- Canada

- /

- Metals and Mining

- /

- TSXV:NFG

New Found Gold (TSXV:NFG): Valuation Check After Financing Milestone and First Production Timeline Set for 2025

Reviewed by Simply Wall St

New Found Gold (TSXV:NFG) just checked off two major milestones: finishing construction at its Hammerdown open pit and securing $30 million in financing, setting up first gold production in the second half of 2025.

See our latest analysis for New Found Gold.

Those milestones seem to be reinvigorating sentiment, with a roughly 33% 1 month share price return and a 68% 1 year total shareholder return contrasting with still negative 3 year total shareholder returns. This suggests momentum is rebuilding from a lower base.

If this kind of turnaround story has your attention, it might also be worth exploring fast growing stocks with high insider ownership for other potential standouts building momentum behind the scenes.

With first production now in sight, New Found Gold’s surging share price and modest discount to analyst targets raise a key question: is this just the start of a rerating, or is future growth already priced in?

Price-to-Book of 13.3x: Is It Justified?

New Found Gold last closed at CA$3.94, a level that implies a rich valuation when set against its book value and sector peers.

The price to book ratio compares a company’s market value to the net assets on its balance sheet, a common yardstick for asset heavy miners and early stage explorers. At 13.3 times book, investors appear willing to pay a substantial premium for New Found Gold’s exploration potential and future cash flows relative to its current asset base.

That premium stands out sharply against benchmarks, with the Canadian Metals and Mining industry trading around 2.8 times book and close peers averaging 9.5 times. This suggests the market is assigning New Found Gold a noticeably higher expectation profile than both its broader sector and its immediate comparables.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Book of 13.3x (OVERVALUED)

However, investors still face clear risks, including prolonged pre-revenue exploration burn and potential disappointment if drilling or development results fall short of high expectations.

Find out about the key risks to this New Found Gold narrative.

Another Lens on Value

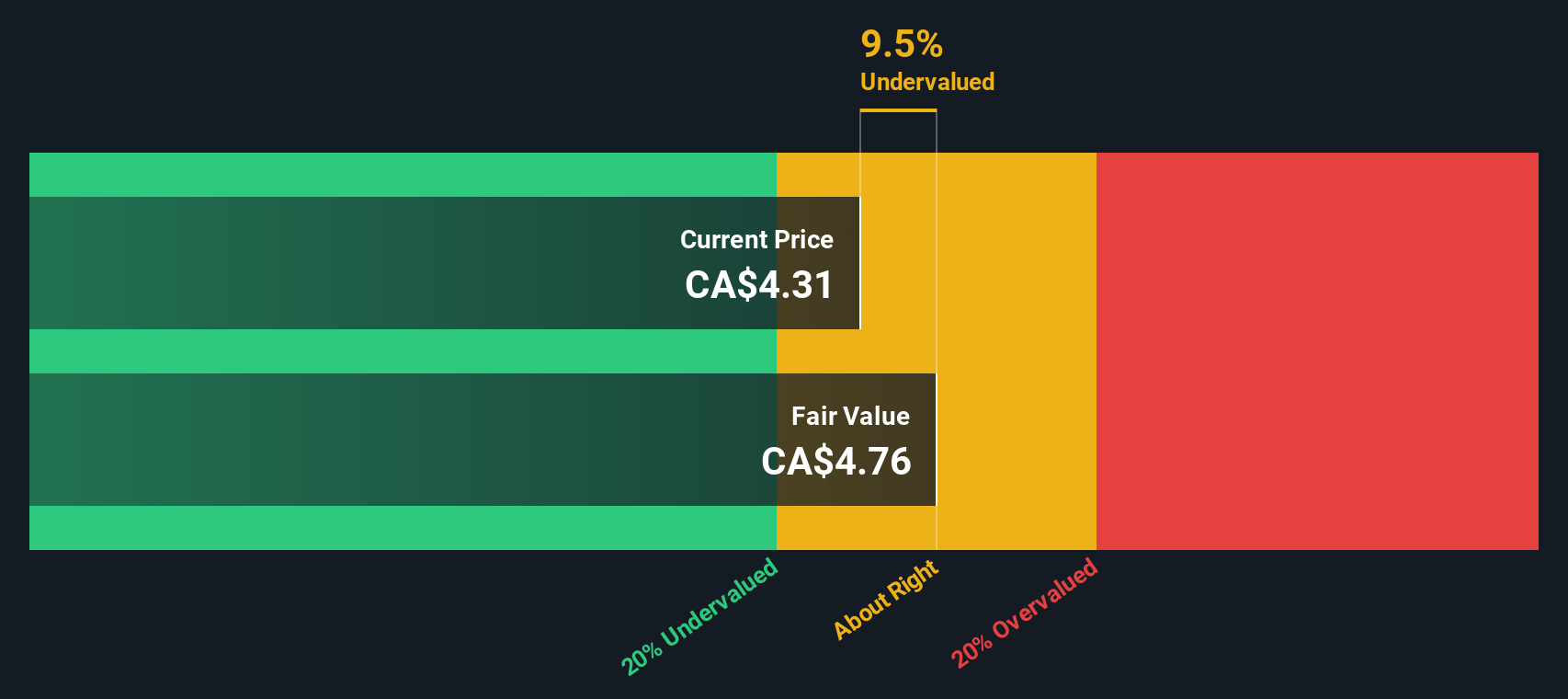

Our DCF model points in the same direction as the price to book metric, suggesting New Found Gold is slightly overvalued at around CA$3.94 versus an estimated fair value near CA$3.65. If both asset based and cash flow views lean cautious, where might upside surprise come from?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out New Found Gold for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 913 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own New Found Gold Narrative

If you would rather follow your own process and dig deeper into the numbers, you can build a personalized view in just a few minutes, Do it your way.

A great starting point for your New Found Gold research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Ready for Your Next Investing Move?

If you stop here, you could miss companies quietly building the next wave of returns. Use the Simply Wall St Screener to sharpen your opportunity set today.

- Capitalize on underpriced potential by targeting these 913 undervalued stocks based on cash flows that the market has not fully appreciated yet.

- Tap into cutting edge innovation by focusing on these 24 AI penny stocks shaping the future with real world AI applications.

- Lock in dependable income streams by zeroing in on these 12 dividend stocks with yields > 3% that can strengthen your portfolio’s cash flow.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if New Found Gold might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:NFG

New Found Gold

A mineral exploration company, engages in the identification, evaluation, acquisition, and exploration of mineral properties in the Provinces of Newfoundland and Labrador, Canada.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion