- Canada

- /

- Paper and Forestry Products

- /

- TSX:WFG

TSX Stocks Estimated At Up To 38.8% Below Intrinsic Value Offering Potential Opportunities

Reviewed by Simply Wall St

The Canadian market has shown resilience, with equities reaching new record highs following dovish signals from the Bank of Canada and favorable responses to interest rate expectations. In this environment, identifying stocks that are trading below their intrinsic value can offer potential opportunities for investors looking to capitalize on market conditions that remain supportive yet challenging due to ongoing economic uncertainties.

Top 10 Undervalued Stocks Based On Cash Flows In Canada

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Topicus.com (TSXV:TOI) | CA$123.00 | CA$225.43 | 45.4% |

| Neo Performance Materials (TSX:NEO) | CA$15.73 | CA$31.16 | 49.5% |

| Major Drilling Group International (TSX:MDI) | CA$13.25 | CA$22.18 | 40.3% |

| kneat.com (TSX:KSI) | CA$4.73 | CA$9.35 | 49.4% |

| GURU Organic Energy (TSX:GURU) | CA$4.81 | CA$8.91 | 46% |

| EQB (TSX:EQB) | CA$98.40 | CA$183.21 | 46.3% |

| Endeavour Mining (TSX:EDV) | CA$68.01 | CA$124.16 | 45.2% |

| Dexterra Group (TSX:DXT) | CA$11.80 | CA$22.92 | 48.5% |

| Aya Gold & Silver (TSX:AYA) | CA$19.84 | CA$38.86 | 48.9% |

| 5N Plus (TSX:VNP) | CA$17.29 | CA$30.91 | 44.1% |

We're going to check out a few of the best picks from our screener tool.

NanoXplore (TSX:GRA)

Overview: NanoXplore Inc. is a graphene company that manufactures and supplies graphene powder for the transportation and industrial markets in Australia, with a market cap of CA$397.33 million.

Operations: The company's revenue is derived from two main segments: Battery Cells and Materials, contributing CA$0.92 million, and Advanced Materials, Plastics and Composite Products, accounting for CA$117.77 million.

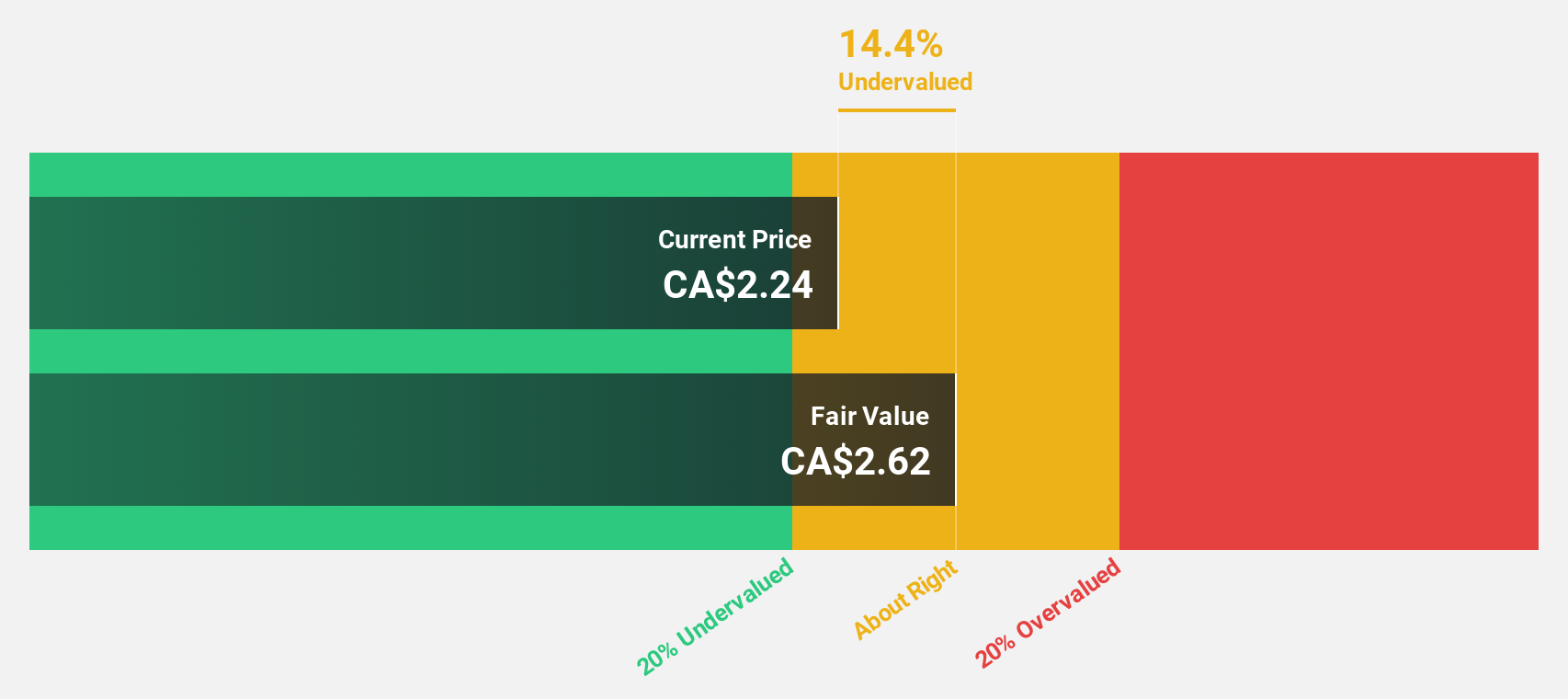

Estimated Discount To Fair Value: 38.8%

NanoXplore's stock appears undervalued, trading at CA$2.19 compared to its fair value estimate of CA$3.58, with earnings forecasted to grow significantly by 68.72% annually. Recent strategic moves include a multi-year supply agreement with Club Car and Chevron Phillips Chemical, enhancing revenue streams and diversification beyond traditional sectors. Despite a recent net loss increase in Q1 2025, the company is poised for future profitability within three years amid robust revenue growth expectations exceeding market averages.

- According our earnings growth report, there's an indication that NanoXplore might be ready to expand.

- Take a closer look at NanoXplore's balance sheet health here in our report.

New Found Gold (TSXV:NFG)

Overview: New Found Gold Corp. is a mineral exploration company focused on identifying, evaluating, acquiring, and exploring mineral properties in Newfoundland and Labrador, Canada, with a market cap of CA$740.28 million.

Operations: New Found Gold Corp. does not currently report any revenue segments in its financial statements.

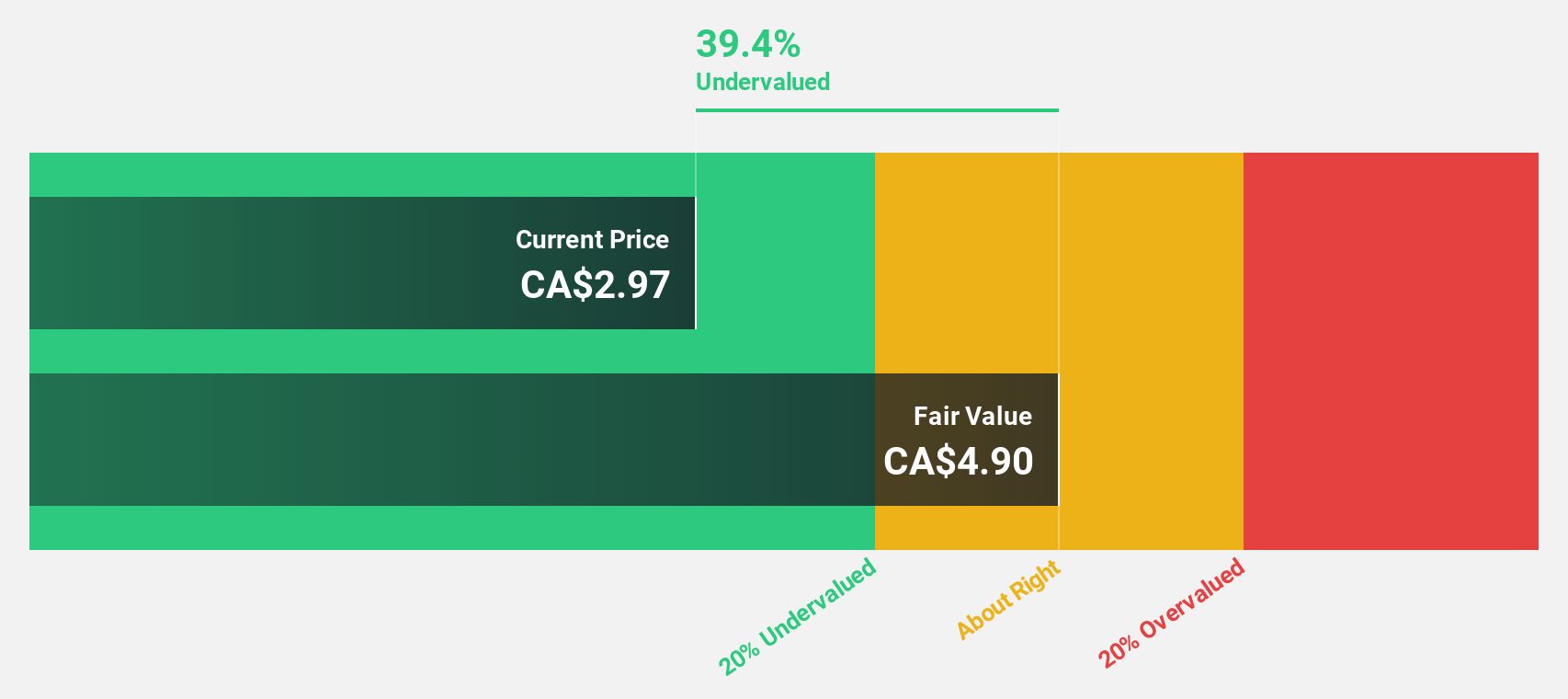

Estimated Discount To Fair Value: 26.7%

New Found Gold is trading at CA$3.73, significantly below its estimated fair value of CA$5.09. The company's revenue is expected to grow rapidly at 77.5% annually, outpacing the Canadian market's average growth rate and positioning it for profitability within three years. Recent expansion through acquiring mineral claims adjacent to its Queensway Project enhances potential cash flows, although shareholders experienced dilution over the past year due to strategic share issuance for acquisitions.

- Our comprehensive growth report raises the possibility that New Found Gold is poised for substantial financial growth.

- Get an in-depth perspective on New Found Gold's balance sheet by reading our health report here.

West Fraser Timber (TSX:WFG)

Overview: West Fraser Timber Co. Ltd. is a diversified wood products company involved in manufacturing, selling, marketing, and distributing lumber, engineered wood products, pulp, newsprint, wood chips, and other residuals and renewable energy with a market cap of CA$6.65 billion.

Operations: The company's revenue segments include Lumber ($2.63 billion), Pulp & Paper ($314 million), Europe Engineered Wood Products ($486 million), and North America Engineered Wood Products ($2.34 billion).

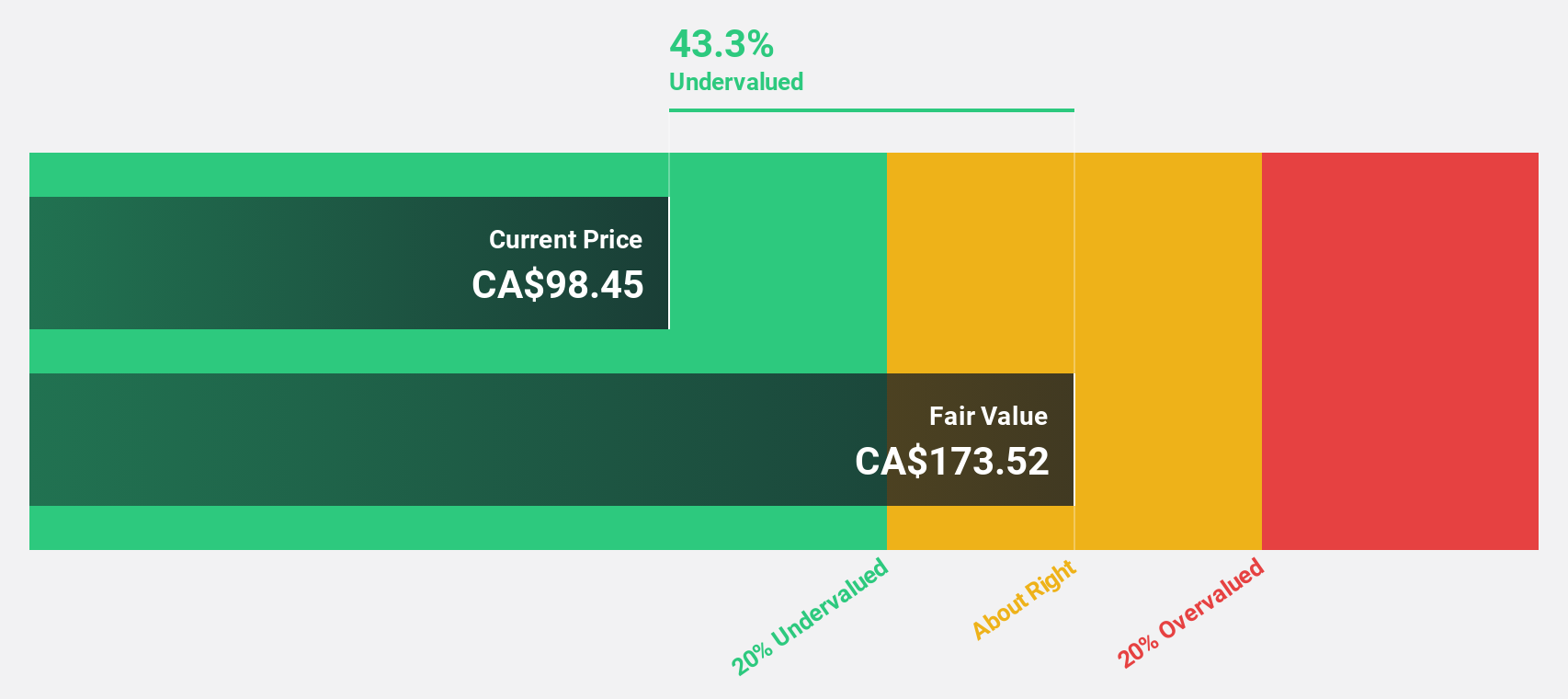

Estimated Discount To Fair Value: 16.5%

West Fraser Timber is trading at CA$84.81, approximately 16.5% below its estimated fair value of CA$101.56, suggesting undervaluation based on cash flows despite recent challenges such as mill closures and restructuring charges impacting earnings. While revenue growth is forecasted to outpace the Canadian market at 5.9% annually, profitability remains a future target with expected annual profit growth above market averages within three years, though dividends remain inadequately covered by current earnings or free cash flow.

- The growth report we've compiled suggests that West Fraser Timber's future prospects could be on the up.

- Dive into the specifics of West Fraser Timber here with our thorough financial health report.

Where To Now?

- Discover the full array of 30 Undervalued TSX Stocks Based On Cash Flows right here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if West Fraser Timber might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:WFG

West Fraser Timber

A diversified wood products company, engages in manufacturing, selling, marketing, and distributing lumber, engineered wood products, pulp, newsprint, wood chips, and other residuals and renewable energy.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion