A., aiming to optimize geological understanding and resource potential. The company remains debt-free with stable short-term financials.

- Jump into the full analysis health report here for a deeper understanding of Regulus Resources.

- Explore historical data to track Regulus Resources' performance over time in our past results report.

Theralase Technologies (TSXV:TLT)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Theralase Technologies Inc. is a clinical stage pharmaceutical company focused on the research, development, and commercialization of light-activated photodynamic compounds for treating cancers, bacteria, and viruses globally, with a market cap of CA$47.27 million.

Operations: The company's revenue is primarily derived from its Device segment, which generated CA$1.03 million.

Market Cap: CA$47.27M

Theralase Technologies Inc., with a market cap of CA$47.27 million, is a clinical-stage pharmaceutical company currently pre-revenue, focusing on light-activated compounds for treating various diseases. The company's short-term assets of CA$1.6 million exceed its liabilities, providing some financial stability despite recent auditor concerns about its ability to continue as a going concern. Theralase has made significant strides in its clinical trials for bladder cancer treatment and is actively seeking commercialization partners as it nears completion of Study II. Recent preclinical results also show promising efficacy in cancer and viral treatments, potentially enhancing future revenue streams.

- Dive into the specifics of Theralase Technologies here with our thorough balance sheet health report.

- Gain insights into Theralase Technologies' future direction by reviewing our growth report.

Key Takeaways

- Take a closer look at our TSX Penny Stocks list of 900 companies by clicking here.

- Interested In Other Possibilities? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:MCB

McCoy Global

Provides equipment and technologies designed to support tubular running operations that enhance wellbore integrity and assist with collecting data for the energy industry in the United States, Latin America, the Middle East, Africa, Europe, the Asia Pacific, and Canada.

Flawless balance sheet and fair value.

Market Insights

Community Narratives