- Canada

- /

- Metals and Mining

- /

- TSXV:GSVR

Further Upside For Guanajuato Silver Company Ltd. (CVE:GSVR) Shares Could Introduce Price Risks After 46% Bounce

Despite an already strong run, Guanajuato Silver Company Ltd. (CVE:GSVR) shares have been powering on, with a gain of 46% in the last thirty days. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 39% in the last twelve months.

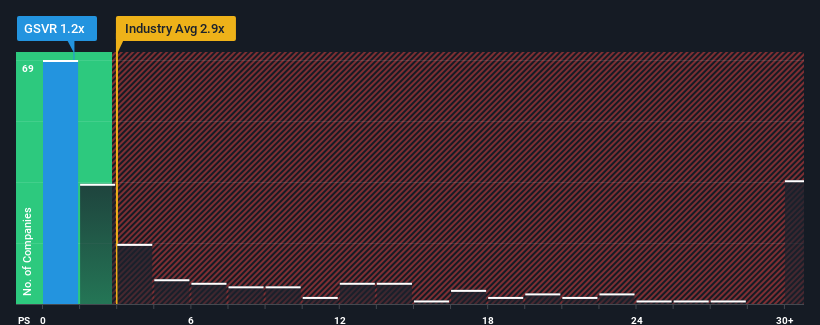

In spite of the firm bounce in price, Guanajuato Silver may still be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 1.2x, since almost half of all companies in the Metals and Mining industry in Canada have P/S ratios greater than 2.9x and even P/S higher than 16x are not unusual. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Guanajuato Silver

What Does Guanajuato Silver's Recent Performance Look Like?

Recent times have been advantageous for Guanajuato Silver as its revenues have been rising faster than most other companies. It might be that many expect the strong revenue performance to degrade substantially, which has repressed the share price, and thus the P/S ratio. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on Guanajuato Silver will help you uncover what's on the horizon.Is There Any Revenue Growth Forecasted For Guanajuato Silver?

Guanajuato Silver's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Taking a look back first, we see that the company grew revenue by an impressive 79% last year. Although, its longer-term performance hasn't been as strong with three-year revenue growth being relatively non-existent overall. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Turning to the outlook, the next year should generate growth of 23% as estimated by the sole analyst watching the company. With the industry only predicted to deliver 18%, the company is positioned for a stronger revenue result.

With this information, we find it odd that Guanajuato Silver is trading at a P/S lower than the industry. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

What Does Guanajuato Silver's P/S Mean For Investors?

The latest share price surge wasn't enough to lift Guanajuato Silver's P/S close to the industry median. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

To us, it seems Guanajuato Silver currently trades on a significantly depressed P/S given its forecasted revenue growth is higher than the rest of its industry. The reason for this depressed P/S could potentially be found in the risks the market is pricing in. At least price risks look to be very low, but investors seem to think future revenues could see a lot of volatility.

You always need to take note of risks, for example - Guanajuato Silver has 4 warning signs we think you should be aware of.

If you're unsure about the strength of Guanajuato Silver's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSXV:GSVR

Guanajuato Silver

A precious metals producer, engages in reactivating past producing mines in Mexico.

Reasonable growth potential with adequate balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026