- Canada

- /

- Metals and Mining

- /

- TSXV:NILI

3 TSX Penny Stocks With Market Caps Larger Than CA$40M

Reviewed by Simply Wall St

The Canadian stock market has been experiencing a steady climb, supported by trade optimism and robust corporate earnings, though upcoming economic events could test this calm. In such an environment, investors often seek opportunities beyond the well-known names, and penny stocks—despite their somewhat outdated moniker—remain a relevant investment area. These smaller or newer companies can offer surprising value and potential growth when they demonstrate financial resilience.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$0.66 | CA$66.76M | ✅ 3 ⚠️ 3 View Analysis > |

| Fintech Select (TSXV:FTEC) | CA$0.035 | CA$2.4M | ✅ 2 ⚠️ 3 View Analysis > |

| Foraco International (TSX:FAR) | CA$1.72 | CA$172.6M | ✅ 4 ⚠️ 1 View Analysis > |

| Findev (TSXV:FDI) | CA$0.435 | CA$12.03M | ✅ 2 ⚠️ 4 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$0.76 | CA$518.93M | ✅ 3 ⚠️ 2 View Analysis > |

| Automotive Finco (TSXV:AFCC.H) | CA$0.91 | CA$18.23M | ✅ 2 ⚠️ 4 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$3.65 | CA$183.23M | ✅ 2 ⚠️ 1 View Analysis > |

| ACT Energy Technologies (TSX:ACX) | CA$4.89 | CA$164.23M | ✅ 4 ⚠️ 2 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$1.94 | CA$184.26M | ✅ 3 ⚠️ 1 View Analysis > |

| McChip Resources (TSXV:MCS) | CA$1.58 | CA$9.02M | ✅ 2 ⚠️ 4 View Analysis > |

Click here to see the full list of 455 stocks from our TSX Penny Stocks screener.

Let's uncover some gems from our specialized screener.

Surge Battery Metals (TSXV:NILI)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Surge Battery Metals Inc. is an exploration stage company focused on acquiring, exploring, and developing mineral properties in North America with a market cap of CA$48.23 million.

Operations: Surge Battery Metals Inc. currently does not report any revenue segments as it is focused on the exploration and development of mineral properties in North America.

Market Cap: CA$48.23M

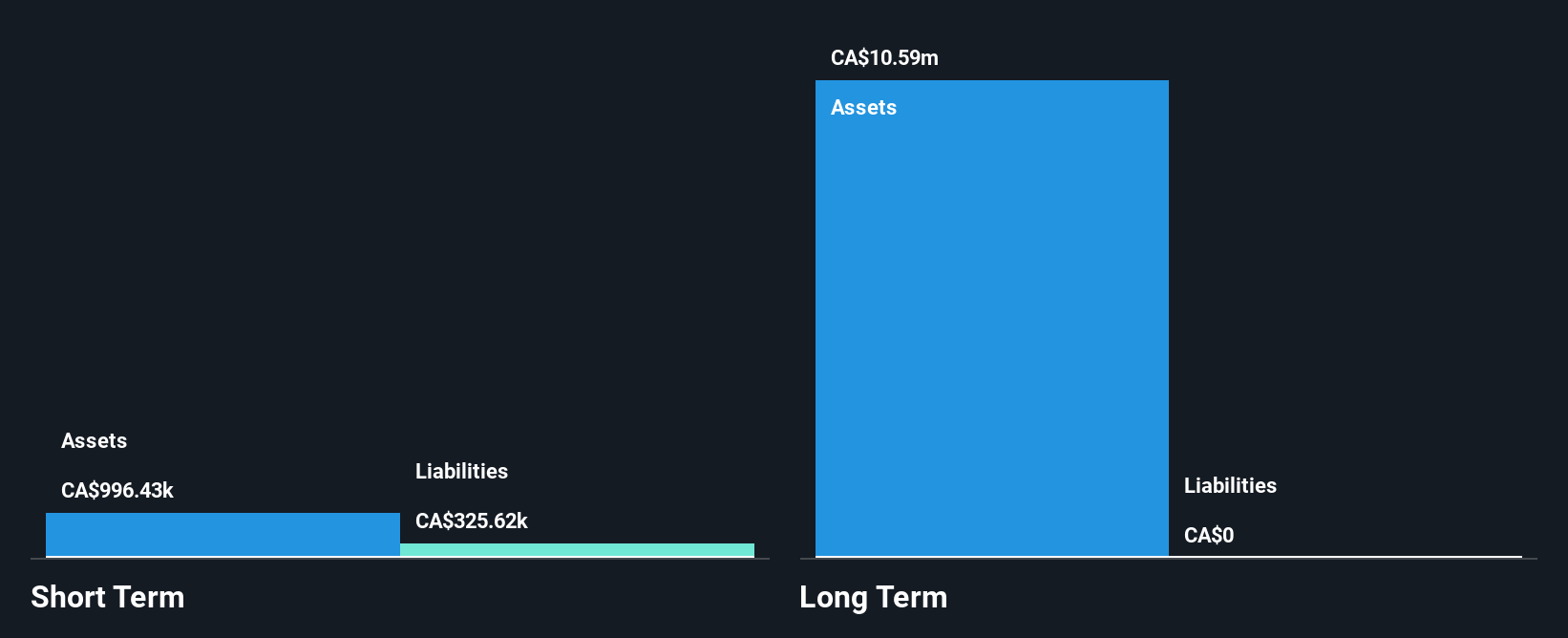

Surge Battery Metals Inc., with a market cap of CA$48.23 million, is pre-revenue and focuses on mineral exploration in North America. Recent developments include a Preliminary Economic Assessment for its Nevada North Lithium Project, indicating robust economics for a long-life lithium operation. Despite having no debt and covering short-term liabilities with assets of CA$996.4K, the company faces challenges such as less than one year of cash runway and ongoing losses (net loss of CAD 1.07 million in Q1 2025). The management team is experienced; however, the board's average tenure suggests recent changes.

- Dive into the specifics of Surge Battery Metals here with our thorough balance sheet health report.

- Review our historical performance report to gain insights into Surge Battery Metals' track record.

Regulus Resources (TSXV:REG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Regulus Resources Inc. is a mineral exploration company operating in Canada and Peru, with a market cap of CA$313.68 million.

Operations: Regulus Resources Inc. does not report any revenue segments, focusing instead on mineral exploration activities in Canada and Peru.

Market Cap: CA$313.68M

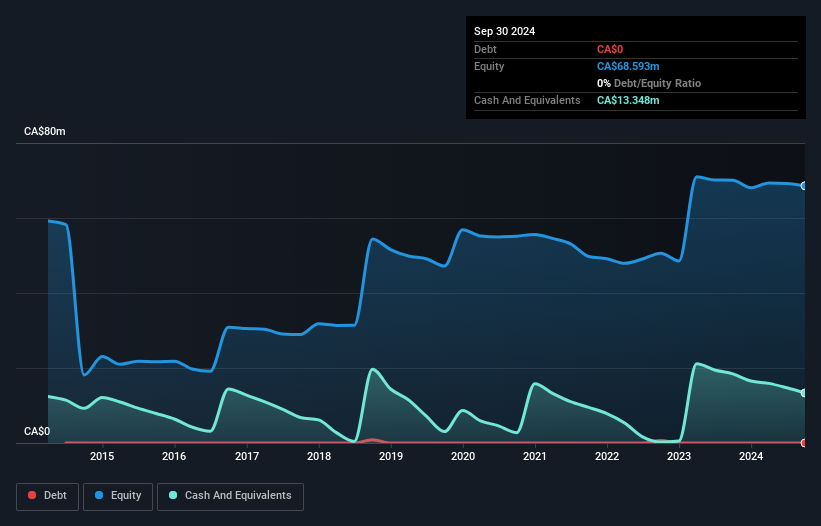

Regulus Resources Inc., with a market cap of CA$313.68 million, is pre-revenue and focuses on mineral exploration in Canada and Peru. The company is debt-free, with short-term assets of CA$11.5 million exceeding liabilities, ensuring financial stability for over two years based on cash runway projections. Recent advancements include promising results from the Phase Two metallurgical test program at the AntaKori project with Nuton LLC, achieving high copper extractions using bio-leaching technology. Collaboration with Compañía Minera Coimolache S.A. continues to progress towards an integrated resource estimate for the Integrated Sulphide Project, enhancing future potential prospects.

- Click to explore a detailed breakdown of our findings in Regulus Resources' financial health report.

- Explore historical data to track Regulus Resources' performance over time in our past results report.

Yangarra Resources (TSX:YGR)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Yangarra Resources Ltd. is a junior oil and gas company focused on the exploration, development, and production of natural gas and conventional oil in Western Canada, with a market cap of CA$105.33 million.

Operations: The company's revenue is primarily derived from its operations in the production, exploration, and development of resource properties, totaling CA$118.93 million.

Market Cap: CA$105.33M

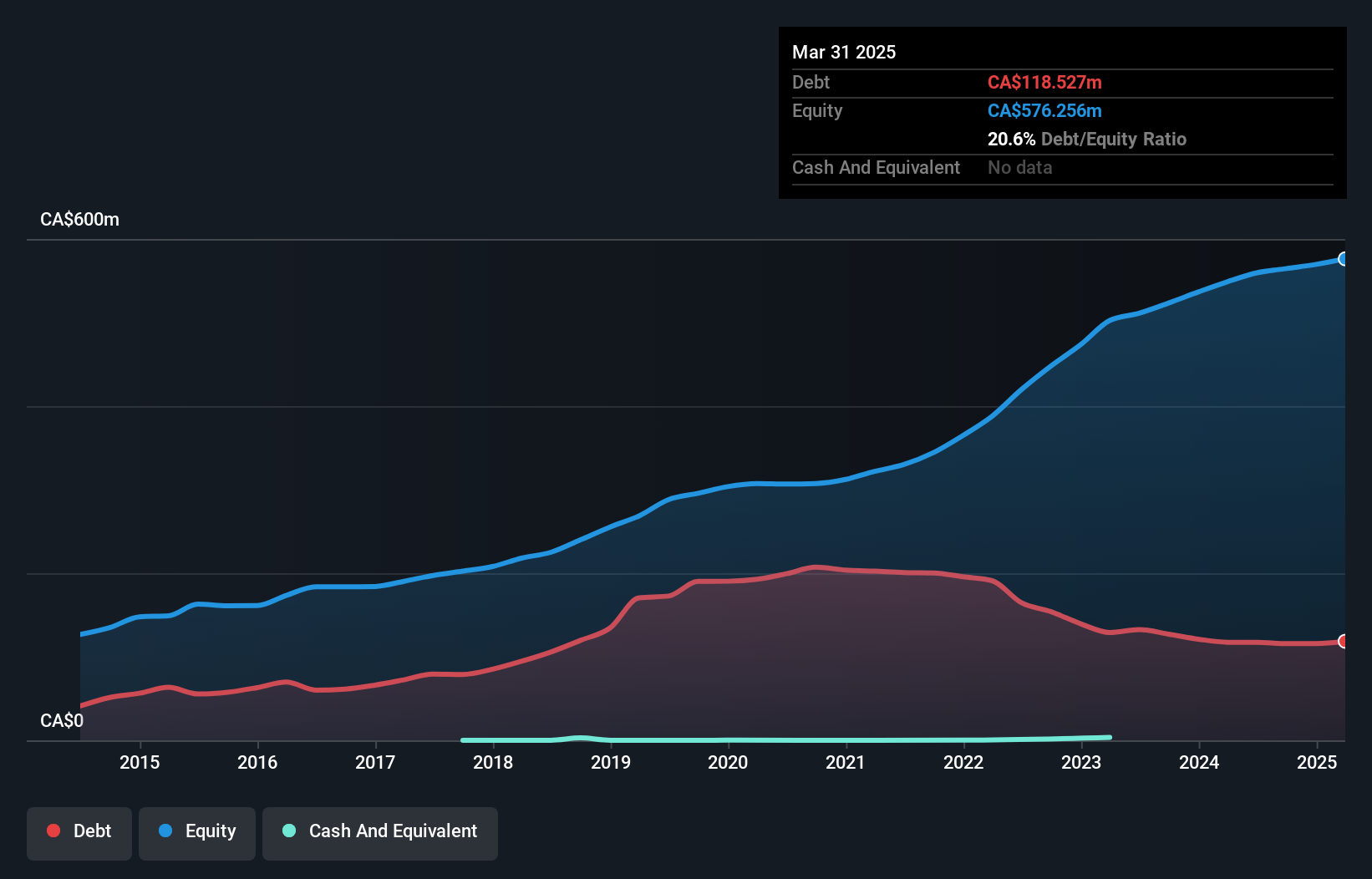

Yangarra Resources Ltd., with a market cap of CA$105.33 million, navigates the challenges of negative earnings growth and declining production figures. Despite this, its debt management is commendable, with a satisfactory net debt to equity ratio of 20.6% and operating cash flow covering 57.9% of its debt. The company's seasoned management and board add stability, though recent quarterly results show decreased revenue (CA$29.43 million) and net income (CA$5.39 million). While profit margins have narrowed from last year, Yangarra's price-to-earnings ratio remains attractive at 4.8x against the Canadian market average of 16.4x.

- Get an in-depth perspective on Yangarra Resources' performance by reading our balance sheet health report here.

- Examine Yangarra Resources' earnings growth report to understand how analysts expect it to perform.

Taking Advantage

- Discover the full array of 455 TSX Penny Stocks right here.

- Looking For Alternative Opportunities? AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:NILI

Surge Battery Metals

An exploration stage company, acquires, explores, and develops mineral properties in North America.

Flawless balance sheet with moderate risk.

Market Insights

Community Narratives