- Canada

- /

- Metals and Mining

- /

- TSXV:MKO

Earnings Tell The Story For Mako Mining Corp. (CVE:MKO) As Its Stock Soars 30%

Mako Mining Corp. (CVE:MKO) shares have continued their recent momentum with a 30% gain in the last month alone. The last month tops off a massive increase of 156% in the last year.

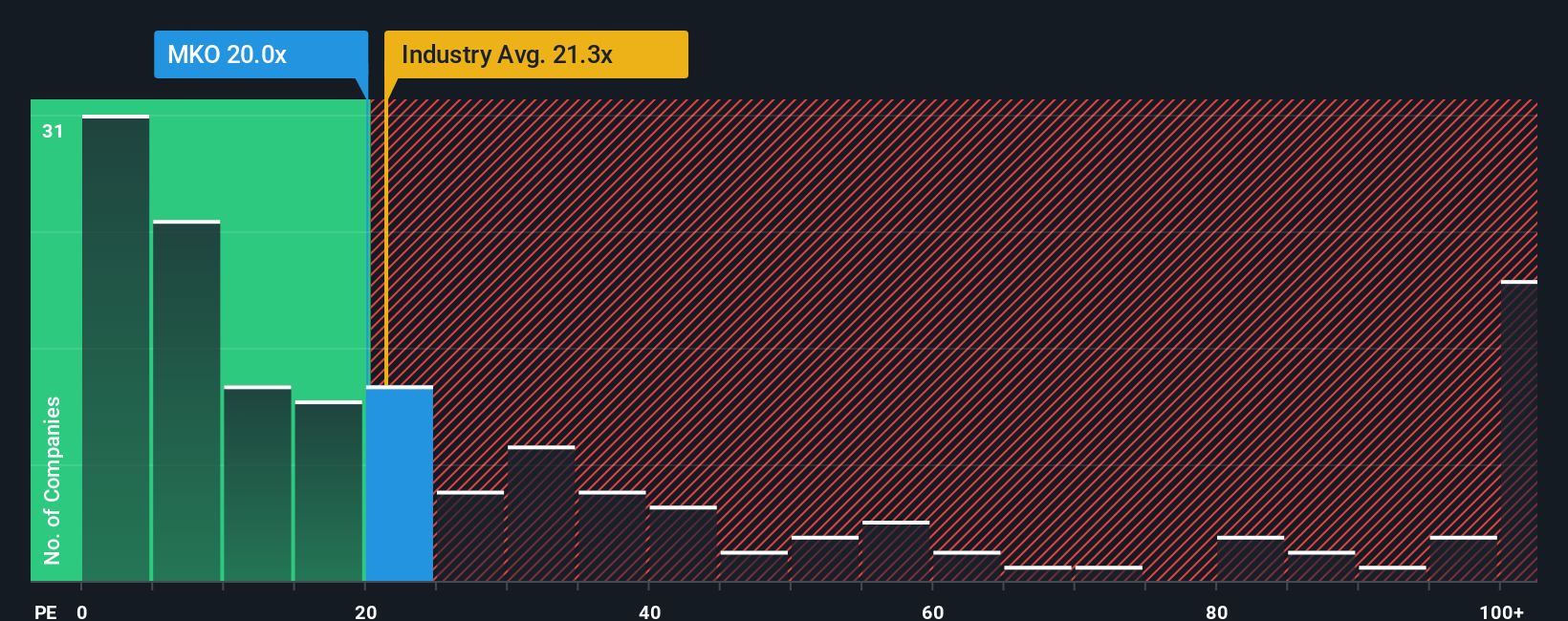

Following the firm bounce in price, Mako Mining may be sending bearish signals at the moment with its price-to-earnings (or "P/E") ratio of 20x, since almost half of all companies in Canada have P/E ratios under 16x and even P/E's lower than 9x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/E.

For example, consider that Mako Mining's financial performance has been poor lately as its earnings have been in decline. One possibility is that the P/E is high because investors think the company will still do enough to outperform the broader market in the near future. If not, then existing shareholders may be quite nervous about the viability of the share price.

View our latest analysis for Mako Mining

Does Growth Match The High P/E?

The only time you'd be truly comfortable seeing a P/E as high as Mako Mining's is when the company's growth is on track to outshine the market.

Retrospectively, the last year delivered a frustrating 13% decrease to the company's bottom line. However, a few very strong years before that means that it was still able to grow EPS by an impressive 2,258% in total over the last three years. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been more than adequate for the company.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 18% shows it's noticeably more attractive on an annualised basis.

With this information, we can see why Mako Mining is trading at such a high P/E compared to the market. It seems most investors are expecting this strong growth to continue and are willing to pay more for the stock.

The Key Takeaway

Mako Mining shares have received a push in the right direction, but its P/E is elevated too. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of Mako Mining revealed its three-year earnings trends are contributing to its high P/E, given they look better than current market expectations. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. Unless the recent medium-term conditions change, they will continue to provide strong support to the share price.

A lot of potential risks can sit within a company's balance sheet. You can assess many of the main risks through our free balance sheet analysis for Mako Mining with six simple checks.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSXV:MKO

Mako Mining

Engages in gold mining and exploration activities in Nicaragua.

Flawless balance sheet and good value.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026