Warren Buffett famously said, 'Volatility is far from synonymous with risk.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We note that EMX Royalty Corporation (CVE:EMX) does have debt on its balance sheet. But is this debt a concern to shareholders?

Why Does Debt Bring Risk?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. If things get really bad, the lenders can take control of the business. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. When we examine debt levels, we first consider both cash and debt levels, together.

View our latest analysis for EMX Royalty

What Is EMX Royalty's Net Debt?

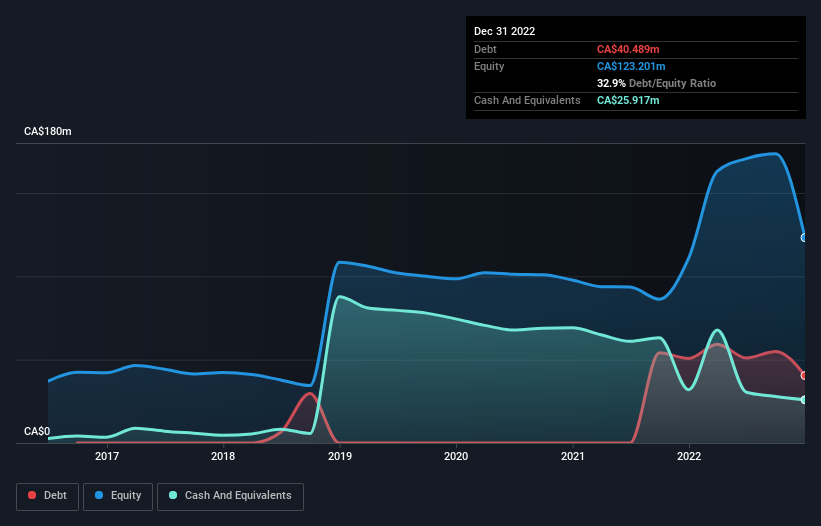

As you can see below, EMX Royalty had CA$40.5m of debt at December 2022, down from CA$50.7m a year prior. On the flip side, it has CA$25.9m in cash leading to net debt of about CA$14.6m.

How Healthy Is EMX Royalty's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that EMX Royalty had liabilities of CA$7.26m due within 12 months and liabilities of CA$38.4m due beyond that. On the other hand, it had cash of CA$25.9m and CA$11.6m worth of receivables due within a year. So its liabilities outweigh the sum of its cash and (near-term) receivables by CA$8.14m.

Given EMX Royalty has a market capitalization of CA$316.5m, it's hard to believe these liabilities pose much threat. However, we do think it is worth keeping an eye on its balance sheet strength, as it may change over time. When analysing debt levels, the balance sheet is the obvious place to start. But it is future earnings, more than anything, that will determine EMX Royalty's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

In the last year EMX Royalty wasn't profitable at an EBIT level, but managed to grow its revenue by 143%, to CA$18m. So its pretty obvious shareholders are hoping for more growth!

Caveat Emptor

While we can certainly appreciate EMX Royalty's revenue growth, its earnings before interest and tax (EBIT) loss is not ideal. Indeed, it lost CA$4.9m at the EBIT level. Considering that alongside the liabilities mentioned above does not give us much confidence that company should be using so much debt. So we think its balance sheet is a little strained, though not beyond repair. On the bright side, we note that trailing twelve month EBIT is worse than the free cash flow of CA$16m and the profit of CA$3.3m. So one might argue that there's still a chance it can get things on the right track. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. Case in point: We've spotted 2 warning signs for EMX Royalty you should be aware of.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

Valuation is complex, but we're here to simplify it.

Discover if EMX Royalty might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSXV:EMX

EMX Royalty

As of November 13, 2025, EMX Royalty Corporation was acquired by Elemental Altus Royalties Corp.

Adequate balance sheet with limited growth.

Market Insights

Community Narratives