- Canada

- /

- Capital Markets

- /

- NEOE:INXD

TSX Penny Stocks Under CA$100M Market Cap To Watch

Reviewed by Simply Wall St

As uncertainty around trade policies persists, investors are encouraged to remain patient and focused on diversification, as evidenced by recent positive movements in the Canadian TSX. For those exploring beyond established market giants, penny stocks offer intriguing possibilities despite their vintage moniker. These smaller or newer companies can present unique opportunities for growth and stability, especially when backed by strong financials.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$0.73 | CA$71.82M | ✅ 3 ⚠️ 3 View Analysis > |

| NTG Clarity Networks (TSXV:NCI) | CA$2.52 | CA$106.21M | ✅ 4 ⚠️ 2 View Analysis > |

| Intermap Technologies (TSX:IMP) | CA$2.36 | CA$129.8M | ✅ 3 ⚠️ 2 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$0.72 | CA$459.25M | ✅ 3 ⚠️ 2 View Analysis > |

| Orezone Gold (TSX:ORE) | CA$1.44 | CA$738.03M | ✅ 4 ⚠️ 2 View Analysis > |

| McChip Resources (TSXV:MCS) | CA$0.82 | CA$4.68M | ✅ 2 ⚠️ 5 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$1.80 | CA$170.11M | ✅ 3 ⚠️ 1 View Analysis > |

| PetroTal (TSX:TAL) | CA$0.63 | CA$567.29M | ✅ 3 ⚠️ 3 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$2.70 | CA$132.98M | ✅ 1 ⚠️ 2 View Analysis > |

| Findev (TSXV:FDI) | CA$0.445 | CA$12.18M | ✅ 2 ⚠️ 4 View Analysis > |

Click here to see the full list of 875 stocks from our TSX Penny Stocks screener.

Let's explore several standout options from the results in the screener.

INX Digital Company (NEOE:INXD)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: The INX Digital Company, Inc. operates a trading platform for cryptocurrencies and digital securities with a market cap of CA$32.14 million.

Operations: The company's revenue is primarily derived from Switzerland ($0.89 million), followed by the United States ($0.22 million), Japan ($0.03 million), and other countries ($0.07 million).

Market Cap: CA$32.14M

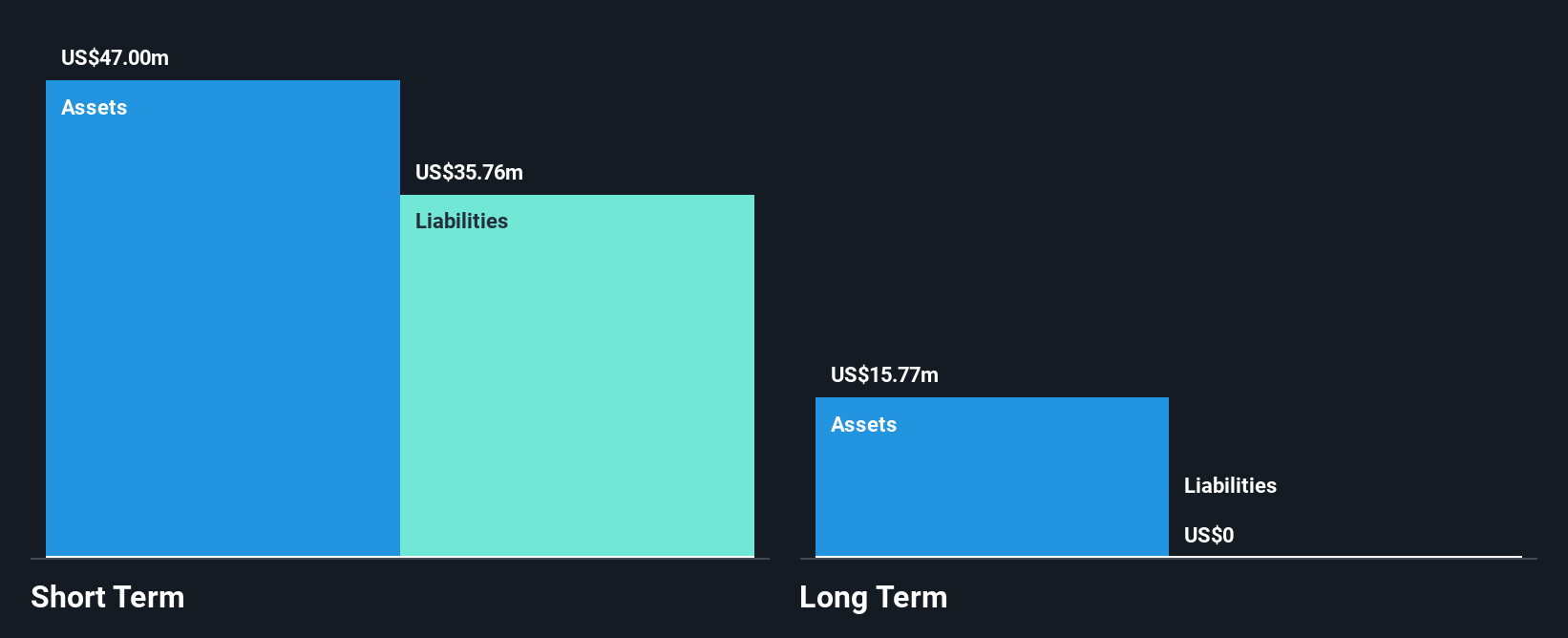

INX Digital Company, Inc., with a market cap of CA$32.14 million, operates in the cryptocurrency and digital securities space. Despite recent volatility and a net loss of US$5.19 million for Q1 2025, INX has become profitable over the past year with high-quality earnings and no debt liabilities. The company is trading at a significant discount to its estimated fair value and remains debt-free with strong short-term asset coverage over liabilities. An acquisition by OpenDeal Inc., valued at $54.8 million, is pending shareholder approval, which could influence future prospects for investors in this penny stock segment.

- Jump into the full analysis health report here for a deeper understanding of INX Digital Company.

- Review our historical performance report to gain insights into INX Digital Company's track record.

Supremex (TSX:SXP)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Supremex Inc. is a company that produces and sells envelopes, paper-based packaging solutions, and specialty products to a diverse range of clients in Canada and the United States, with a market cap of CA$96.77 million.

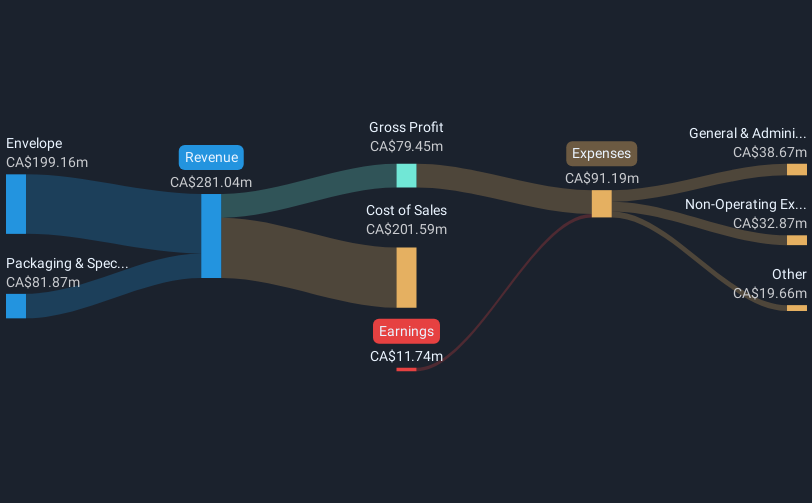

Operations: The company's revenue is derived from two main segments: Envelope, which contributes CA$194.15 million, and Packaging & Specialty Products, generating CA$83.84 million.

Market Cap: CA$96.77M

Supremex Inc., with a market cap of CA$96.77 million, operates in the envelope and packaging sectors, generating significant revenues from both segments. Despite being unprofitable, the company trades at a substantial discount to its estimated fair value and maintains satisfactory debt levels with strong operating cash flow coverage. Recent earnings showed a decline in sales and net income compared to last year, yet Supremex continues to pay dividends and seeks strategic acquisitions within its Packaging & Specialty Products segment. The management team is experienced, providing stability amid efforts for capital returns to shareholders.

- Click to explore a detailed breakdown of our findings in Supremex's financial health report.

- Assess Supremex's future earnings estimates with our detailed growth reports.

American Lithium (TSXV:LI)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: American Lithium Corp. is an exploration and development stage company focused on acquiring, exploring, and developing mineral properties in North and South America, with a market cap of CA$79.36 million.

Operations: American Lithium Corp. currently does not report any revenue segments.

Market Cap: CA$79.36M

American Lithium Corp., with a market cap of CA$79.36 million, is pre-revenue and focused on mineral exploration and development in the Americas. The company has no debt, which positions it favorably for potential future growth. However, it faces challenges with a limited cash runway of less than a year and an inexperienced management team averaging 1.8 years in tenure. While its short-term assets of CA$7.3 million comfortably cover both short-term and long-term liabilities, the lack of revenue generation remains a significant hurdle as earnings have declined by 21.3% annually over the past five years.

- Click here to discover the nuances of American Lithium with our detailed analytical financial health report.

- Explore historical data to track American Lithium's performance over time in our past results report.

Key Takeaways

- Click here to access our complete index of 875 TSX Penny Stocks.

- Ready To Venture Into Other Investment Styles? We've found 20 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NEOE:INXD

INX Digital Company

Operates trading platform for cryptocurrencies and digital securities.

Adequate balance sheet and slightly overvalued.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success