- Canada

- /

- Metals and Mining

- /

- TSXV:BTR

3 TSX Penny Stocks With Market Caps Over CA$40M

Reviewed by Simply Wall St

As the Canadian market navigates potential changes in U.S. tax policies and rising bond yields, investors are closely monitoring how these shifts might influence their portfolios. Penny stocks, a term that may seem outdated, still capture interest by representing smaller or newer companies with growth potential at accessible price points. By focusing on firms with strong financials and clear growth trajectories, investors can uncover hidden opportunities within this segment of the market.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$0.75 | CA$75.86M | ✅ 3 ⚠️ 3 View Analysis > |

| NTG Clarity Networks (TSXV:NCI) | CA$2.70 | CA$114.25M | ✅ 4 ⚠️ 2 View Analysis > |

| Intermap Technologies (TSX:IMP) | CA$2.36 | CA$139.72M | ✅ 3 ⚠️ 1 View Analysis > |

| Orezone Gold (TSX:ORE) | CA$1.20 | CA$636.86M | ✅ 4 ⚠️ 2 View Analysis > |

| McChip Resources (TSXV:MCS) | CA$0.77 | CA$4.4M | ✅ 2 ⚠️ 5 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$1.74 | CA$168.16M | ✅ 3 ⚠️ 1 View Analysis > |

| PetroTal (TSX:TAL) | CA$0.60 | CA$548.99M | ✅ 3 ⚠️ 3 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$2.61 | CA$132.47M | ✅ 1 ⚠️ 2 View Analysis > |

| Findev (TSXV:FDI) | CA$0.44 | CA$12.6M | ✅ 2 ⚠️ 3 View Analysis > |

| BluMetric Environmental (TSXV:BLM) | CA$1.43 | CA$52.9M | ✅ 2 ⚠️ 4 View Analysis > |

Click here to see the full list of 905 stocks from our TSX Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Bonterra Resources (TSXV:BTR)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Bonterra Resources Inc. is an exploration stage company focused on acquiring, exploring, and evaluating mineral properties in Canada, with a market cap of CA$44.66 million.

Operations: Currently, there are no reported revenue segments for this exploration stage company.

Market Cap: CA$44.66M

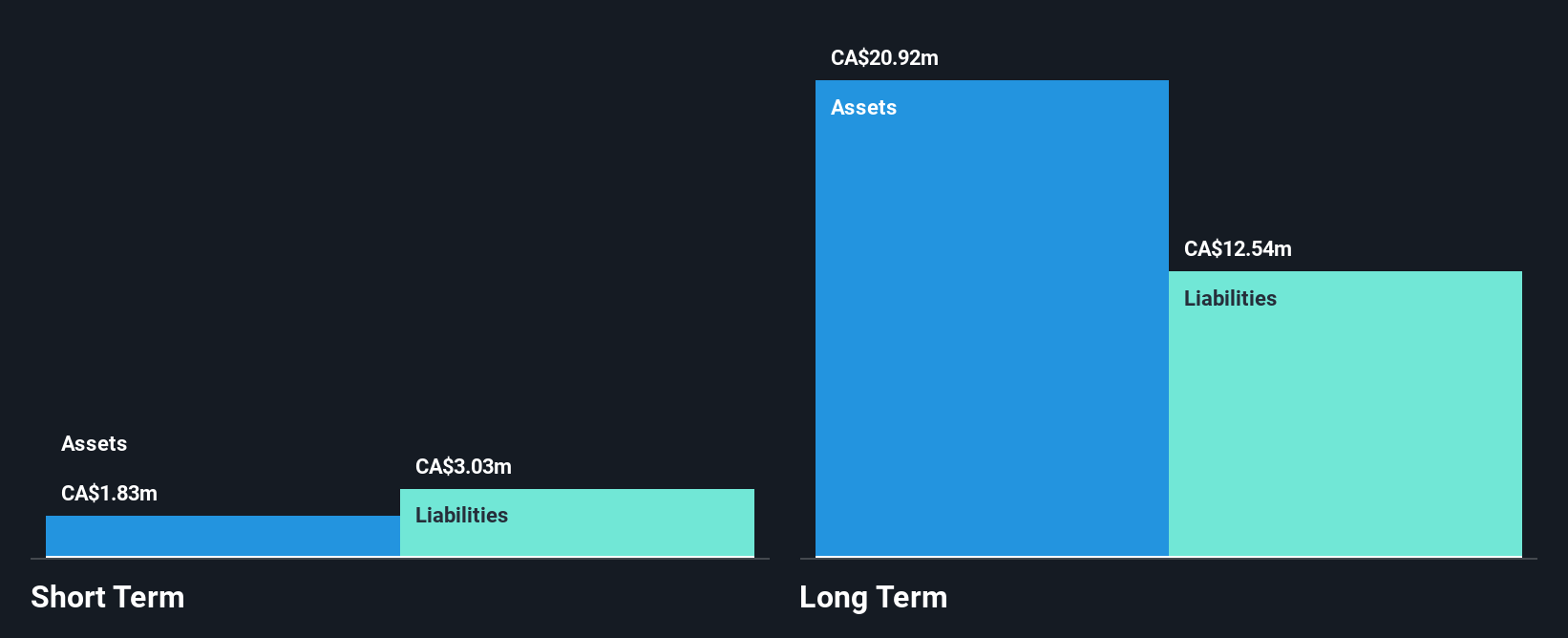

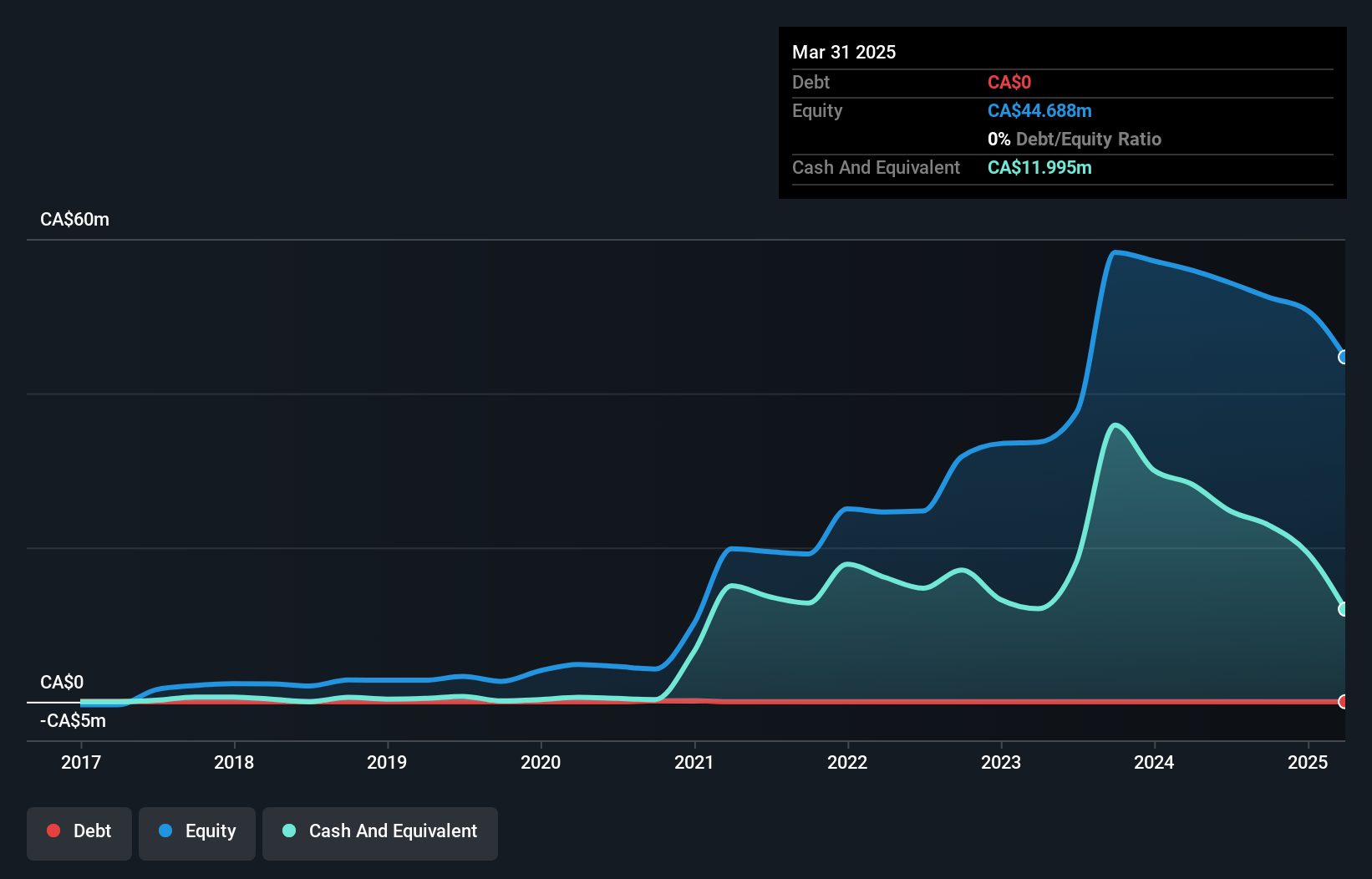

Bonterra Resources, a pre-revenue exploration stage company with a market cap of CA$44.66 million, is focused on mineral properties in Canada. Despite having no debt and reducing losses over the past five years, Bonterra faces financial challenges with short-term assets of CA$1.8 million not covering its liabilities. Recent earnings reported a net loss of CA$1.81 million for Q1 2025, though improved from the previous year. The company's cash runway is limited but has been bolstered by recent capital raises through private placements. A joint venture with Gold Fields aims to advance exploration efforts at promising targets like Gladiator SW.

- Click here and access our complete financial health analysis report to understand the dynamics of Bonterra Resources.

- Examine Bonterra Resources' past performance report to understand how it has performed in prior years.

DLP Resources (TSXV:DLP)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: DLP Resources Inc. is a mineral exploration company focused on acquiring, exploring, and developing mineral properties in Canada and Peru, with a market cap of CA$52.23 million.

Operations: DLP Resources Inc. has not reported any revenue segments.

Market Cap: CA$52.23M

DLP Resources, with a market cap of CA$52.23 million, is a pre-revenue mineral exploration company focusing on Canadian and Peruvian properties. The recent appointment of Derek White as Chairman brings extensive mining industry experience to the board. Despite being debt-free, DLP faces financial constraints with less than a year of cash runway and volatile share prices. Recent earnings reported a net loss of CA$1.37 million for Q3 2025, consistent with previous periods. The Aurora Project's maiden Mineral Resource estimate highlights potential but requires further drilling to enhance geological confidence and assess economic viability through preliminary assessments.

- Click here to discover the nuances of DLP Resources with our detailed analytical financial health report.

- Assess DLP Resources' previous results with our detailed historical performance reports.

E3 Lithium (TSXV:ETL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: E3 Lithium Limited focuses on the development and extraction of lithium resources in Alberta, with a market cap of CA$46.78 million.

Operations: E3 Lithium Limited does not currently report any revenue segments.

Market Cap: CA$46.78M

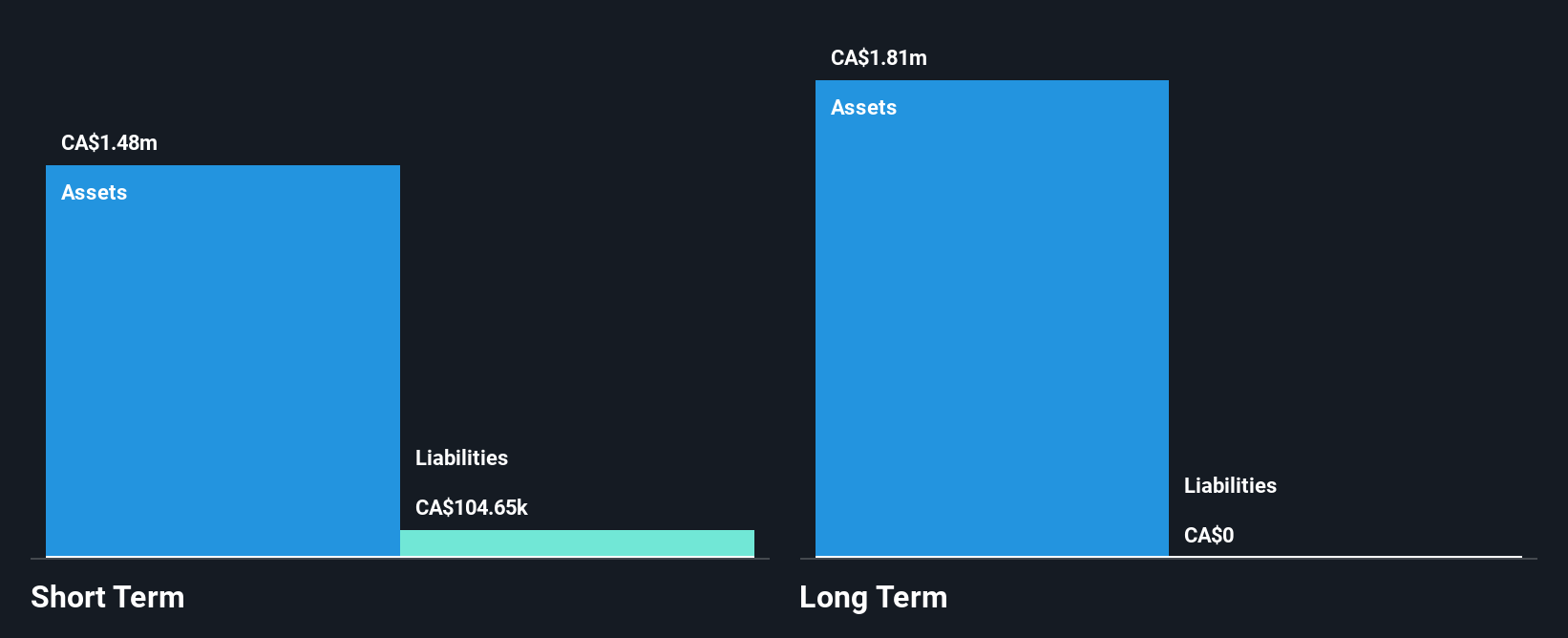

E3 Lithium, with a market cap of CA$46.78 million, is a pre-revenue company focused on lithium extraction in Alberta. Recent collaboration with Pure Lithium Corporation has shown promising results in producing high-purity lithium metal anodes from E3's brines, achieving over 500 battery cycles while maintaining performance. Despite being unprofitable and experiencing losses of CA$9.7 million last year, E3 remains debt-free and has short-term assets exceeding liabilities by a significant margin. The company continues to advance its demonstration facility to validate processing technology, aiming for future commercial-scale production and project financing for the Clearwater Project.

- Navigate through the intricacies of E3 Lithium with our comprehensive balance sheet health report here.

- Learn about E3 Lithium's historical performance here.

Summing It All Up

- Access the full spectrum of 905 TSX Penny Stocks by clicking on this link.

- Ready For A Different Approach? We've found 19 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bonterra Resources might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:BTR

Bonterra Resources

An exploration stage company, engages in the acquisition, exploration, and evaluation of mineral properties in Canada.

Adequate balance sheet with slight risk.

Market Insights

Community Narratives