- Canada

- /

- Capital Markets

- /

- NEOE:JPEG

TSX Penny Stocks To Watch In June 2025

Reviewed by Simply Wall St

The Canadian market has been navigating a complex landscape, with the Bank of Canada's easing cycle more advanced amid geopolitical risks and economic uncertainties, yet maintaining resilience. For those looking to invest in smaller or newer companies, penny stocks—despite the name's vintage feel—can still offer surprising value. In this article, we highlight several penny stocks that demonstrate financial strength and explore their potential for long-term growth.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$0.64 | CA$64.74M | ✅ 3 ⚠️ 3 View Analysis > |

| PetroTal (TSX:TAL) | CA$0.67 | CA$612.77M | ✅ 3 ⚠️ 4 View Analysis > |

| Fintech Select (TSXV:FTEC) | CA$0.03 | CA$2.4M | ✅ 2 ⚠️ 3 View Analysis > |

| Findev (TSXV:FDI) | CA$0.50 | CA$14.32M | ✅ 2 ⚠️ 4 View Analysis > |

| Mandalay Resources (TSX:MND) | CA$4.79 | CA$453.98M | ✅ 3 ⚠️ 1 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$0.78 | CA$518.93M | ✅ 3 ⚠️ 2 View Analysis > |

| Automotive Finco (TSXV:AFCC.H) | CA$0.98 | CA$19.42M | ✅ 2 ⚠️ 4 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$2.96 | CA$150.23M | ✅ 1 ⚠️ 1 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$1.92 | CA$184.07M | ✅ 3 ⚠️ 1 View Analysis > |

| McChip Resources (TSXV:MCS) | CA$0.91 | CA$5.2M | ✅ 2 ⚠️ 3 View Analysis > |

Click here to see the full list of 459 stocks from our TSX Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Pioneer AI Foundry (NEOE:JPEG)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Pioneer AI Foundry Inc. is a venture capital firm that specializes in early to mid-stage companies, with a market cap of CA$14.08 million.

Operations: The company generates revenue through its investment in gaming and esports businesses, amounting to CA$0.90 million.

Market Cap: CA$14.08M

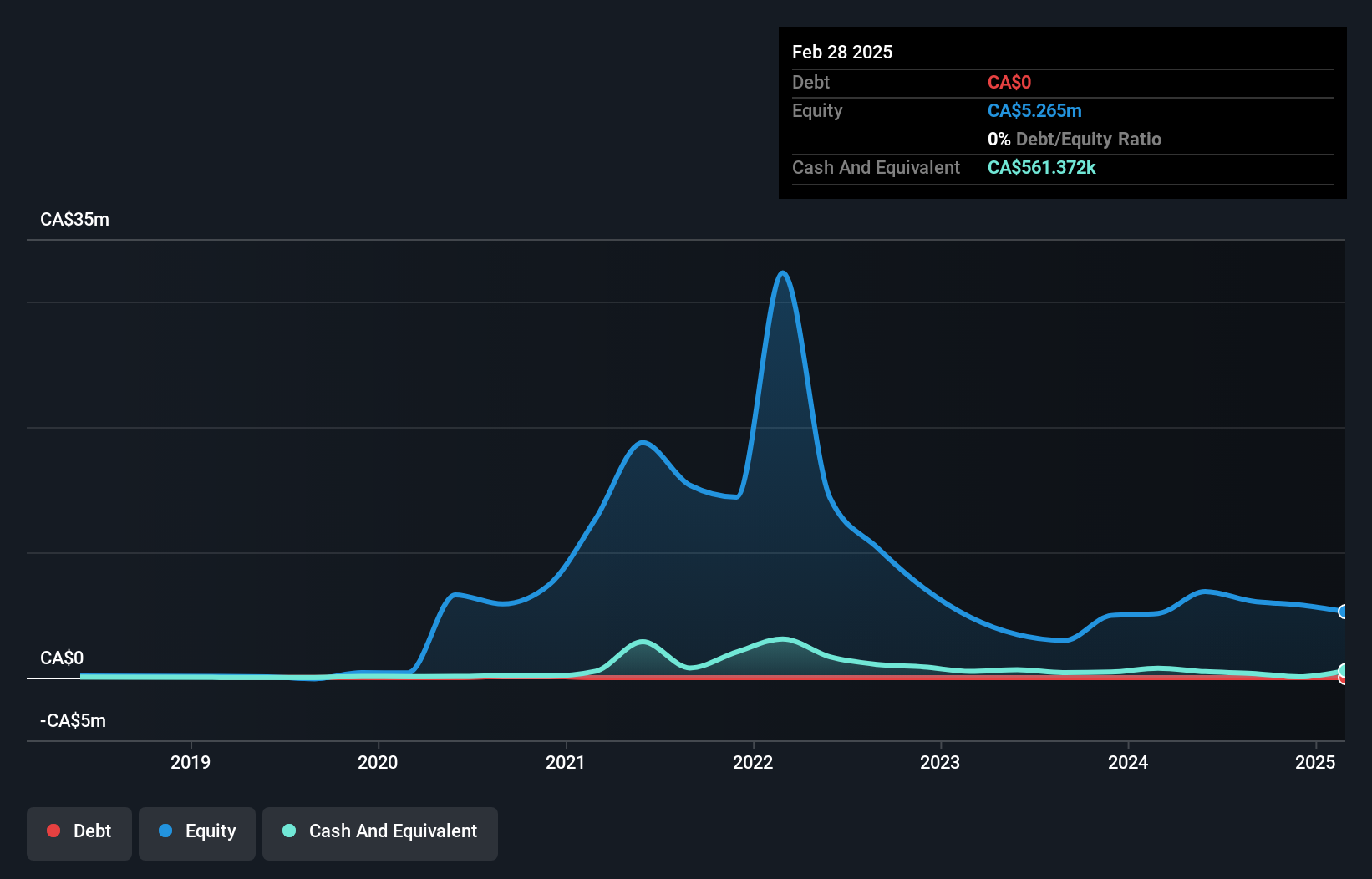

Pioneer AI Foundry Inc., with a market cap of CA$14.08 million, remains pre-revenue, generating CA$0.90 million primarily from investments in gaming and esports. The company recently launched Kora AI, an autonomous trading platform for crypto assets on Solana Blockchain, marking a strategic move towards leveraging digital asset treasury optimization. Despite its innovative approach and partnerships in AI and blockchain sectors, the company faces challenges with high volatility and limited cash runway of three months based on free cash flow estimates as of February 2025. Additionally, Pioneer is debt-free but struggles with profitability issues.

- Dive into the specifics of Pioneer AI Foundry here with our thorough balance sheet health report.

- Gain insights into Pioneer AI Foundry's past trends and performance with our report on the company's historical track record.

DLP Resources (TSXV:DLP)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: DLP Resources Inc. is a mineral exploration company focused on acquiring, exploring, and developing mineral properties in Canada and Peru, with a market cap of CA$42.37 million.

Operations: No revenue segments have been reported for the company.

Market Cap: CA$42.37M

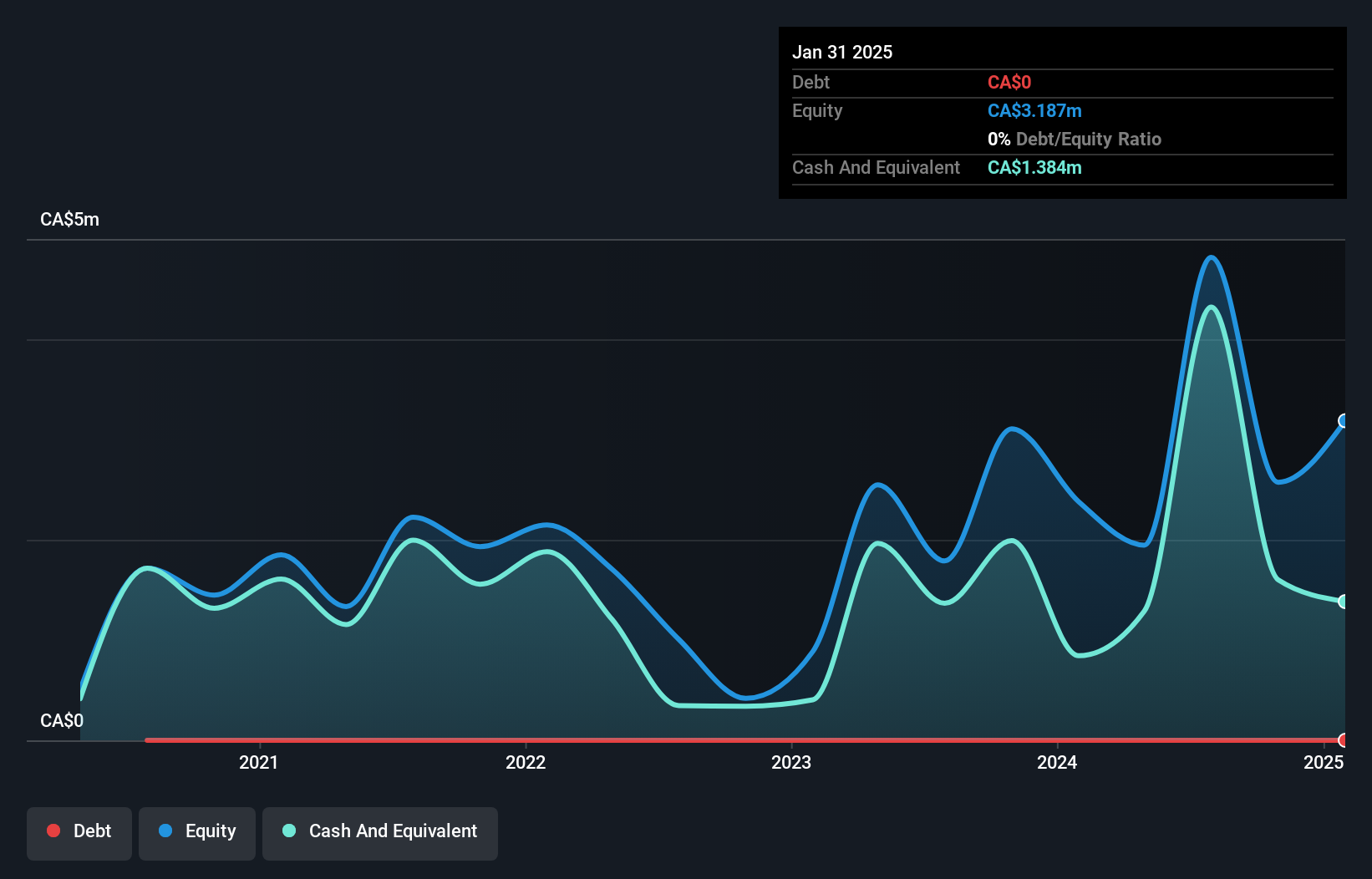

DLP Resources Inc., with a market cap of CA$42.37 million, is pre-revenue and remains unprofitable, reporting a net loss of CA$6.15 million for the nine months ending January 31, 2025. The company recently raised CA$10 million through private placements to strengthen its financial position amid a limited cash runway of two months based on free cash flow estimates. Despite no debt or long-term liabilities and experienced management and board members, DLP faces challenges with high share price volatility and negative return on equity. The appointment of Derek White as Chairman brings seasoned leadership to navigate these hurdles.

- Unlock comprehensive insights into our analysis of DLP Resources stock in this financial health report.

- Explore historical data to track DLP Resources' performance over time in our past results report.

Frontier Lithium (TSXV:FL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Frontier Lithium Inc. focuses on acquiring, exploring, and developing mining properties in North America, with a market cap of CA$118.57 million.

Operations: Frontier Lithium Inc. does not report revenue segments as it focuses on acquiring, exploring, and developing mining properties in North America.

Market Cap: CA$118.57M

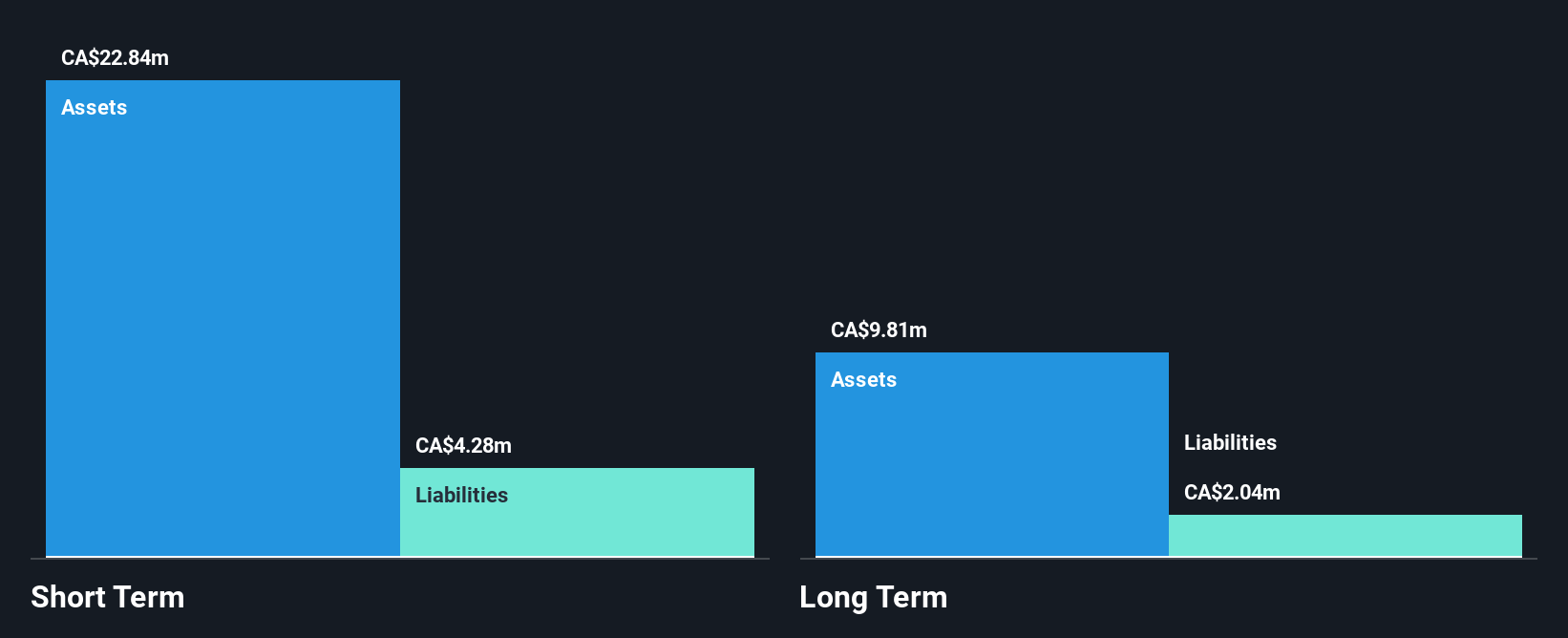

Frontier Lithium Inc., with a market cap of CA$118.57 million, is pre-revenue and currently unprofitable, but it maintains a strong financial position with short-term assets exceeding both its short and long-term liabilities, and no debt. The company recently reported promising results from its Definitive Feasibility Study for the PAK Lithium Project near Red Lake, Ontario, highlighting potential cumulative net revenue of CA$11 billion and an after-tax NPV of CA$932 million. Despite the lack of immediate revenue streams, Frontier's experienced management team positions it well to advance toward a Final Investment Decision within 24 months.

- Take a closer look at Frontier Lithium's potential here in our financial health report.

- Assess Frontier Lithium's future earnings estimates with our detailed growth reports.

Where To Now?

- Access the full spectrum of 459 TSX Penny Stocks by clicking on this link.

- Looking For Alternative Opportunities? We've found 17 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NEOE:JPEG

Pioneer AI Foundry

A venture capital firm specializes in early stage to mid-level companies.

Excellent balance sheet slight.

Market Insights

Community Narratives