- Canada

- /

- Metals and Mining

- /

- TSXV:MMY

Monument Mining (TSXV:MMY) Valuation: Assessing the Stock After Surging Production and Earnings Growth

Reviewed by Simply Wall St

Monument Mining (TSXV:MMY) just published its latest operating and earnings results, showing more than double the annual sales, along with higher gold production and net income compared to the previous year. Investors are taking note of these strong improvements.

See our latest analysis for Monument Mining.

Momentum is clearly building for Monument Mining, with the share price jumping 11% in one day and achieving a massive 64% gain over the past week. Investors who stuck with it through the last three years have been well rewarded, seeing a total shareholder return of over 1,300% that far outpaces most of the market.

If you’re looking to uncover more companies delivering outsized growth, now would be a smart time to explore fast growing stocks with high insider ownership.

With shares surging and results smashing expectations, the big question now is whether Monument Mining’s stock still offers value for new investors, or if the strong rally means future growth is already priced in.

Price-to-Earnings of 7x: Is it justified?

Monument Mining currently trades at a price-to-earnings (P/E) ratio of 7x, a figure that stands out when compared to both its peers and the broader industry. With the last close price at CA$1.07, the company’s valuation appears low for its recent surge in earnings and outperformance.

The price-to-earnings ratio measures how much investors are willing to pay for one dollar of company earnings. For mining companies, this is a key benchmark, reflecting sentiment not only on their profit growth but also sector expectations.

Monument Mining’s P/E of 7x is dramatically below the peer average of 36x and the Canadian Metals and Mining industry average of 22.5x. Such a substantial discount signals that the market may be underpricing Monument's remarkable profitability and growth trajectory, especially given its exceptional earnings momentum. If the market were to recognize and reward this performance, there is significant room for the valuation multiple to close the gap toward broader industry levels.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 7x (UNDERVALUED)

However, investors should note that the stock now trades above its analyst price target. Future earnings growth is not guaranteed amid sector volatility.

Find out about the key risks to this Monument Mining narrative.

Another View: What Does Our DCF Model Suggest?

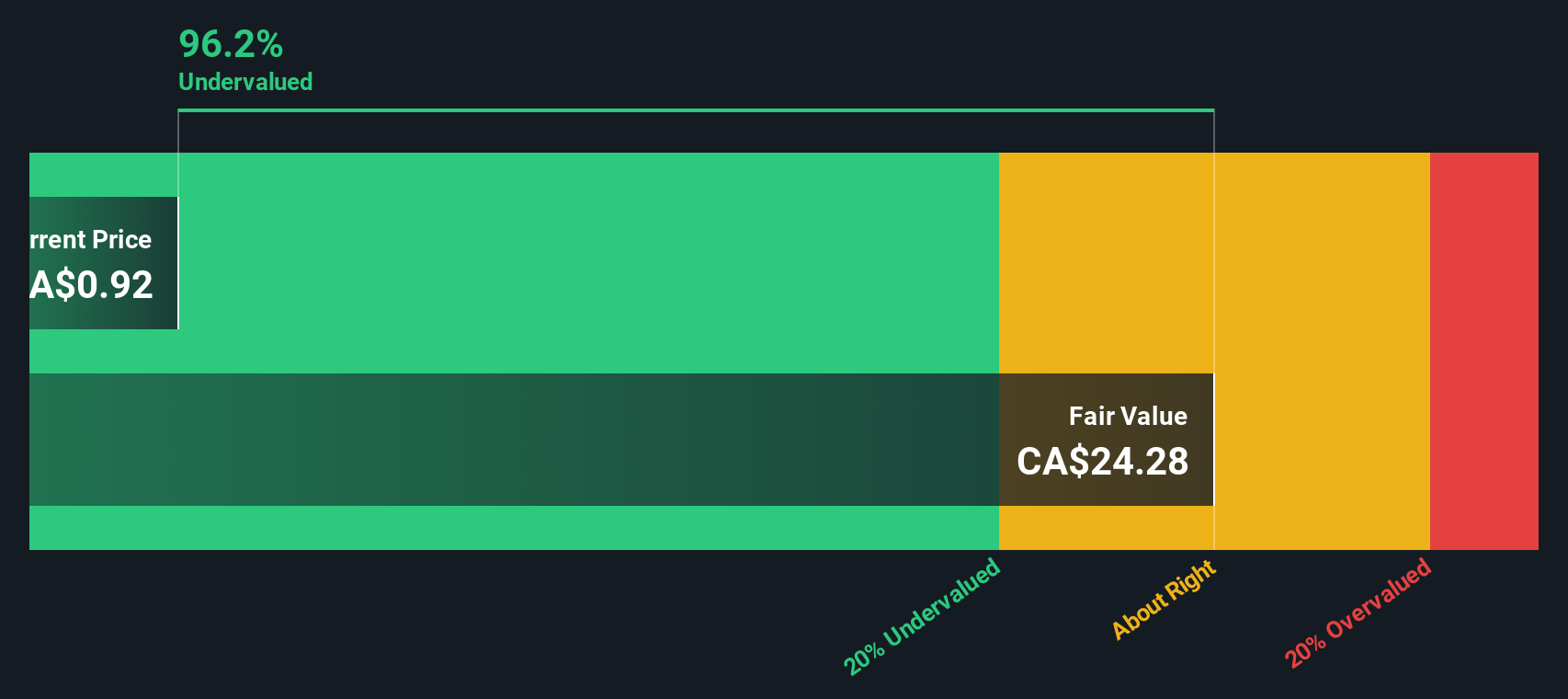

Beyond looking at earnings multiples, another valuation tool is the SWS DCF model. According to our DCF analysis, Monument Mining is trading far below its estimated fair value. This suggests that the market may be overlooking hidden long-term potential. But how reliable is this outlook?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Monument Mining for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Monument Mining Narrative

If you’d rather draw your own conclusions or see the data differently, there’s nothing stopping you from building your own take in just a few minutes. Do it your way Do it your way.

A great starting point for your Monument Mining research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Unlock your next investing opportunity by checking out our handpicked lists. The smartest moves start with the freshest stock ideas you might otherwise miss.

- Maximize your returns with reliable income streams by tapping into these 17 dividend stocks with yields > 3% offering strong yields above 3%.

- Ride the momentum behind artificial intelligence breakthroughs by tracking these 24 AI penny stocks making waves with transformative new technologies.

- Expand your portfolio with untapped potential. Jump on these 875 undervalued stocks based on cash flows that our analysis shows are trading below their true worth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:MMY

Monument Mining

Engages in the production, exploration, and development of precious metals in Canada, Australia, and Malaysia.

Outstanding track record with flawless balance sheet.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion