- Canada

- /

- Metals and Mining

- /

- TSXV:MD

We Think Some Shareholders May Hesitate To Increase Midland Exploration Inc.'s (CVE:MD) CEO Compensation

In the past three years, shareholders of Midland Exploration Inc. (CVE:MD) have seen a loss on their investment. Despite positive EPS growth in the past few years, the share price hasn't tracked the fundamental performance of the company. The AGM coming up on the 09 February 2023 could be an opportunity for shareholders to bring these concerns to the board's attention. They could also try to influence management and firm direction through voting on resolutions such as executive remuneration and other company matters. We discuss below why we think shareholders should be cautious of approving a raise for the CEO at the moment.

See our latest analysis for Midland Exploration

How Does Total Compensation For Gino Roger Compare With Other Companies In The Industry?

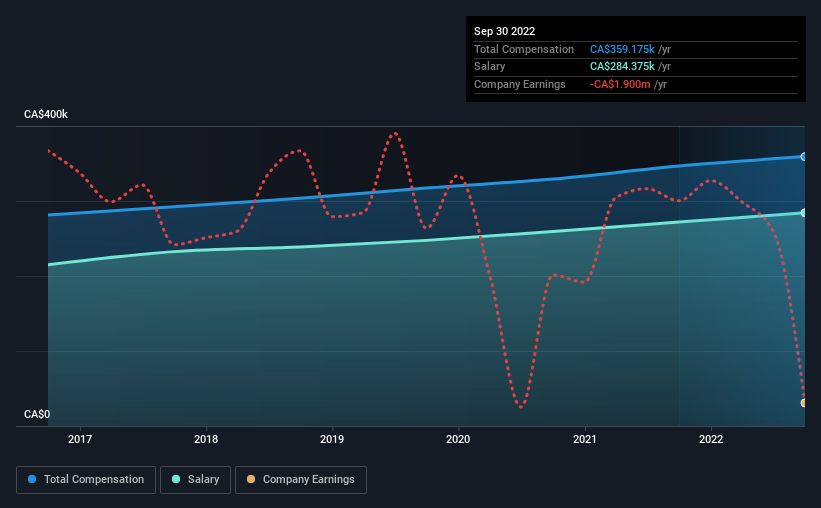

Our data indicates that Midland Exploration Inc. has a market capitalization of CA$58m, and total annual CEO compensation was reported as CA$359k for the year to September 2022. That's just a smallish increase of 3.6% on last year. We note that the salary portion, which stands at CA$284.4k constitutes the majority of total compensation received by the CEO.

In comparison with other companies in the Canadian Metals and Mining industry with market capitalizations under CA$266m, the reported median total CEO compensation was CA$183k. Hence, we can conclude that Gino Roger is remunerated higher than the industry median. What's more, Gino Roger holds CA$701k worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2022 | 2021 | Proportion (2022) |

| Salary | CA$284k | CA$272k | 79% |

| Other | CA$75k | CA$75k | 21% |

| Total Compensation | CA$359k | CA$347k | 100% |

On an industry level, roughly 89% of total compensation represents salary and 11% is other remuneration. It's interesting to note that Midland Exploration allocates a smaller portion of compensation to salary in comparison to the broader industry. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

A Look at Midland Exploration Inc.'s Growth Numbers

Midland Exploration Inc.'s earnings per share (EPS) grew 2.8% per year over the last three years. Its revenue is up 4.1% over the last year.

We're not particularly impressed by the revenue growth, but we're happy with the modest EPS growth. So there are some positives here, but not enough to earn high praise. We don't have analyst forecasts, but you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Has Midland Exploration Inc. Been A Good Investment?

Given the total shareholder loss of 13% over three years, many shareholders in Midland Exploration Inc. are probably rather dissatisfied, to say the least. So shareholders would probably want the company to be less generous with CEO compensation.

To Conclude...

Shareholders have not seen their shares grow in value, rather they have seen their shares decline. The stock's movement is disjointed with the company's earnings growth, which ideally should move in the same direction. Shareholders would probably be keen to find out what are the other factors could be weighing down the stock. These concerns should be addressed at the upcoming AGM, where shareholders can question the board and evaluate if their judgement and decision making is still in line with their expectations.

CEO pay is simply one of the many factors that need to be considered while examining business performance. We identified 5 warning signs for Midland Exploration (2 can't be ignored!) that you should be aware of before investing here.

Important note: Midland Exploration is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSXV:MD

Midland Exploration

A mineral exploration company, engages in the acquisition, exploration, and evaluation of mineral properties in Canada.

Flawless balance sheet with low risk.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026