- Canada

- /

- Metals and Mining

- /

- TSXV:CERT

Cerrado Gold Inc. (CVE:CERT) Surges 26% Yet Its Low P/S Is No Reason For Excitement

Cerrado Gold Inc. (CVE:CERT) shares have had a really impressive month, gaining 26% after a shaky period beforehand. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 42% over that time.

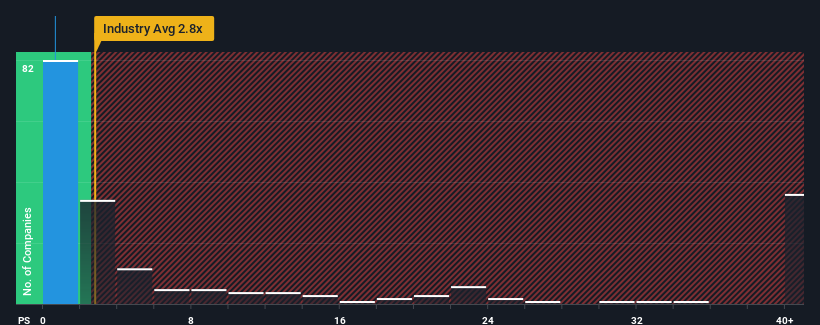

Although its price has surged higher, Cerrado Gold may still be sending very bullish signals at the moment with its price-to-sales (or "P/S") ratio of 0.6x, since almost half of all companies in the Metals and Mining industry in Canada have P/S ratios greater than 2.8x and even P/S higher than 22x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

Check out our latest analysis for Cerrado Gold

What Does Cerrado Gold's P/S Mean For Shareholders?

Recent times haven't been great for Cerrado Gold as its revenue has been rising slower than most other companies. It seems that many are expecting the uninspiring revenue performance to persist, which has repressed the growth of the P/S ratio. If you still like the company, you'd be hoping revenue doesn't get any worse and that you could pick up some stock while it's out of favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Cerrado Gold.What Are Revenue Growth Metrics Telling Us About The Low P/S?

In order to justify its P/S ratio, Cerrado Gold would need to produce anemic growth that's substantially trailing the industry.

Taking a look back first, we see that the company grew revenue by an impressive 29% last year. However, the latest three year period hasn't been as great in aggregate as it didn't manage to provide any growth at all. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Shifting to the future, estimates from the two analysts covering the company suggest revenue growth is heading into negative territory, declining 0.5% per annum over the next three years. That's not great when the rest of the industry is expected to grow by 12% per year.

With this in consideration, we find it intriguing that Cerrado Gold's P/S is closely matching its industry peers. However, shrinking revenues are unlikely to lead to a stable P/S over the longer term. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

The Key Takeaway

Even after such a strong price move, Cerrado Gold's P/S still trails the rest of the industry. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of Cerrado Gold's analyst forecasts revealed that its outlook for shrinking revenue is contributing to its low P/S. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

Don't forget that there may be other risks. For instance, we've identified 4 warning signs for Cerrado Gold (1 can't be ignored) you should be aware of.

If these risks are making you reconsider your opinion on Cerrado Gold, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSXV:CERT

Cerrado Gold

Operates as a gold mining and exploration company in Argentina and Canada.

Slight risk with acceptable track record.

Market Insights

Community Narratives