- Canada

- /

- Entertainment

- /

- TSX:BRMI

3 Promising TSX Penny Stocks With Market Caps Over CA$10M

Reviewed by Simply Wall St

As we step into 2025, the Canadian market continues to navigate a mix of headwinds and tailwinds, with policy uncertainties around tariffs and interest rates shaping investor sentiment. For those willing to explore beyond established names, penny stocks—typically representing smaller or newer companies—remain a relevant investment area despite their somewhat outdated label. These stocks can offer surprising value when backed by strong financial health, presenting opportunities for growth with potentially greater stability.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Mandalay Resources (TSX:MND) | CA$4.09 | CA$370.94M | ★★★★★★ |

| Pulse Seismic (TSX:PSD) | CA$2.42 | CA$125.06M | ★★★★★★ |

| Silvercorp Metals (TSX:SVM) | CA$4.40 | CA$970.33M | ★★★★★★ |

| Findev (TSXV:FDI) | CA$0.50 | CA$14.32M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.66 | CA$583.7M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.40 | CA$236.24M | ★★★★★☆ |

| NamSys (TSXV:CTZ) | CA$1.14 | CA$31.7M | ★★★★★★ |

| East West Petroleum (TSXV:EW) | CA$0.045 | CA$4.07M | ★★★★★★ |

| Hemisphere Energy (TSXV:HME) | CA$1.83 | CA$179.46M | ★★★★★☆ |

| Tornado Infrastructure Equipment (TSXV:TGH) | CA$0.97 | CA$140.31M | ★★★★★☆ |

Click here to see the full list of 944 stocks from our TSX Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Boat Rocker Media (TSX:BRMI)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Boat Rocker Media Inc. is an entertainment company that creates, produces, and distributes television and film content across Canada, the United States, and internationally; it has a market cap of CA$36.02 million.

Operations: The company's revenue is derived from its Television segment, which generated CA$134.89 million, and its Kids and Family segment, contributing CA$50.67 million.

Market Cap: CA$36.02M

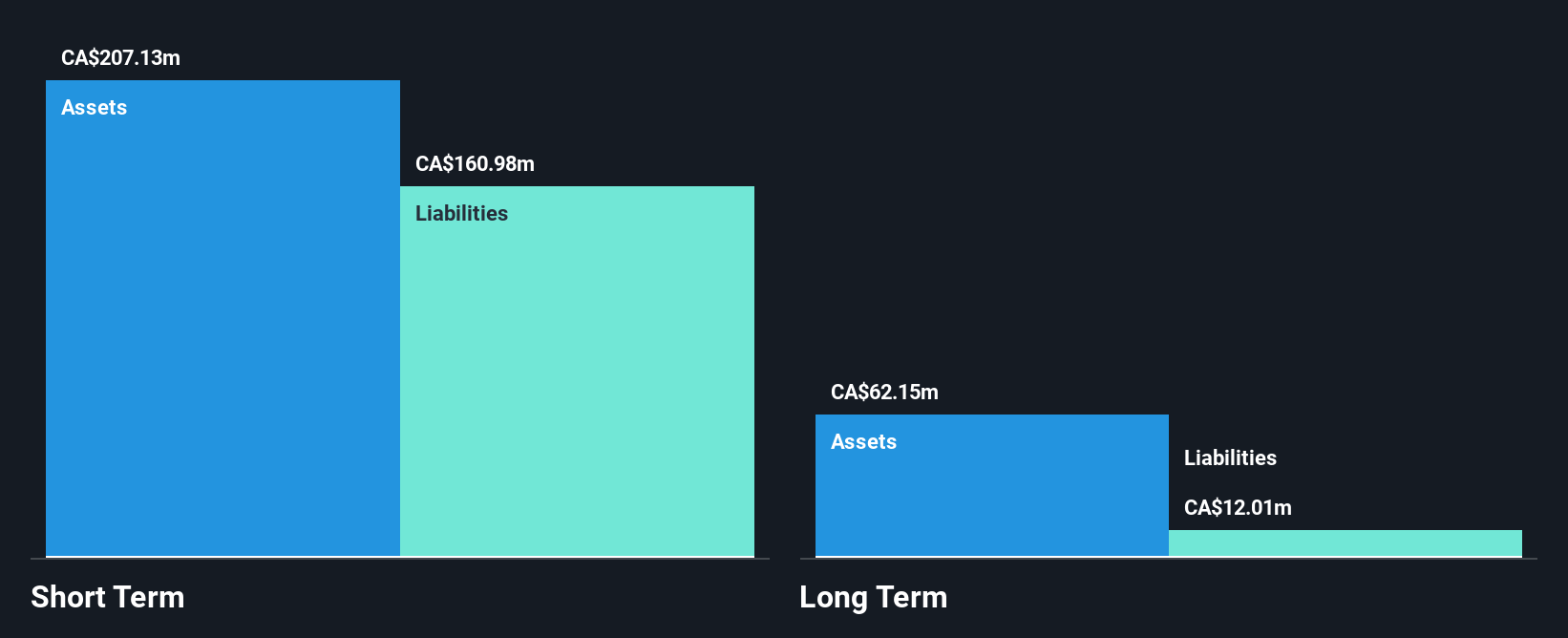

Boat Rocker Media Inc., with a market cap of CA$36.02 million, faces challenges as its recent earnings report showed a significant decline in sales to CA$36.83 million for Q3 2024 from CA$196.36 million the previous year, alongside an increased net loss of CA$18.52 million. Despite being unprofitable, the company has reduced its debt significantly over five years and maintains a satisfactory net debt to equity ratio of 14.9%. It also benefits from a strong cash position that covers long-term liabilities and provides more than three years of runway due to positive free cash flow growth.

- Navigate through the intricacies of Boat Rocker Media with our comprehensive balance sheet health report here.

- Examine Boat Rocker Media's earnings growth report to understand how analysts expect it to perform.

Critical Elements Lithium (TSXV:CRE)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Critical Elements Lithium Corporation focuses on acquiring, exploring, and developing mining properties in Canada with a market cap of CA$100.21 million.

Operations: Currently, there are no reported revenue segments for Critical Elements Lithium Corporation.

Market Cap: CA$100.21M

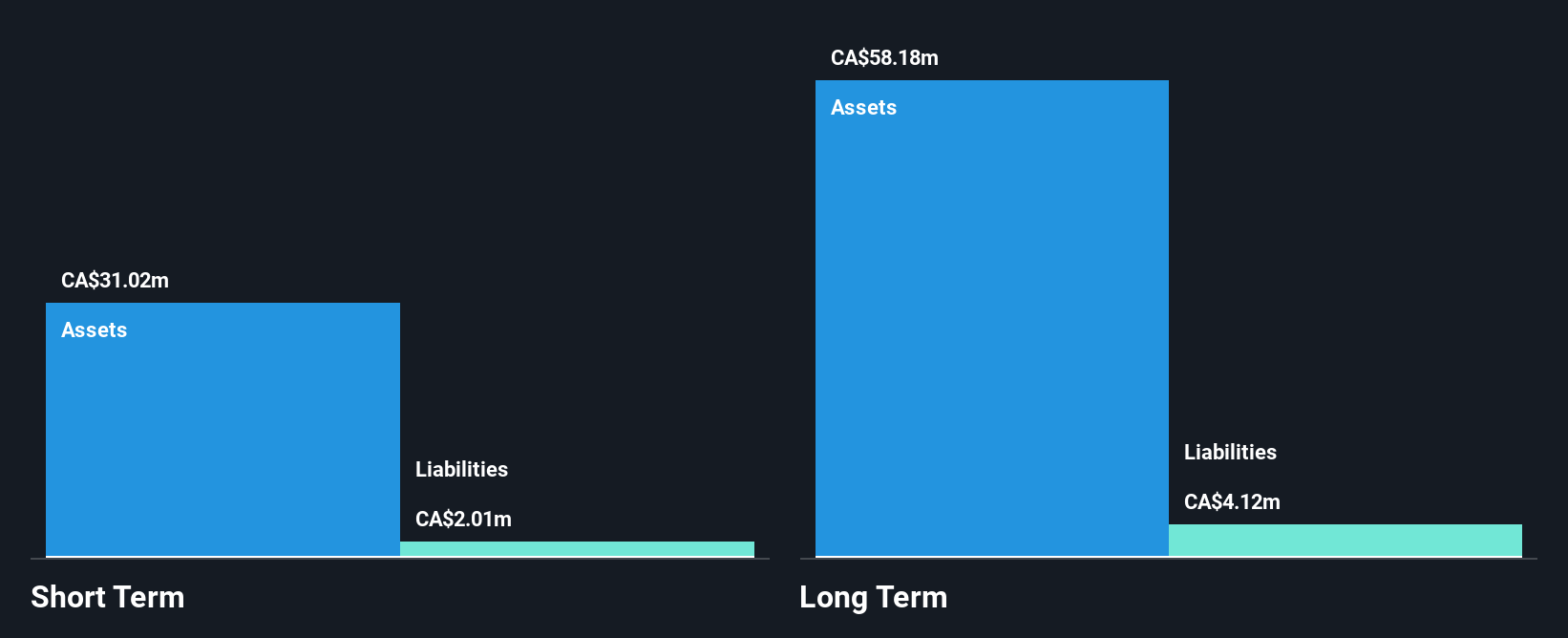

Critical Elements Lithium Corporation, with a market cap of CA$100.21 million, remains pre-revenue as it advances its Rose Lithium-Tantalum project in Quebec. The company has secured essential occupancy leases and infrastructure rights but requires strategic partnerships and financing to progress further. Despite a net loss reduction from CA$3.25 million to CA$0.124 million over the past year, it remains unprofitable with less than a year of cash runway if current cash flow trends persist. However, the company's seasoned management and board are actively working on securing comprehensive funding for project development while maintaining an attractive capital structure.

- Click to explore a detailed breakdown of our findings in Critical Elements Lithium's financial health report.

- Review our growth performance report to gain insights into Critical Elements Lithium's future.

Oceanic Iron Ore (TSXV:FEO)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Oceanic Iron Ore Corp. is an exploration stage company focused on acquiring and exploring iron ore properties in Québec, Canada, with a market cap of CA$16.42 million.

Operations: Currently, there are no reported revenue segments for this exploration stage company focused on iron ore properties in Québec, Canada.

Market Cap: CA$16.42M

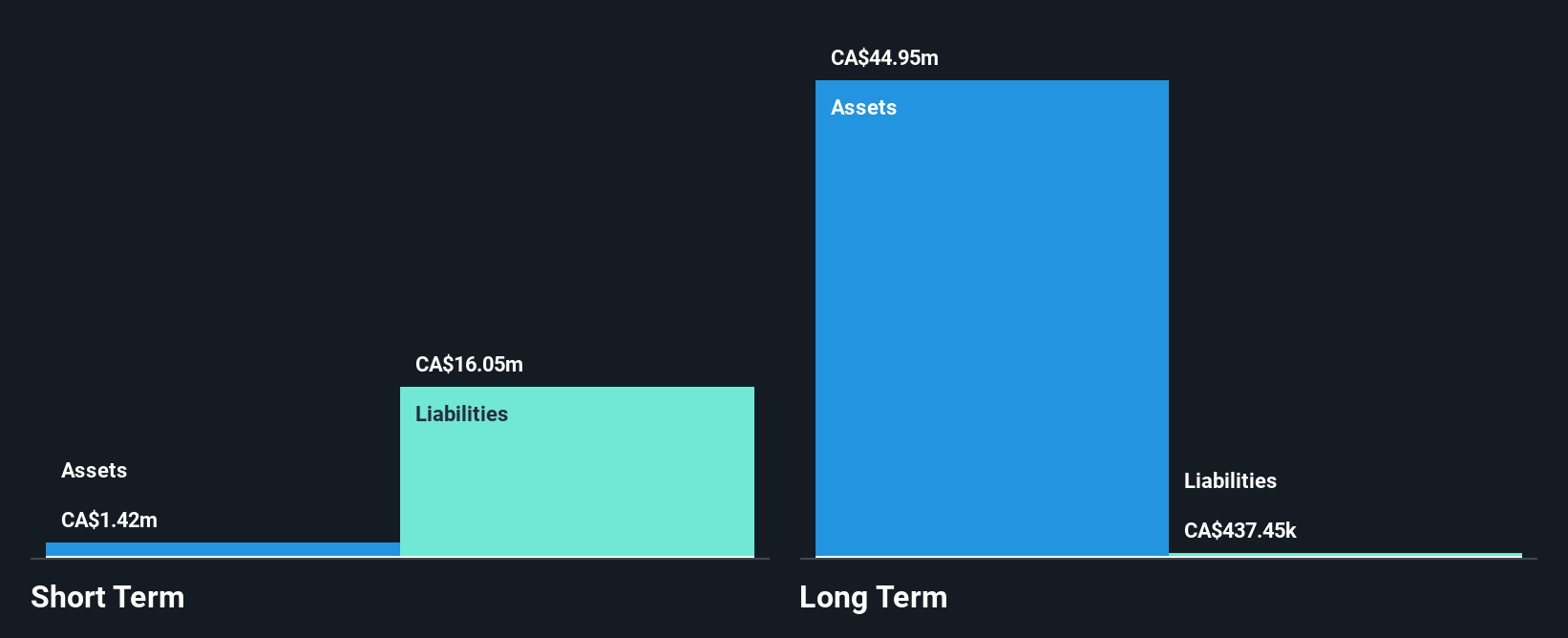

Oceanic Iron Ore Corp., with a market cap of CA$16.42 million, is pre-revenue and focused on iron ore exploration in Québec. Despite a seasoned board with an average tenure of 10.8 years, the company faces financial challenges, including short-term liabilities (CA$12.1M) exceeding short-term assets (CA$1.9M). Recent earnings showed a net loss of CA$3.37 million for Q3 2024, highlighting ongoing unprofitability and shareholder dilution due to a 4.8% increase in shares outstanding over the past year. Positively, Oceanic maintains a satisfactory net debt to equity ratio of 27.3%, providing some financial stability amidst volatility.

- Get an in-depth perspective on Oceanic Iron Ore's performance by reading our balance sheet health report here.

- Review our historical performance report to gain insights into Oceanic Iron Ore's track record.

Make It Happen

- Unlock our comprehensive list of 944 TSX Penny Stocks by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Boat Rocker Media might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:BRMI

Boat Rocker Media

An entertainment company, creates, produces, and distributes television and film content in Canada, the United States, and internationally.

Flawless balance sheet and slightly overvalued.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)