When Nicola Mining Inc. (CVE:NIM) reported its results to December 2021 its auditors, Davidson & Company could not be sure that it would be able to continue as a going concern in the next year. This means that, based on the financial results to that date, the company arguably should raise capital, or otherwise strengthen the balance sheet, as soon as possible.

Given its situation, it may not be in a good position to raise capital on favorable terms. So it is suddenly extremely important to consider whether the company is taking too much risk on its balance sheet. Debt is always a risk factor in these cases, as creditors could be in a position to wind up the company, in the worst case scenario.

Check out our latest analysis for Nicola Mining

How Much Debt Does Nicola Mining Carry?

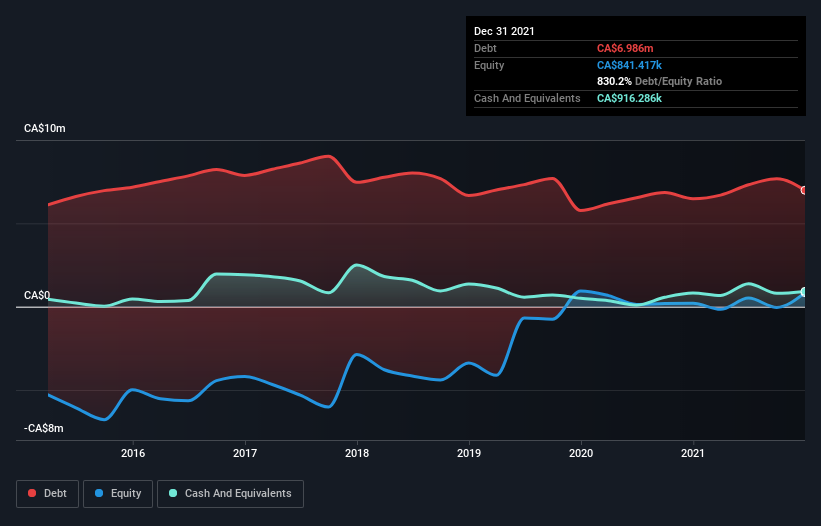

The image below, which you can click on for greater detail, shows that at December 2021 Nicola Mining had debt of CA$6.99m, up from CA$6.48m in one year. On the flip side, it has CA$916.3k in cash leading to net debt of about CA$6.07m.

A Look At Nicola Mining's Liabilities

According to the last reported balance sheet, Nicola Mining had liabilities of CA$7.02m due within 12 months, and liabilities of CA$4.50m due beyond 12 months. Offsetting these obligations, it had cash of CA$916.3k as well as receivables valued at CA$734.9k due within 12 months. So its liabilities total CA$9.87m more than the combination of its cash and short-term receivables.

While this might seem like a lot, it is not so bad since Nicola Mining has a market capitalization of CA$27.7m, and so it could probably strengthen its balance sheet by raising capital if it needed to. But it's clear that we should definitely closely examine whether it can manage its debt without dilution. When analysing debt levels, the balance sheet is the obvious place to start. But you can't view debt in total isolation; since Nicola Mining will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Given its lack of meaningful operating revenue, investors are probably hoping that Nicola Mining finds some valuable resources, before it runs out of money.

Caveat Emptor

Importantly, Nicola Mining had an earnings before interest and tax (EBIT) loss over the last year. Its EBIT loss was a whopping CA$3.5m. Considering that alongside the liabilities mentioned above does not give us much confidence that company should be using so much debt. So we think its balance sheet is a little strained, though not beyond repair. However, it doesn't help that it burned through CA$2.7m of cash over the last year. So suffice it to say we consider the stock very risky. We prefer to avoid a company after its auditor has expressed any uncertainty about its ability to continue as a going concern. That's because we find it more comfortable to invest in companies that always keep the balance sheet reasonably strong. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. To that end, you should learn about the 5 warning signs we've spotted with Nicola Mining (including 2 which shouldn't be ignored) .

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

Valuation is complex, but we're here to simplify it.

Discover if Nicola Mining might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSXV:NIM

Nicola Mining

A junior exploration and custom milling company, engages in the identification, acquisition, and exploration of mineral property interests in Canada.

Slight risk and slightly overvalued.

Market Insights

Community Narratives