As the Canadian market navigates through a period of economic moderation and geopolitical uncertainties, investors are keenly observing how these factors impact opportunities across various sectors. Penny stocks, often considered relics of past market eras, continue to hold potential for those seeking affordable entry points into smaller or newer companies with growth prospects. In this context, we will explore several penny stocks that combine financial strength with promising long-term potential.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$0.61 | CA$64.74M | ✅ 3 ⚠️ 3 View Analysis > |

| PetroTal (TSX:TAL) | CA$0.68 | CA$612.77M | ✅ 3 ⚠️ 4 View Analysis > |

| illumin Holdings (TSX:ILLM) | CA$1.86 | CA$96.49M | ✅ 4 ⚠️ 1 View Analysis > |

| Fintech Select (TSXV:FTEC) | CA$0.035 | CA$2.4M | ✅ 2 ⚠️ 3 View Analysis > |

| Findev (TSXV:FDI) | CA$0.43 | CA$14.32M | ✅ 2 ⚠️ 4 View Analysis > |

| Mandalay Resources (TSX:MND) | CA$4.85 | CA$453.98M | ✅ 3 ⚠️ 1 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$0.78 | CA$518.93M | ✅ 3 ⚠️ 2 View Analysis > |

| Automotive Finco (TSXV:AFCC.H) | CA$0.99 | CA$19.42M | ✅ 2 ⚠️ 4 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$1.90 | CA$184.12M | ✅ 3 ⚠️ 1 View Analysis > |

| McChip Resources (TSXV:MCS) | CA$1.15 | CA$5.2M | ✅ 2 ⚠️ 3 View Analysis > |

Click here to see the full list of 458 stocks from our TSX Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Trulieve Cannabis (CNSX:TRUL)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Trulieve Cannabis Corp. operates as a cannabis retailer with a market cap of approximately CA$905.82 million.

Operations: The company's revenue is primarily generated from its Pharmaceuticals segment, which accounts for $1.19 billion.

Market Cap: CA$905.82M

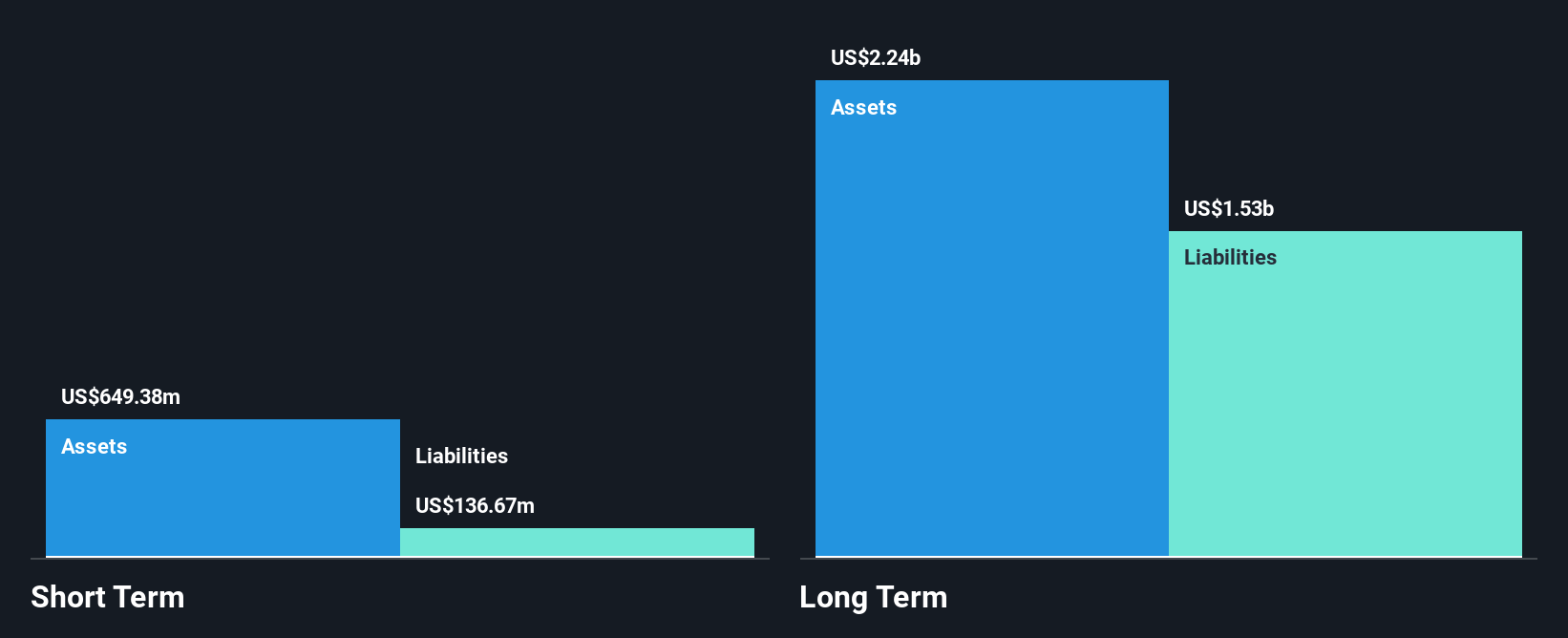

Trulieve Cannabis Corp., with a market cap of approximately CA$905.82 million, operates primarily in the Pharmaceuticals segment, generating US$1.19 billion in revenue. Despite being unprofitable, it trades at a significant discount to its estimated fair value and maintains a satisfactory net debt to equity ratio of 12.6%. Recent expansions include new dispensaries in Ohio and Florida, enhancing its retail footprint. The company has stable weekly volatility at 10% and adequate cash runway for over three years due to positive free cash flow growth. However, challenges remain as it is not projected to achieve profitability soon.

- Click here to discover the nuances of Trulieve Cannabis with our detailed analytical financial health report.

- Gain insights into Trulieve Cannabis' future direction by reviewing our growth report.

Aldebaran Resources (TSXV:ALDE)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Aldebaran Resources Inc. is involved in the acquisition, exploration, and evaluation of mineral properties in Canada and Argentina, with a market cap of CA$314.34 million.

Operations: Aldebaran Resources Inc. does not report any revenue segments as it focuses on acquiring, exploring, and evaluating mineral properties in Canada and Argentina.

Market Cap: CA$314.34M

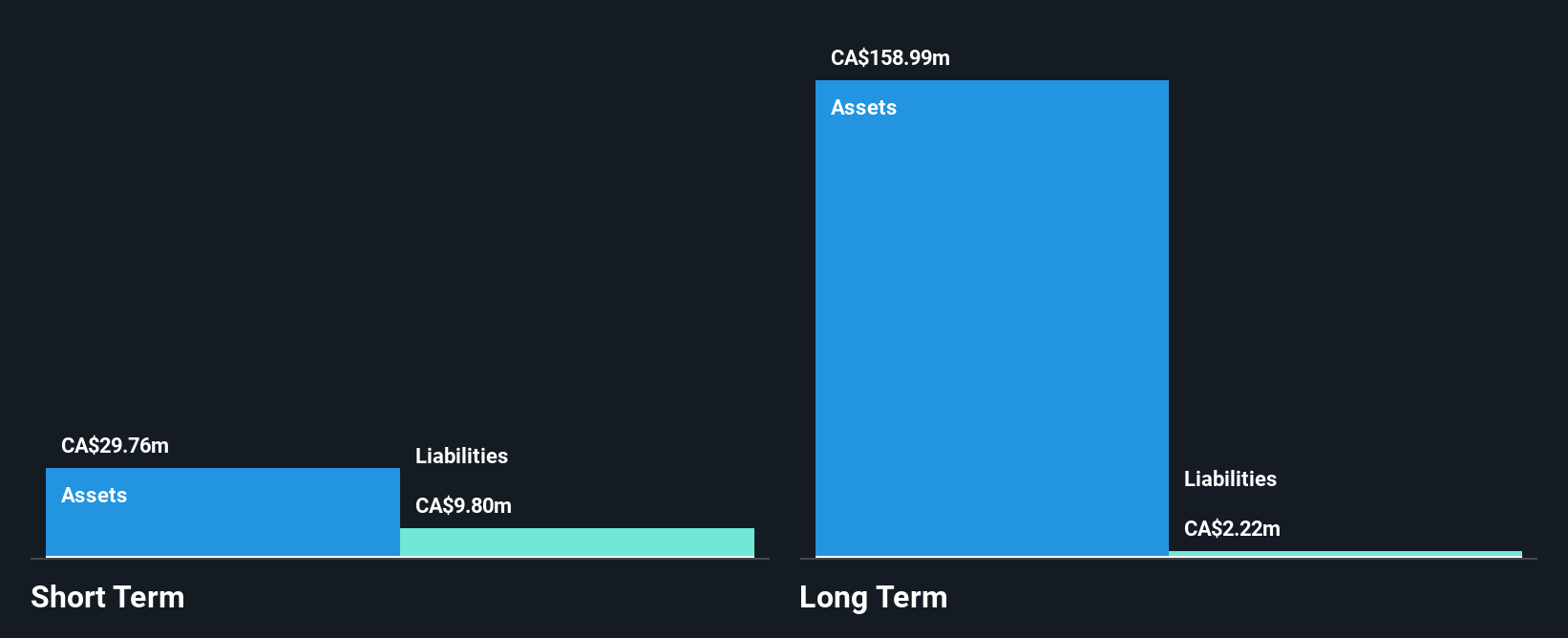

Aldebaran Resources, with a market cap of CA$314.34 million, remains pre-revenue as it focuses on the Altar project in Argentina. Recent drilling results aim to upgrade resource classifications from Inferred to Measured & Indicated, enhancing its potential value. The company has no debt and maintains a cash runway for up to two years if historical cash flow reductions persist. Despite ongoing losses, Aldebaran has reduced these by 5.1% annually over five years and reports experienced management and board teams with an average tenure of seven years each. Its short-term assets significantly exceed both short- and long-term liabilities.

- Click to explore a detailed breakdown of our findings in Aldebaran Resources' financial health report.

- Learn about Aldebaran Resources' historical performance here.

FPX Nickel (TSXV:FPX)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: FPX Nickel Corp. is a junior mining company focused on the acquisition, exploration, and development of nickel mineral resource properties in Canada, with a market cap of CA$78.73 million.

Operations: FPX Nickel Corp. does not report any revenue segments as it is primarily engaged in the exploration and development of nickel mineral resource properties in Canada.

Market Cap: CA$78.73M

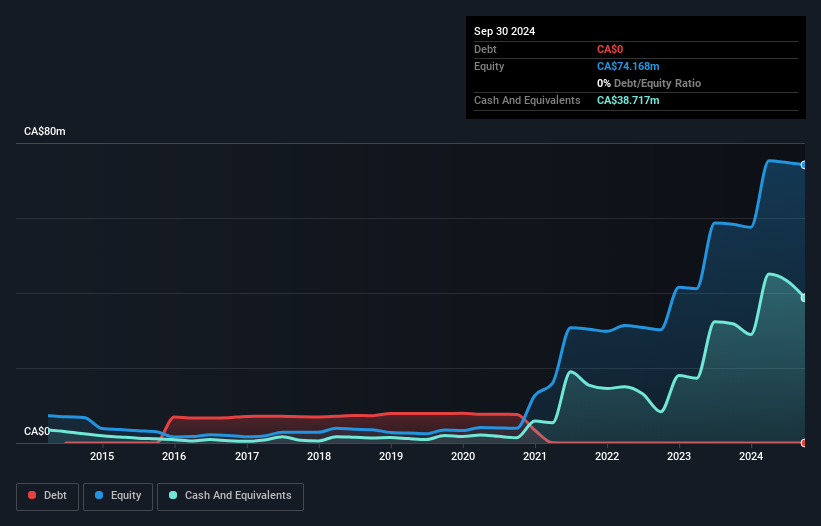

FPX Nickel Corp., with a market cap of CA$78.73 million, is pre-revenue and focuses on developing its Baptiste Nickel Project. The company is debt-free, but has less than a year of cash runway if historical cash flow reductions continue. Recent advancements include the successful production of battery-grade nickel sulphate, aligning with industry demand for low-carbon solutions. Exploration at the Klow property is fully funded by JOGMEC under an earn-in agreement, potentially enhancing FPX's resource base. Despite ongoing losses and no significant revenue streams, FPX benefits from experienced management and board teams with substantial tenure.

- Click here and access our complete financial health analysis report to understand the dynamics of FPX Nickel.

- Examine FPX Nickel's past performance report to understand how it has performed in prior years.

Where To Now?

- Click this link to deep-dive into the 458 companies within our TSX Penny Stocks screener.

- Seeking Other Investments? Outshine the giants: these 22 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Trulieve Cannabis might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About CNSX:TRUL

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives