- Canada

- /

- Metals and Mining

- /

- TSXV:RCK

October 2024's TSX Penny Stocks To Watch Closely

Reviewed by Simply Wall St

The Canadian stock market is enjoying a robust year, with the TSX up over 17%, reflecting a broader trend of economic growth, favorable interest-rate policies, and rising corporate profits. In this context of market strength, penny stocks—though an older term—remain relevant as they often represent smaller or newer companies with potential for significant returns. By focusing on those with strong financial health and clear growth trajectories, investors can uncover hidden value in these lesser-known opportunities.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| PetroTal (TSX:TAL) | CA$0.66 | CA$620.8M | ★★★★★★ |

| Alvopetro Energy (TSXV:ALV) | CA$5.00 | CA$183.06M | ★★★★★★ |

| Pulse Seismic (TSX:PSD) | CA$2.33 | CA$119.2M | ★★★★★★ |

| Findev (TSXV:FDI) | CA$0.42 | CA$12.03M | ★★★★★☆ |

| Winshear Gold (TSXV:WINS) | CA$0.16 | CA$4.71M | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$3.35 | CA$314.9M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.44 | CA$227.75M | ★★★★★☆ |

| Amerigo Resources (TSX:ARG) | CA$1.77 | CA$290.15M | ★★★★★☆ |

| East West Petroleum (TSXV:EW) | CA$0.045 | CA$3.17M | ★★★★★★ |

| Enterprise Group (TSX:E) | CA$2.12 | CA$126.75M | ★★★★☆☆ |

Click here to see the full list of 948 stocks from our TSX Penny Stocks screener.

Let's dive into some prime choices out of the screener.

GT Resources (TSXV:GT)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: GT Resources Inc. is involved in the exploration and development of mineral resource properties, with a market cap of CA$11.65 million.

Operations: No revenue segments are reported.

Market Cap: CA$11.65M

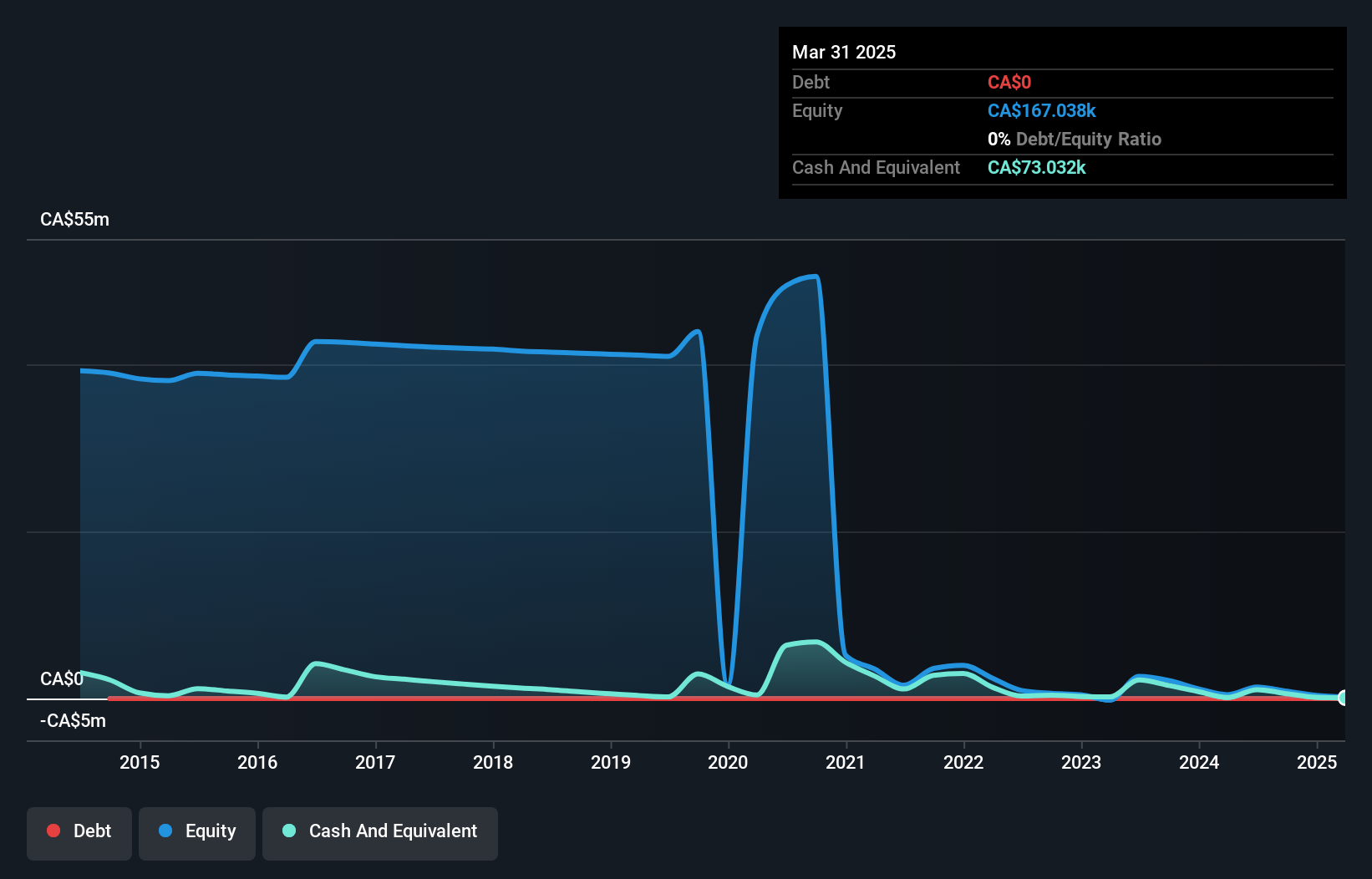

GT Resources, with a market cap of CA$11.65 million, is pre-revenue and debt-free, yet it faces challenges typical of early-stage mining ventures. Recent drilling at the Canalask Nickel-Copper Project revealed complex geological conditions but also potential for significant mineralization akin to world-class deposits. Despite historical earnings declines and shareholder dilution, the company maintains a sufficient cash runway for two years under current conditions. While short-term assets cover liabilities comfortably, GT's high volatility and negative return on equity highlight risks inherent in its speculative exploration activities. Revenue growth is anticipated at 40.54% annually according to forecasts.

- Click here and access our complete financial health analysis report to understand the dynamics of GT Resources.

- Learn about GT Resources' future growth trajectory here.

Rock Tech Lithium (TSXV:RCK)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Rock Tech Lithium Inc. is involved in the exploration and development of lithium properties, with a market cap of CA$128.04 million.

Operations: Currently, there are no reported revenue segments for the company.

Market Cap: CA$128.04M

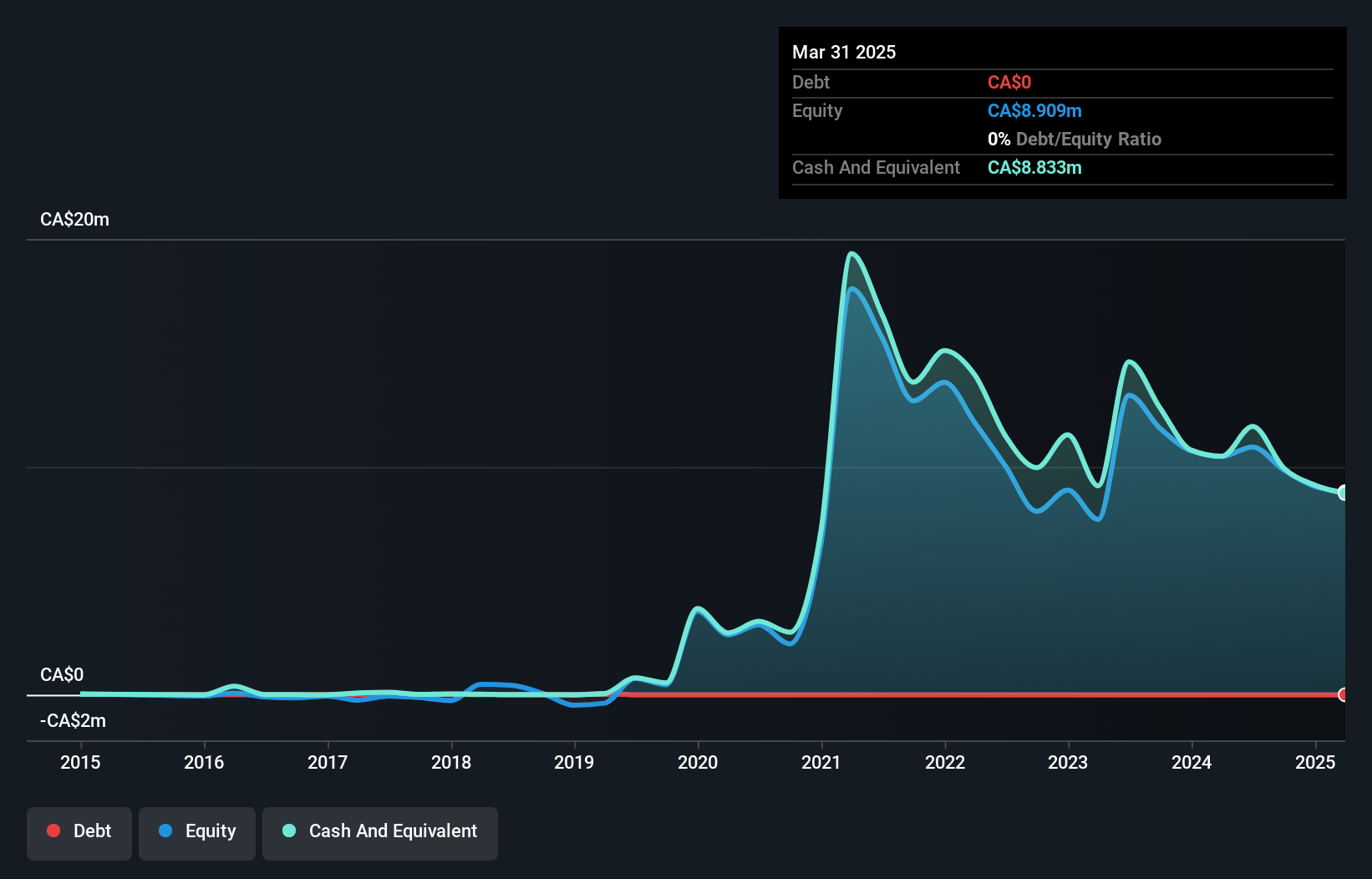

Rock Tech Lithium, with a market cap of CA$128.04 million, is pre-revenue and debt-free, reflecting its early-stage status in lithium exploration. The company has experienced shareholder dilution with shares outstanding increasing by 7.6% over the past year. Despite unprofitability and forecasts indicating further earnings decline, Rock Tech's short-term assets of CA$6.8 million exceed its liabilities, providing some financial stability. Recent private placements have raised additional capital totaling approximately CA$4.71 million, including participation from Canada's Critical Minerals Infrastructure Fund, which may support ongoing development activities amidst a volatile market environment.

- Jump into the full analysis health report here for a deeper understanding of Rock Tech Lithium.

- Examine Rock Tech Lithium's earnings growth report to understand how analysts expect it to perform.

Unigold (TSXV:UGD)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Unigold Inc. is a junior natural resource company engaged in exploring and developing gold projects in the Dominican Republic, with a market cap of CA$16.46 million.

Operations: Unigold Inc. has not reported any revenue segments.

Market Cap: CA$16.46M

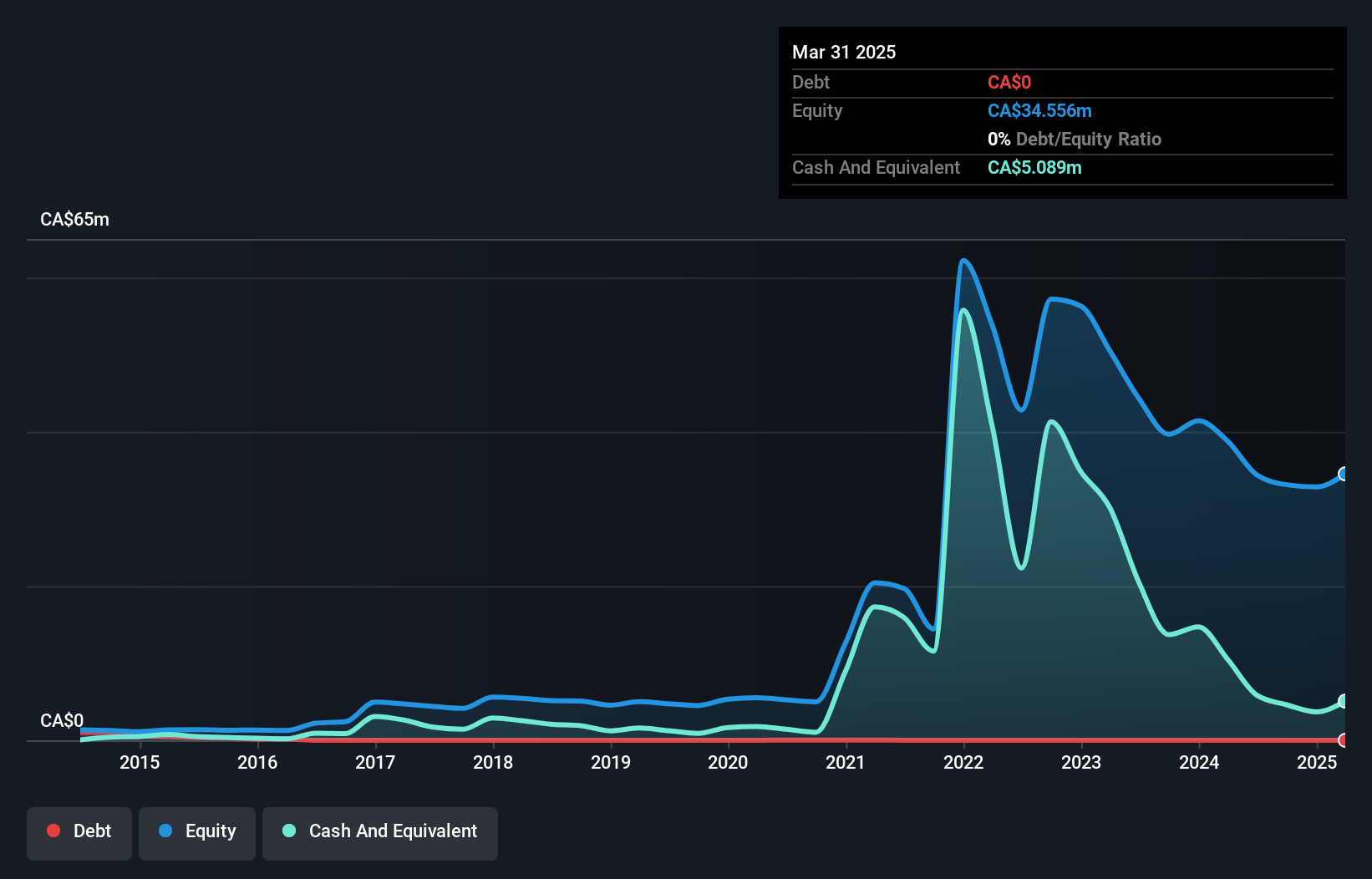

Unigold Inc., with a market cap of CA$16.46 million, is a pre-revenue junior resource company focused on gold exploration in the Dominican Republic. The company remains unprofitable, with losses narrowing slightly over the past year but still significant at CA$0.60 million for Q2 2024. Unigold has no long-term liabilities and is debt-free, yet its cash runway is under one year, raising concerns about financial sustainability without additional capital inflows. Shareholder dilution occurred with shares outstanding increasing by 7.3% last year. Despite high volatility and negative return on equity, short-term assets cover liabilities comfortably.

- Click to explore a detailed breakdown of our findings in Unigold's financial health report.

- Gain insights into Unigold's historical outcomes by reviewing our past performance report.

Where To Now?

- Unlock more gems! Our TSX Penny Stocks screener has unearthed 945 more companies for you to explore.Click here to unveil our expertly curated list of 948 TSX Penny Stocks.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:RCK

Rock Tech Lithium

Engages in the exploration and development of lithium properties.

Flawless balance sheet moderate.