It's A Story Of Risk Vs Reward With good natured Products Inc. (CVE:GDNP)

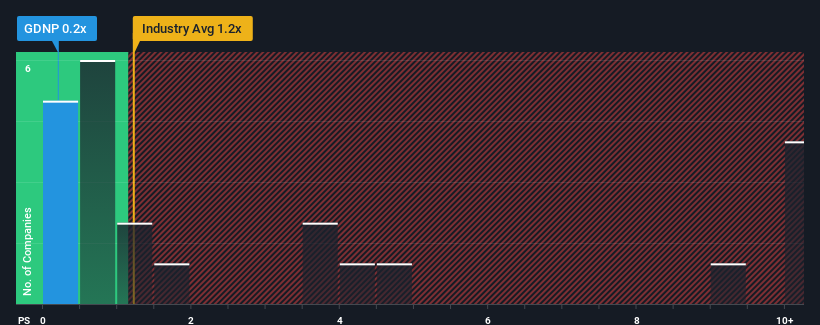

good natured Products Inc.'s (CVE:GDNP) price-to-sales (or "P/S") ratio of 0.2x might make it look like a buy right now compared to the Chemicals industry in Canada, where around half of the companies have P/S ratios above 1.2x and even P/S above 5x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

See our latest analysis for good natured Products

What Does good natured Products' Recent Performance Look Like?

While the industry has experienced revenue growth lately, good natured Products' revenue has gone into reverse gear, which is not great. The P/S ratio is probably low because investors think this poor revenue performance isn't going to get any better. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on good natured Products.Is There Any Revenue Growth Forecasted For good natured Products?

The only time you'd be truly comfortable seeing a P/S as low as good natured Products' is when the company's growth is on track to lag the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 19%. In spite of this, the company still managed to deliver immense revenue growth over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company, but investors will want to ask why it is now in decline.

Shifting to the future, estimates from the dual analysts covering the company suggest revenue growth will show minor resilience over the next year growing only by 0.7%. This isn't typically strong growth, but with the rest of the industry predicted to shrink by 2.1%, that would be a solid result.

With this in consideration, we find it intriguing that good natured Products' P/S falls short of its industry peers. It looks like most investors aren't convinced at all that the company can achieve positive future growth in the face of a shrinking broader industry.

The Key Takeaway

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that good natured Products currently trades on a much lower than expected P/S since its growth forecasts are potentially beating a struggling industry. We believe there could be some underlying risks that are keeping the P/S modest in the context of above-average revenue growth. Perhaps there is some hesitation about the company's ability to keep swimming against the current of the broader industry turmoil. It appears many are indeed anticipating revenue instability, because the company's current prospects should normally provide a boost to the share price.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 4 warning signs with good natured Products, and understanding these should be part of your investment process.

If these risks are making you reconsider your opinion on good natured Products, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSXV:GDNP.H

good natured Products

An earth-friendly product company, develops an assortment of plant-based products in Canada and the United States.

Moderate and slightly overvalued.

Market Insights

Community Narratives