- Canada

- /

- Metals and Mining

- /

- TSXV:GRSL

Top TSX Penny Stocks To Watch In March 2025

Reviewed by Simply Wall St

As 2025 unfolds, the Canadian stock market has experienced volatility, with diversification emerging as a crucial theme due to softened growth outlooks in both Canada and the U.S. Despite these challenges, certain sectors have demonstrated resilience, highlighting the importance of a balanced investment strategy. While penny stocks might seem like an outdated term, they continue to offer intriguing opportunities for investors seeking smaller or newer companies with solid financial foundations and potential for long-term growth.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Alvopetro Energy (TSXV:ALV) | CA$4.585 | CA$168.17M | ★★★★★★ |

| NTG Clarity Networks (TSXV:NCI) | CA$1.93 | CA$79.25M | ★★★★★☆ |

| Findev (TSXV:FDI) | CA$0.50 | CA$14.32M | ★★★★★★ |

| BluMetric Environmental (TSXV:BLM) | CA$1.00 | CA$38.4M | ★★★★★★ |

| McCoy Global (TSX:MCB) | CA$2.88 | CA$79.37M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.69 | CA$604.82M | ★★★★★★ |

| NamSys (TSXV:CTZ) | CA$1.10 | CA$29.55M | ★★★★★★ |

| Orezone Gold (TSX:ORE) | CA$0.91 | CA$411.57M | ★★★★★☆ |

| Madoro Metals (TSXV:MDM) | CA$0.04 | CA$4.03M | ★★★★★★ |

| Amerigo Resources (TSX:ARG) | CA$1.91 | CA$309.61M | ★★★★★☆ |

Click here to see the full list of 934 stocks from our TSX Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Trilogy Metals (TSX:TMQ)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Trilogy Metals Inc. focuses on the exploration and development of mineral properties in the United States, with a market cap of CA$378.70 million.

Operations: Trilogy Metals Inc. does not report any revenue segments as it is focused on exploration and development activities in the United States.

Market Cap: CA$378.7M

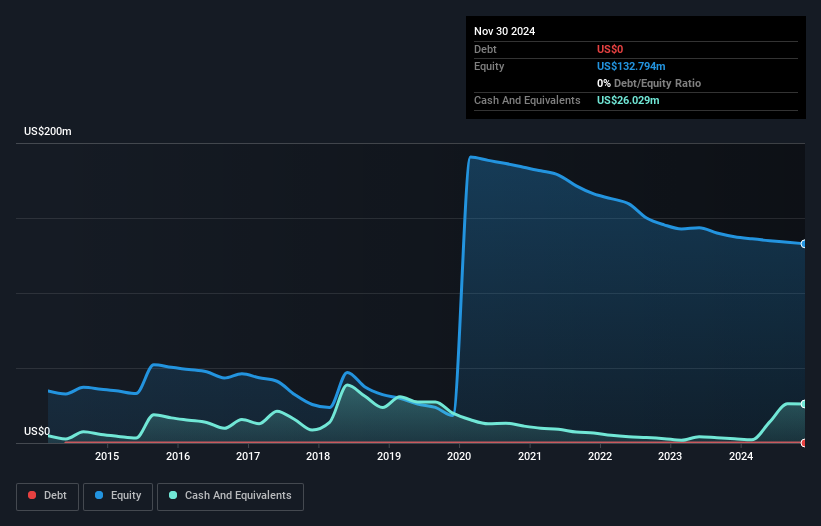

Trilogy Metals Inc. is a pre-revenue company focused on mineral exploration, with a market cap of CA$378.70 million. Despite being unprofitable, it has no debt and sufficient cash runway exceeding three years based on current free cash flow trends. Recent developments include a $50 million shelf registration filing, indicating potential future capital raising activities. The Bornite Project's Preliminary Economic Assessment highlights significant copper production potential over 17 years, with the possibility of extending mine life to over 30 years. Management and board experience are solid, with average tenures of 4.8 and 9.8 years respectively, providing stability amid volatility reduction from 21% to 11%.

- Take a closer look at Trilogy Metals' potential here in our financial health report.

- Evaluate Trilogy Metals' historical performance by accessing our past performance report.

GR Silver Mining (TSXV:GRSL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: GR Silver Mining Ltd. is involved in the acquisition and exploration of mineral resource properties, with a market cap of CA$64.44 million.

Operations: GR Silver Mining Ltd. currently does not report any revenue segments as it focuses on the acquisition and exploration of mineral resource properties.

Market Cap: CA$64.44M

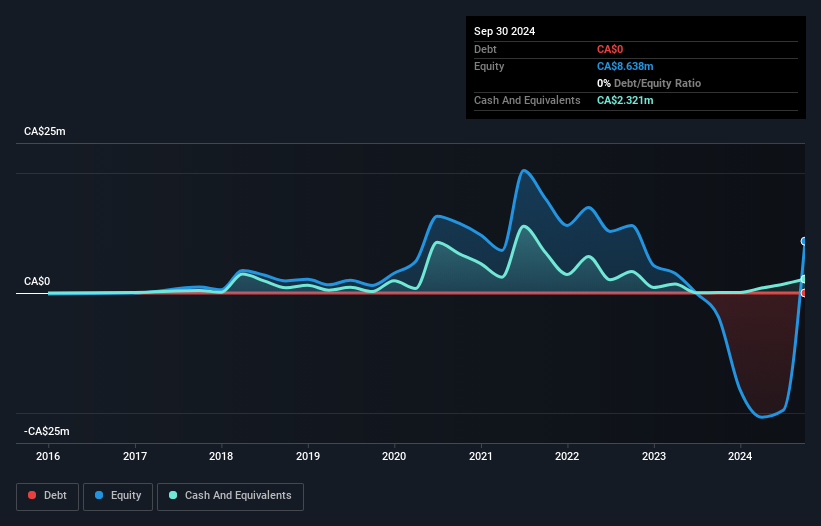

GR Silver Mining Ltd., with a market cap of CA$64.44 million, remains pre-revenue as it focuses on mineral exploration, particularly at its San Marcial Area. The company has strengthened its financial position by eliminating a working capital deficit and raising CA$1.8 million through warrant exercises. Recent initiatives include resuming field exploration and step-out drilling to expand the San Marcial resource footprint, supported by partnerships with geological experts like CODES. Despite being debt-free and having stable weekly volatility (12%), GR Silver's board lacks seasoned experience, averaging 2.2 years in tenure, potentially impacting strategic decision-making during expansion efforts.

- Navigate through the intricacies of GR Silver Mining with our comprehensive balance sheet health report here.

- Learn about GR Silver Mining's historical performance here.

Tornado Infrastructure Equipment (TSXV:TGH)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Tornado Infrastructure Equipment Ltd. designs, fabricates, manufactures, and sells hydrovac trucks in North America and China, with a market cap of CA$143.06 million.

Operations: The company generates revenue from two primary regions, with CA$34.37 million coming from Canada and CA$97.71 million from the United States.

Market Cap: CA$143.06M

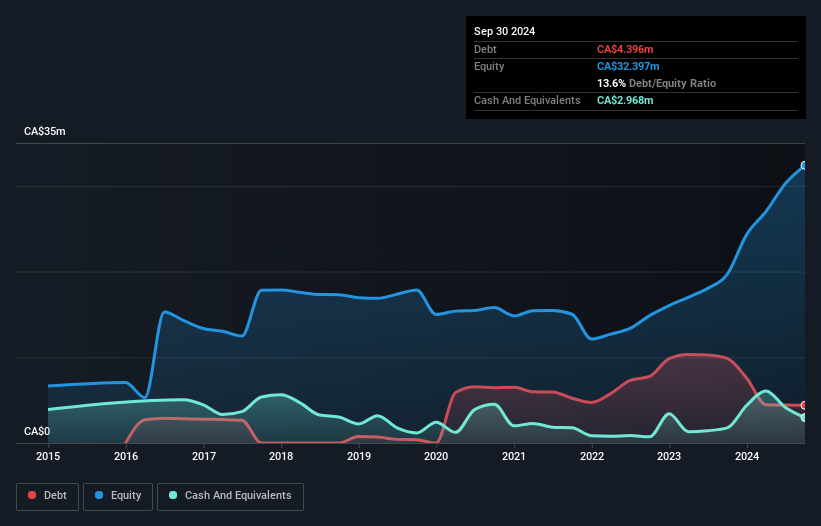

Tornado Infrastructure Equipment Ltd., with a market cap of CA$143.06 million, has shown significant financial strength and growth potential. Recent product launches, including the EF4 Tornado Hydrovac and Coring Machine, highlight its commitment to innovation in infrastructure equipment. The company's new financing arm aims to enhance customer accessibility and generate additional revenue streams. Financially, Tornado's net profit margins have improved from last year, with earnings growing substantially by 242.1%. Its debt is well covered by operating cash flow, and interest payments are comfortably managed by EBIT. The management team is experienced, contributing positively to strategic growth efforts.

- Click here and access our complete financial health analysis report to understand the dynamics of Tornado Infrastructure Equipment.

- Gain insights into Tornado Infrastructure Equipment's future direction by reviewing our growth report.

Summing It All Up

- Reveal the 934 hidden gems among our TSX Penny Stocks screener with a single click here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:GRSL

Flawless balance sheet with low risk.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)