- Canada

- /

- Metals and Mining

- /

- TSXV:RBX

Those Who Purchased Robex Resources (CVE:RBX) Shares Five Years Ago Have A 64% Loss To Show For It

Statistically speaking, long term investing is a profitable endeavour. But unfortunately, some companies simply don't succeed. For example, after five long years the Robex Resources Inc. (CVE:RBX) share price is a whole 64% lower. That's an unpleasant experience for long term holders.

View our latest analysis for Robex Resources

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

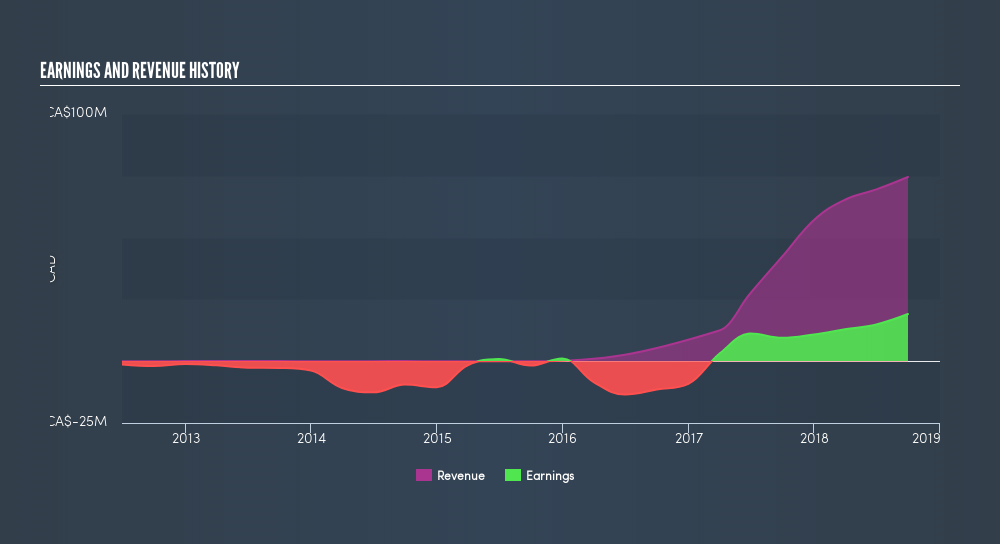

Robex Resources became profitable within the last five years. Most would consider that to be a good thing, so it's counter-intuitive to see the share price declining. Other metrics might give us a better handle on how its value is changing over time.

Revenue is actually up 69% over the time period. A more detailed examination of the revenue and earnings may or may not explain why the share price languishes; there could be an opportunity.

The graphic below shows how revenue and earnings have changed as management guided the business forward. If you want to see cashflow, you can click on the chart.

Take a more thorough look at Robex Resources's financial health with this freereport on its balance sheet.

A Different Perspective

Robex Resources shareholders are down 11% for the year, but the market itself is up 7.9%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. However, the loss over the last year isn't as bad as the 19% per annum loss investors have suffered over the last half decade. We would want clear information suggesting the company will grow, before taking the view that the share price will stabilize. You could get a better understanding of Robex Resources's growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

If you like to buy stocks alongside management, then you might just love this freelist of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About TSXV:RBX

Robex Resources

Engages in the exploration, development, and production of gold in West Africa.

Exceptional growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives