- Canada

- /

- Metals and Mining

- /

- TSXV:KC

Roots And 2 Other TSX Penny Stocks To Consider

Reviewed by Simply Wall St

The Canadian market is navigating a period of political uncertainty with Prime Minister Justin Trudeau's recent resignation announcement, which adds to the broader economic landscape shaped by central-bank policies and fluctuating bond yields. Amidst these developments, investors are reminded that financial markets are primarily driven by fundamentals rather than politics. For those interested in exploring opportunities beyond well-known large-cap stocks, penny stocks—often representing smaller or newer companies—can offer intriguing growth potential at lower price points.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Mandalay Resources (TSX:MND) | CA$4.18 | CA$392.54M | ★★★★★★ |

| Findev (TSXV:FDI) | CA$0.46 | CA$13.18M | ★★★★★★ |

| Pulse Seismic (TSX:PSD) | CA$2.46 | CA$125.06M | ★★★★★★ |

| Silvercorp Metals (TSX:SVM) | CA$4.36 | CA$948.57M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.69 | CA$629.3M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.29 | CA$225.41M | ★★★★★☆ |

| NamSys (TSXV:CTZ) | CA$1.11 | CA$29.82M | ★★★★★★ |

| East West Petroleum (TSXV:EW) | CA$0.045 | CA$4.07M | ★★★★★★ |

| Hemisphere Energy (TSXV:HME) | CA$1.85 | CA$180.43M | ★★★★★☆ |

| Tornado Infrastructure Equipment (TSXV:TGH) | CA$0.97 | CA$133.43M | ★★★★★☆ |

Click here to see the full list of 944 stocks from our TSX Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Roots (TSX:ROOT)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Roots Corporation, along with its subsidiaries, is engaged in designing, marketing, and selling apparel, leather goods, footwear, and accessories under the Roots brand both in Canada and internationally with a market cap of CA$87.75 million.

Operations: The company's revenue is primarily generated from its Direct-To-Consumer segment, which accounts for CA$219.79 million, complemented by CA$40.56 million from Partners and Other activities.

Market Cap: CA$87.75M

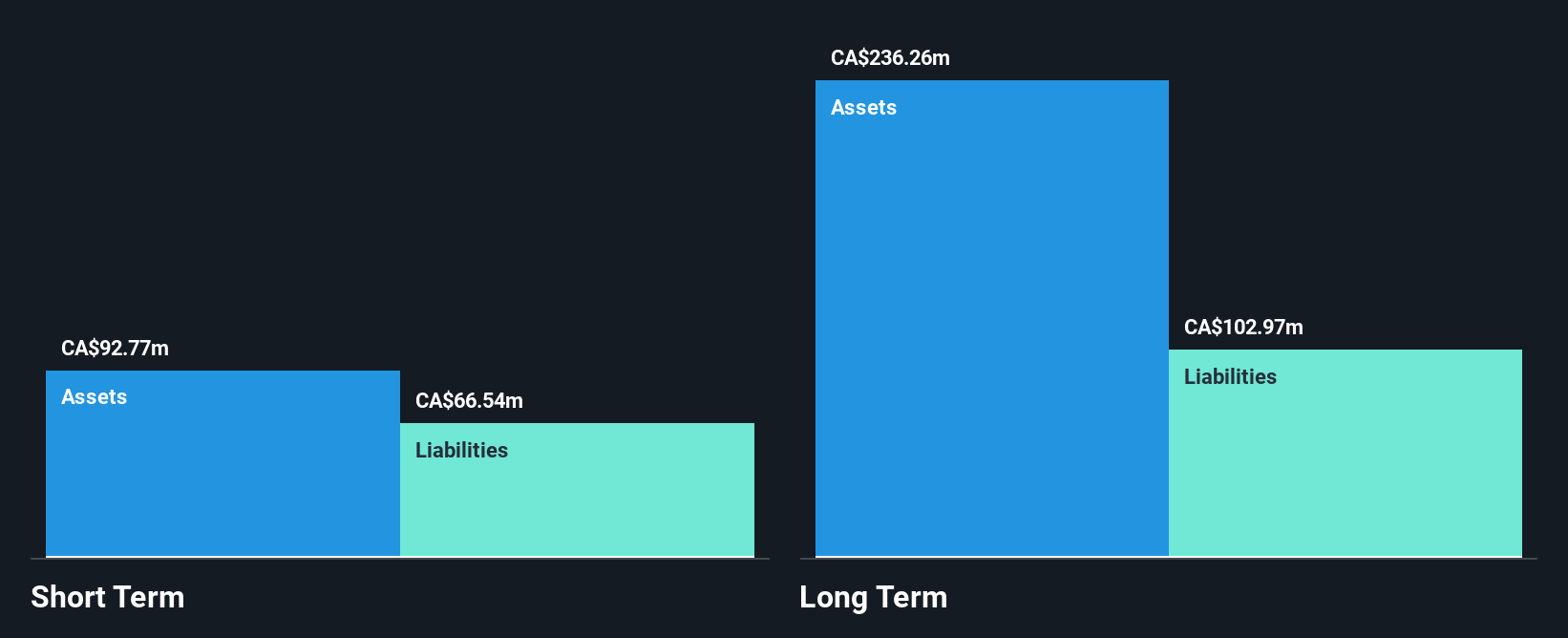

Roots Corporation, with a market cap of CA$87.75 million, has shown significant earnings growth of 918.7% over the past year, although its Return on Equity remains low at 1.6%. The company's revenue is primarily driven by its Direct-To-Consumer segment. While short-term liabilities are covered by assets, long-term liabilities exceed them. Debt management appears satisfactory with a net debt to equity ratio of 26.1%, and operating cash flow covers debt well at 62.9%. Recent financials indicate improved profit margins and reduced losses compared to last year despite a large one-off loss impacting results.

- Unlock comprehensive insights into our analysis of Roots stock in this financial health report.

- Learn about Roots' future growth trajectory here.

Kutcho Copper (TSXV:KC)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Kutcho Copper Corp. is a resource development company focused on acquiring and exploring resource properties in Canada, with a market cap of CA$24.33 million.

Operations: Kutcho Copper Corp. does not report any revenue segments.

Market Cap: CA$24.33M

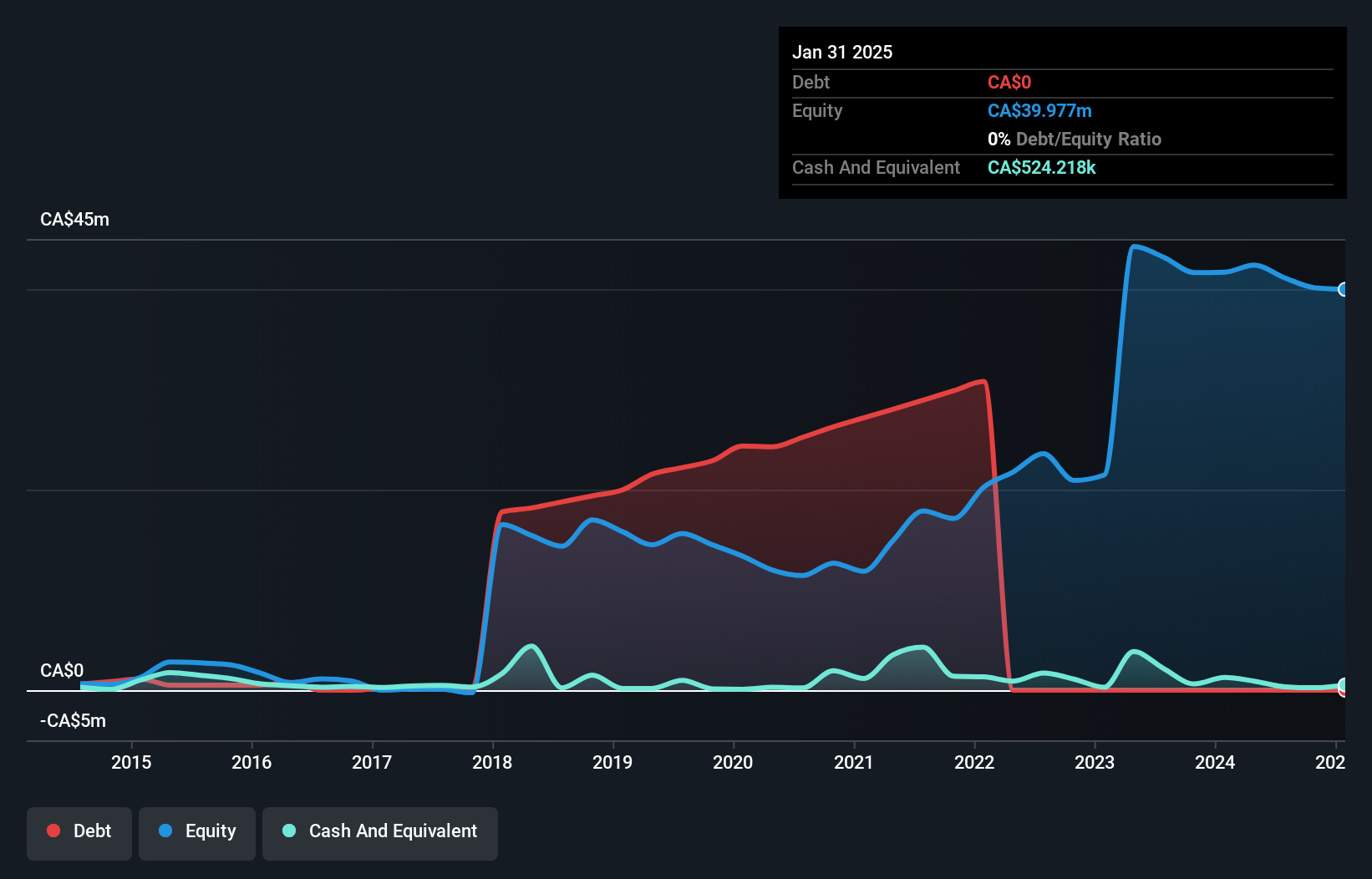

Kutcho Copper Corp., with a market cap of CA$24.33 million, is pre-revenue and has been actively raising capital through private placements, issuing units to strengthen its financial position. Recent transactions include the issuance of 12.89 million units for gross proceeds of CA$1.29 million and an additional CA$750,000 from another offering. Despite being debt-free, the company faces challenges with long-term liabilities (CA$28.8M) far exceeding short-term assets (CA$921.5K). The management team is experienced but shareholder dilution occurred over the past year as shares outstanding increased by 8.3%. The company's cash runway remains limited despite recent fundraising efforts.

- Jump into the full analysis health report here for a deeper understanding of Kutcho Copper.

- Learn about Kutcho Copper's historical performance here.

Nicola Mining (TSXV:NIM)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Nicola Mining Inc. is a junior exploration and custom milling company focused on identifying, acquiring, and exploring mineral properties in Canada, with a market cap of CA$5.40 million.

Operations: There are no reported revenue segments for the company.

Market Cap: CA$54M

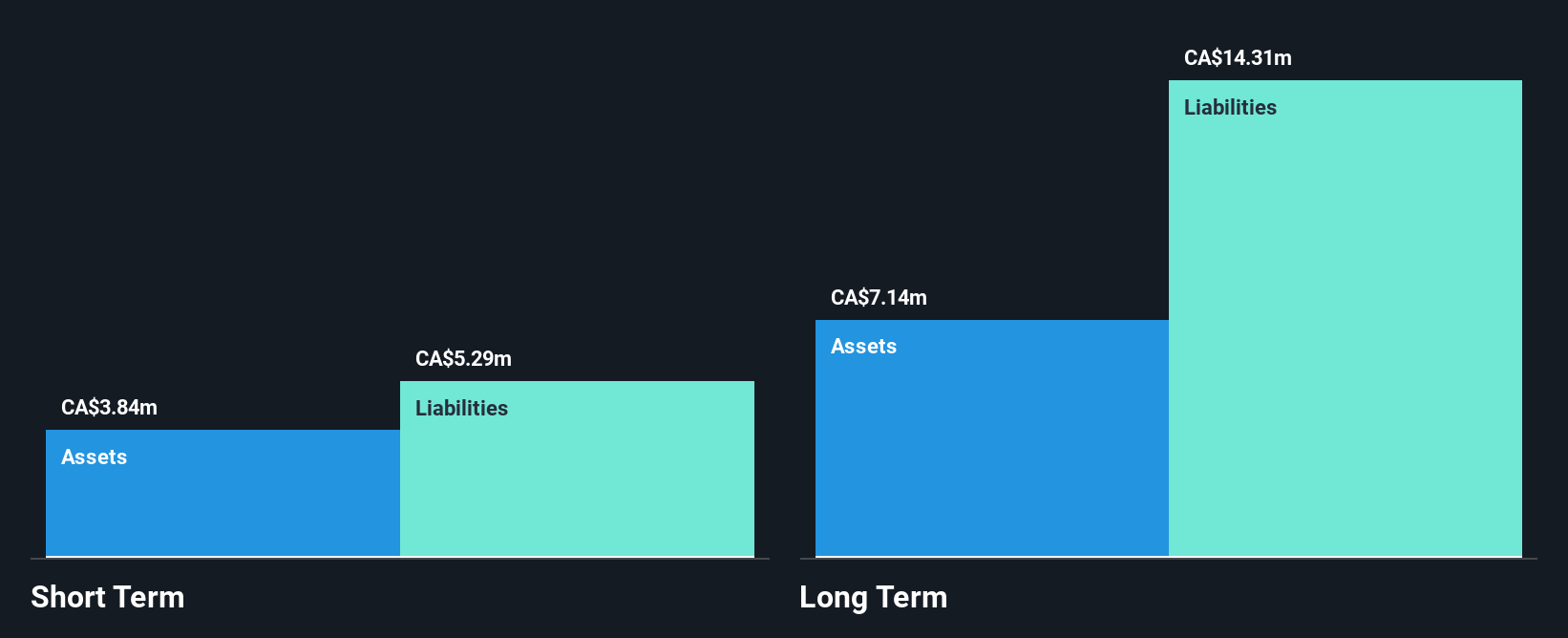

Nicola Mining Inc., with a market cap of CA$5.40 million, is pre-revenue and has been actively engaged in exploration activities, notably at its New Craigmont Copper Project. Recent drilling efforts have targeted unexplored zones to assess mineralization potential, with results pending analysis. The company recently raised CA$549,999 through a private placement to support its operations but continues to face financial challenges with net losses reported for the third quarter of 2024. While short-term liabilities are covered by assets (CA$3.3M), long-term liabilities (CA$19.5M) remain significant, and shareholder dilution occurred over the past year.

- Click to explore a detailed breakdown of our findings in Nicola Mining's financial health report.

- Gain insights into Nicola Mining's historical outcomes by reviewing our past performance report.

Summing It All Up

- Reveal the 944 hidden gems among our TSX Penny Stocks screener with a single click here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Kutcho Copper might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:KC

Kutcho Copper

Engages in the acquisition and exploration of resource properties in Canada.

Adequate balance sheet with low risk.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Q3 Outlook modestly optimistic

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion