- Canada

- /

- Metals and Mining

- /

- TSXV:NTX

TSX Penny Stocks With Market Caps Under CA$200M

Reviewed by Simply Wall St

As we head into the second half of 2025, the Canadian market is navigating a landscape shaped by ongoing tariff and trade negotiations, which could influence economic growth and inflation. Despite these uncertainties, the potential for positive economic growth remains, especially as both Canada and the U.S. are largely service-driven economies. In this context, penny stocks—often representing smaller or newer companies—continue to be an intriguing investment area due to their potential for significant returns when backed by strong financial health.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| PetroTal (TSX:TAL) | CA$0.69 | CA$640.24M | ✅ 3 ⚠️ 4 View Analysis > |

| Orezone Gold (TSX:ORE) | CA$1.24 | CA$665.6M | ✅ 4 ⚠️ 2 View Analysis > |

| Dynacor Group (TSX:DNG) | CA$4.40 | CA$189.71M | ✅ 4 ⚠️ 2 View Analysis > |

| Findev (TSXV:FDI) | CA$0.445 | CA$12.6M | ✅ 2 ⚠️ 4 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$0.77 | CA$518.93M | ✅ 3 ⚠️ 2 View Analysis > |

| Automotive Finco (TSXV:AFCC.H) | CA$0.89 | CA$17.44M | ✅ 2 ⚠️ 4 View Analysis > |

| NTG Clarity Networks (TSXV:NCI) | CA$2.26 | CA$98.22M | ✅ 4 ⚠️ 2 View Analysis > |

| Intermap Technologies (TSX:IMP) | CA$2.19 | CA$125.23M | ✅ 3 ⚠️ 2 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$1.95 | CA$185.99M | ✅ 3 ⚠️ 1 View Analysis > |

| McChip Resources (TSXV:MCS) | CA$1.00 | CA$5.65M | ✅ 2 ⚠️ 4 View Analysis > |

Click here to see the full list of 890 stocks from our TSX Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Psyched Wellness (CNSX:PSYC)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Psyched Wellness Ltd. is a health supplements company that produces and distributes mushroom-derived products and related consumer packaged goods in the United States, with a market cap of CA$8.66 million.

Operations: The company generates revenue from its Vitamins & Nutrition Products segment, amounting to CA$0.64 million.

Market Cap: CA$8.66M

Psyched Wellness Ltd. is a pre-revenue company with CA$0.64 million in sales, facing auditor concerns about its ability to continue as a going concern. Despite having no debt and sufficient short-term assets (CA$6.7M) to cover liabilities (CA$234.9K), it remains unprofitable with increasing losses over the past five years at 14.7% annually. The stock's volatility is high, yet stable compared to previous periods, and shareholders have not faced significant dilution recently. A recent pilot for a new dietary supplement may offer future revenue potential if successful in consumer testing and market launch preparations are completed effectively.

- Unlock comprehensive insights into our analysis of Psyched Wellness stock in this financial health report.

- Review our historical performance report to gain insights into Psyched Wellness' track record.

Sailfish Royalty (TSXV:FISH)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Sailfish Royalty Corp. focuses on acquiring precious metals royalty and streaming agreements, with a market cap of CA$185.49 million.

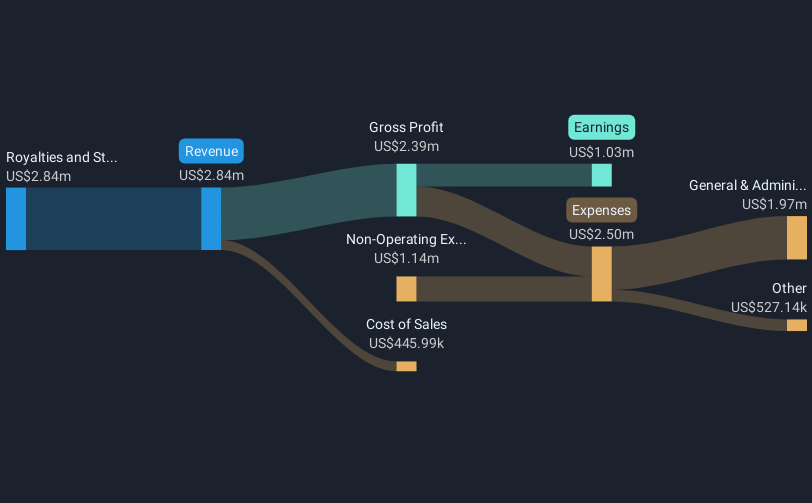

Operations: The company generates revenue of $3.07 million from its royalties and stream interests.

Market Cap: CA$185.49M

Sailfish Royalty Corp. has a market cap of CA$185.49 million and is not pre-revenue, with US$0.59 million in revenue for Q1 2025 despite a net loss of US$0.075 million compared to the previous year's profit. The company benefits from its 2% net smelter return royalty on Mako Mining's El Golfo area, where promising drill results have been reported, potentially enhancing future cash flows and resource expansion opportunities. While Sailfish's earnings grew significantly last year, its forecasted decline in earnings presents a challenge alongside limited interest coverage by EBIT and dividends not well covered by earnings or free cash flow.

- Click here to discover the nuances of Sailfish Royalty with our detailed analytical financial health report.

- Understand Sailfish Royalty's earnings outlook by examining our growth report.

NeoTerrex Minerals (TSXV:NTX)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: NeoTerrex Minerals Inc. is involved in the evaluation, acquisition, and exploration of mineral properties in Canada with a market cap of CA$14.96 million.

Operations: NeoTerrex Minerals Inc. does not currently report any revenue segments.

Market Cap: CA$14.96M

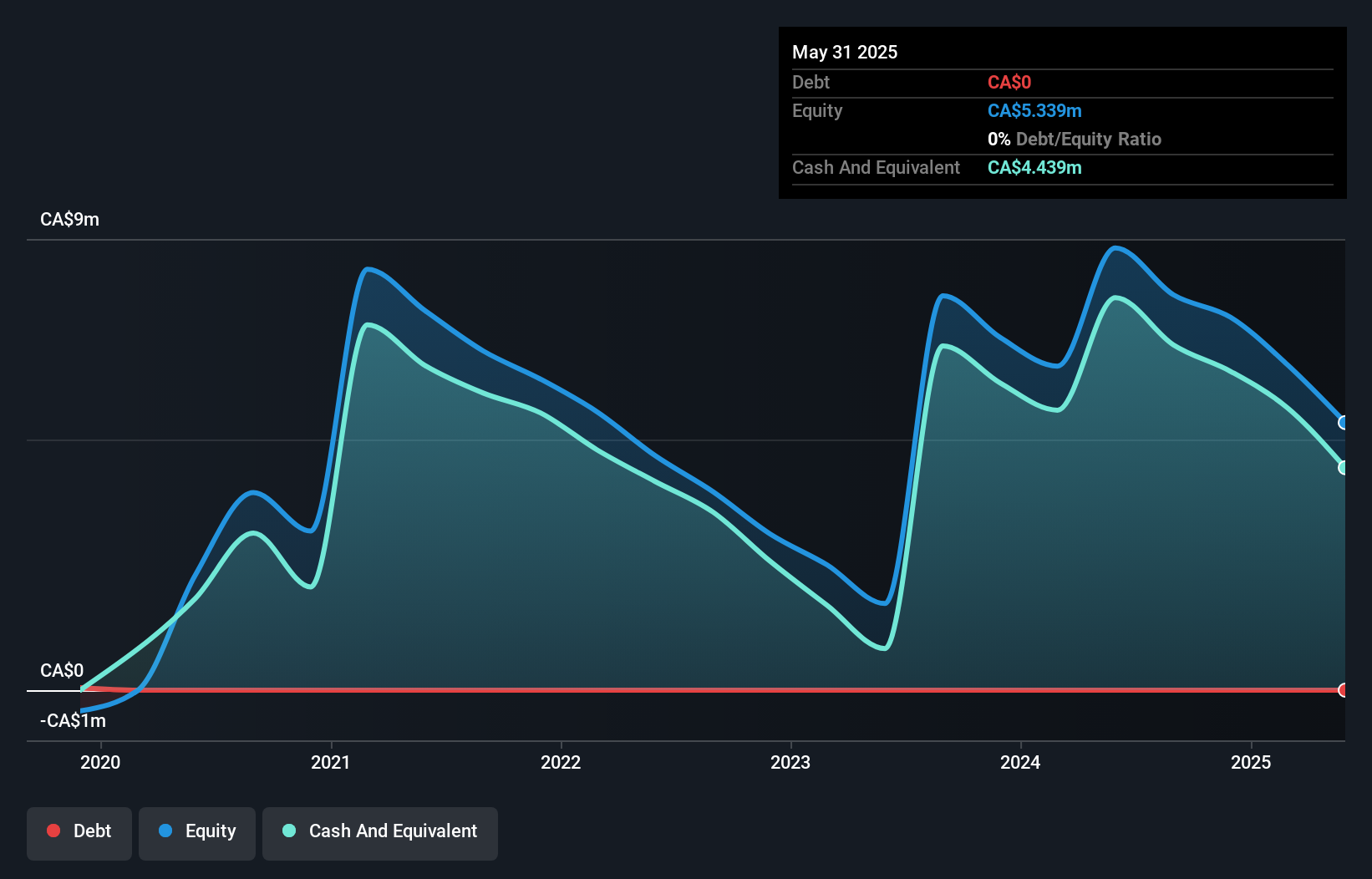

NeoTerrex Minerals Inc., with a market cap of CA$14.96 million, is pre-revenue and focuses on mineral exploration in Canada. The company has no debt and maintains a cash runway exceeding one year under stable conditions. Recent announcements highlight fully-funded exploration plans targeting rare earth elements across several projects, including Mount Discovery and Galactic REE projects, leveraging favorable tax incentives. Despite its unprofitability, NeoTerrex's strategic focus on critical minerals positions it for potential future value creation pending successful exploration outcomes. However, the stock remains highly volatile with significant price fluctuations observed recently.

- Navigate through the intricacies of NeoTerrex Minerals with our comprehensive balance sheet health report here.

- Explore historical data to track NeoTerrex Minerals' performance over time in our past results report.

Next Steps

- Click through to start exploring the rest of the 887 TSX Penny Stocks now.

- Ready To Venture Into Other Investment Styles? AI is about to change healthcare. These 22 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NeoTerrex Minerals might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:NTX

NeoTerrex Minerals

Engages in the evaluation, acquisition, and exploration of mineral properties in Canada.

Flawless balance sheet low.

Market Insights

Community Narratives