The Canadian equity market has recently reached new record highs, buoyed by supportive signals from the Bank of Canada and the Federal Reserve. In this context, penny stocks—often representing smaller or newer companies—remain an intriguing investment area due to their affordability and potential for growth when backed by strong financials. This article will explore several standout penny stocks on the TSX that demonstrate financial robustness and long-term potential.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$2.10 | CA$53.59M | ✅ 3 ⚠️ 4 View Analysis > |

| Canso Select Opportunities (TSXV:CSOC.A) | CA$4.50 | CA$21.61M | ✅ 2 ⚠️ 2 View Analysis > |

| Sailfish Royalty (TSXV:FISH) | CA$3.27 | CA$249.69M | ✅ 1 ⚠️ 4 View Analysis > |

| Zoomd Technologies (TSXV:ZOMD) | CA$1.16 | CA$123.98M | ✅ 4 ⚠️ 2 View Analysis > |

| Montero Mining and Exploration (TSXV:MON) | CA$0.425 | CA$3.93M | ✅ 2 ⚠️ 4 View Analysis > |

| CEMATRIX (TSX:CEMX) | CA$0.345 | CA$52.57M | ✅ 3 ⚠️ 1 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$1.33 | CA$884.85M | ✅ 3 ⚠️ 2 View Analysis > |

| Automotive Finco (TSXV:AFCC.H) | CA$1.20 | CA$23.78M | ✅ 2 ⚠️ 3 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$3.01 | CA$148.62M | ✅ 2 ⚠️ 1 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$1.97 | CA$189.25M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 389 stocks from our TSX Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

NanoXplore (TSX:GRA)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: NanoXplore Inc. is a graphene company that produces and distributes graphene powder for transportation and industrial markets in Australia, with a market cap of CA$397.33 million.

Operations: The company's revenue is derived from two segments: Battery Cells and Materials, generating CA$0.92 million, and Advanced Materials, Plastics and Composite Products, contributing CA$117.77 million.

Market Cap: CA$397.33M

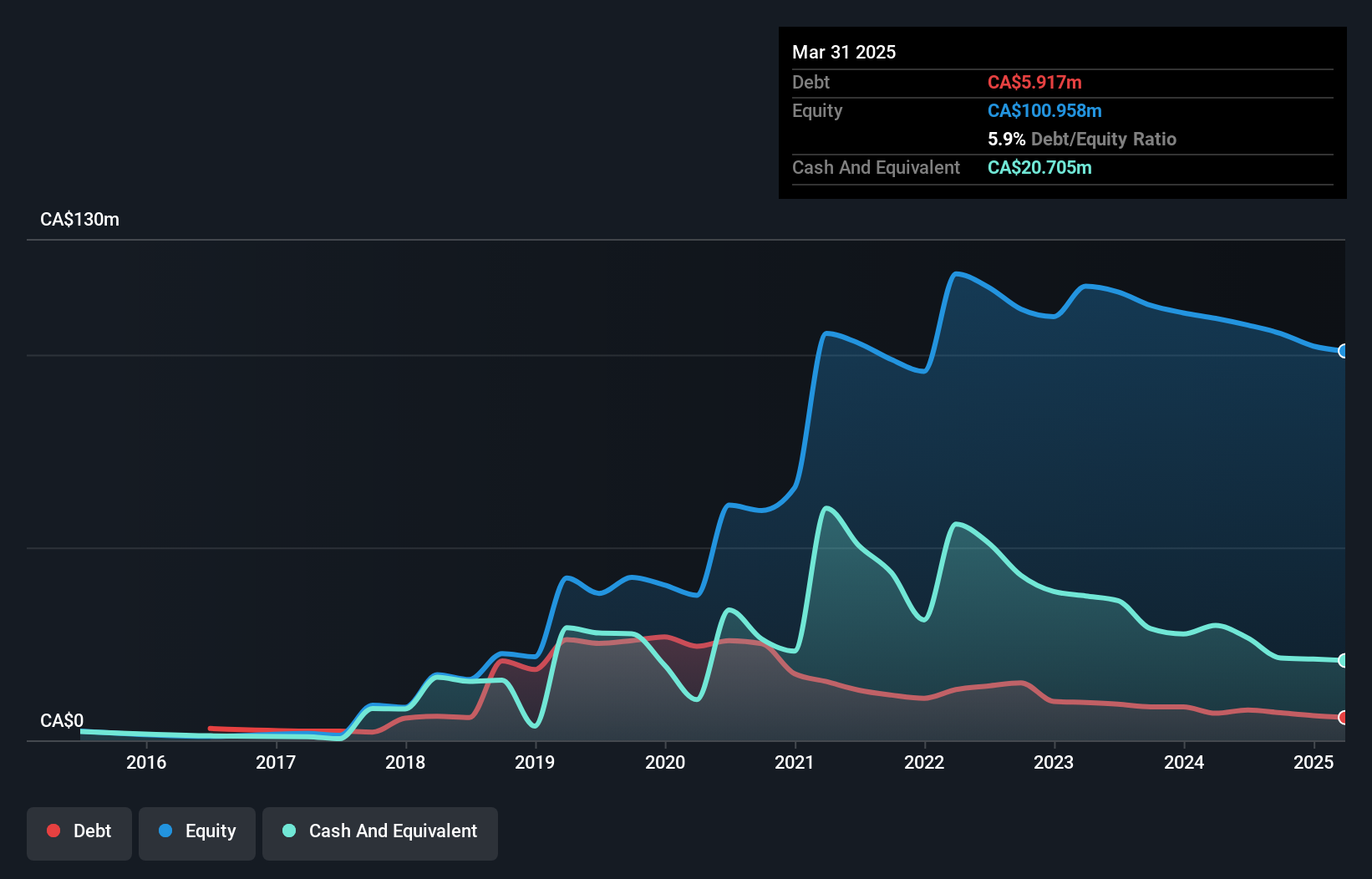

NanoXplore Inc. has shown resilience in the penny stock market with its strategic initiatives and recent developments. Despite being unprofitable, it has reduced losses over the past five years and maintains a strong cash position, exceeding its total debt. The company recently secured a €20 million private placement involving significant defense sector players, indicating confidence in its growth potential. Furthermore, NanoXplore's exclusive supply agreement with Club Car is expected to generate approximately $15 million annually, enhancing revenue streams beyond traditional markets. However, investors should note the company's short cash runway of six months despite additional capital raises.

- Click to explore a detailed breakdown of our findings in NanoXplore's financial health report.

- Gain insights into NanoXplore's future direction by reviewing our growth report.

Latin Metals (TSXV:LMS)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Latin Metals Inc. is an exploration stage company focused on acquiring, exploring, and evaluating mineral properties in South America, with a market cap of CA$26.60 million.

Operations: No revenue segments are reported for this exploration stage company focused on mineral properties in South America.

Market Cap: CA$26.6M

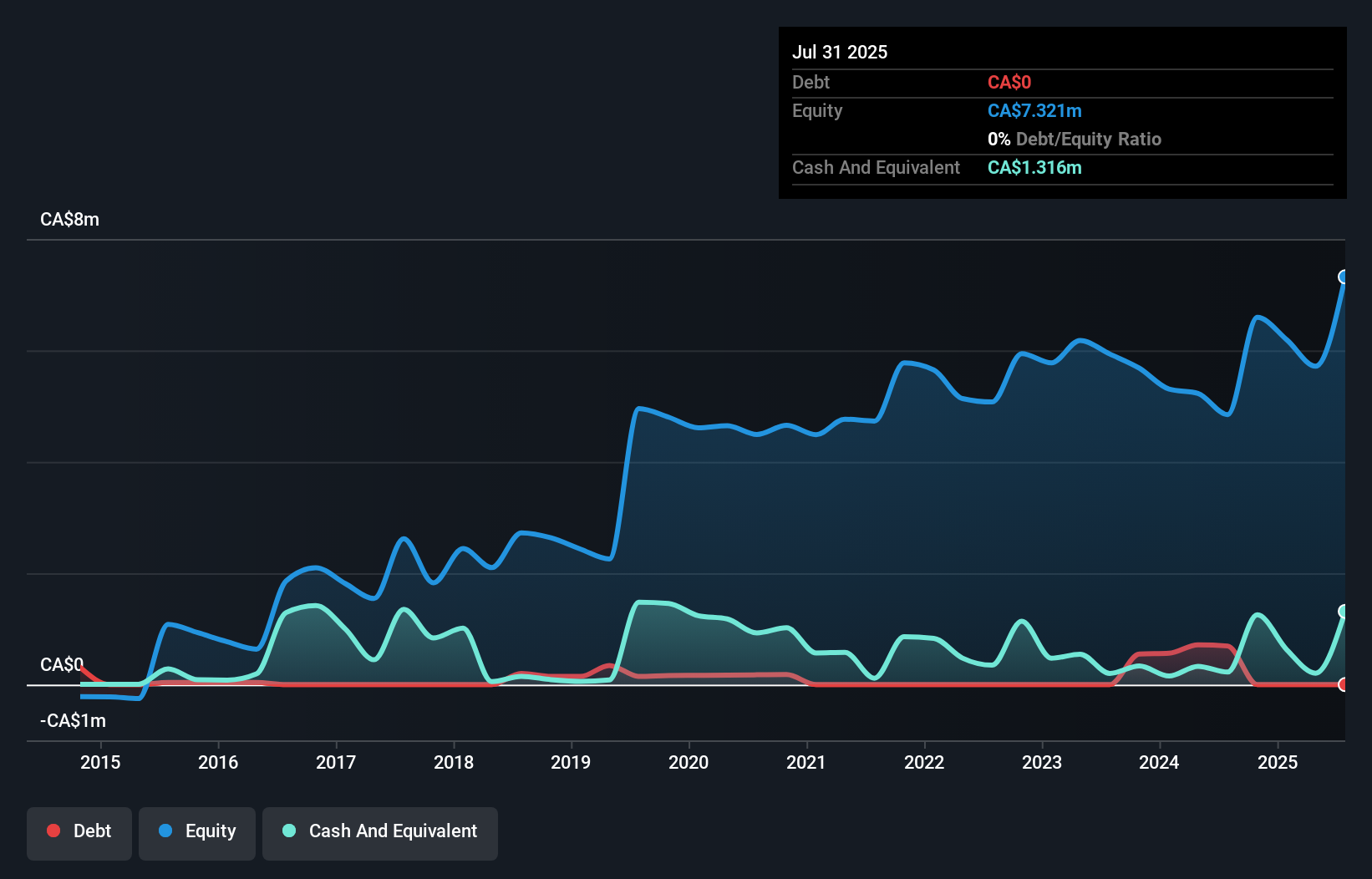

Latin Metals Inc., a pre-revenue exploration company, recently entered into a strategic alliance with Daura Gold Corp. allowing Daura to earn up to an 80% interest in key projects in Argentina, highlighting its collaborative approach to advancing exploration activities. Despite its unprofitability and high share price volatility, Latin Metals benefits from having no long-term liabilities and is debt-free. However, it faces financial challenges with less than one year of cash runway if current cash flow trends persist. The management team is seasoned, providing stability amid the company's efforts to secure further strategic partnerships for project development.

- Unlock comprehensive insights into our analysis of Latin Metals stock in this financial health report.

- Assess Latin Metals' previous results with our detailed historical performance reports.

Mongolia Growth Group (TSXV:YAK.H)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Mongolia Growth Group Ltd. operates in the subscription product business and has a market cap of CA$28.00 million.

Operations: The company's revenue is derived from two segments: CA$2.15 million from subscription products and CA$0.09 million from corporate activities.

Market Cap: CA$28M

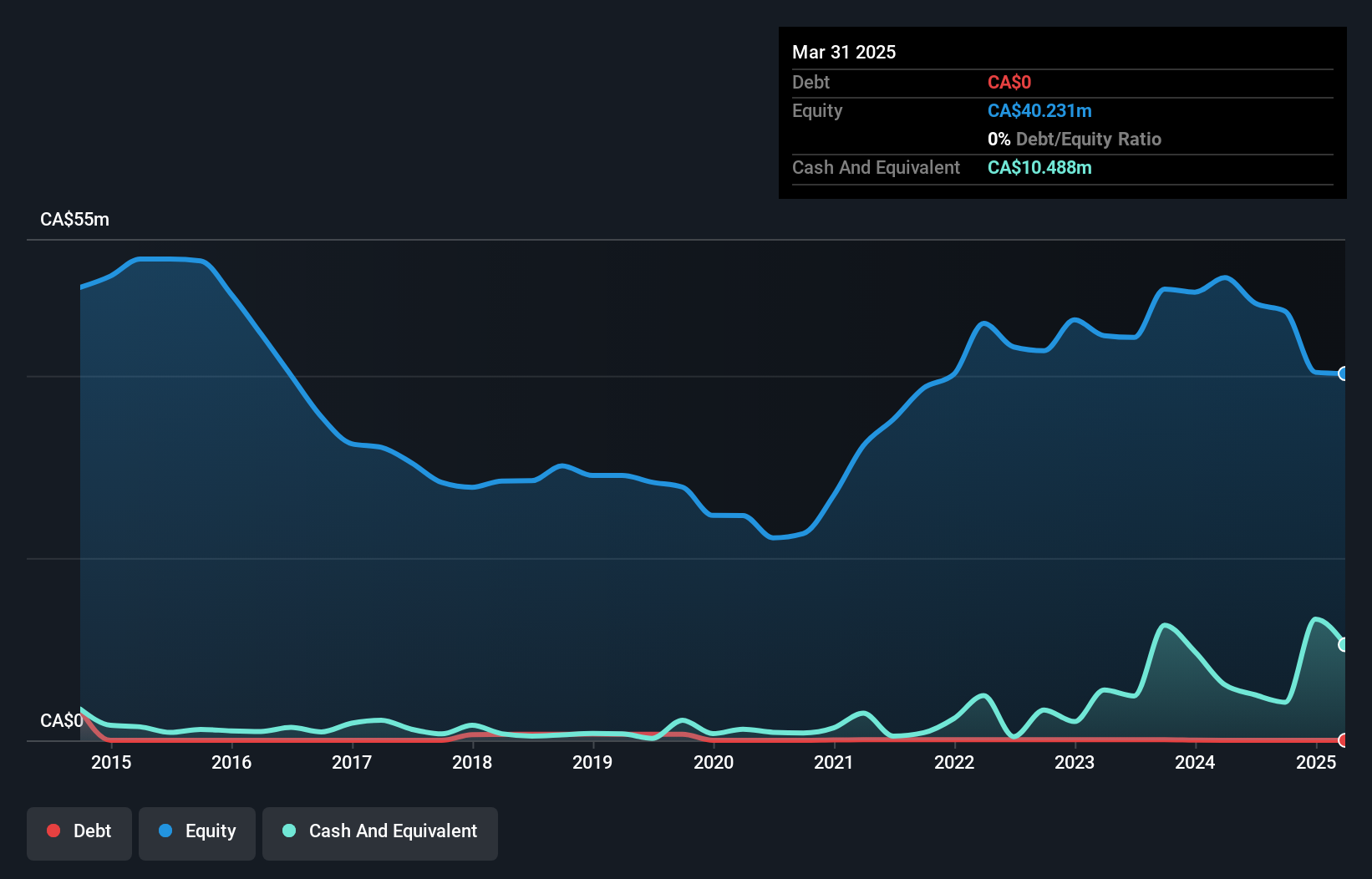

Mongolia Growth Group Ltd. operates with a market cap of CA$28 million, deriving revenue primarily from subscription products and corporate activities totaling CA$2.24 million. Despite being unprofitable with increasing losses over the past five years, the company maintains strong short-term financial health, as its assets (CA$35.9 million) exceed liabilities (CA$3.5 million). The board is experienced with an average tenure of 11 years, providing stability amid operational challenges. Recent earnings showed reduced revenue but a shift to net income for Q3 2025 compared to a loss last year, though overall losses remain significant for the year-to-date period.

- Take a closer look at Mongolia Growth Group's potential here in our financial health report.

- Examine Mongolia Growth Group's past performance report to understand how it has performed in prior years.

Seize The Opportunity

- Click here to access our complete index of 389 TSX Penny Stocks.

- Interested In Other Possibilities? The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if NanoXplore might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:GRA

NanoXplore

A graphene company, manufactures and supplies graphene powder for use in transportation and industrial markets in Australia.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion