The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. As with many other companies Eskay Mining Corp. (CVE:ESK) makes use of debt. But is this debt a concern to shareholders?

When Is Debt A Problem?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. If things get really bad, the lenders can take control of the business. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, plenty of companies use debt to fund growth, without any negative consequences. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

Check out our latest analysis for Eskay Mining

What Is Eskay Mining's Net Debt?

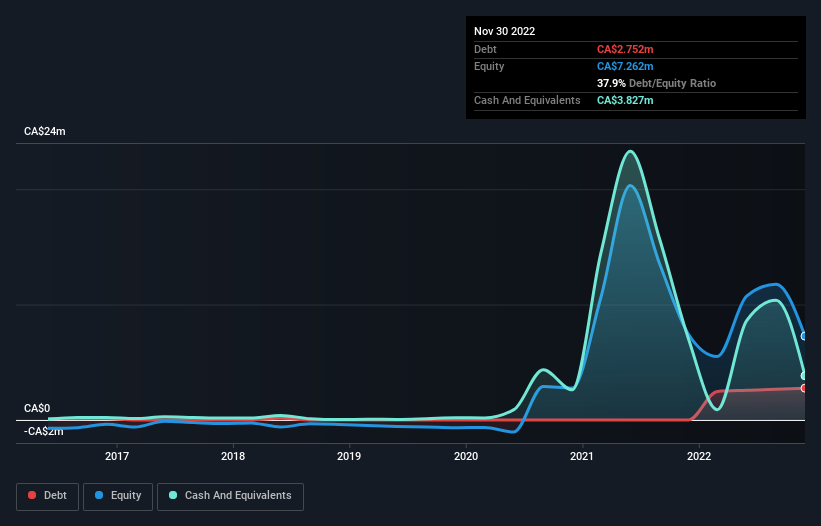

You can click the graphic below for the historical numbers, but it shows that as of November 2022 Eskay Mining had CA$2.75m of debt, an increase on none, over one year. However, its balance sheet shows it holds CA$3.83m in cash, so it actually has CA$1.08m net cash.

A Look At Eskay Mining's Liabilities

We can see from the most recent balance sheet that Eskay Mining had liabilities of CA$3.27m falling due within a year, and liabilities of CA$107.9k due beyond that. Offsetting this, it had CA$3.83m in cash and CA$537.6k in receivables that were due within 12 months. So it actually has CA$985.4k more liquid assets than total liabilities.

Having regard to Eskay Mining's size, it seems that its liquid assets are well balanced with its total liabilities. So it's very unlikely that the CA$115.7m company is short on cash, but still worth keeping an eye on the balance sheet. Simply put, the fact that Eskay Mining has more cash than debt is arguably a good indication that it can manage its debt safely. There's no doubt that we learn most about debt from the balance sheet. But it is future earnings, more than anything, that will determine Eskay Mining's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Given its lack of meaningful operating revenue, investors are probably hoping that Eskay Mining finds some valuable resources, before it runs out of money.

So How Risky Is Eskay Mining?

By their very nature companies that are losing money are more risky than those with a long history of profitability. And the fact is that over the last twelve months Eskay Mining lost money at the earnings before interest and tax (EBIT) line. Indeed, in that time it burnt through CA$15m of cash and made a loss of CA$20m. But the saving grace is the CA$1.08m on the balance sheet. That kitty means the company can keep spending for growth for at least two years, at current rates. Even though its balance sheet seems sufficiently liquid, debt always makes us a little nervous if a company doesn't produce free cash flow regularly. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. For instance, we've identified 6 warning signs for Eskay Mining (3 are a bit concerning) you should be aware of.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

Valuation is complex, but we're here to simplify it.

Discover if Eskay Mining might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSXV:ESK

Eskay Mining

A natural resource company, engages in the acquisition and exploration of mineral properties in British Columbia, Canada.

Flawless balance sheet with low risk.

Market Insights

Community Narratives