- Canada

- /

- Metals and Mining

- /

- TSXV:LA

Los Andes Copper (CVE:LA) Has Debt But No Earnings; Should You Worry?

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We can see that Los Andes Copper Ltd. (CVE:LA) does use debt in its business. But is this debt a concern to shareholders?

When Is Debt A Problem?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

See our latest analysis for Los Andes Copper

What Is Los Andes Copper's Net Debt?

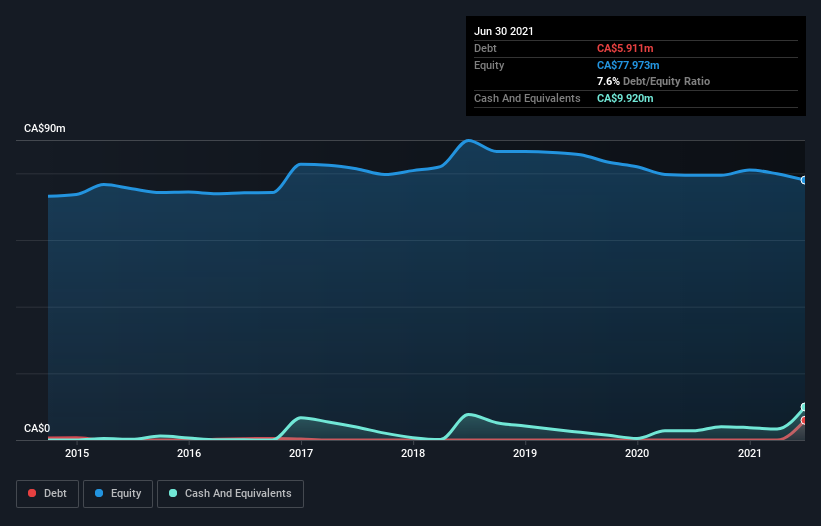

As you can see below, at the end of June 2021, Los Andes Copper had CA$5.91m of debt, up from none a year ago. Click the image for more detail. However, it does have CA$9.92m in cash offsetting this, leading to net cash of CA$4.01m.

A Look At Los Andes Copper's Liabilities

According to the last reported balance sheet, Los Andes Copper had liabilities of CA$625.7k due within 12 months, and liabilities of CA$15.1m due beyond 12 months. Offsetting this, it had CA$9.92m in cash and CA$7.2k in receivables that were due within 12 months. So it has liabilities totalling CA$5.85m more than its cash and near-term receivables, combined.

Of course, Los Andes Copper has a market capitalization of CA$197.0m, so these liabilities are probably manageable. But there are sufficient liabilities that we would certainly recommend shareholders continue to monitor the balance sheet, going forward. Despite its noteworthy liabilities, Los Andes Copper boasts net cash, so it's fair to say it does not have a heavy debt load! There's no doubt that we learn most about debt from the balance sheet. But you can't view debt in total isolation; since Los Andes Copper will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Since Los Andes Copper has no significant operating revenue, shareholders probably hope it will develop a valuable new mine before too long.

So How Risky Is Los Andes Copper?

Although Los Andes Copper had an earnings before interest and tax (EBIT) loss over the last twelve months, it generated positive free cash flow of CA$1.1m. So although it is loss-making, it doesn't seem to have too much near-term balance sheet risk, keeping in mind the net cash. Until we see some positive EBIT, we're a bit cautious of the stock, not least because of the rather modest revenue growth. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. Case in point: We've spotted 1 warning sign for Los Andes Copper you should be aware of.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

When trading stocks or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSXV:LA

Los Andes Copper

Acquires, explores, and develops copper deposits in Latin America.

Mediocre balance sheet with questionable track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success