- Canada

- /

- Metals and Mining

- /

- TSXV:KES

TSX Penny Stocks To Watch In October 2025

Reviewed by Simply Wall St

In Canada, recent economic data shows signs of stabilization, with the August labor market report indicating a relative steadiness in employment changes and inflation figures aligning with expectations. As investors navigate a period of potential market volatility and seasonal fluctuations, they may find value in exploring opportunities beyond traditional equities. Penny stocks, often associated with smaller or newer companies, continue to offer intriguing possibilities for those seeking affordability and growth potential when backed by strong financials.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$3.22 | CA$79.63M | ✅ 3 ⚠️ 4 View Analysis > |

| Canso Select Opportunities (TSXV:CSOC.A) | CA$4.50 | CA$22.73M | ✅ 2 ⚠️ 2 View Analysis > |

| Montero Mining and Exploration (TSXV:MON) | CA$0.285 | CA$2.42M | ✅ 2 ⚠️ 4 View Analysis > |

| CEMATRIX (TSX:CEMX) | CA$0.365 | CA$54.82M | ✅ 2 ⚠️ 1 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$1.32 | CA$838.27M | ✅ 3 ⚠️ 2 View Analysis > |

| Automotive Finco (TSXV:AFCC.H) | CA$1.16 | CA$21.6M | ✅ 2 ⚠️ 3 View Analysis > |

| Amerigo Resources (TSX:ARG) | CA$2.70 | CA$439.26M | ✅ 3 ⚠️ 2 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$3.56 | CA$180.18M | ✅ 2 ⚠️ 1 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$2.25 | CA$209.8M | ✅ 3 ⚠️ 1 View Analysis > |

| Matachewan Consolidated Mines (TSXV:MCM.A) | CA$0.86 | CA$10.7M | ✅ 2 ⚠️ 3 View Analysis > |

Click here to see the full list of 413 stocks from our TSX Penny Stocks screener.

We'll examine a selection from our screener results.

Thinkific Labs (TSX:THNC)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Thinkific Labs Inc. develops, markets, and manages a cloud-based platform serving Canada, the United States, and international markets with a market cap of CA$135.99 million.

Operations: The company generates revenue of $70.71 million from the development, marketing, and support management of its cloud-based platform.

Market Cap: CA$136M

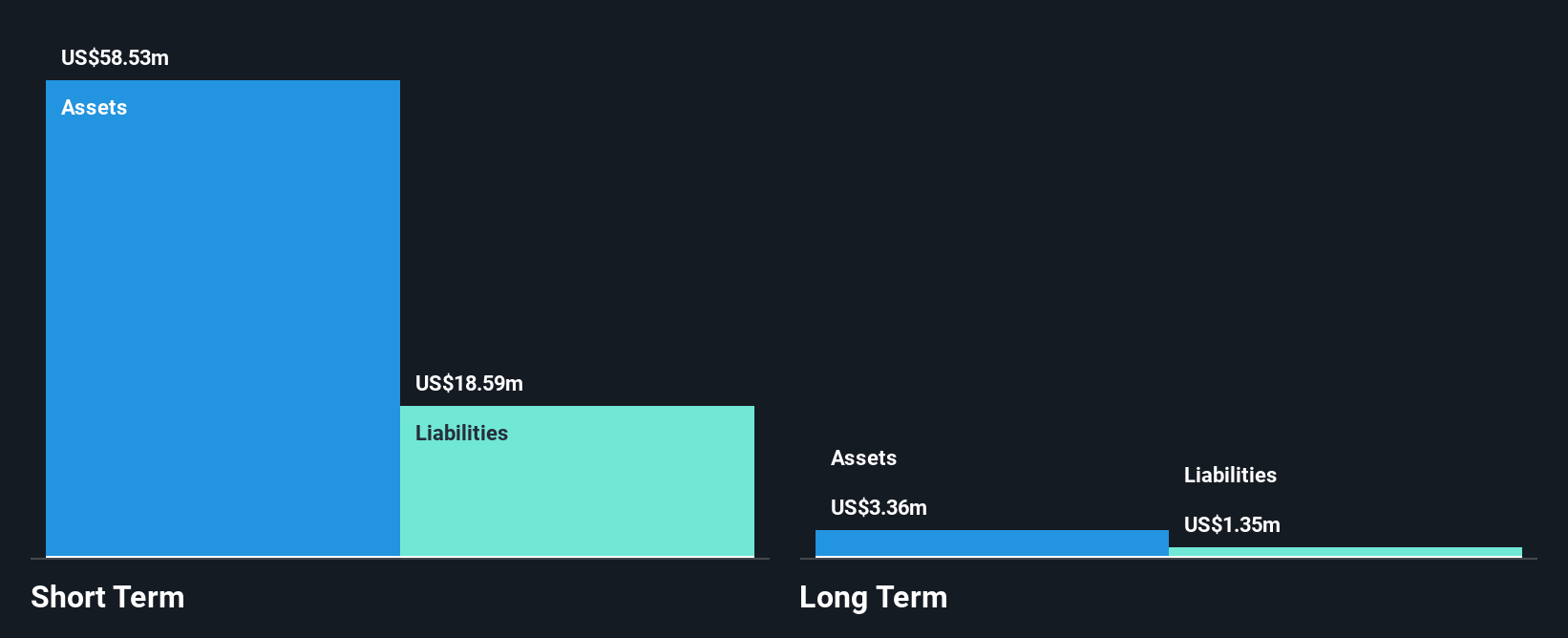

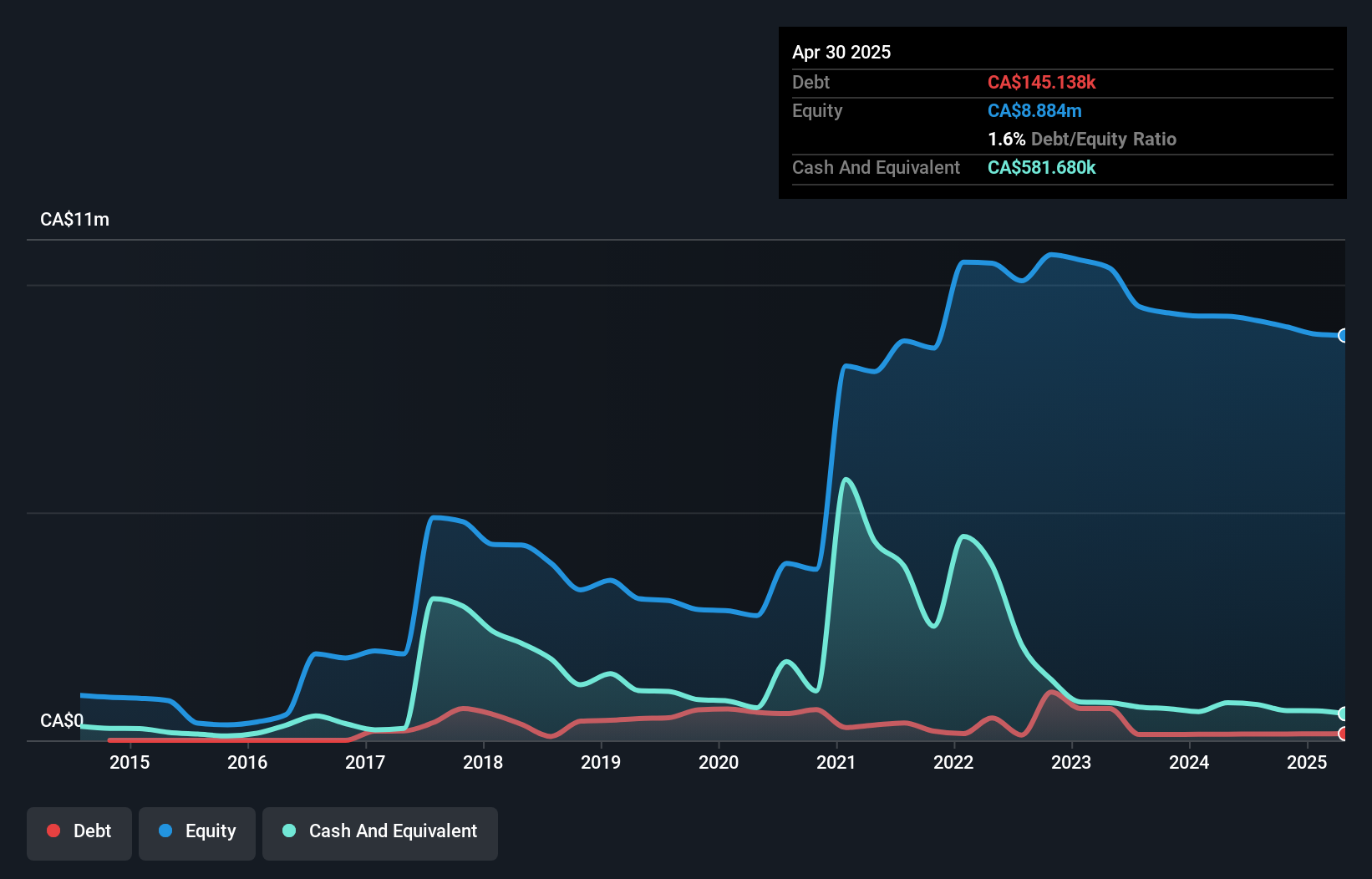

Thinkific Labs Inc. has recently achieved profitability, marking a significant milestone for the company. The firm reported second-quarter sales of US$18.1 million, with net income reaching US$0.372 million, reflecting a positive turnaround from past losses. Despite its low return on equity at 1.6%, Thinkific's financial stability is underscored by its debt-free status and robust short-term assets of $60.1 million exceeding liabilities significantly. While earnings are forecast to decline over the next three years, revenue growth is anticipated at 8.48% annually, suggesting potential resilience in its business model amidst market fluctuations.

- Get an in-depth perspective on Thinkific Labs' performance by reading our balance sheet health report here.

- Assess Thinkific Labs' future earnings estimates with our detailed growth reports.

Kesselrun Resources (TSXV:KES)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Kesselrun Resources Ltd. is involved in the acquisition, exploration, and development of mineral properties in Canada, with a market cap of CA$6.59 million.

Operations: Kesselrun Resources Ltd. currently does not report any revenue segments.

Market Cap: CA$6.59M

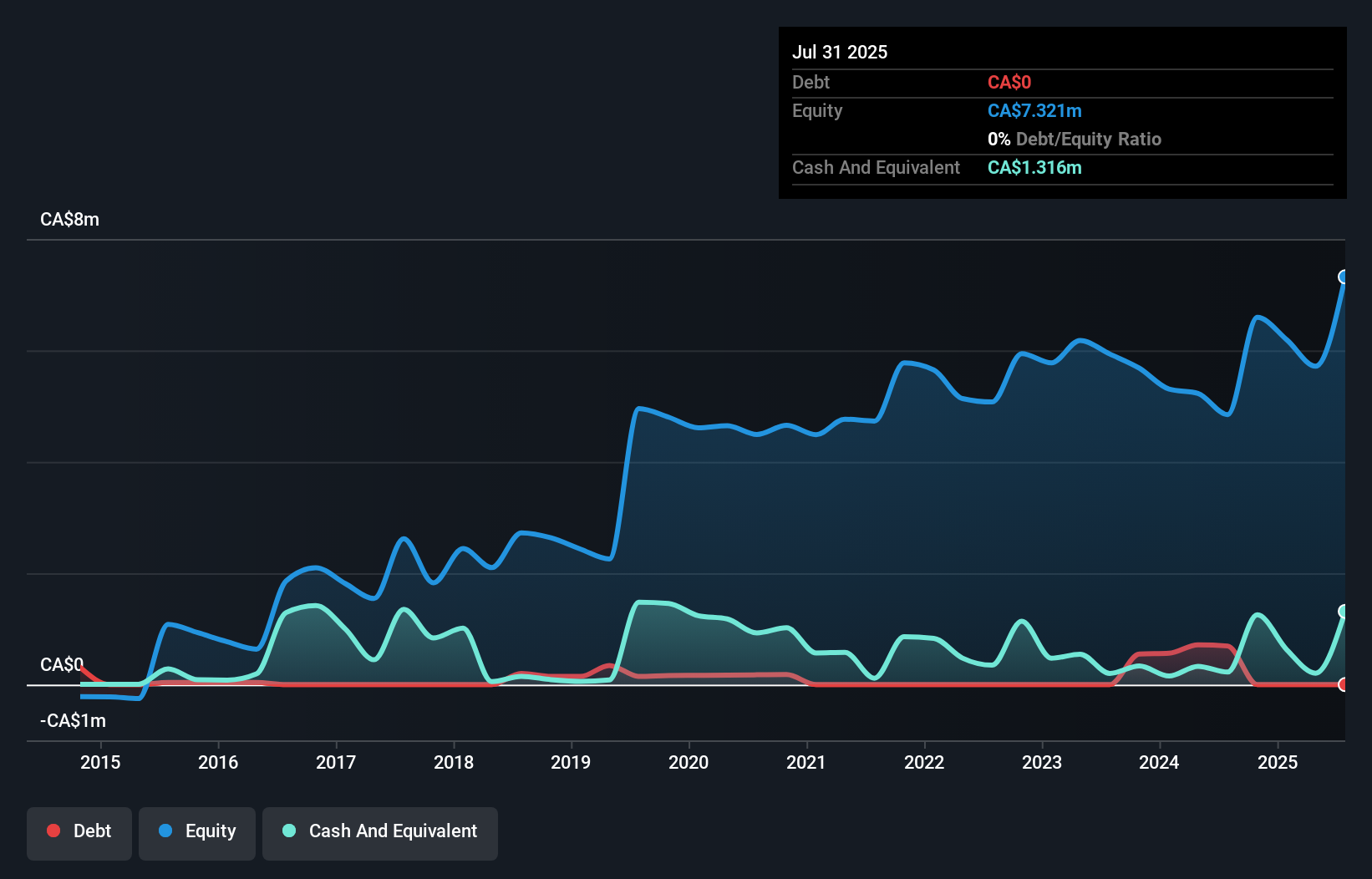

Kesselrun Resources Ltd. is a pre-revenue company with a market cap of CA$6.59 million, currently navigating financial challenges typical of its exploration-focused peers. Its short-term assets of CA$650.6K fall short against liabilities totaling CA$2.2M, although it maintains more cash than debt and has reduced its debt-to-equity ratio significantly over five years. The company's board is experienced with an average tenure exceeding 13 years, providing stable governance amid volatility in share price and increased weekly volatility to 29%. Recently, Gold X2 Mining Inc.'s acquisition agreement values Kesselrun at CA$12.4 million, subject to regulatory approvals by November 2025's end.

- Take a closer look at Kesselrun Resources' potential here in our financial health report.

- Understand Kesselrun Resources' track record by examining our performance history report.

Latin Metals (TSXV:LMS)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Latin Metals Inc. is an exploration stage company focused on acquiring, exploring, and evaluating mineral properties in South America, with a market cap of CA$25.92 million.

Operations: Currently, there are no reported revenue segments for this exploration stage company.

Market Cap: CA$25.92M

Latin Metals Inc., with a market cap of CA$25.92 million, is a pre-revenue exploration company focused on mineral properties in South America. The company has less than a year of cash runway and no long-term liabilities, but its short-term assets exceed its liabilities by CA$1.31 million. Recent developments include progress at the Esperanza copper-gold project in Argentina, where significant geological work has been conducted under an option agreement with Moxico Resources plc. Additionally, Latin Metals expanded its Para copper project in Peru by acquiring more land and defining new drill targets, positioning it for potential growth if funding partners are secured.

- Unlock comprehensive insights into our analysis of Latin Metals stock in this financial health report.

- Learn about Latin Metals' historical performance here.

Make It Happen

- Unlock our comprehensive list of 413 TSX Penny Stocks by clicking here.

- Seeking Other Investments? We've found 18 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kesselrun Resources might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:KES

Kesselrun Resources

Engages in the acquisition, exploration, and development of mineral properties in Canada.

Excellent balance sheet with slight risk.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026