- Canada

- /

- Metals and Mining

- /

- TSXV:MMY

Even though Monument Mining (CVE:MMY) has lost CA$13m market cap in last 7 days, shareholders are still up 491% over 5 years

The Monument Mining Limited (CVE:MMY) share price has had a bad week, falling 11%. But that doesn't undermine the fantastic longer term performance (measured over five years). In fact, during that period, the share price climbed 491%. Impressive! So it might be that some shareholders are taking profits after good performance. But the real question is whether the business fundamentals can improve over the long term.

In light of the stock dropping 11% in the past week, we want to investigate the longer term story, and see if fundamentals have been the driver of the company's positive five-year return.

View our latest analysis for Monument Mining

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

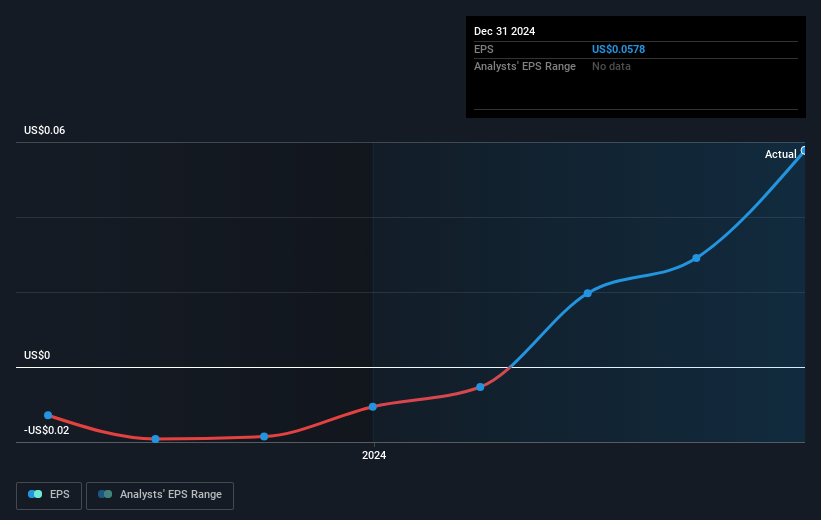

During the five years of share price growth, Monument Mining moved from a loss to profitability. That kind of transition can be an inflection point that justifies a strong share price gain, just as we have seen here.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

It is of course excellent to see how Monument Mining has grown profits over the years, but the future is more important for shareholders. Take a more thorough look at Monument Mining's financial health with this free report on its balance sheet.

A Different Perspective

It's nice to see that Monument Mining shareholders have received a total shareholder return of 103% over the last year. Since the one-year TSR is better than the five-year TSR (the latter coming in at 43% per year), it would seem that the stock's performance has improved in recent times. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For instance, we've identified 1 warning sign for Monument Mining that you should be aware of.

Of course Monument Mining may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Canadian exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSXV:MMY

Monument Mining

Engages in the production, exploration, and development of precious metals in Canada, Australia, and Malaysia.

Outstanding track record with flawless balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Near zero debt, Japan centric focus provides future growth

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.