- Canada

- /

- Metals and Mining

- /

- TSXV:ESK

TSX Penny Stocks With Market Caps Over CA$40M To Consider

Reviewed by Simply Wall St

With Canada's election now behind it, a source of uncertainty has been removed, allowing policymakers to focus on trade and economic issues. As the Canadian market navigates these changes, investors are increasingly looking at diverse opportunities that may benefit from fiscal stimulus and potential interest rate cuts. Penny stocks, though an older term, continue to offer intriguing prospects for growth when backed by strong financials. These smaller or newer companies can provide unique opportunities for investors seeking value and growth outside the mainstream indices.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$0.74 | CA$74.85M | ✅ 4 ⚠️ 3 View Analysis > |

| NTG Clarity Networks (TSXV:NCI) | CA$1.73 | CA$73.2M | ✅ 4 ⚠️ 2 View Analysis > |

| Silvercorp Metals (TSX:SVM) | CA$4.83 | CA$1.05B | ✅ 5 ⚠️ 2 View Analysis > |

| Orezone Gold (TSX:ORE) | CA$1.10 | CA$576.02M | ✅ 4 ⚠️ 2 View Analysis > |

| Amerigo Resources (TSX:ARG) | CA$1.71 | CA$280.6M | ✅ 2 ⚠️ 2 View Analysis > |

| PetroTal (TSX:TAL) | CA$0.55 | CA$503.51M | ✅ 4 ⚠️ 3 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$2.53 | CA$128.51M | ✅ 1 ⚠️ 2 View Analysis > |

| McCoy Global (TSX:MCB) | CA$3.15 | CA$84.74M | ✅ 3 ⚠️ 2 View Analysis > |

| Findev (TSXV:FDI) | CA$0.49 | CA$14.04M | ✅ 2 ⚠️ 3 View Analysis > |

| Enterprise Group (TSX:E) | CA$1.50 | CA$116.3M | ✅ 3 ⚠️ 3 View Analysis > |

Click here to see the full list of 928 stocks from our TSX Penny Stocks screener.

We'll examine a selection from our screener results.

Eskay Mining (TSXV:ESK)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Eskay Mining Corp. is a natural resource company focused on the acquisition and exploration of mineral properties in British Columbia, Canada, with a market cap of CA$52.39 million.

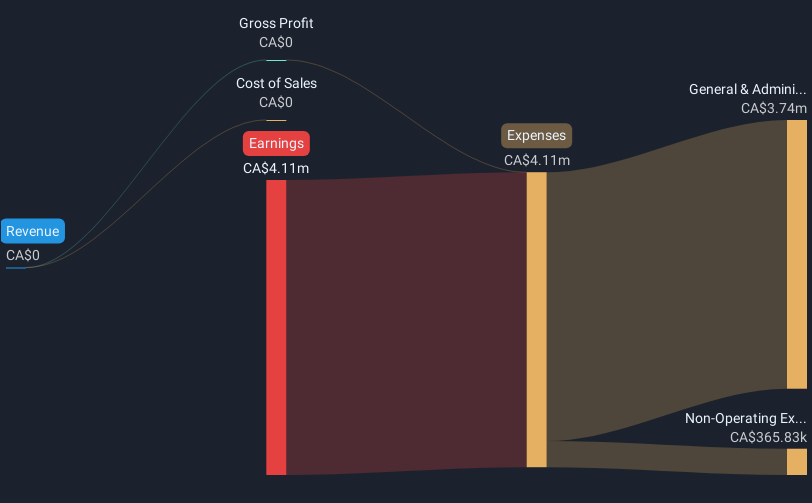

Operations: Eskay Mining Corp. does not have any reported revenue segments as it is primarily engaged in the acquisition and exploration of mineral properties in British Columbia, Canada.

Market Cap: CA$52.39M

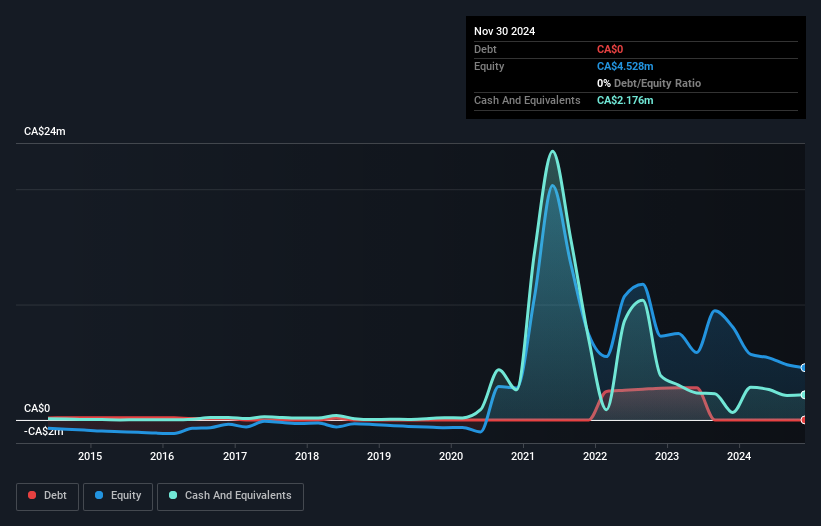

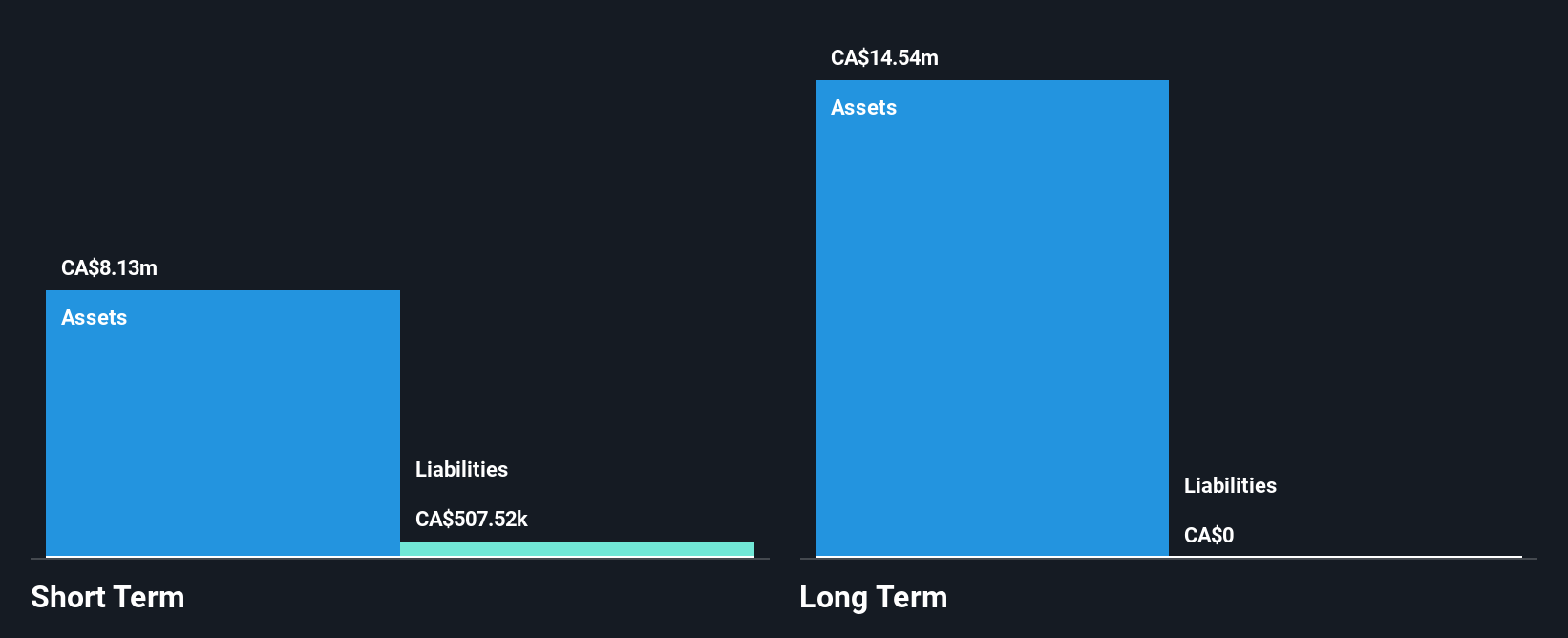

Eskay Mining Corp., with a market cap of CA$52.39 million, remains pre-revenue as it focuses on mineral exploration in British Columbia. The company has no debt and maintains a solid cash runway exceeding three years, despite being unprofitable. Recent developments include promising assay results from the C10-Vermillion-Ted Morris trend, revealing high-grade gold and silver prospects that could lead to significant discoveries. This area is strategically located near Newmont's Valley of the Kings mine, enhancing its potential appeal. Eskay's experienced management and board are steering efforts towards further exploration at these promising sites this season.

- Unlock comprehensive insights into our analysis of Eskay Mining stock in this financial health report.

- Review our historical performance report to gain insights into Eskay Mining's track record.

Mayfair Gold (TSXV:MFG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Mayfair Gold Corp. is an exploration-stage company focused on acquiring, exploring, evaluating, and developing mineral properties with a market cap of CA$196.71 million.

Operations: Mayfair Gold Corp. does not report any revenue segments as it is currently in the exploration stage, focusing on mineral property development.

Market Cap: CA$196.71M

Mayfair Gold Corp., with a market cap of CA$196.71 million, is pre-revenue and focused on advancing its Fenn-Gib gold project in Northern Ontario. The company is progressing towards a Pre-Feasibility Study (PFS) for a 4,800 tpd open pit scenario, aiming to complete it by the end of 2025. Recent efforts include metallurgical testing, environmental data review, and community engagement to support provincial permitting activities. Despite having only four months of cash runway as per last reports, Mayfair has raised additional capital recently. Leadership changes include appointing Drew Anwyll as COO to leverage his extensive mining experience for project advancement.

- Get an in-depth perspective on Mayfair Gold's performance by reading our balance sheet health report here.

- Evaluate Mayfair Gold's historical performance by accessing our past performance report.

Stillwater Critical Minerals (TSXV:PGE)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Stillwater Critical Minerals Corp. is a mineral exploration company focused on acquiring, exploring, and developing mineral properties in Canada and the United States, with a market cap of CA$46.58 million.

Operations: Stillwater Critical Minerals Corp. does not report any specific revenue segments as it is focused on the exploration and development of mineral properties in Canada and the United States.

Market Cap: CA$46.58M

Stillwater Critical Minerals Corp., with a market cap of CA$46.58 million, is pre-revenue and focused on mineral exploration in North America. Recent geophysical surveys at its Stillwater West project have identified multiple large-scale magmatic sulphide targets, enhancing the 3D geological model from 9.5 to 20 kilometers and providing new drill targets for mid- and high-grade mineralization expansion. Despite a highly volatile share price recently, the company remains debt-free with short-term assets exceeding liabilities. Recent capital raises have extended its cash runway beyond two months, supporting ongoing exploration efforts without significant shareholder dilution over the past year.

- Click to explore a detailed breakdown of our findings in Stillwater Critical Minerals' financial health report.

- Gain insights into Stillwater Critical Minerals' past trends and performance with our report on the company's historical track record.

Where To Now?

- Click this link to deep-dive into the 928 companies within our TSX Penny Stocks screener.

- Interested In Other Possibilities? Outshine the giants: these 28 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Eskay Mining might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:ESK

Eskay Mining

A natural resource company, engages in the acquisition and exploration of mineral properties in British Columbia, Canada.

Flawless balance sheet with low risk.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Visa Stock: The Toll Booth at the Center of Global Commerce

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion