- Canada

- /

- Metals and Mining

- /

- TSXV:NCX

TSX Spotlight: Promising Penny Stocks For August 2025

Reviewed by Simply Wall St

As the Canadian economy navigates a landscape of moderated services inflation and a slightly elevated unemployment rate, investors are keenly observing potential opportunities in various sectors. Penny stocks, often associated with smaller or newer companies, continue to attract attention for their potential to offer value and growth where larger firms may not. Despite being considered an outdated term by some, penny stocks remain relevant as investment options when backed by strong financials; we'll explore three such promising examples that could present long-term success for investors seeking hidden value.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$0.61 | CA$61.7M | ✅ 3 ⚠️ 3 View Analysis > |

| illumin Holdings (TSX:ILLM) | CA$1.67 | CA$110.97M | ✅ 5 ⚠️ 1 View Analysis > |

| Fintech Select (TSXV:FTEC) | CA$0.03 | CA$2.8M | ✅ 2 ⚠️ 3 View Analysis > |

| Findev (TSXV:FDI) | CA$0.435 | CA$12.46M | ✅ 2 ⚠️ 4 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$0.77 | CA$505.63M | ✅ 3 ⚠️ 2 View Analysis > |

| McCoy Global (TSX:MCB) | CA$3.62 | CA$98.2M | ✅ 3 ⚠️ 2 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$4.10 | CA$206.57M | ✅ 2 ⚠️ 1 View Analysis > |

| ACT Energy Technologies (TSX:ACX) | CA$4.61 | CA$159.49M | ✅ 4 ⚠️ 2 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$1.90 | CA$183.3M | ✅ 3 ⚠️ 1 View Analysis > |

| McChip Resources (TSXV:MCS) | CA$1.69 | CA$9.71M | ✅ 2 ⚠️ 4 View Analysis > |

Click here to see the full list of 434 stocks from our TSX Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Emerita Resources (TSXV:EMO)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Emerita Resources Corp., through its subsidiary, focuses on acquiring, exploring, and developing mineral properties in Spain, with a market cap of CA$314.38 million.

Operations: Emerita Resources Corp. has not reported any revenue segments.

Market Cap: CA$314.38M

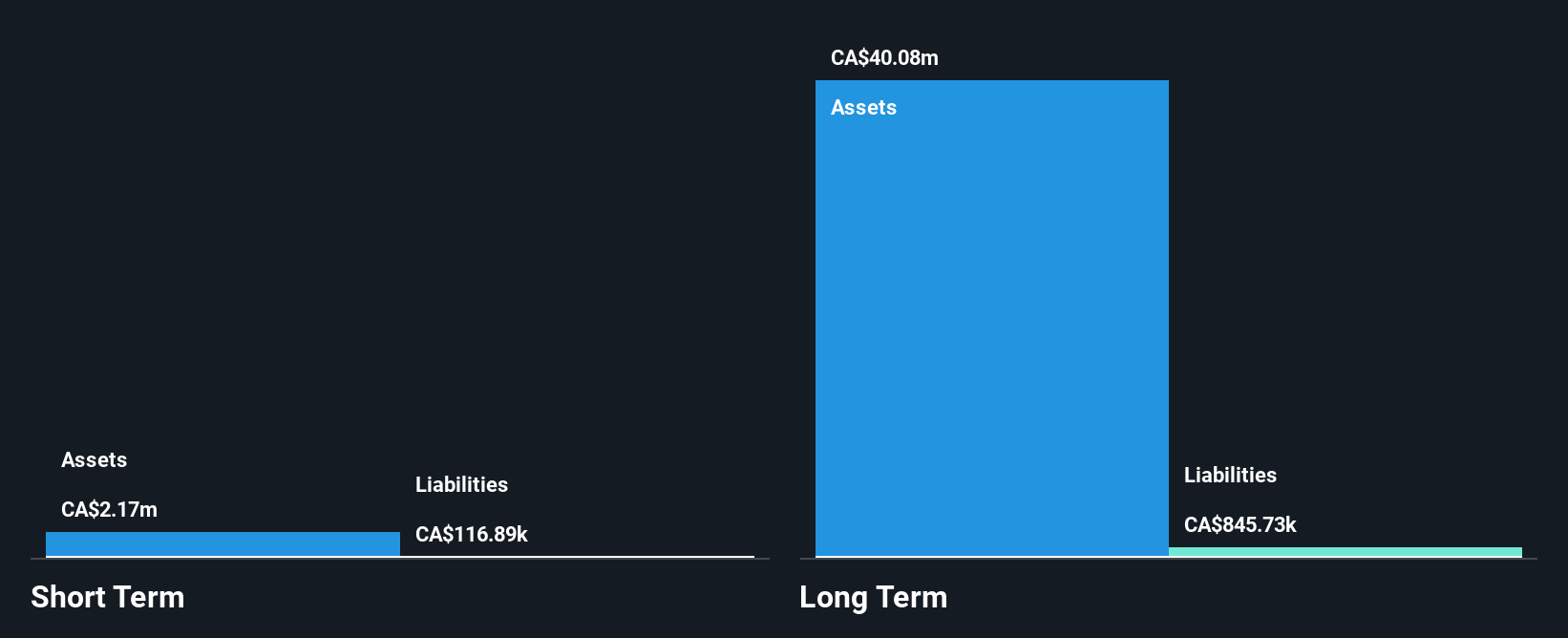

Emerita Resources Corp. is currently pre-revenue, focusing on mineral exploration and development in Spain. Recent drilling at the El Cura deposit has intersected promising copper-gold-zinc-lead-silver mineralization, indicating potential resource expansion. The company has improved its financial position with positive shareholder equity and no significant dilution over the past year. However, Emerita remains unprofitable with a negative return on equity and less than a year of cash runway based on current free cash flow levels. Despite these challenges, management's seasoned experience may support strategic advancements as they continue to optimize their metallurgical processes for better recovery rates.

- Jump into the full analysis health report here for a deeper understanding of Emerita Resources.

- Assess Emerita Resources' previous results with our detailed historical performance reports.

NorthIsle Copper and Gold (TSXV:NCX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: NorthIsle Copper and Gold Inc. is a junior resources company focused on the exploration, development, and acquisition of mineral properties in Canada, with a market cap of CA$326.40 million.

Operations: NorthIsle Copper and Gold Inc. does not report any revenue segments as it is primarily engaged in the exploration and development of mineral properties.

Market Cap: CA$326.4M

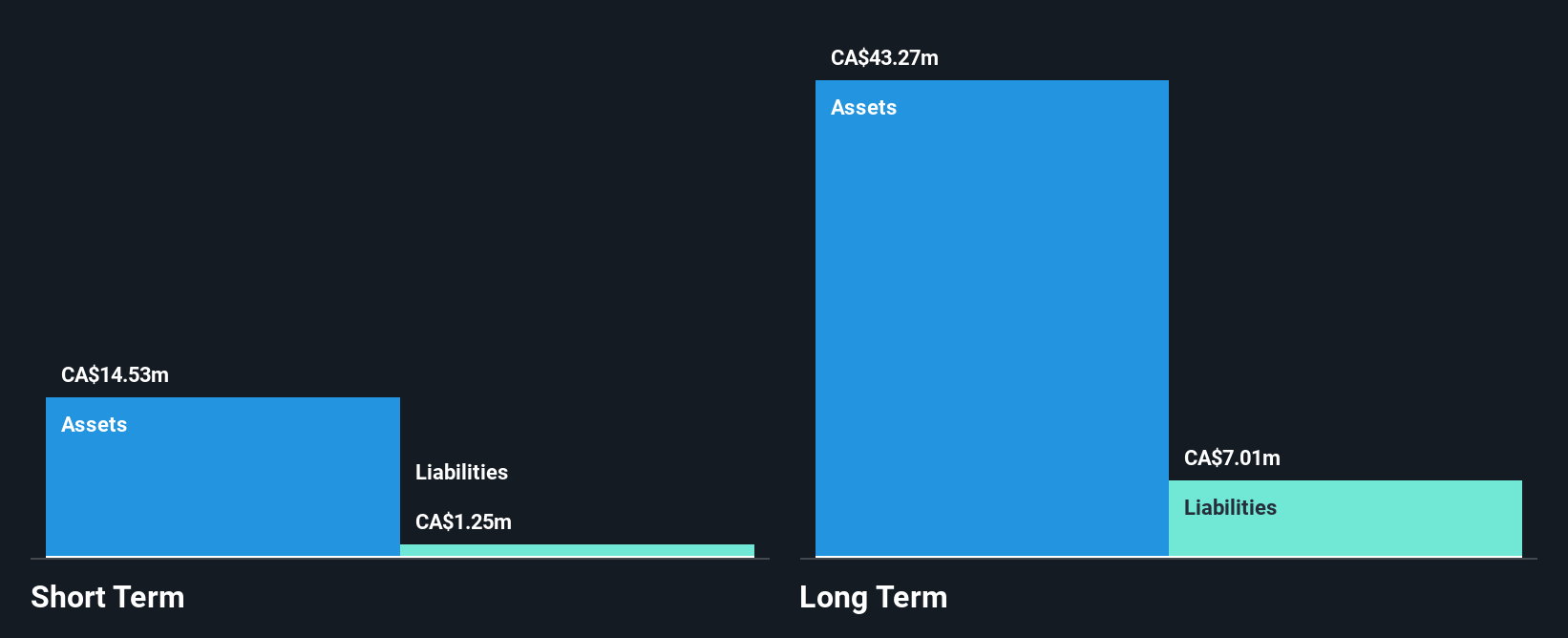

NorthIsle Copper and Gold Inc. is pre-revenue, focusing on mineral exploration with a market cap of CA$326.40 million. The company recently announced a private placement to raise capital, enhancing its financial position without significant shareholder dilution over the past year. Its short-term assets exceed liabilities, but it remains unprofitable with negative return on equity and increasing losses over five years. Recent exploration efforts at the North Island Project have shown promising results, supported by advanced geophysical tools like the Scan by Veracio system, aiming to enhance resource potential in high-margin areas while maintaining positive stakeholder engagement.

- Navigate through the intricacies of NorthIsle Copper and Gold with our comprehensive balance sheet health report here.

- Understand NorthIsle Copper and Gold's track record by examining our performance history report.

Silver One Resources (TSXV:SVE)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Silver One Resources Inc. focuses on the acquisition, exploration, and development of mineral properties in the United States with a market cap of CA$80.68 million.

Operations: Silver One Resources Inc. does not report any revenue segments.

Market Cap: CA$80.68M

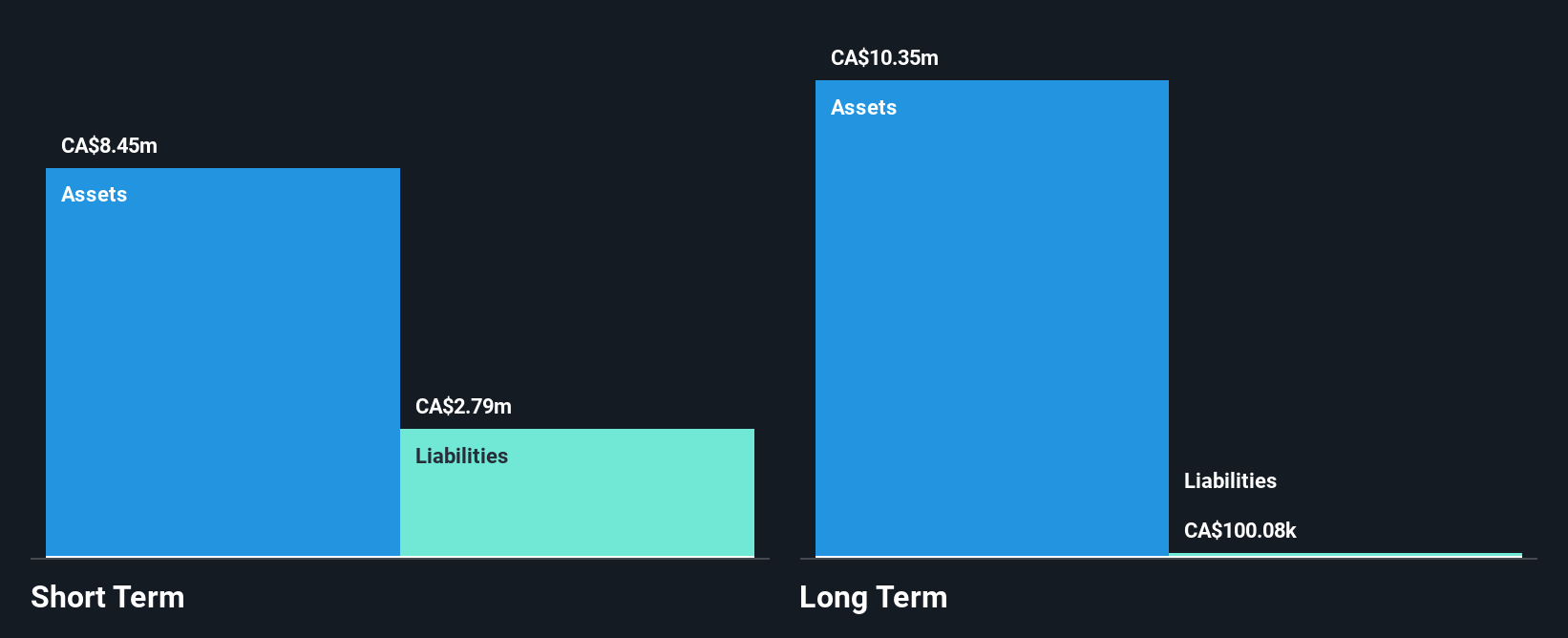

Silver One Resources Inc., with a market cap of CA$80.68 million, is pre-revenue and focuses on mineral exploration in the U.S. The company remains debt-free, which can be advantageous for managing financial flexibility. Despite experienced management and board teams averaging nine years of tenure, Silver One faces challenges with less than a year of cash runway and increasing losses over five years at 2.8% annually. Short-term assets exceed both short- and long-term liabilities, providing some financial stability amid its negative return on equity due to ongoing unprofitability. Recent participation in industry events highlights its active engagement in the sector.

- Click here and access our complete financial health analysis report to understand the dynamics of Silver One Resources.

- Evaluate Silver One Resources' historical performance by accessing our past performance report.

Seize The Opportunity

- Jump into our full catalog of 434 TSX Penny Stocks here.

- Searching for a Fresh Perspective? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NorthIsle Copper and Gold might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:NCX

NorthIsle Copper and Gold

A junior resources company, engages in the exploration, development, and acquisition of mineral properties in Canada.

Flawless balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives